A reader asks:

Everybody says the easiest way to invest is to simply buy an S&P 500 index fund. However, when you look into the returns of each of the 11 sectors that make up the S&P 500, it becomes clear that some sectors consistently outperform others. I’ve recently discovered SPDR Select Sector ETFs and am wondering what your take is on using them to reconfigure the weighting of an S&P 500 indexing fund? I like the idea of eliminating the real estate, utilities and materials sectors from my portfolio and simply reweighting the remaining 8 sectors to reflect the S&P500 weighting as closely as possible. Any thoughts on this strategy?

I get some variation of this question at least once a year.

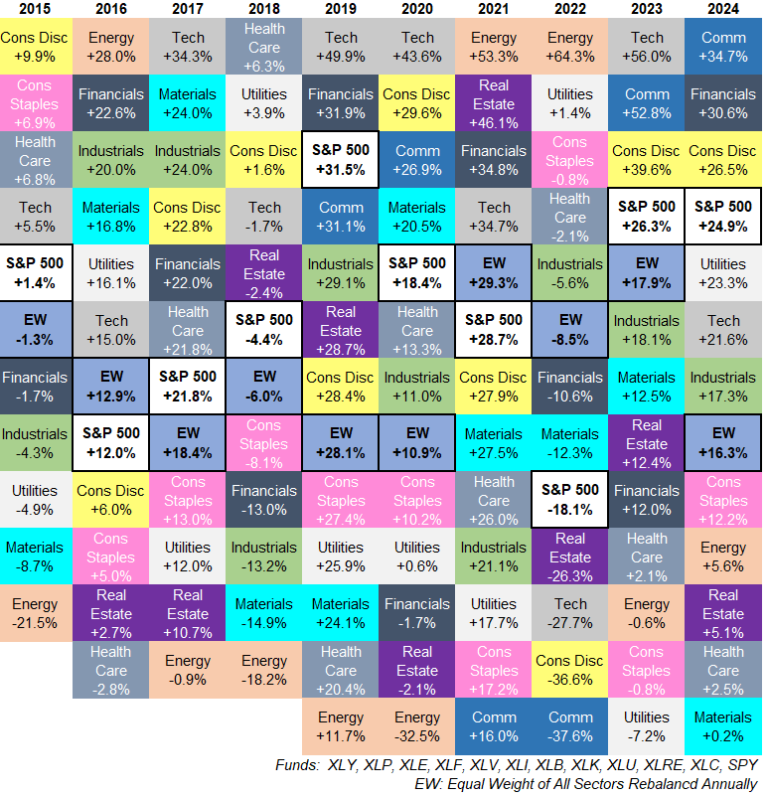

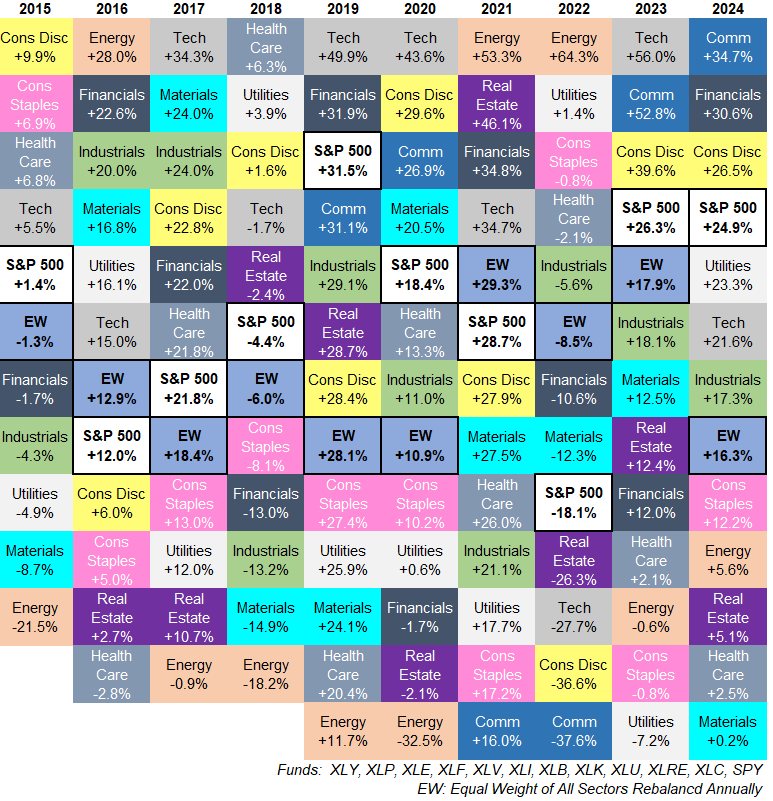

This is a good excuse to update my annual sector quilt:

It’s not nearly as eye-catching as my asset allocation quilt because they’ve added two new sectors (real estate and communications) in the past decade. Oh well.

