Most investors would like the world of finance to exist in black or white.

Just tell me when to buy or sell, get bullish or bearish, buy this stock or avoid that one, go all in or get out of the market.

Markets are hard because most things exist in shades of gray. It’s difficult to be certain about anything because no one knows what the future holds and the past can be unreliable when used incorrectly.

The giant mega cap stocks are a perfect example of this.

Some think the concentration of large tech stocks in the U.S. is a real cause for concern.

Others feel it would be foolish to bet against the biggest, best corporations we’ve ever seen.

Let’s take a look at both sides of the argument here.

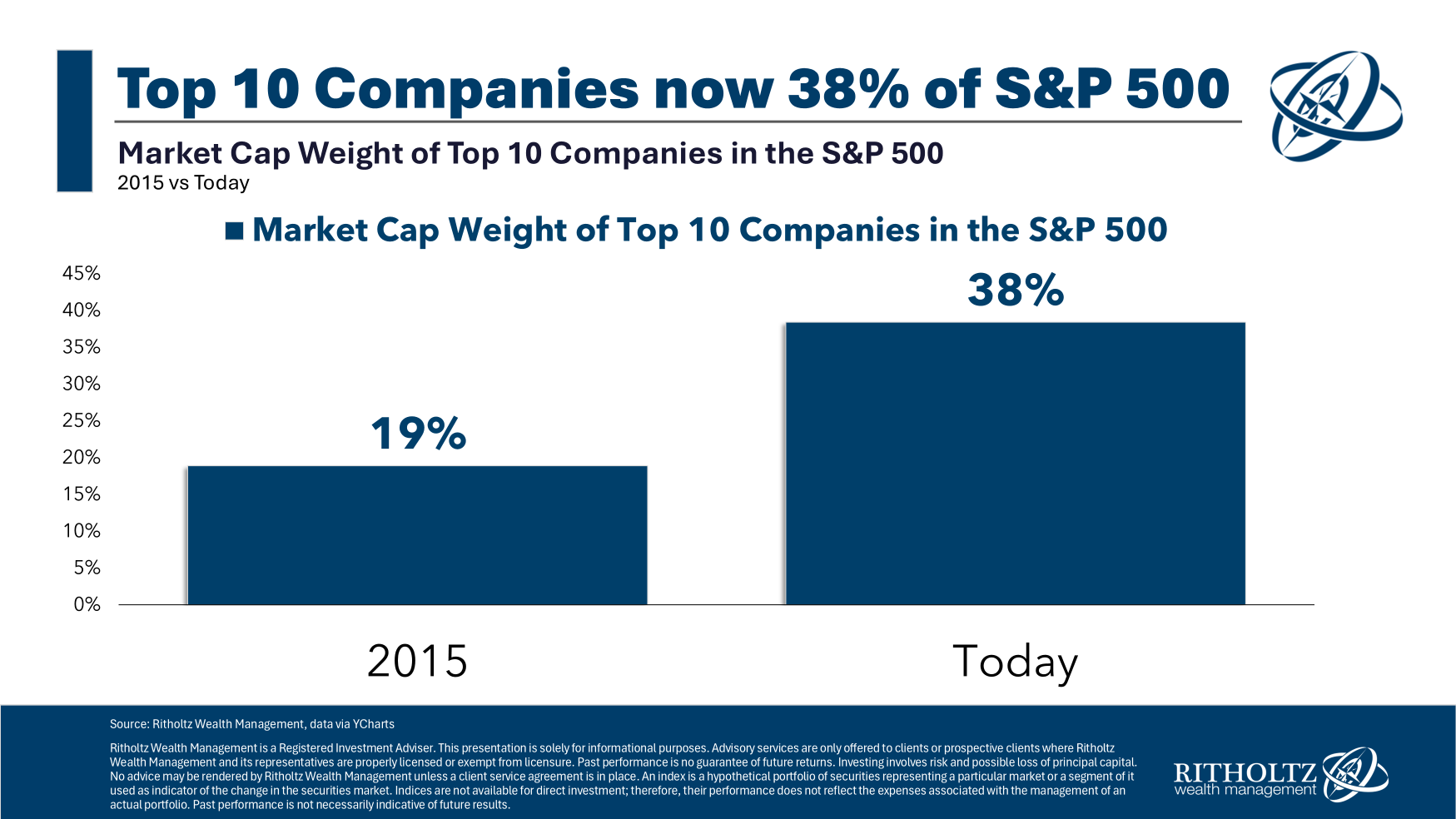

The concentration among the biggest companies is a sight to behold. Just look at how quickly things have changed from the end of 2015 alone:

The five biggest companies (Nvidia, Apple, Microsoft, Amazon and Google) make up nearly 30% of the total.

