One of my favorite market datasets just got its annual update.

Aswath Damodaran at NYU publishes a yearly update of returns for stocks (S&P 500), bonds (10 year Treasuries), cash (3-month T-bills), real estate, gold and inflation going back to 1928. Plus this year he added small caps to the mix.1

These are the long-term returns for each asset class from 1928-2024:

- Stocks +9.94%

- Small caps +11.74%

- Bonds +4.50%

- Cash +3.31%

- Real estate +4.23%

- Gold +5.12%

Inflation averaged right around 3% per year for the past 97 years for the real return people.

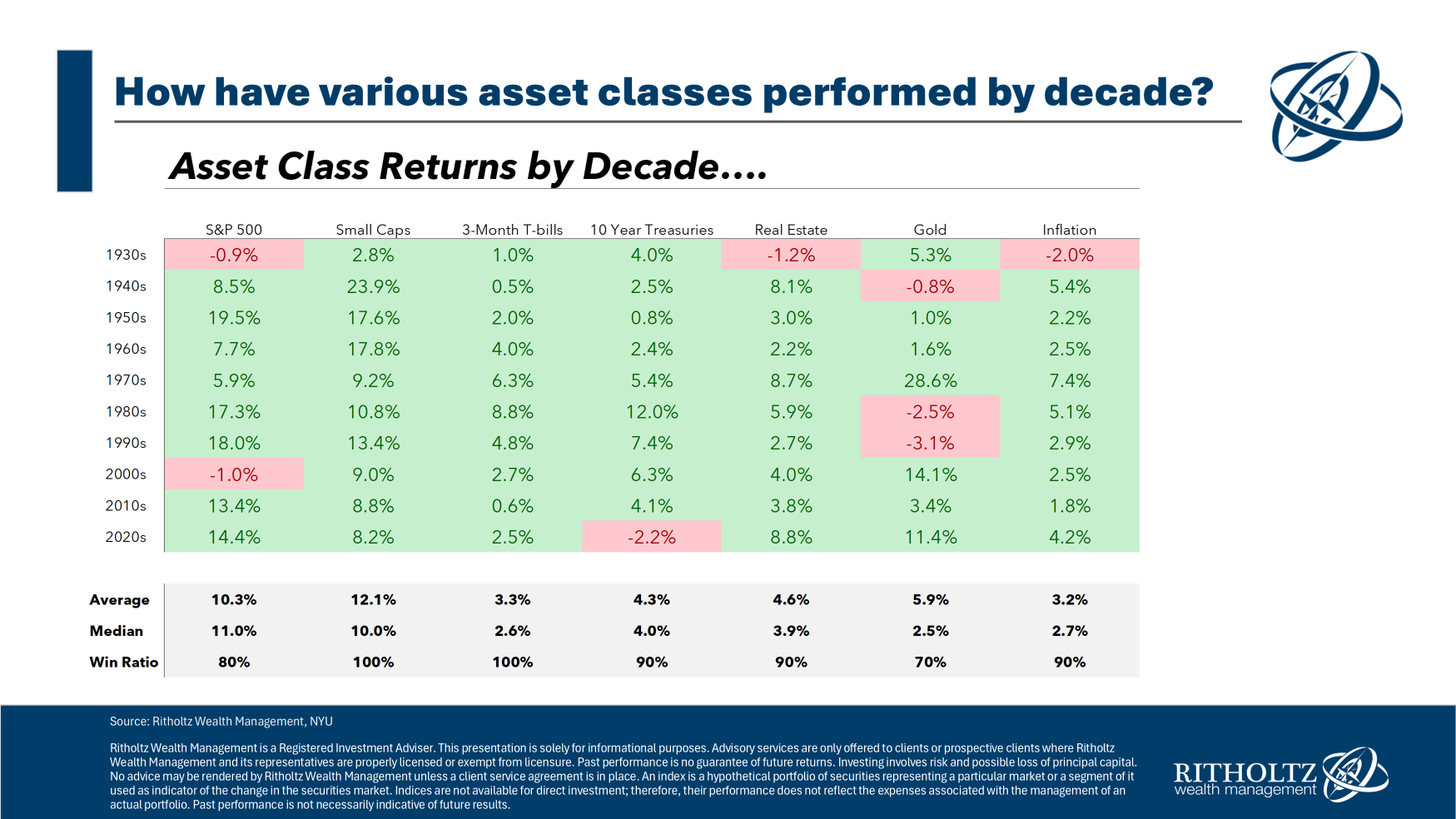

Here are the annual returns for each sorted by decade starting in the 1930s through the end of 2024:

One thing that stands out is the lack of red on this table. There are a handful of lost decades in the various asset classes but they are rare.2

The small cap data is interesting because they beat large caps by a wide margin over the long haul but this data requires some context.

From 1940-1969 the S&P 500 was up more than 2,700% in total, good enough for annual returns of nearly 12% over that 30 year period. Pretty good. But small caps rose 22,000% in total or around 20% per year over the same 30 year window.

The problem is many of the stocks in that group were tiny micro caps that were illiquid and expensive to trade back then. Since 1970, small caps are up more like 10% per year, which is more or less in line with the S&P 500. The data is the data but this is an important caveat when thinking about something like the small cap premium.

I don’t believe you invest in small cap stocks because you’re hoping for a premium over large caps. The real case is diversification in decades like the 2000s and 1970s when large caps struggled and small caps picked up the slack.

And large caps have returned the favor by picking up the slack in the 2010s and 2020s so far.

This entire dataset is a billboard for diversification. The leaders and laggards change from decade to decade. There are no constants from one period to the next.