Tech stocks were obviously the best-performing sector of the past 10 years with 20% annual gains. The only other sectors with 10 year annual returns in the double-digits were consumer discretionary (+13%), financials (+11%) and industrials (+11%). Energy was the worst sector with 5% annual returns from 2015-2024.

I understand the desire to pick sectors. Sure, picking stocks is hard but sectors can help you catch trends by investing in a group of stocks.

I’m sorry to say I have some problems with this sector-picking strategy.

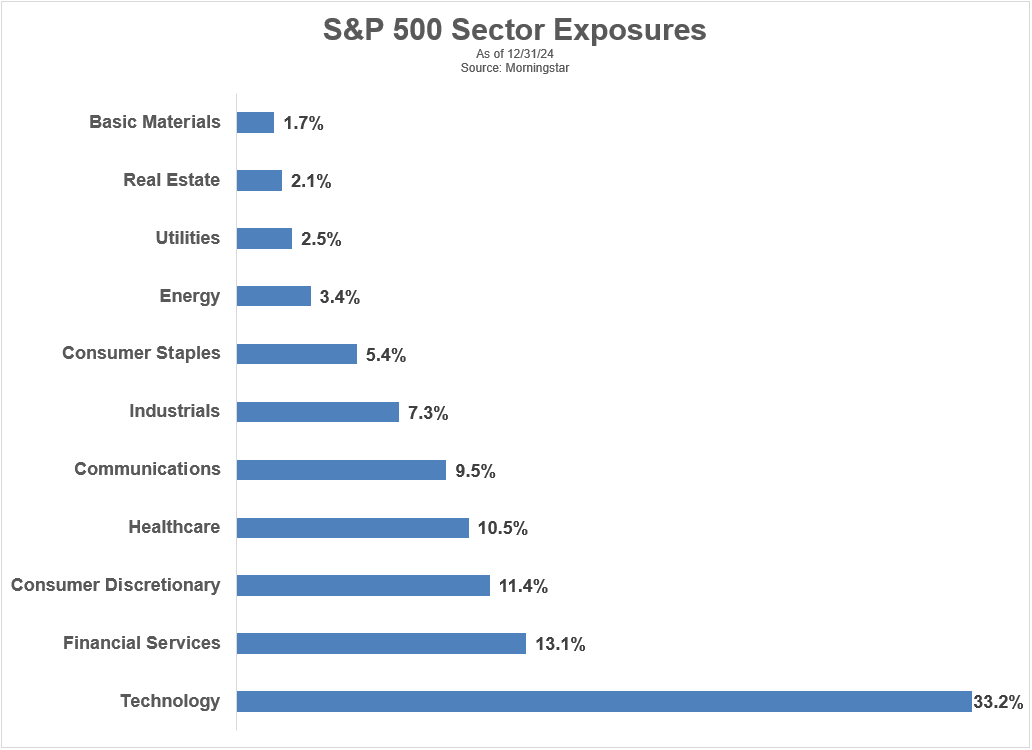

For one thing, it doesn’t move the needle all that much. Look at the sector weightings for the S&P 500 as of year-end 2024:

The three sectors our reader wants to underweight — materials, real estate and utilities — are the three smallest sectors by far. They make up just 6% of the total. Taking them out of the equation will not make a big impact on returns one way or another.

I’m also a big proponent of simplification. This strategy is the opposite of that.

It requires more holdings. You might have to rebalance as sectors change or names move in and out of the index.

After all of that work, you’ll probably still end up underperforming the S&P 500 because you’ll be tempted to over and underweight other sectors that are outperforming or underperforming. The winning and losing sectors are not static over time.

Stock-picking is hard. Sector-picking is no picnic either.

The two best-performing sectors of the past 10 years — tech and financials — were the two worst-performing sectors of the first 15 years of this century:

The worst performer from 2015-2024, energy, was the best performer from 2000-2014.

One of the biggest benefits of indexing lies in its simplicity. There are no extra points awarded for the degree of difficulty in the investment process.

Don’t make investing more complicated than it needs to be.

Own the index and move on with your life.

I went into even more detail on this question on the latest edition of Ask the Compound:

We also answered questions about 2025 retirement account limits, Coast FIRE strategies, when to take money off the table from the stock market, how to account for pension and Social Security income during retirement and how other economies impact the U.S. markets.

Further Reading:

Updating My Favorite Performance Chart For 2024

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.