A reader asks:

Say the 10 year got to 5% and you wanted to allocate some of the 40 side there. Wouldn’t you be better off buying the bonds straight up as opposed to an ETF like IEF? The ETF is no guarantee of principal return, no?

Fixed income has experienced one of its worst environments in history.

Yields were paltry for the entirety of the 2010s. Then Covid hit and we went to generational lows. That was good news for returns in the short-run but disastrous for longer-term returns. The comeuppance came in the form of rapidly rising inflation and yields coming out of the pandemic.

Just look at the 10 year Treasury yield this decade alone:

We’ve gone from historically low yields of 0.5% all the way to 5% just a few short years later. After some back and forth in the past couple of years we are now within spitting distance of 5% again.

After dealing with well over 10 years of low yields I’m not surprised fixed income investors would want to lock in higher rates here. Sure, maybe they go higher, but investors would have sold their firstborn for 4-5% yields just a few short years ago.

The question here is: How should you lock in today’s rates?

This question gets back to one of my favorite contentious investment topics — individual bonds versus bond funds.

People have very strong opinions about this topic. Some investors swear that holding individual bonds to maturity is a secret investing hack. My opinion is one option isn’t better or worse than the other. A bond ETF is simply a fund made up of individual bonds.

Holding an individual bond to maturity doesn’t make it any more or less risky than holding a bond fund. You’re still subject to changes in market rates whether you acknowledge it or not.

Certain investors assumed holding individual bonds to maturity was the only hedge against rising interest rates and inflation. It sounds great in theory. You get your principal back in full and don’t have to worry about mark-to-mark losses in the meantime. What’s not to like?

This is an illusion.

By holding a bond until it matures you will indeed get your principal back at maturity. But you will get that principal repayment in an environment with higher rates and inflation. This means the nominal principal you receive is now worth less after accounting for inflation. Plus, you were earning a lower-than-market yield while you waited.

You’re simply trading one set of risks — principal losses from rising rates — for another set of risks.

Pick your poison.1

It really comes down to what your goals are.

Do you have spending needs with a set deadline in a certain number of years? Owning individual bonds is great for asset-liability matching. You could own all sorts of different maturities depending on your various goals and time horizons.

If you’re really worried about interest rate risk or reinvestment risk, you could also build a bond ladder using, say, 1, 3, 5, 7 and 10 year bonds. As each bond matures you can reinvest the proceeds or spend the money as needed. Some will come due at higher rates and some at lower rates but it spreads out the risks.

Investing in a bond fund gives you more of a static maturity profile.

When you hold an individual bond, that 10 year bond becomes a 9 year bond which becomes and 8 year bond and so on until maturity. Most bond funds seek a constant maturity profile.

IEF is the iShares 7-10 Year Treasury Bond ETF. The maturity profile of the fund stays in the 7-10 year range by buying and selling bonds as their maturities change.