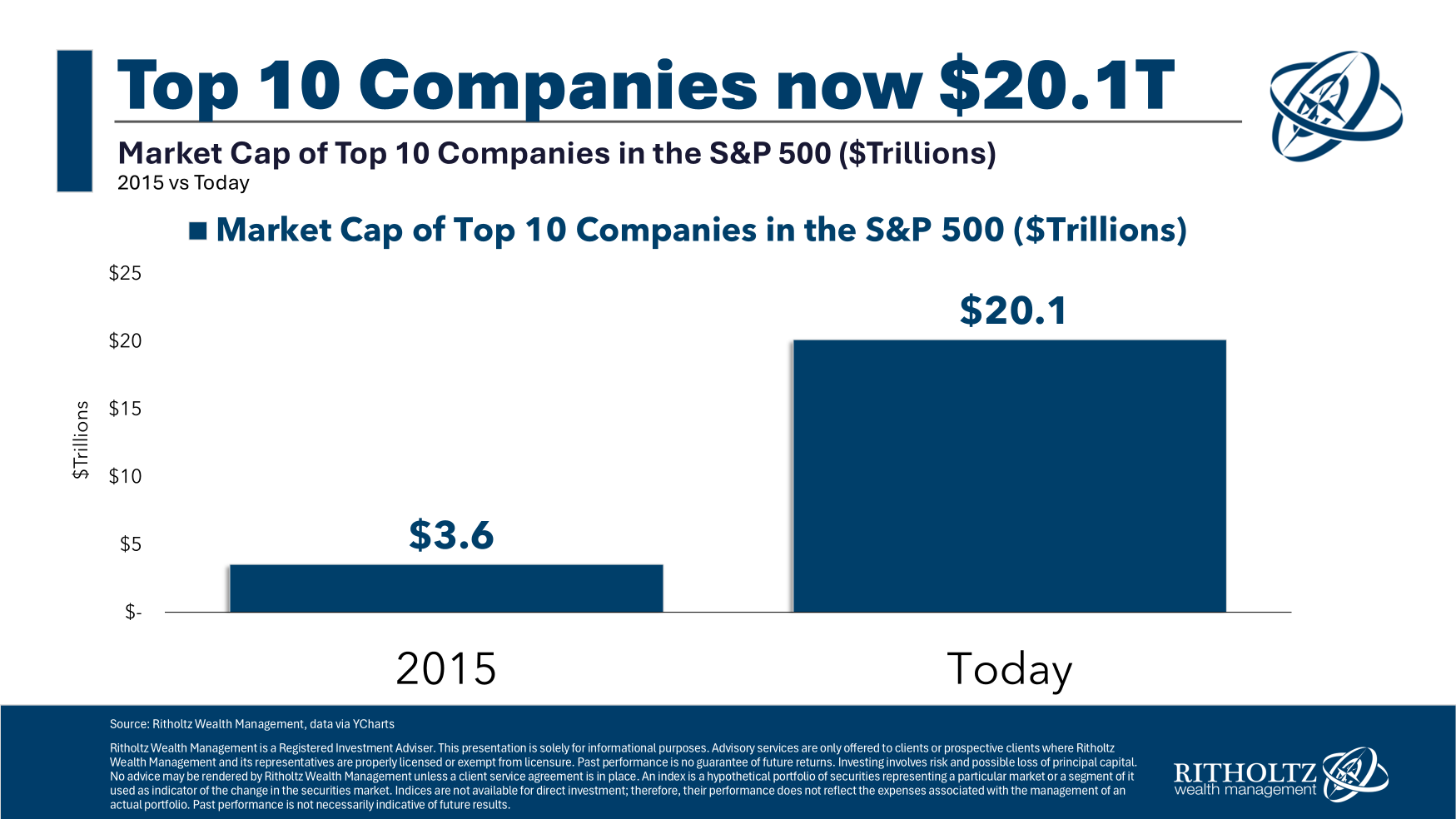

The market capitalizations of these companies are also breathtaking:

Apple, Nvidia and Microsoft are all $3 trillion companies. Google and Amazon are worth more than $2 trillion apiece, while Facebook, Tesla, and Broadcom are all in the four-comma club. Berkshire Hathaway is a stone’s throw from $1 trillion.

These numbers are staggering.

Nvidia is worth more than the entire market cap of Pluto and Venus combined! I kid, but these companies are as large as many developed nation stock markets which is hard to wrap your head around.

