Boy that escalated quickly.

The S&P 500 closed at a new all-time high on February 19th. Since then it’s basically gone down in a straight line.

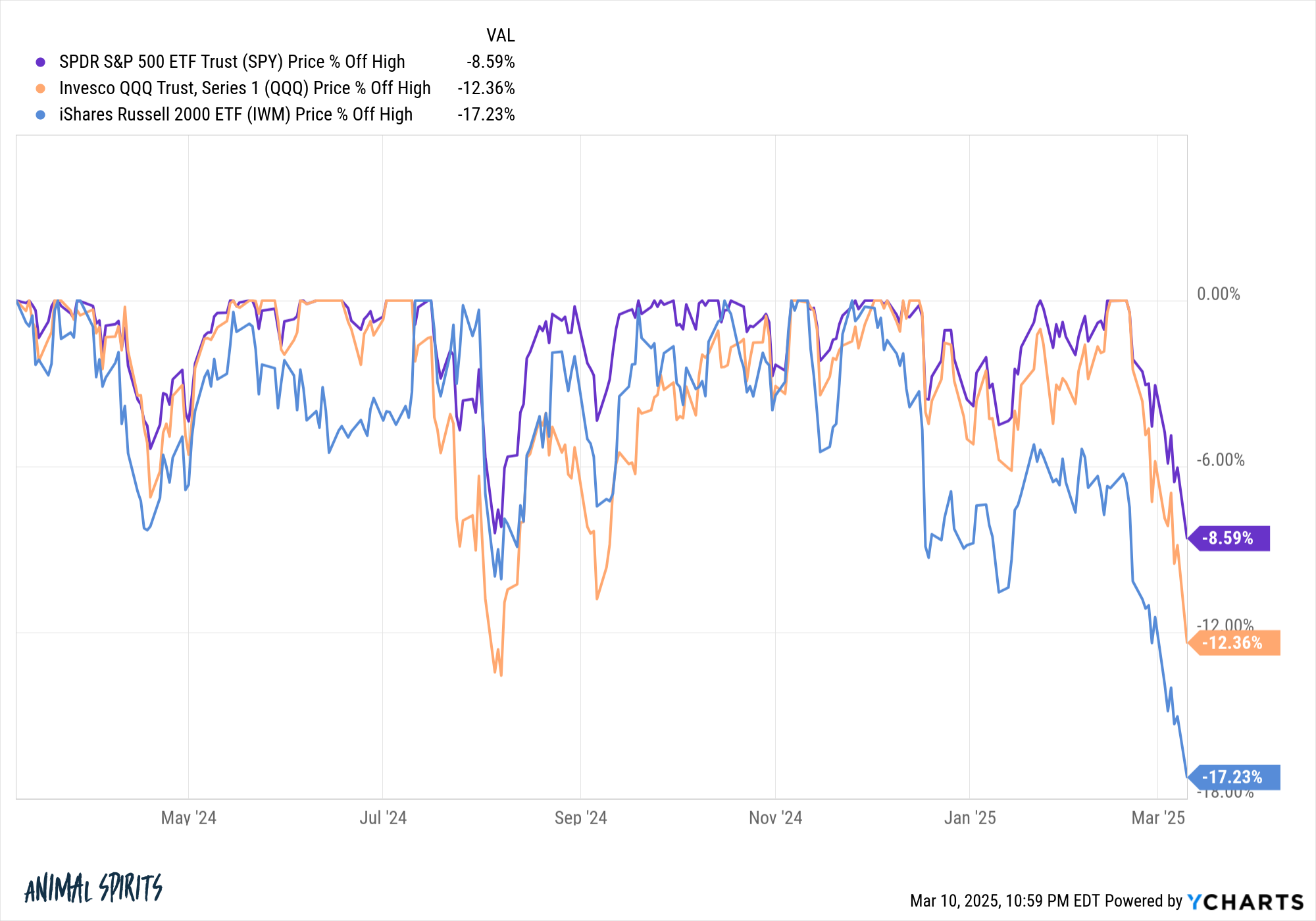

Through the close on Monday the S&P 500 was down nearly 9%. The Nasdaq 100 is in a 12%+ correction while the Russell 2000 is flirting with bear market territory, down 17%.

I’m not a huge fan of this-year-is-just-like-that-year charts because people often take too many liberties with their comparisons. Having said that, the speed and timing of this correction reminds me of the start of the Covid crash:

This chart is helpful because it shows that these things can happen quickly. It also shows the current correction is insignificant in the grand scheme of things. This is merely a flesh wound (so far).

Obviously, I don’t think we’re due for another Covid-like plunge by any means. It’s just worth remembering these things can happen in a hurry.

Every correction looks healthy in hindsight and this one will be no different once we’re far enough away from it. But we’re in it now so the question is this: How do you make this a healthy correction?

I’m going to answer a question with more questions because context always matters with these things:

Are you still saving? Lower stock prices are a good thing. Keep saving and investing.