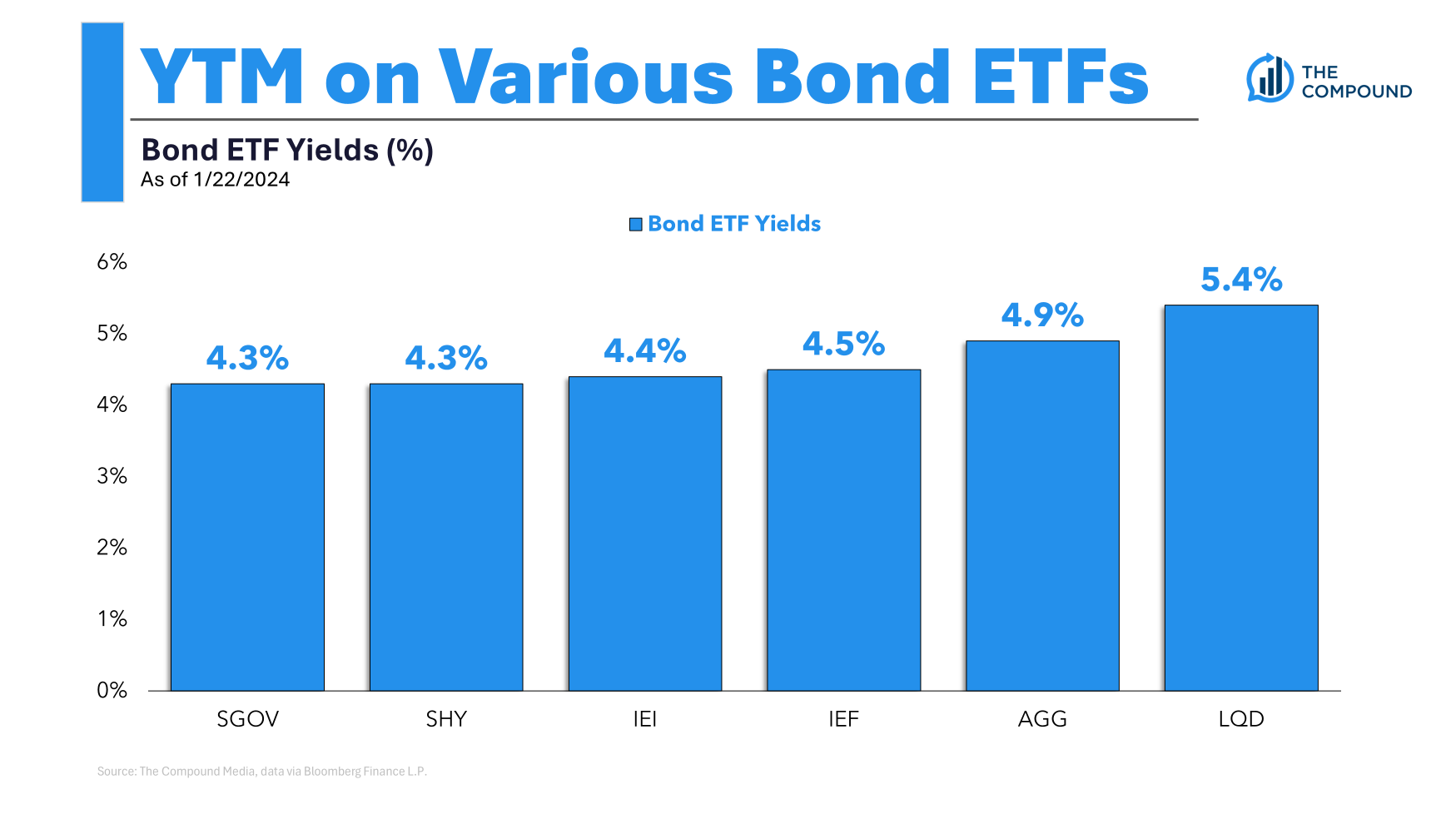

Here’s a look at the average yield to maturity on a host of different bond types2 and maturities:

You can already earn around 5% in a total bond market index fund like the AGG or even more in a corporate bond fund.3 Treasury yields are close while cash yields are falling from the Fed’s rate cuts.

There’s nothing magical about a 5% yield other than people like nice round numbers.

I’m unable to predict the direction of interest rates but I don’t think you want to get too cute here about trying to time specific thresholds.

As always, I don’t know what the best timing on these decisions is. No one does.

I know there are far more exciting investments out there right now but there is going to come a time when people are kicking themselves for not locking in ~5% yields in the future, however you choose to do it.

I spoke about this question on the latest edition of Ask the Compound:

We also covered questions about offering financial advice to family members, how to lower your auto insurance rates, how many years worth of fixed income you need in your portfolio and how to begin the estate planning process.

If you have a question email us: AskTheCompoundShow@gmail.com

Further Reading:

Owning Individual Bonds vs. Owning a Bond Fund

1I know I’ve written about this subject a few times over the years but it feels good to get it off my chest on occasion.

2Here’s a quick summary: SGOV (T-bills), SHY (1-3 year Treasuries), IEI (3-7 year Treasuries), IEF (7-10 yeah Treasuries), AGG (Barclays Aggregate) and LQD (corporate bonds).

3Higher yields tend to have higher risk, all else equal.