During bull markets there are always certain investors who take things too far.

They chase performance, take on too much leverage, speculate on fad investment themes and abandon diversification.

Then the tide goes out and we find out who’s been swimming naked as Warren Buffett likes to say.

Bear markets and corrections also cause mistakes on the opposite end of the spectrum.

When the stock market goes down, certain investors begin timing the market, getting too defensive, discarding their investment plan, and abandoning buy-and-hold.

Some people are only buy and hold investors when it suits them, which kind of defeats the purpose. Here’s a story from The Wall Street Journal on this very topic:

These are always my favorite stories from the WSJ because they allow you to peer into the psyche of different investors. Here’s one of them:

For years, Yoram Ariely hadn’t touched most of his investments, preferring to ride the stock market’s ups and downs. Last Tuesday, he decided he had enough.

The 82-year-old unloaded almost half of his stock investments, fearful of the effects of President Trump’s economic agenda, and tariffs in particular. He may get rid of more still.

“The decisions are changing daily,” said Ariely, a retired business owner in Longboat Key, Fla.

The Trump administration’s chaotic mix of tariffs and government budget cuts have jolted legions of everyday investors, leading them to question the assumption that they should buy and hold stocks on autopilot.

Uncertainty leads to fear which can lead to getting out of the stock market. I get it. There is a lot of uncertainty about the president’s economic policies. I would just be curious to know what the plan is here.

Do you hold off on stocks until he leaves office? Do you buy back in when the tariff situation becomes more certain? What if you’re wrong?

Here’s another guy who decided to tap out:

Patton Price said he expected geopolitical chaos in Trump’s second term, back when equities were still flying high. He sold all the stocks in his retirement accounts around the time of the presidential inauguration on Jan. 20.

“It’s not like I have some fancy thesis and I think I know what’s going to happen,” said Price, a 46-year-old musician and former political consultant in Richmond, Calif. “I just don’t think anybody knows what’s going to happen.”

His timing was actually pretty good. He missed the correction.1 Now what? This is the problem:

He doesn’t know when he will get that money back into the market.

Market timing is hard because, even if you get out at an opportune time, you have to nail the landing and get back in. Few people can do both. In fact, getting the first leg of the parlay right often makes it even harder to get back in because you become so attached to the loving arms of cash.

The psychology of market timing becomes even more challenging when you add politics to the mix.

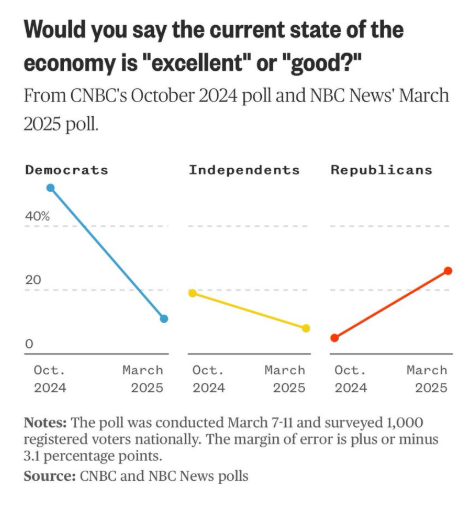

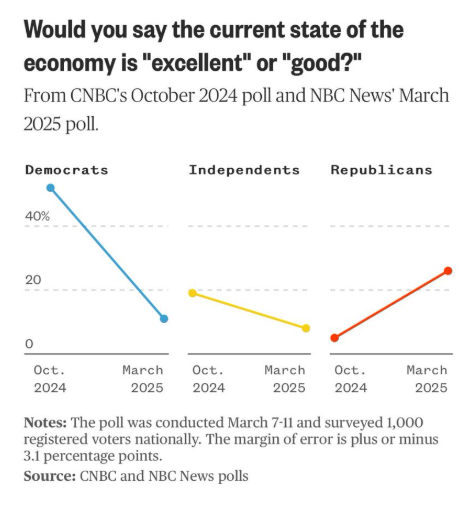

Check out this CNBC poll about feelings on the current state of the economy a month before the election to now:

I suppose this is the cycle of fear and greed but for politics.

Democrats felt great about the economy in October and not so great now. Republicans hated the economy in October yet now they love it. Is this rational? Maybe. Ask me again in 6-12 months.

I’m never going to be a fan of ditching your investment strategy without a plan. There are times when it makes sense to recalibrate your risk. Now might be one of those times. The stock market is only ~8% off its highs. The world hasn’t ended yet.

However, you can’t just wing it. You have to invest in something. The only way to guarantee your investment plan will fail is by investing in nothing.

Even a mediocre plan is better than no plan at all.

Michael and I talked about timing the market, buy and hold and some fun stories from Miami on our live Animal Spirits this week:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How to Make it a Healthy Correction

Now here’s what I’ve been reading lately:

Books:

1To be fair he also missed a little of the upside in February. The S&P 500 is only down about 6% from inauguration day.