Investors are worried for all of the cliched talking points.

Trees don’t grow to the sky. Size is the enemy of outperformance. Nothing fails like success on Wall Street. Price is what you pay, value is what you get.

And yet…

These companies just keep getting bigger, stronger and more powerful.

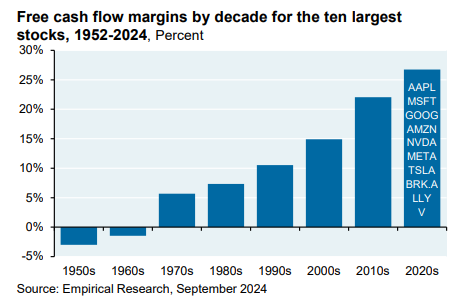

JP Morgan’s Michael Cembalest shared the following chart in a recent piece that shows how unique today’s top 10 companies are relative to history:

We’ve never seen companies this big with margins like this before. These aren’t the railroads or iron smelting industrial companies of the past that required major fixed investments in plant and equipment. They are technology companies with more efficiency and scale than your grandfather’s mega caps.

Of course, everyone knows all of this by now.

You would have had to have your head sewn to the carpet for the past decade to miss the fact that these companies have outperformed the market by a wide margin. That’s how they became so big in the first place!

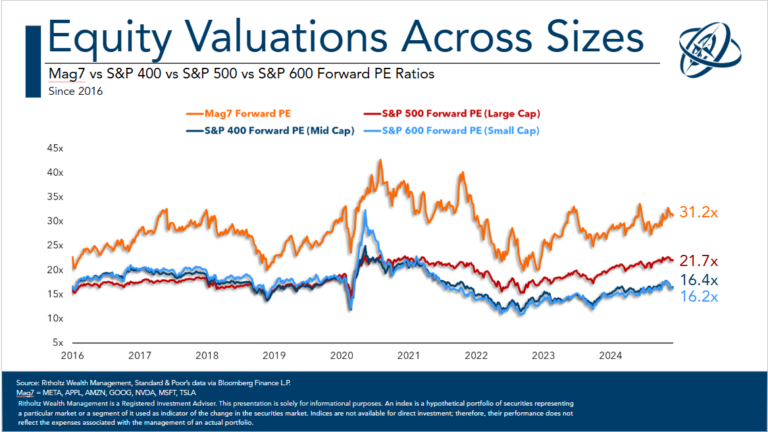

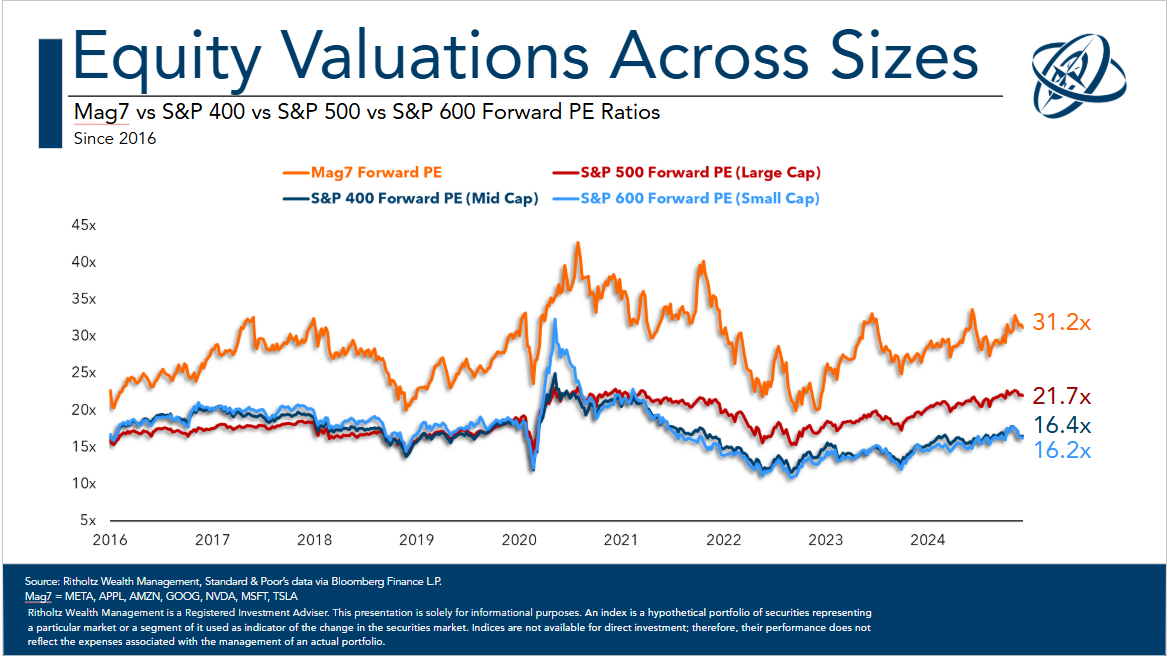

The returns and attention have caused investors to bid up the valuations commensurate with the fundamental performance:

Valuations for the rest of the S&P 500 along with small and mid caps stocks look reasonable by comparison.

