Here’s a question from a podcast listener:

On a recent episode of TCAF (Ep. 171 with Harvey Schwartz) you and Josh mention how wealth management has drastically changed over the last ~20 years specifically citing that CFP candidacies are at record highs while CFA candidacies are at record lows. Knowing you and Ben are both charterholders, what do you think of this trend and how would you suggest a young person consider these options for extra-curricular education and accreditation?

We get A LOT of questions about this.

Questions from young people looking to set themselves up for a lengthy career in financial services. Questions from older people looking to break into wealth management. Questions from people who are unsure which path is right for them.

I have plenty of thoughts on the matter but let’s check out the numbers first.

Think Advisor has an update on the number of CFPs:

In 2024, the number of certified financial planners hit 103,093 — an increase of 4.3% over 2023, according to the Certified Financial Planner Board of Standards, with a total of 10,437 candidates sitting for the exam.

Nearly 60% of newly minted CFPs are under the age of 35.

There are more CFA charterholders than those with a CFP. The number I found from the CFA Institute was more than 200,000 charterholders worldwide, so about double the number of CFPs.

But the trend is interesting here. The arrow is pointing up for CFPs and down for CFAs.

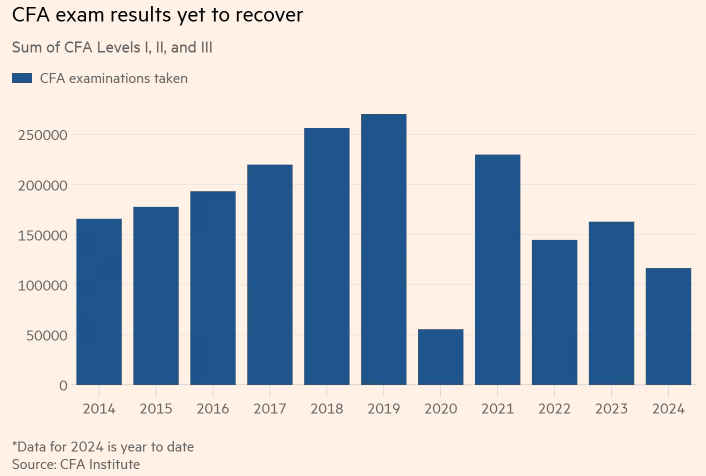

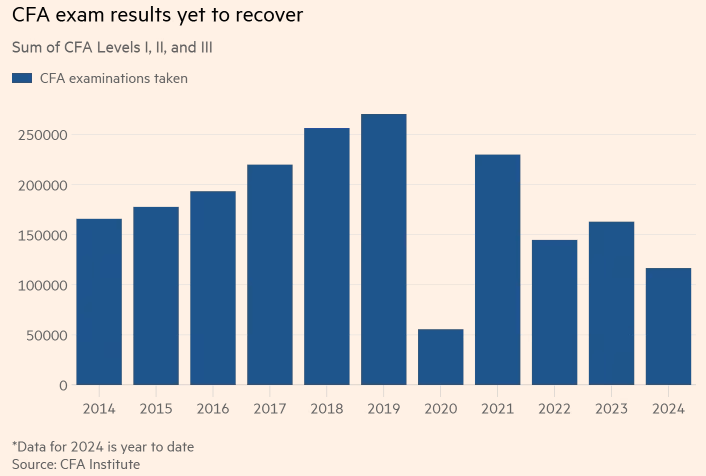

The Financial Times wrote a story on the trends in CFA exam participation:

The latest available results for CFA Institute, which oversees the tests, show 116,727 people sat all three levels of the exam in the first eight months of the year, down 2,735 on the same period in 2023.

Last year there were 163,000 exam registrations, 40 per cent down from the peak of 270,456 in 2019.

Check out the number of exam-takers for the CFA by year:

It’s in a severe bear market from the pre-pandemic days.

I wrestled with this question when I was trying to find my place in the finance industry too. I’ve always been more of an analytical thinker and didn’t have much exposure to wealth management early in my career so I went the CFA route.

Taking the exam didn’t necessarily make me a better investor but it did make me more knowledgable and employable. Many of the roles I was applying for out of college required you to either sit for the exams or already have the CFA designation.

I know for a fact that just sitting for the level one exam got me an interview that eventually led to a job offer. So it was worth the gruelly three years of studying.

But that was 15-20 years ago. What if I had to make that decision now?

I’m not so sure I would go the CFA route again knowing what I now know.

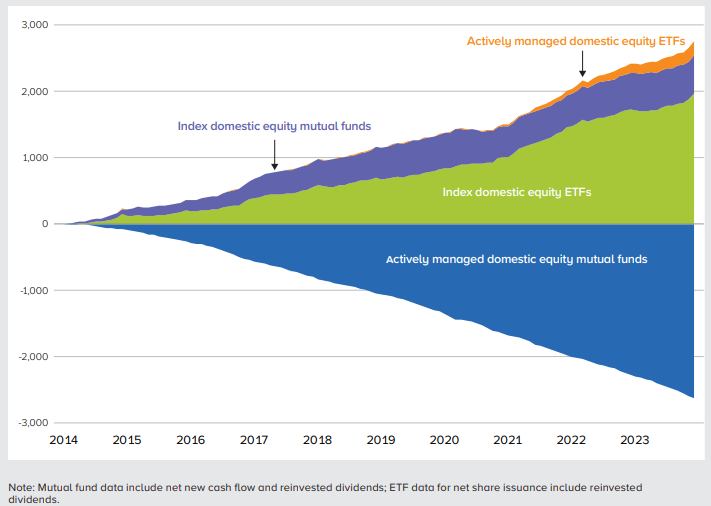

The CFA is a portfolio management designation and while portfolio management will always be important, security selection is not a huge priority like it was in the past. Index funds and ETFs are swallowing up the fund industry. There is a far greater emphasis on asset allocation, index exposure and thematic funds than old school active security selection.

Just look at the fund flow data (via ICI):

On the other hand, the market for financial advice is set to explode in the years ahead.

I firmly believe one of the biggest bull markets in the finance space over the next 20-30 years will be providing financial advice to retired baby boomers and managing the transition of trillions of dollars to their heirs. There are 70 million baby boomers who control $82 trillion of wealth. They need it to last throughout retirement and then see a smooth transition to their children.

The CFP is a financial planning designation and the need for financial planning will only grow in importance in the years ahead. And most advisors are themselves entering retirement age.

In VC-speak, the TAM is much higher for the CFP than the CFA.

Being a financial advisor requires more intrapersonal skills so it’s not for everyone.

But if you want to go where the growth is, the CFP makes more sense than the CFA.

Michael and I talked about CFAs, CFPs and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The CFA vs. MBA Decision

Now here’s what I’ve been reading lately:

Books: