Some things I like and don’t like at the moment:

I like big up years in the stock market. Last year the S&P 500 was up 26%. This year it’s up nearly 29%.

Since 1928 there have only been three other instances of 25%+ returns in back-to-back years:

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

So what happened next?

Something for everyone:

- 1937: -35%

- 1956: +7%

- 1999: +21%

Terrible, decent and great. Not helpful.

It’s impossible to draw many conclusions from an N=3 sample size but it’s important to remember one or two years of returns doesn’t help much when it comes to predicting next year’s returns.

Your guess is as good as mine.

I don’t like the housing market. The housing market has been broken for a few years now but the longer the current situation goes the worse it will be in the future.

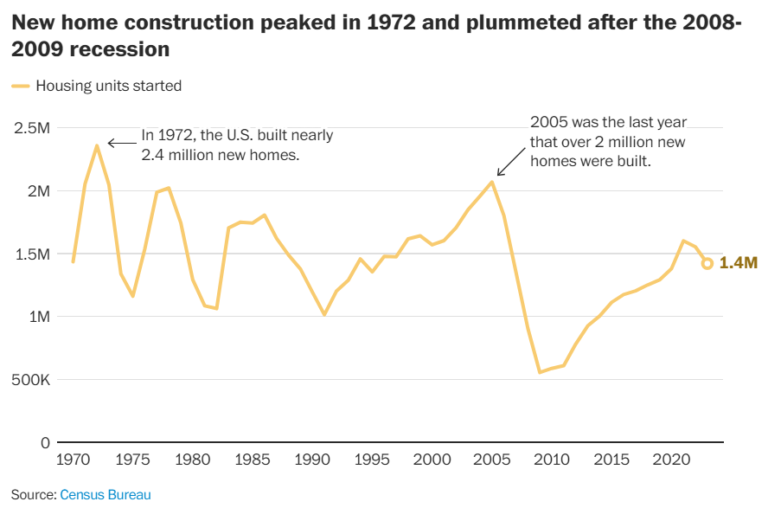

Allow me to explain using a chart from The Washington Post:

Here’s Heather Long on our lack of building in America:

In 1972, when the U.S. population was just over 200 million, nearly 2.4 million new homes were built. Last year, only 1.4 million homes were added, for a population of 335 million. Realistically, at least 2 million new homes need to be built every year.

More people and fewer houses being built.

With 7% mortgage rates this number won’t be increasing anywhere close to the 2 million homes we need added annually.

Obviously, people who already own a home and/or have a 3% mortgage benefit from ever-rising prices. Still, it makes things worse for housing activity, which is a big part of the economy.

And young people who want to buy a house are out of luck.

I like The Agency. I don’t know how many people have Showtime on Paramount+ (sometimes the streamers are so confusing) but The Agency is the best new show of the year.

It’s got Michael Fassbender, Jeffrey Wright, Richard Gere, CIA/spy stuff.

This is the kind of show where you put your phone down for an hour and don’t look at it even once.

The Agency is a wicked smart show.

I don’t like how every meeting is a Zoom meeting. I understand why video meetings took off during the pandemic. Remote work became a thing. It was a great way to stay connected.

Sometimes it’s nice to see people in a meeting.

But all meetings? Seriously?

Can we sprinkle in a good old conference call every once in a while?1

I like having conversations about the potential for AI. I don’t use Chat GPT or Claude or Perplexity all that much yet. I’ve played around with all of them but AI isn’t part of my daily routine.

But I’ve had lots of conversations and demos with people who use these tools regularly, and it makes me excited for the future.

I enjoy the honeymoon phase of technology like this.

I also think AI is going to make out lives more efficient in so many ways.

I don’t like any of the Home Alone movies after the first two. Look, Home Alone 2 was a cash grab following the success of the original but it was still good.

However, all 4-5 (?) iterations that tried to recreate lightning in a bottle are unwatchable.2

Home Alone is the greatest family movie of all-time so I get why they tried to do this.

