In 2022, it was a bad year for the markets.

At the time I wrote about how it was maybe one of the worst years ever when you consider bonds had a bear market at the same time as stocks.

Last year I wrote about how 2023 was a good year which was nice because sometimes bad years are followed by bad years.

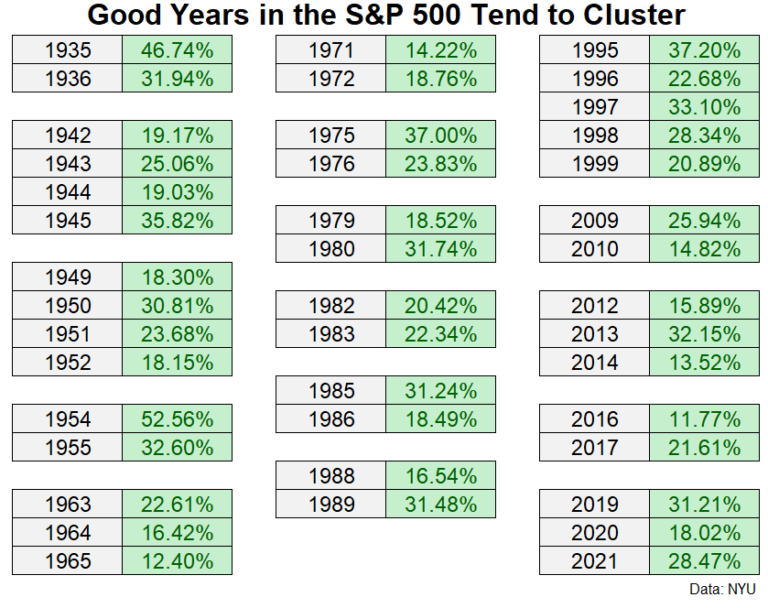

I followed that up writing about how good years in the markets tend to cluster:

Well, the S&P 500 was up 25% in 2024. It happened again.

I’m not taking a victory lap here. I wasn’t making a prediction that 2024 would be another great year. I was simply using history as a guide to show how momentum tends to work in the stock market.

So now we’re looking at back-to-back years of 25%+ gains for the S&P 500 (+26% in 2023 and +25% in 2024).

A few weeks ago I noted how rare this is:

Since 1928 there have only been three other instances of 25%+ returns in back-to-back years:

-

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

So what happened next?

Something for everyone:

-

- 1937: -35%

- 1956: +7%

- 1999: +21%

Terrible, decent and great. Not helpful.

I suppose we could be setting up for another late-1990s boom time where 20% gains every year were the norm but we’ve already been on a fantastic run in the U.S. stock market.

Not so for the fixed income side of the ledger. The Bloomberg Aggregate Bond Index was up a little more than 1% in 2024.1 That would mean a U.S.-centric 60/40 portfolio was up a little more than 15% last year.

Some would say this shows diversification is dead or doesn’t work anymore. I would say this proves diversification works as intended. Bonds have performed poorly in recent years but the stock market has picked up the slack. That’s how diversification is supposed to work.

There will come a time in the years ahead when the stock market struggles and bonds do the heavy lifting.

