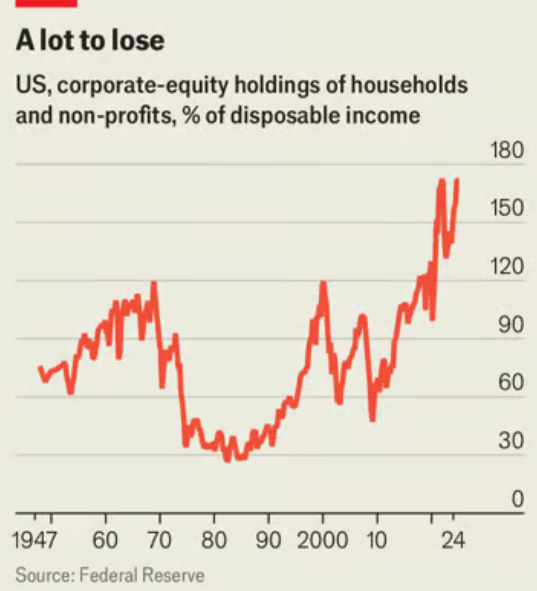

The Economist has a good piece about the growing importance of the stock market on household balance sheets.

Here’s the chart that matters:

By the end of 2024, Americans owned stocks worth 170% of disposable income which is back at record levels and much higher than in previous decades.

The worry here is that a sustained drop in stock prices could eventually have an impact on the real economy.

I’m gonna both sides this one.

The top 10% of households by net worth own nearly 90% of stocks. This group also accounts for 50% of consumer spending. If stocks go into a prolonged downturn, that could cause this cohort to reduce their consumption in a big way.

If that happens, the theory goes that the stock market could cause a slowdown in the economy.