As far as I’m concerned, Home Alone stopped after number two in New York City.

I like this story about Woj. Sports Illustrated had a story about why Adrian Wojnarowski walked away from his job at ESPN. This part hits hard:

In May, Woj traveled to Rogers, Ark., for a memorial for Chris Mortensen, the longtime NFL insider who died in March from throat cancer. Mortensen spent more than three decades at ESPN. When Woj arrived in Bristol in 2017, Mortensen was among the first to welcome him. Many ESPNers made the trip to Arkansas. What Woj was struck by was how many did not. “It made me remember that the job isn’t everything,” Woj says. “In the end it’s just going to be your family and close friends. And it’s also, like, nobody gives a s—. Nobody remembers [breaking stories] in the end. It’s just vapor.”

Work is important. I love my job. It’s not everything.

I don’t like it when markets seem too easy. Market cycles are happening faster than ever these days.

This decade alone we’ve experienced the following:

- 2020: The Covid crash, putting the economy on ice, 14% unemployment, negative oil prices and an insane recovery to new all-time highs in record time.

- 2021: The meme stock bubble that burst in a painful way.

- 2022: Four decade-high inflation, interest rates going from 0% to 5%, everyone assumes a recession is imminent and housing prices that refuse to crash.

- 2023: Inflation falls from 9% to sub-3% yet we don’t have a recession, the stock market booms and consumers just keep spending.

- 2024: The Fed lowers rates but bond yields go up, the stock market/crypto keep booming and leverage takes off.

That’s a lot to digest and it feels like I’m only scratching the surface of all the stuff that happened.

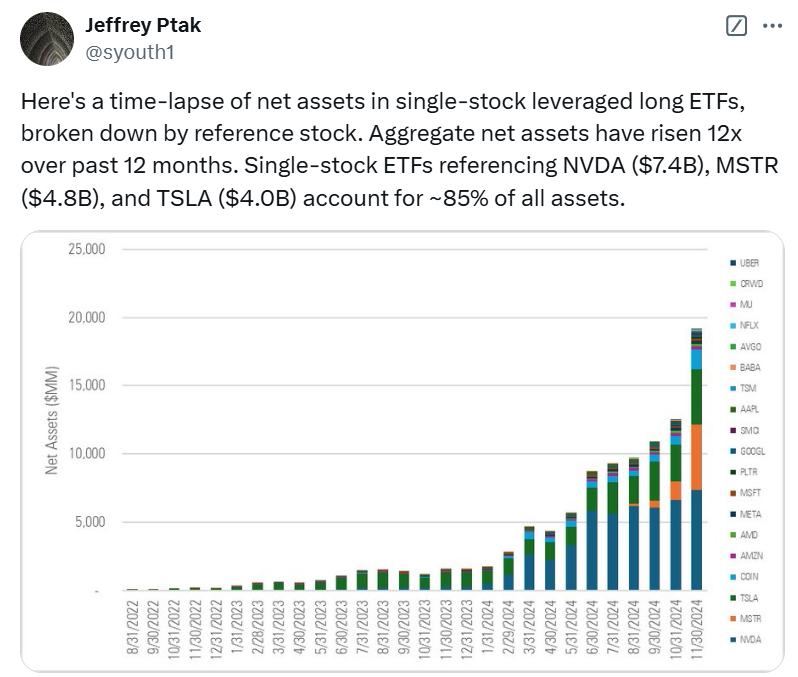

Look at this chart from Morningstar’s Jeff Ptak on the insane growth in single-stock leveraged ETFs in recent years:

People are going crazy for these vehicles.

I’m sure plenty of investors (speculators?) have made money in these funds. Good for them.

I just become a little uneasy when it seems like people are making easy money.

Investing can be made simple but it’s never easy…at least over the long-term.

Further Reading:

Are U.S. Stocks Overvalued

1I know you can turn your video off but if you’re the only one it makes you look like a curmudgeon. I need everyone to use no video.

2My kids made us try them all.