The S&P 500 is approaching bear market territory and it happened in a hurry:

This drawdown profile doesn’t even look real. It looks like an intern fat-fingered the wrong number on the spreadsheet.

The speed and ferocity of this downturn is a good reminder that risk can happen fast. The stock market lost nearly 11% in just two days. Woosh…gone.

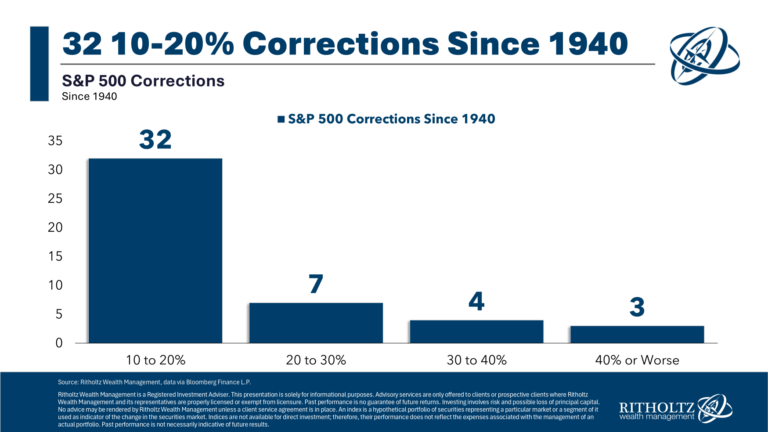

Since 1940 there have been 46 double-digit corrections.

Most of those corrections didn’t turn into bear markets. Just 14 out of those 42 drawdowns turned into a 20% or worse bear market. That’s 30% of the total, meaning 70% of the time a correction did not morph into a full-fledged bear.

In half of those 14 bear markets, losses were more than 30%. Three of them turned into a crash of 40% or more.

Here is the breakdown over the past 85 years:

Great, thanks for the history lesson Ben but this tells us nothing about the current environment which no one has ever seen before.

That’s true.

We’ve never been through a trade war like this before. There is no playbook.

History shows thar most of the time these things don’t get completely out of control but sometimes they do. That doesn’t make the current environment any easier to handicap but it’s always like this when you’re in the eye of the storm.

We’re already a stone’s throw away from a bear market. I would be surprised if this downturn doesn’t turn into a bear. At this rate, one more big down day and we’re there.

If the current tariff plan stays in effect for more than a month or two it would not shock me to see the stock market down 30-40%.

These policies will crush margins, profitability, investment and business confidence. I don’t say this lightly. The stock market doesn’t take this type of disruption lightly either.

If there are concessions and negotiations, the damage could be contained.

Here’s something no one likes to say in times like these: I don’t know.

I don’t know if these tariffs are here to stay or not.

I don’t know when the pain will subside.

I don’t know what will cause the selling to end.

I do know panicking will not help you make better investment decisions. Times like these are why you have an investment plan in the first place.

In my next piece, I’ll share what I’ve been doing during this sell-off and what my own plan calls for during chaotic markets.

Further Reading:

A Short History of Tariffs

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.