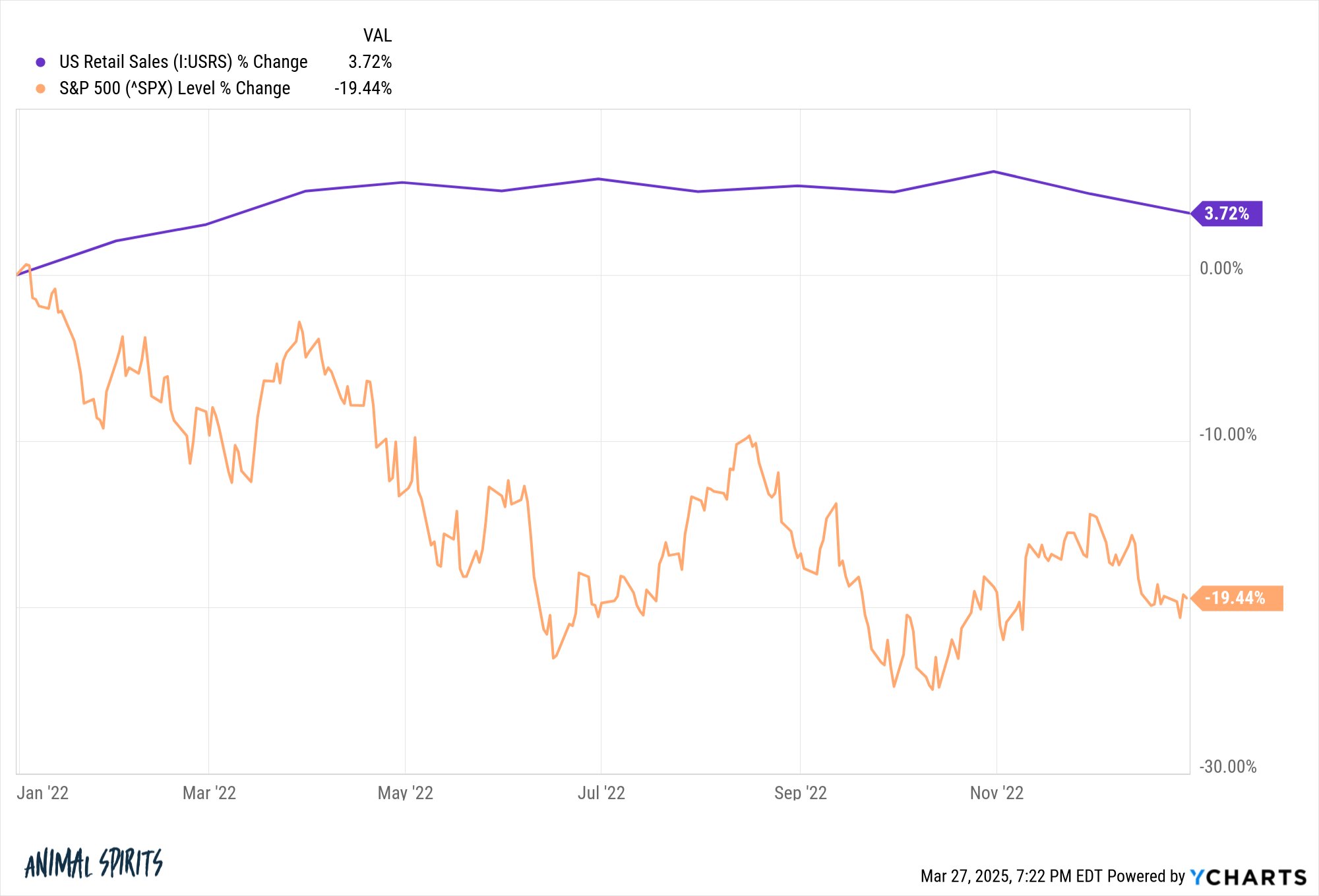

On the other hand, we already had a bear market a few years ago yet people kept on spending money right through the downturn:

The stock market got hammered in 2022 while retail sales were up.

Everyone thought we were going into a recession. Inflation was out of control. People kept spending money.

Now, you could say that was a pandemic outlier event. Household balance sheets were in amazing shape heading into that environment. That 2022 period could be a pandemic outlier you have to throw out the window.

I’m not sure people are selling their stocks to fund consumption so the wealth effect is mostly psychological in nature. You could make a similar case for housing market wealth. At the end of 2024, American households owned $47 trillion in equities and $48 trillion in real estate.

Do people spend more money because their house is worth more? Some might.