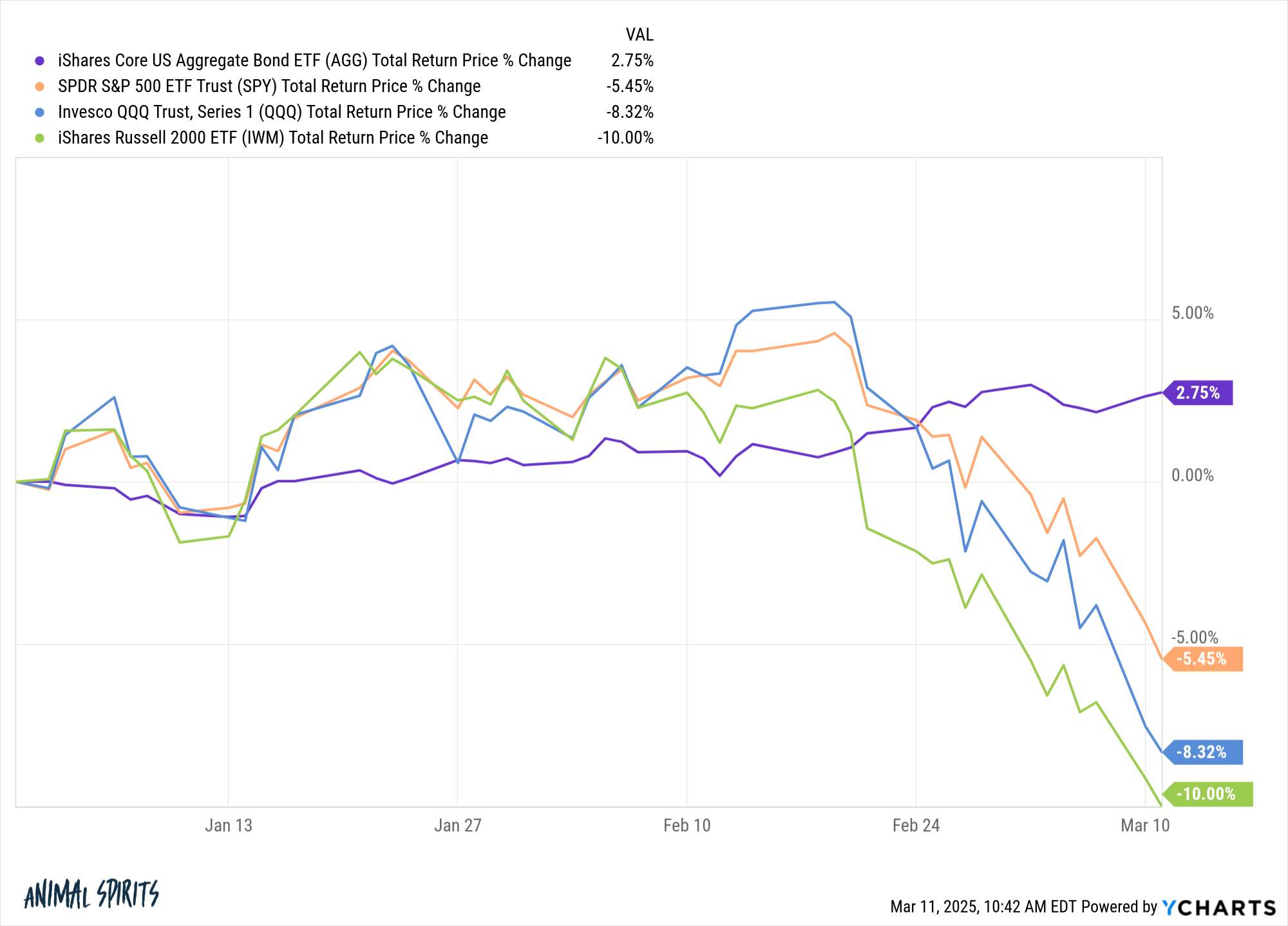

Do you have dry powder? Bonds are working again as a portfolio stabilizer this year:

You not only have higher starting yields but price appreciation from falling rates. Bonds can provide a great source of dry powder during a market correction if you rebalance to lean into the pain.

Did you take too much risk? We’re not in a bear market or a crash, just a correction. These things happen. The average intra-year stock market correction since 1950 is a peak-to-trough drawdown of roughly 14%.

We’re not even there yet.

I’m not a fan of going all-in or all-out of the market because market timing plays head games with you. But if a minor correction like this forces you into the realization that you have too much equity risk, there is no shame in going from 90/10 to 80/20 or 70/30 to 60/40 if it helps you stick with your investment plan.

Are you a forced seller? Equity risk can be painful at times but it is temporary in nature. Blow-up risk, on the other hand, can have long-lasting effects. If you invested on margin you can blow yourself up. If you went heavy into 3x levered ETFs you can blow yourself up. If you try to time the market you can blow yourself up.

There are necessary and unnecessary risks when it comes to investing. Avoid unnecessary risk so you can live to fight another day.

Are you waiting for the dust to settle? Every market crash started out as a correction, morphed into a bear market and got out of control before falling apart. This is why corrections are so worrisome when you’re in the eye of the storm. No one knows how far things will go.

Just know that no one shouts an all-clear signal to alert you when it’s time to get back in. Markets don’t bottom on good news just news that’s less bad.

Things could get worse before they get better or this could be over by the end of the day. No one knows for sure. The market wants you to lose your cool. So does the financial media.

It’s a healthy correction when you don’t panic.

It’s a healthy correction when you have dry powder in the form of future savings or liquid assets to deploy.

It’s a healthy correction when you live to fight another day in the markets.

It’s a healthy correction when you keep your wits about you when others are losing theirs.

And it’s a healthy correction if you stay the course.

Further Reading:

What Does a Healthy Correction Look Like?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.