In 20 years of managing money I have never witnessed more dismal sentiment for international stocks, value stocks and really valuations in general.

Investors I come into contact with have all but given up on this stuff. I know you could have said the same thing the past 5-7 years or so but it feels like the dam truly broke this year. Investors are throwing in the towel.

I have many thoughts on this topic but first a market history lesson.

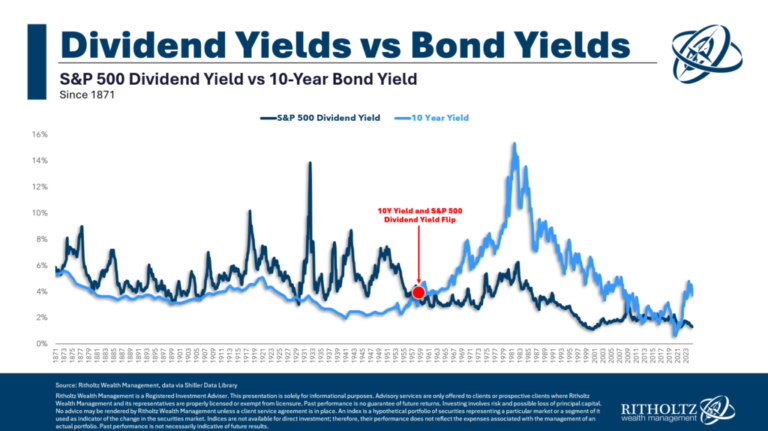

Until the 1950s, investors expected to earn more income from their stocks than bonds. The general idea was that stocks are riskier and thus need higher yields to attract investors.

When dividend yields and bond yields converged it was a signal to sell stocks. Stock prices would then fall until dividend yields earned a premium over bonds again.

It was a pretty good market signal too. The yields on stocks and bonds flipped for a month or two right before the Great Depression and many of the biggest bear markets of the late 19th century and early 20th century.

But then a weird thing happened in the late-1950s…it stopped working.

Bonds yields surpassed divided yields and didn’t look back for a very long time. In fact, they remained above stock market yields for 50 years until bond yields finally got low enough during the Great Financial Crisis.

This was something investors took as gospel for decades and then *poof* all of a sudden it vanished.

Peter Bernstein wrote about the lessons he learned from this phenomenon in Against the Gods:

Although the contours of this new world were visible well before 1959, the old relationships in the capital markets tended to persist as long as people with memories of the old days continued to be the main investors. For example, my partners, veterans of the Great Crash, kept assuring me that the seeming trend was nothing but an aberration. They promised me that matters would revert to normal in just a few months, that stock prices would fall and bond prices would rally.

I am still waiting. The fact that something so unthinkable could occur has had a lasting impact on my view of life and on investing in particular. It continues to color my attitude toward the future and has left me skeptical about the wisdom of extrapolating from the past.

Sometimes it really is different this time!