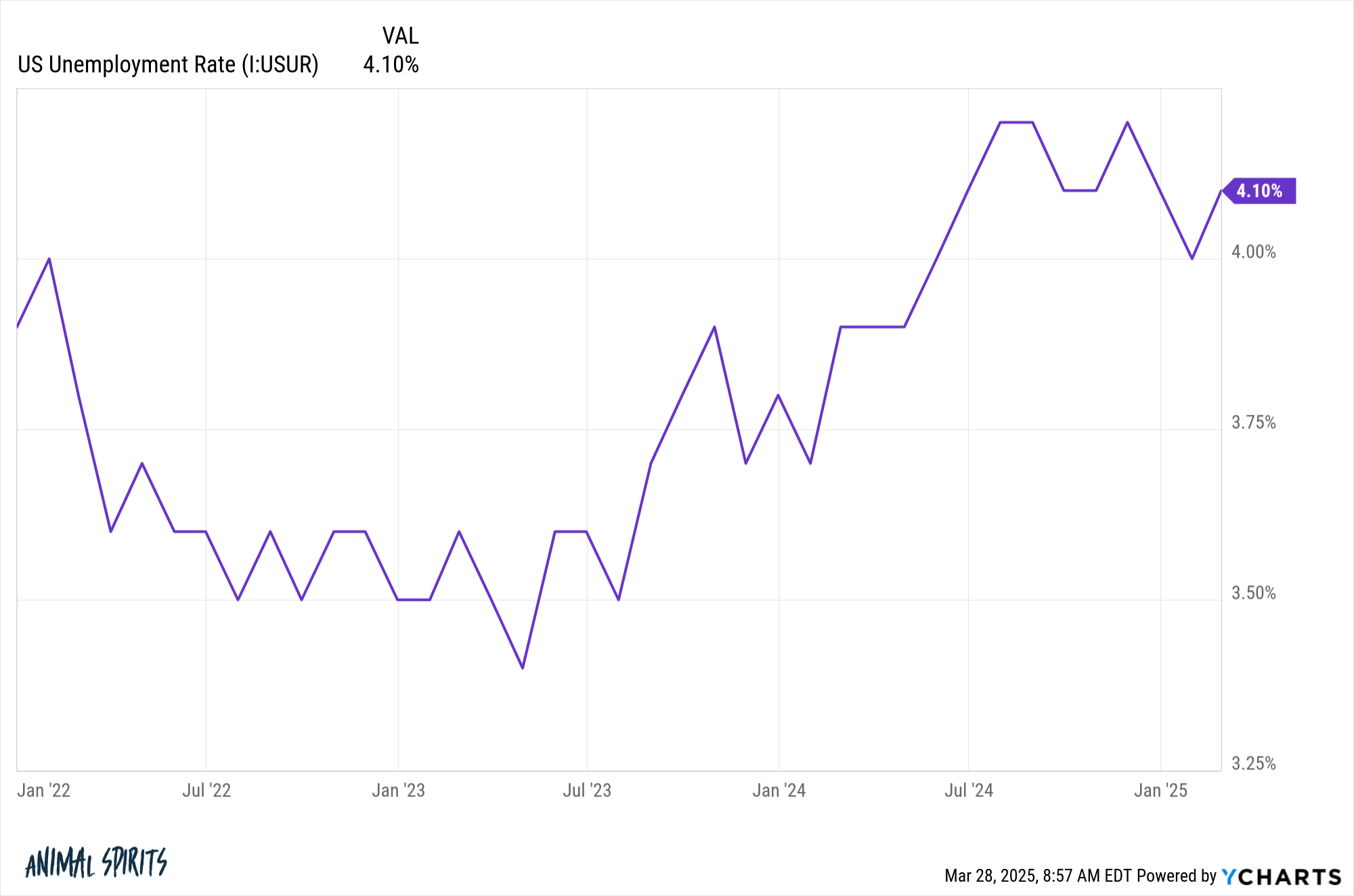

I think the economy is more important than the stock market when it comes to consumption. One of the big reasons we didn’t see a significant pullback in spending during 2022 is the unemployment rate remained low:

If people start losing their jobs during an economic slowdown, that’s going to have a much greater impact on economic growth than falling stock prices.

The wealth effect as a concurrent indicator. When things are going well, stock prices will be up and people will be feeling good but that all goes hand-in-hand.

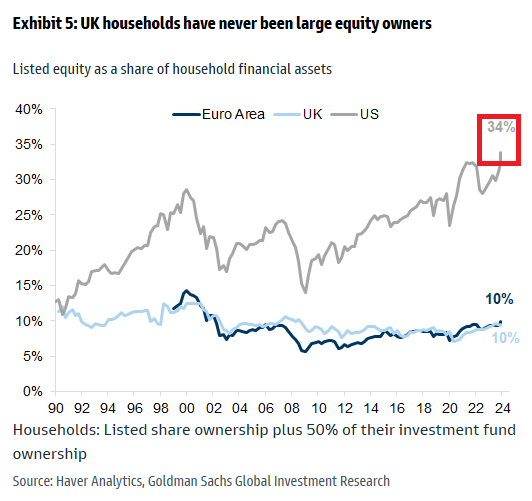

It’s also interesting to look at stock market holdings as a percentage of all household financial assets:

This number is much higher than it was in the past but it makes sense. Investors have never had more access to the stock market through 401ks, IRAs, robo-advisors, brokerage accounts with zero-dollar trades where everything can be automated. The barriers to entry were much higher in the past.

American households are in much better financial shape than the rest of the world in part because of the stock market. We need to get more investors in the Euro Area and UK to invest in stocks for the long run.

I don’t think more wealth in the stock market makes the economy more prone to booms and busts. There have been 8 double-digit corrections in the past 15 years which includes two bear markets (in 2020 and 2022) along with two near bear markets (in 2011 and 2018).

There has only been one recession in that same decade-and-a-half and it lasted for just two months.

I don’t think the stock market can send us into a recession.

I do think a recession can send stocks into a bear market.

Michael and I talked about the implications of the wealth effect and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Stock Market is Always Changing

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.