These cycles never look the same because markets are unpredictable.

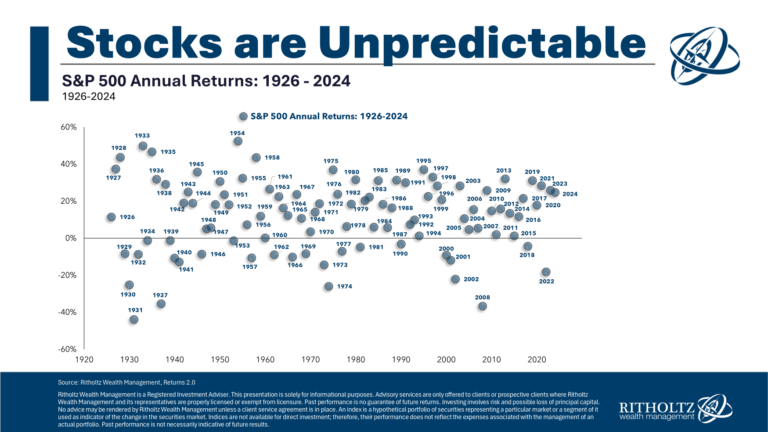

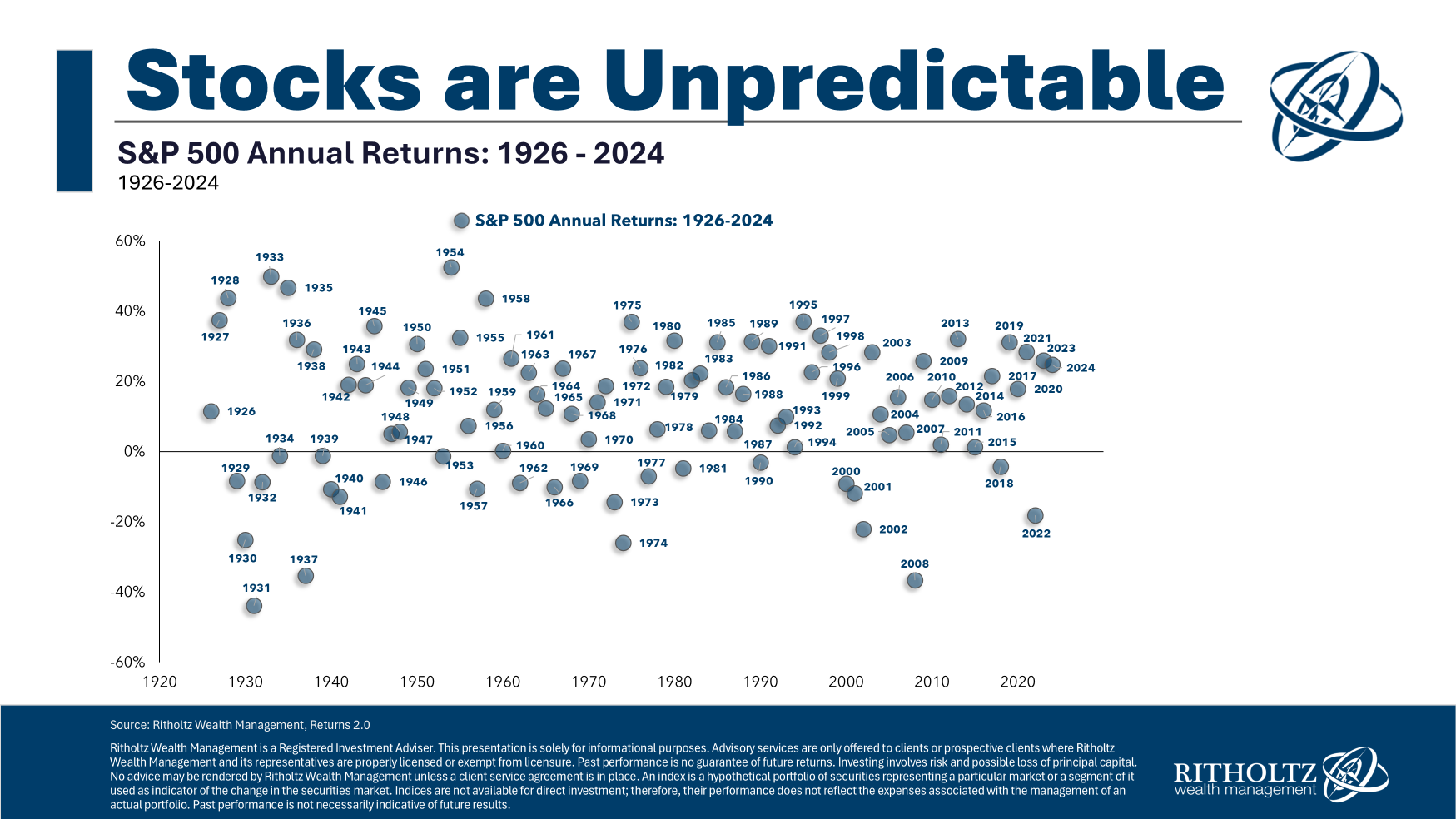

Just look at my updated scatterplot of yearly stock market returns:

Returns are all over the map.

Now, performance numbers in up years since 2019 have been relatively similar but that’s not the norm. The norm is randomness.

The interesting thing about studying market history is that it makes it clear how difficult it is to predict the future.

Further Reading:

31 Years of Stock Market Returns

1He defines small caps as the bottom 10% decile of stocks by market cap.

2Halfway through the 2020s bonds have negative returns but that should be improved going forward since starting yields are now closer to 5%.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.