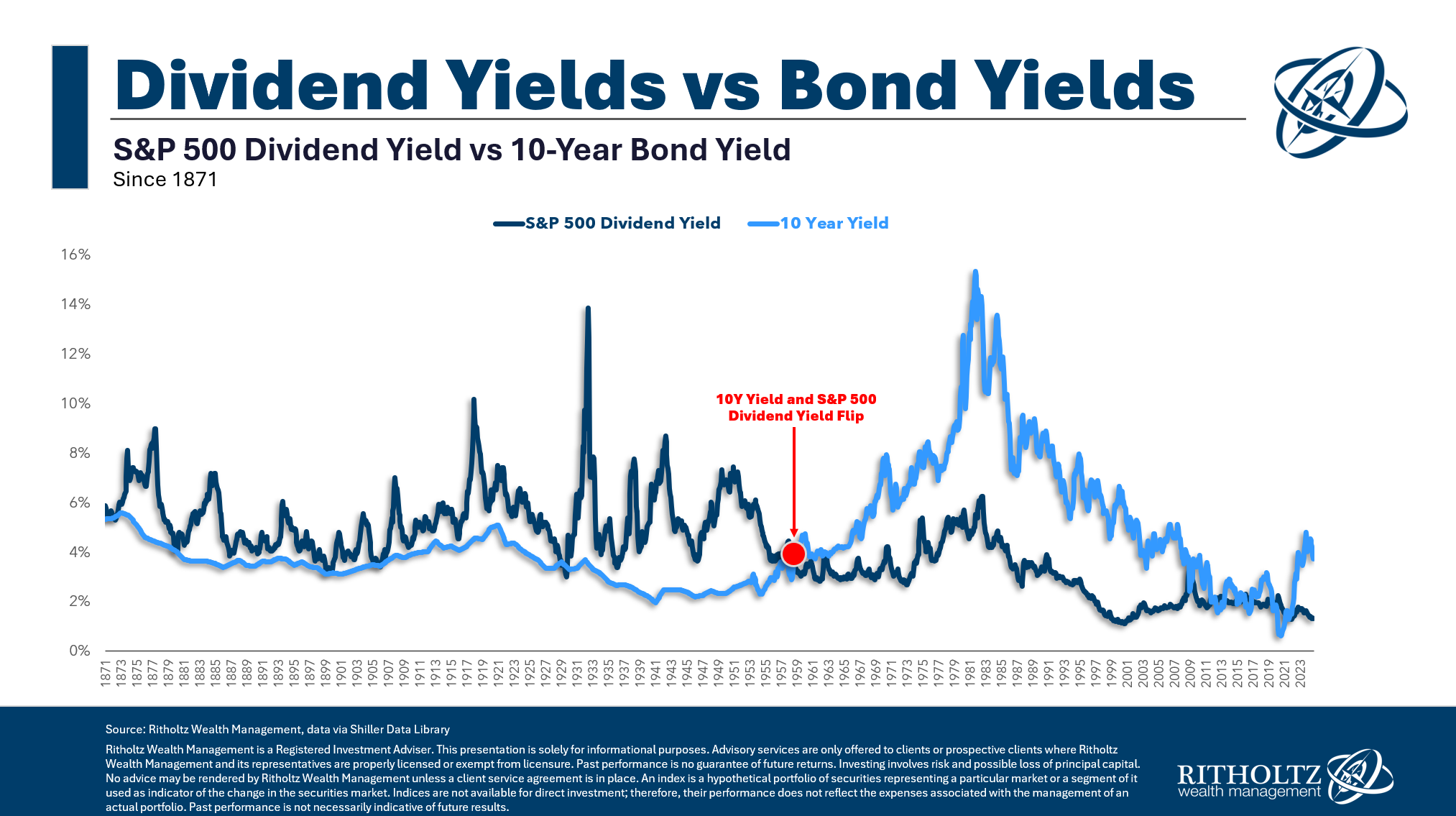

So is it different this time? Are we now in a world where U.S. growth stocks are the only ones worth investing in?

Are these cycles a thing of the past?

My honest answer is I don’t know.

Everything I’ve ever studied about market history tells me there is nothing more reliable than cycles. Strategies, geographies and factors come in and out of favor. Nothing works forever.

But I can’t rule out the possibility that technology has changed things. I wouldn’t bet my life on it but it would be naive to assume there are no paradigm shifts in the markets. This could be one of those shifts.