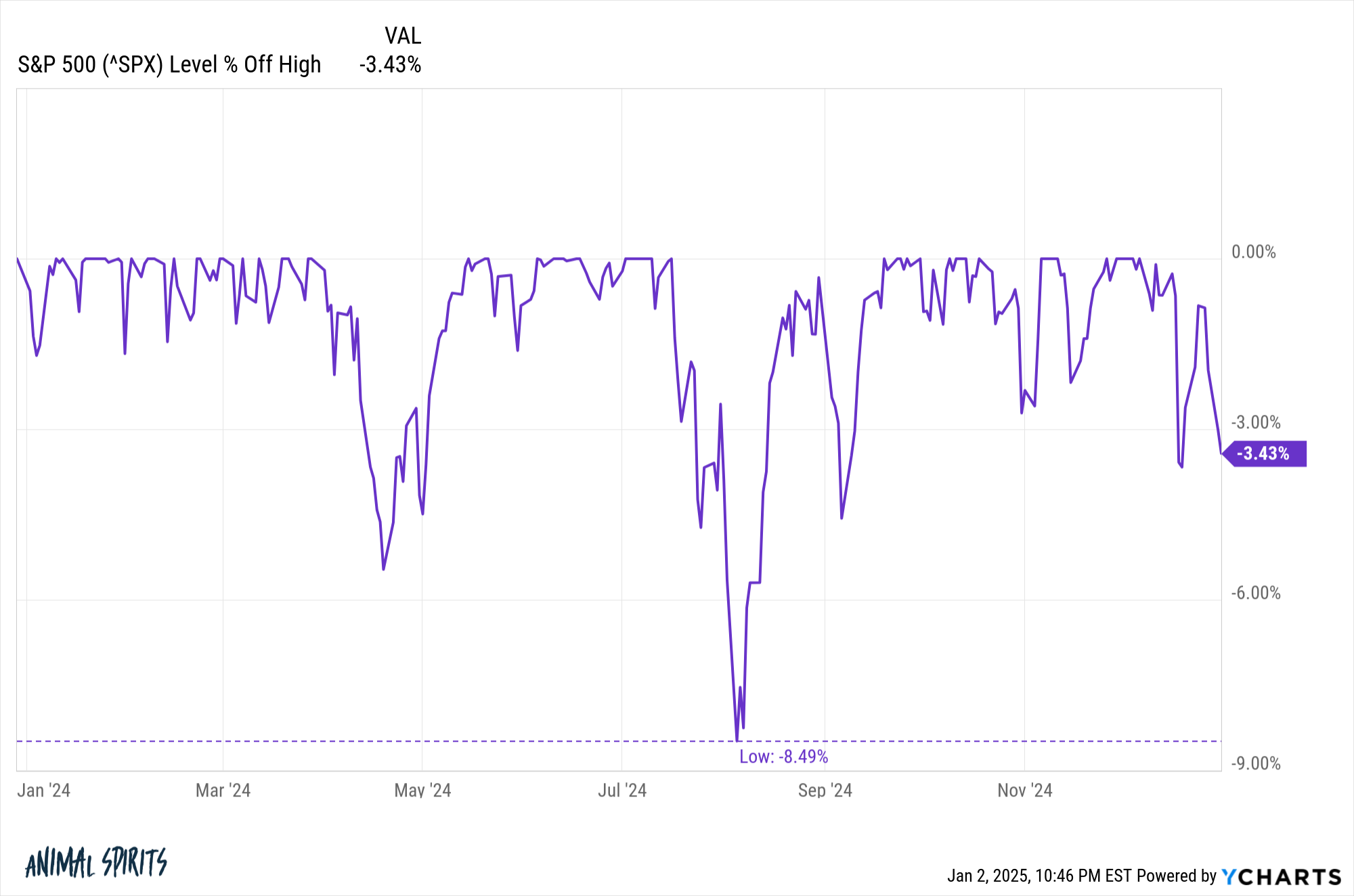

The stock market also made it through the year without triggering a double-digit correction, something that has occurred in two-thirds of all years going back to the late-1920s:

One of the reasons it was a good year for the stock market is because it was a good year for the economy.

The U.S. inflation rate averaged 3% for the year. The unemployment rate came in at an average of 4% in 2024. Real GDP growth was roughly 3% annualized in the 2nd and 3rd quarters.

2024 was a wonderful year for stocks and the economy.

It won’t always be like this but it’s nice to appreciate the good times while they are here.

One of the reasons we get to enjoy good times in the market is because they are invariably followed by bad times.

The good news is the good times more than make up for the bad times.

Micheal and I talked about the year that was in the stock market and more on the latest Animal Spirits this week (sorry no video because of the holidays):

Further Reading:

30% Up Years in the Stock Market

Now here’s what I’ve been reading lately:

Books:

1The saving grace this year was higher yields. The price returns were actually negative.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.