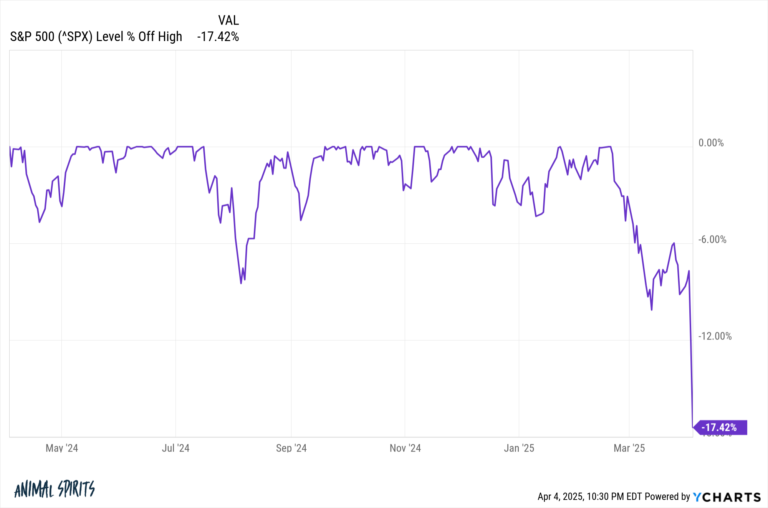

Last Thursday the S&P 500 finished the day down 4.8%.

Then on Friday it declined another 6%.

That’s a loss of more than 10% in just two days. The -10.5% loss was the fifth worse two-day stretch for the stock market since 1950.

The other times this happened occurred in 1987, 2008 and 2020, some of the most volatile market environments we’ve ever seen.

You can go an entire year without experiencing a 10% drawdown. In fact, in 36 out of the previous 97 years, the U.S. stock market did not experience a double-digit drawdown at any point during the year.

Things got ugly in a hurry. It might get even uglier. Who knows.

As the stock market began crashing on Thursday following Trump’s tariff announcement the day before, my family and I were boarding a plane to Florida for spring break.

On Friday when the market really fell off a cliff we had plans to take the kids to a waterpark. So we chilled out in the lazy river and went on as many waterslides as humanly possible.

Life goes on.

Part of me felt guilty. Shouldn’t I be doing something? What if I miss something?

Everyone has these feelings when the market is going down. Shouldn’t I be doing something, anything?

It feels like you should grab the steering wheel when the ship is going down, but trying harder and paying more attention doesn’t always yield better results. This is an illusion of control.

It’s not like I could do anything to stop the market from falling. Plus, my entire investment plan is predicated on making good decisions ahead of time. I don’t want to be making investment moves when emotions are running high during chaotic markets.

At Ritholtz Wealth Management, we run an in-house tactical strategy called Goaltender. We’ve been using it for client portfolios for over a decade.

I have roughly 15% of my personal portfolio invested in this strategy too. I’ve owned it for almost a decade now.

It’s a trend-following strategy that’s meant to keep you invested during market uptrends while trying to avoid severe market downturns.

It’s not perfect and doesn’t always work but the beauty of this strategy is the fact that it’s rules-based. No one on our investment committee is making discretionary decisions. We follow the rules come hell or high water.

That meant taking some risk off the table at the end of March and putting part of the strategy into T-bills because the stock market entered a downtrend.

Here’s what I wrote about trend-following back in 2017:

The combination of a strategic and tactical asset allocation is something I’ve definitely changed my tune on over the years. It doesn’t have to be one or the other. You can marry the two together so they balance each other out. The tactical strategy is meant to further diversify the strategic asset allocation.

It’s a way to diversify across time and market environment as opposed to the traditional view of diversification that simply seeks to diversify across asset classes. In some ways, it’s just a form of rebalancing, except this strategy seeks to over-rebalance to stocks or bonds depending on the market environment.

Pulling this off requires that you allow competing ideologies into your portfolio. Combining the best of index funds, factor-based strategies and trend-following in a low-cost, globally diversified, rules-based portfolio is a great way to diversify across asset class, geography, and strategy. Nothing works all the time so this approach seeks to balance out those periods where one part of the portfolio is performing relatively poorly.

This approach requires having two competing ideas in your head simultaneously. Some people have a difficult time allowing that. I view these strategies as complements.

There are times when trend-following really comes in handy. There are other times when it doesn’t work as well as you would like and you get whipsawed.

There are times when buy and hold and rebalance really comes in handy. There are other times when it doesn’t work as well as you would like and you experience market dislocations in a hurry.

This diversification by strategy requires a balanced mindset. One strategy makes it easier to behave with the other and vice versa.

I also bought stocks last week in my 401k and brokerage accounts. I bought stocks again this week in my brokerage account because an automatic contribution occurs every week regardless of what the market is doing. Next week I’ll make a purchase in my SEP IRA because that’s what happens every single month.

Do you think I’m going to change that because stock prices are down? Of course not! Stocks are on sale.

I’m comfortable holding onto strategies that can diverge from one another because I have no idea what the future holds. I don’t know if the worst is behind us or if the sell-off will intensify.

If I knew what was going to happen there would be no reason to diversify.

My plan for surviving chaotic markets looks like this:

- Automate good decisions ahead of time.

- Follow my investment plan even when it feels uncomfortable.

- Diversify my portfolio to account for different market environments.

- Don’t obsess over short-term market movements.

- Don’t let short-term volatility dictate how I live my life.

Every investor needs their own survival plan. The most important thing is having a plan in the first place.

Further Reading:

My Evolution on Asset Allocation