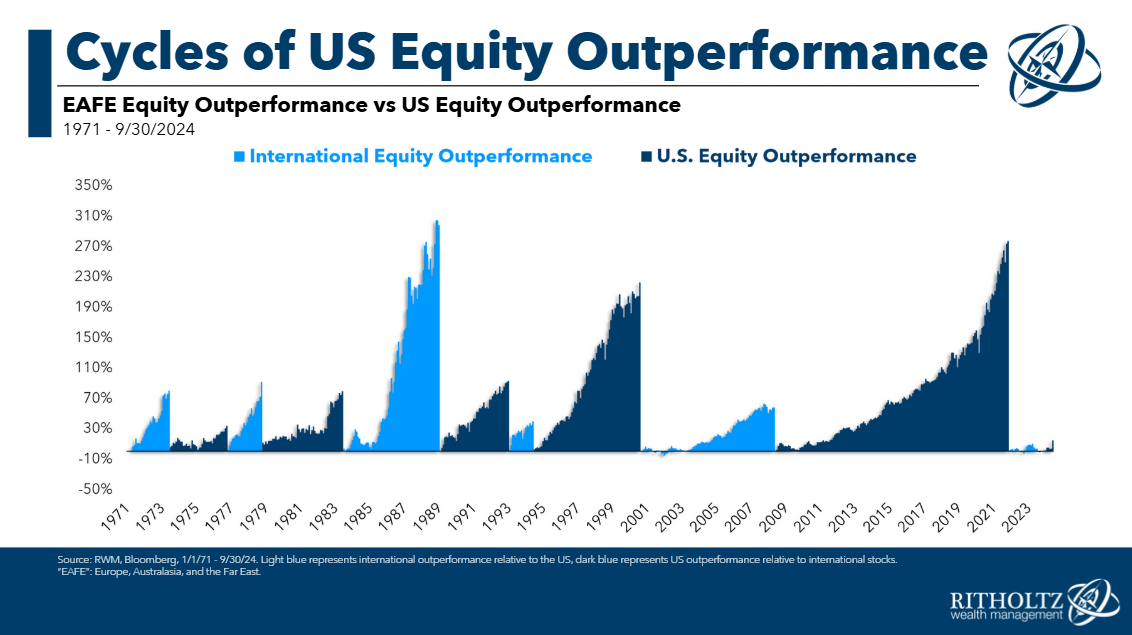

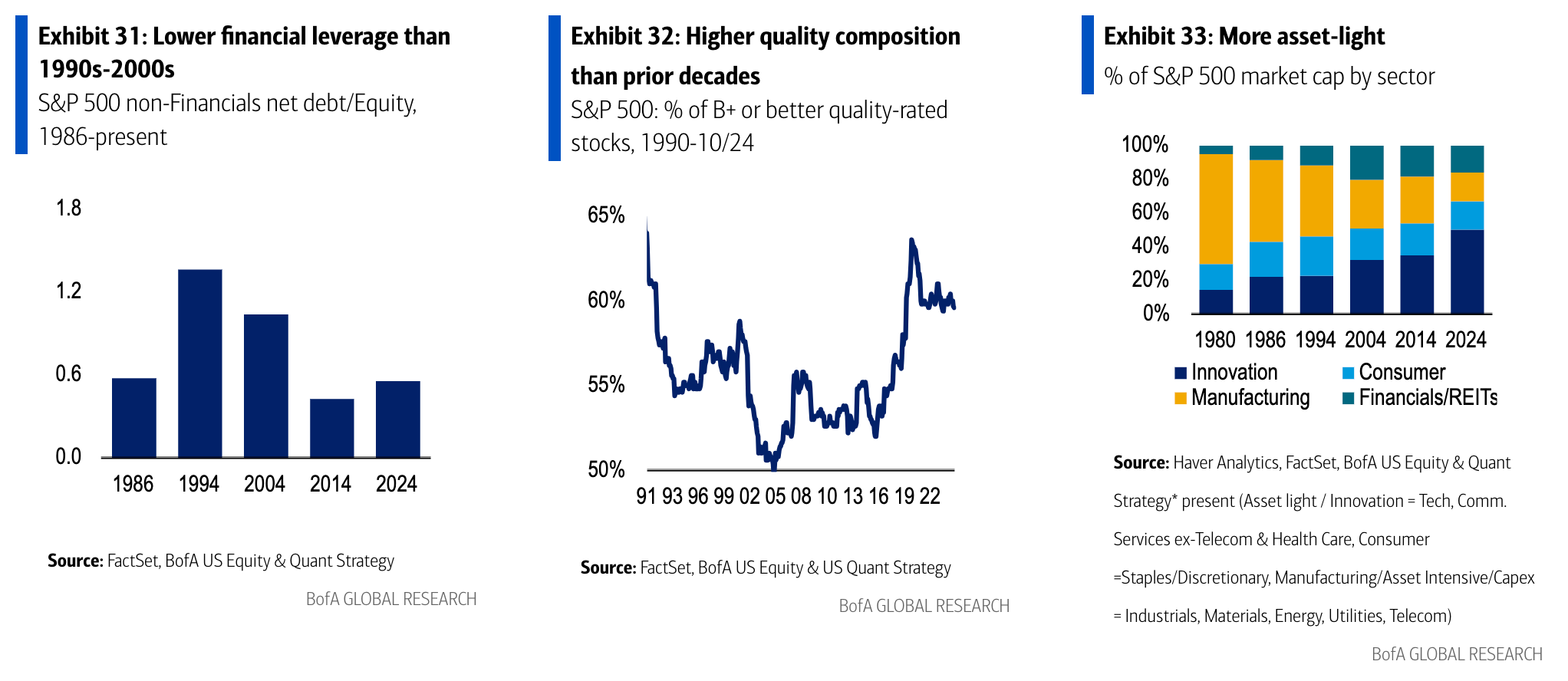

There are reasons large cap growth stocks in the United States are so popular. They have the best fundamentals:

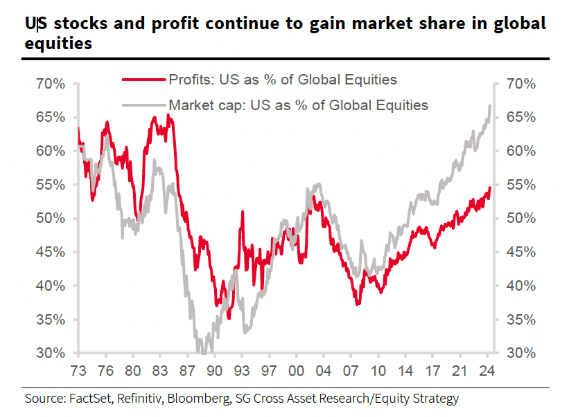

U.S. stocks have gained profit share along with market share:

And these corporations are much higher quality than they were in the past:

Investors hate international stocks, emerging market stocks and value stocks for a reason. The companies at the top of the S&P 500 and Nasdaq 100 are, frankly, better businesses.

They’re outperformed in the stock market because they’ve outperformed on business fundamentals.

Maybe large cap growth now has overtaken what was the small cap value premium in the past. That makes sense to me.

The trillion dollar question is this: What’s priced in?

Whatever the outcome is in the coming 5-10 years it will feel obvious after the fact.

Of course U.S. stocks continued to outperform because they’re the best companies!

Of course U.S. stocks underperformed because valuations were so high!

Again, I don’t know.

I know investors here and around the globe are pouring money into U.S. stocks hand over fist and abandoning other areas of the global stock market.

I’m still a believer in diversification for the simple fact that I have no idea what the future will hold. Diversification is an admission of ignorance about the future.

But I’m not blind to the fact that sometimes market relationships change forever.

The only thing I know for sure is I’ve never seen sentiment so dour on corporations outside of large cap U.S. stocks.

Time will tell if this is one of those generational turning points in historical relationships or another example of investors chasing past performance.

Further Reading:

Diversification is About Decades