To be fair, the valuations for the Mag 7 stocks have been elevated for some time now, and the companies keep delivering. That’s why these stocks continue to charge higher.

The trillion-dollar question is this: What happens if they fail to beat expectations for a time now that those expectations have been ratcheted ever higher? That’s the big risk for these stocks.

The other question is: How could that happen?

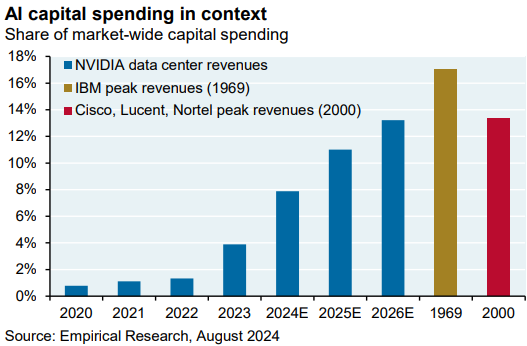

Cembalest also shared a chart that puts the current AI capital spending binge into historical perspective:

Nvidia data centers are expected to bring in nearly as much capital spending as IBM in the Nifty Fifty days of the late-1960s and the network stocks in the dot-com bubble in terms of market share.

I’m running out of adjectives to describe what’s going on here. Astonishing? Mind-blowing? Astounding?

And guess who is spending all of the money on Nvidia data centers? You guessed it — the other Mag 7 stocks! Eventually, the market will require a return on investment from all this capital investment.

Maybe advancements in AI will kick in immediately. Once the killer AI apps are released, we could see a glorious hand-off from AI spending by large tech corporations translate into business and consumer adoption.

You can’t completely rule out that possibility. If it happens the Mag 7 monopolies will grow even more powerful.

The downside risk would be that expectations are now too high and these companies fail to make it over an ever-higher hurdle rate. All of the capital investment into data centers could take longer than they think to bear fruit.

The interesting thing about the two historical capital spending binge comparisons Cembalest used is that both ended in tears in the short-run but still worked out over the long-run.

The one-decision stocks of the late-1960s and early-1970s were the Nifty Fifty blue chips. Companies like Coca-Cola, McDonald’s, Xerox, Polaroid and JC Penney were bid up to nosebleed valuation levels before crashing and burning. Some of these names were down 60-90% from the highs after trading for as much as 50-70x earnings.

But over the long haul many of those same stocks worked out just fine for investors who were willing to hold through the pain.

A similar dynamic was at play during the dot-com boom and bust. Everything people were expecting in the 1990s Internet craze has come true and then some. We got video on demand, online delivery for food, clothing and household essentials with the push of a button, wireless Internet, video calls, global social networks, supercomputers that fit in your pocket and much more.

We just had to live through the bursting of the dot-com bubble to get there. The Nasdaq crashed more than 80% and took 15 years to breakeven because investors set their expectations in the late-1990s far too high.

It all happened just not fast enough.

It seems only fitting that we could see the same dynamic play out with AI overinvestment, where the returns happen but not before investors take things too far and break something because we always get too excited by technological innovation.

So what’s an investor to do?

One could make a strong case in either direction:

Get the hell out of the mega cap tech stocks now! The valuations are too high and due for some mean reversion.

Or

Go all-in on mega cap tech because they are the only game in town. They will only get bigger and stronger in the years ahead when artificial intelligence rules the world.

Alas, I cannot predict the future.

To be honest, neither of these scenarios would come as a complete shock. I don’t know which path we will take. There are far too many unknowns to answer that question.

Human nature is both predictable and unpredictable.

My solution to this conundrum is as follows:

I own index funds and I diversify.

Index funds will own the winners without having to pick them in advance. And diversification gives you the optionality to own the winners that often come from unexpected places.

That’s not a black-and-white answer. I’m not going all-in or all-out on this one.

I prefer to invest in the gray area.

Further Reading:

Updating My Favorite Performance Chart For 2024