I like Jesse Livermore quotes because they’re often multi-faceted.

This is one of my favorites:

Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

I agree with this sentiment. Human nature is the one constant across all market cycles. Even AI won’t change that.

I also know the stock market structure is constantly changing and never the same.

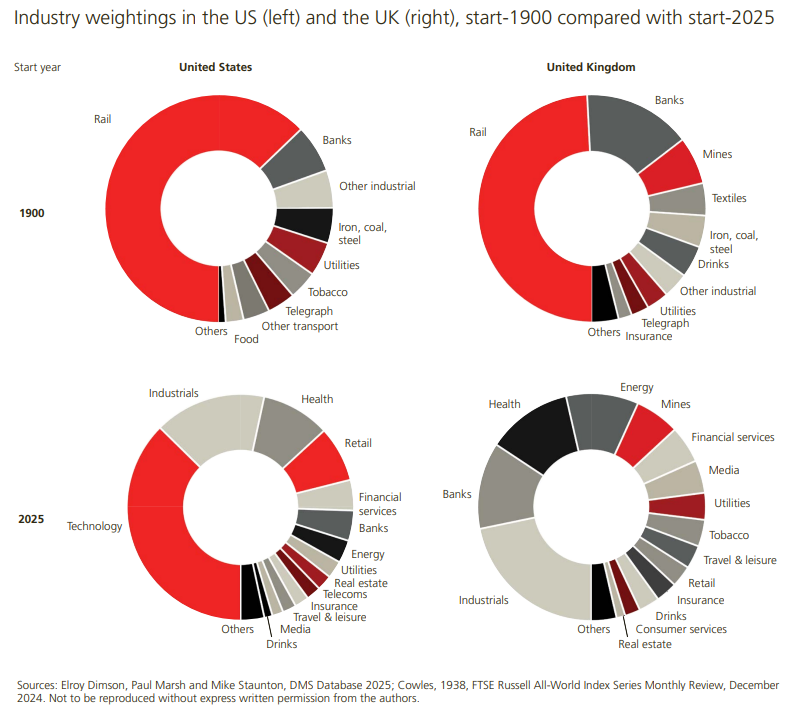

Here’s one of my favorite annual charts from the UBS Global Investment Return Yearbook:

I still remember reading The Intelligent Investor for the first time and wondering why Benjamin Graham kept writing about railroad stocks. Well, it was written in the 1940s and Graham grew up when railroad stocks ruled the day.

That’s not the case anymore. Tech stocks rule the day in America. In the UK, it’s more spread out.

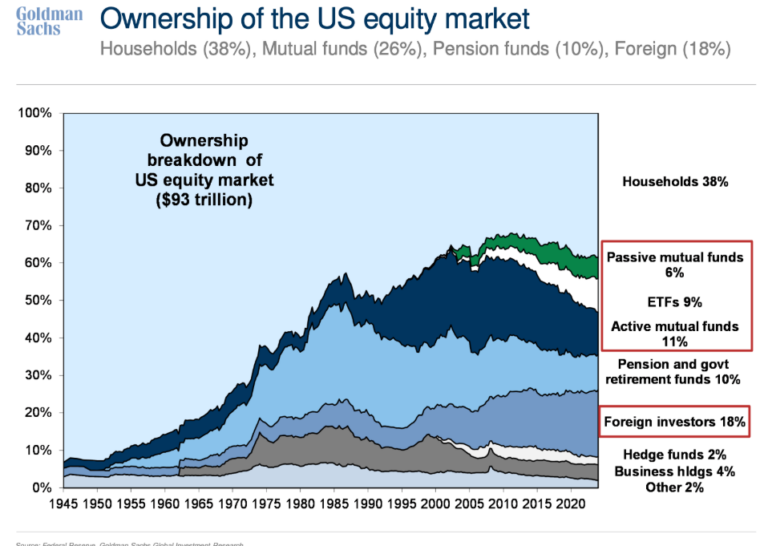

Ownership of the stock market is always changing too. This Goldman Sachs chart is another personal favorite:

Stock market ownership used to be heavily concentrated in the hands of households. That’s not the case anymore.

Households still have the highest ownership percentage but it’s dropped from more than 90% in 1945 to 38% now. The fund industry controls more than one-quarter of the stock market. Foreign investors make up neatly one-fifth of the total.

Obviously, households still own most of the stocks through these other vehicles but there is far more diversification in the ownership structure. I think this is a good thing for the health of the market.

Eggs are in lots of baskets now.

Leadership in the stock market is always changing as well.

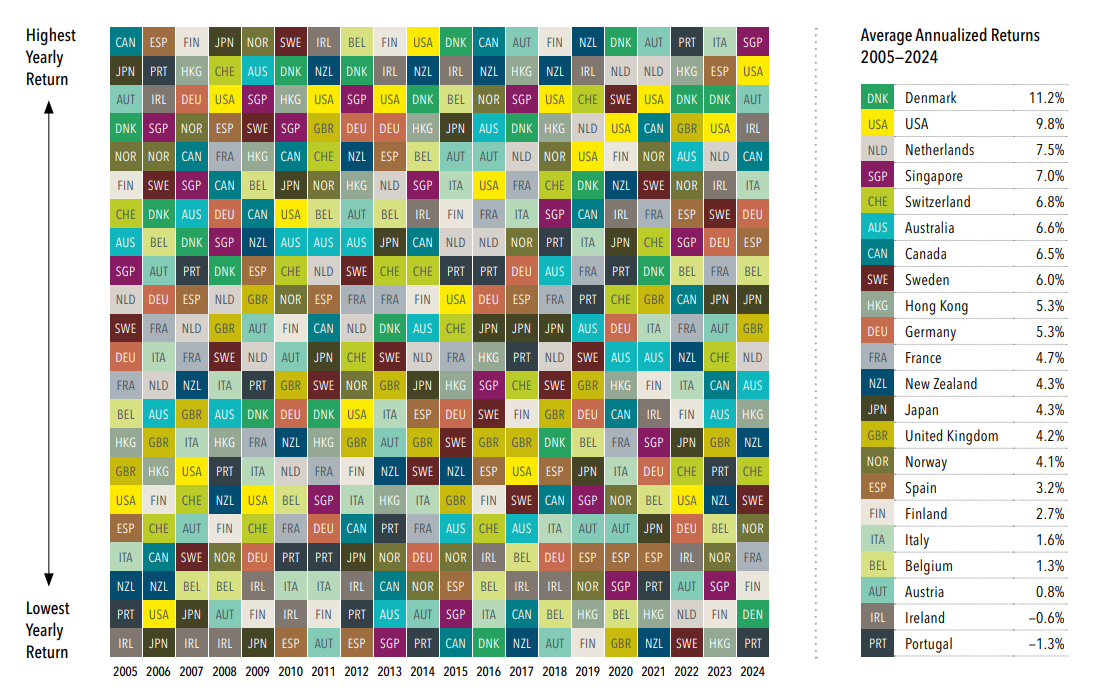

Regular readers of A Wealth of Common Sense know I’m a huge fan of performance quilts. Here’s a great one from DFA that ranks country stock markets over the past 20 years:

Who would have thought Denmark outperformed American stocks over the past 20 years?

But the real takeaway here is how the performance rankings are constantly changing. Can you imagine if you had to guess who the best or worst performer was in a given year?

The global stock market is schizophrenic and I mean that as a compliment.

It wouldn’t make sense if the rankings were the same year in and year out. It wouldn’t be much fun either.

The stock market has to change all the time.

Otherwise it wouldn’t offer investors a risk premium.

Further Reading:

Timeless Wisdom From Jesse Livermore

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.