A reader asks:

Why would a financial advisor recommend a client buy a boat? Isn’t that irresponsible?

This question was in response to a segment from a recent episode of Ask the Compound. Someone made a substantial profit investing in Palantir shares and was asking what to do with the proceeds.

The question was investment-related: Should I let the money ride or invest it in something else? Just to cover all the bases, I wondered if those profits could be used for something else — maybe a vacation or the down payment on a home or boat or something outside of the markets.

Fred Schwed wrote the best finance book title of all time called Where Are the Customers’ Yachts. This story from the book is the origin of the title:

Sailing into the harbour at Newport, William R. Travers saw many beautiful yachts at anchor on the sunny water.

‘Whose boat is that?’ he asked.

‘It belongs to So-and-So, the great Wall Street broker.’

‘Whose yacht is that big one over there?’

‘It belongs to So-and-So, another great Wall Street broker.’

And whose is that big steam yacht almost as large as an ocean liner?’

‘It belongs to the greatest of all the Wall Street brokers and bankers, So-and-So.’

Travers looked at the different yachts, asked about them, and got always the same answer. At last with his usual stutter, he asked: ‘Where are the customers’s yachts?’

There were no customers’s yachts to be seen.

The idea, of course, is that Wall Street employees get rich, not the clients. Jason Zweig once told a joke that goes like this:

I put two children through Harvard by trading options. Unfortunately, they were my broker’s children.

Everyone in the finance industry isn’t looking to rip off their customers but you get the idea.

Interestingly enough, getting wealthy clients to spend their money is one of the biggest roles for a financial advisor today.

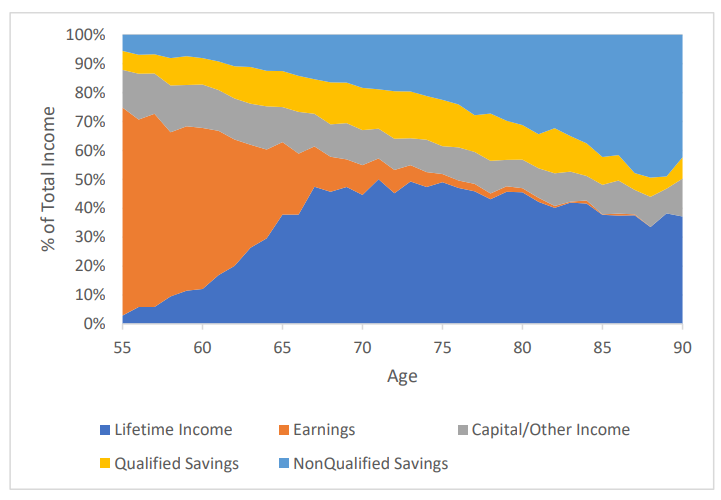

David Blanchett and Michael Finke recently published a research paper on retirement spending habits. Married households 65 and over spent just 2.1% of their savings in a given year on average. Investors are happy to use any income generated from their portfolio but are reluctant to spend down their principal balance. The median retiree is spending far below their capacity to spend based on their financial assets:

Transitioning from saving and investing to spending and consumption is a psychological hurdle that can be difficult to overcome in retirement.

When I joined Ritholtz Wealth Management, Kris Venne explained to me that one of his biggest jobs as a financial advisor centered around helping their clients enjoy the fruits of their labor — buy that vacation home, take that family trip, buy the convertible, buy a boat, etc.

I didn’t really believe him until I experienced it firsthand in client meetings. There are bigger problems in the world but so many discussions revolve around the worries of spending money in the face of all the uncertainties involved in retirement.

Our advisors create comprehensive financial plans with clients so they run the numbers when trying to make these dreams a reality. You can’t just spend with abandon and hope things work out. When the numbers work, we love seeing pictures of clients enjoying their wealth.

The point of money is to spend it.

The point of delayed gratification is eventual gratification in the future. It’s not irresponsible for a financial advisor to recommend their clients buy a boat if that’s one of their financial goals.

I’ve heard the joke that boat translates to Bust Out Another Thousand. It can be expensive to buy a boat, store it in the winter, buy gas and dock it in season. It’s not cheap.

We became a boat family a few years ago. It’s also a lovely way to build memories, hang out with friends and family, and spend time outside away from screens. It’s an investment in experiences.

I’m not saying every wealth management client needs a boat. It’s certainly not for everyone.

You have to define what’s important to you and spend money on those areas. For those with a psychological block on spending money, an objective third party can help give you permission to enjoy your wealth in the context of the financial planning process.

There are opportunity costs if you don’t invest enough for the future and opportunity costs if you don’t enjoy the present.

A good life is all about balance.

Sometimes that balance means spending money. The future is promised to no one and you can’t take it with you.

Blair duQuesnay joined me on Ask the Compound this week to discuss this question:

We also answered questions about when to change your asset allocation during a correction, why Wall Street is so bad at price targets, the economic impact of tariffs and taking out a 401k loan to fund a down payment.

Further Reading:

10 Great Lines From Where Are the Customers’ Yachts?