There are two big economic trends this decade:

1. Consumers keep spending money no matter what.

2. Investors keep buying the dip no matter what.

People keep waiting for these trends to break but they simply won’t. Not yet at least.

What’s it going to take?

One would imagine a recession would break the spending patterns for many consumers. We shall see. Inflation didn’t do it.

I’m not sure what it’s going to take to stop investors from stepping into buy the pain when stocks are down.

April has been an extremely volatile environment for the stock market. Investors aren’t rushing for the exits, at least of the retail variety.

Retail has been a buyer:

I wrote a piece back in 2014 called Millennials & The New Death of Equities. This was from a UBS report at the time:

The Next Gen investor is markedly conservative, more like the WWII generation who came of age during the Great Depression and are in retirement. This translates into their attitude toward the market as we see Millennials, including those with higher net worth, holding significantly more cash than any other generation. And while optimistic about their abilities to achieve goals and their financial futures, Millennials seem somewhat skeptical about long-term investing as the way to get there.

The bursting of the dot-com bubble combined with the Great Financial Crisis unnerved a lot of investors. Millennials were skeptical of markets.

The next generation now has a completely different relationship with risk.

The Wall Street Journal profiled a handful of younger investors to see how the volatility is impacting their investment decisions. They’re leaning into the pain:

“It’s just a screaming buying opportunity,” said Oksnevad, who keeps about 90% of his seven-figure portfolio–including retirement funds–in the cryptocurrency and related stocks such as bitcoin buyer Strategy. “I’m running straight into it.”

The 37-year-old marketing director didn’t mind that the price of bitcoin sank nearly 6% that day, or that he was increasing his exposure to a relatively risky asset during the most significant market meltdown since March 2020. Instead, he focused on the chance of a rebound.

“That’s what I’m after–making decades of returns in weeks or months,” he said. “I truly think volatility is where fortunes are made.”

Here’s another one:

“The kids these days say, ‘No risk, no ‘rari,’” said Patrick Wieland, a content creator and day trader who has in recent weeks poured thousands of dollars into ProShares UltraPro QQQ. (“Rari” is slang for Ferrari.) Shares of the fund, a triple-leveraged ETF that aims to generate three times the daily performance of the Nasdaq-100 index, notched double-digit gains during a historic rally on April 9, but are still down more than 20% this month.

“I think you’ve got to be aggressive,” he said. “When you have such big swings in the market, it’s hard to be risk averse.”

The bull market and pandemic-induced gains have created a new breed of investors who aren’t afraid of volatility. They’re rushing into the burning building.

Some investors might quibble with their vehicles of choice but this behavior is noteworthy. For years and years it’s been drilled into the heads of investors that falling markets are an opportunity. I think it’s great that younger investors have learned this lesson so early.

Could they eventually learn another lesson when the next lost decade comes around? Sure, but those periods aren’t easy for any investor, regardless of age and experience.

It’s also no guarantee that a gigantic market crash would immediately change investor behavior.

The bull market of the 1980s and 1990s were another glorious period when investors learned the art of long-term investing and buying the dip. Even when the stock market fell 50% during the bursting of the dot-com bubble, most investors stayed the course.

Maggie Mahar chronicled this period in her book Bull:

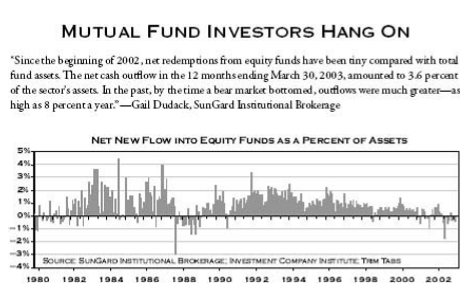

So, even after it became clear to the vast majority of investors that the Great Bull Market of 1982-99 had ended, mutual fund investors stood firm. The mass redemptions from equity funds that many had predicted never took place. As late as March 2003, Gail Dudack observed: “Net redemptions since the beginning of 2002 have been tiny compared with total stock fund assets. The net cash outflow in the 12 months ending March 30, 2003, amounted to 3.6 percent of the sector’s assets.

Here’s the visual:

In 2002, the stock market was down 22% but Vanguard found the average account balance grew by 1% because people kept funneling money into the market.

It wasn’t until the 2008 crisis that many investors began tapping out.

Once a habit forms it’s not that easy to break the pattern.

Maybe a recession will do it, but the next generation of investors is comfortable with volatility.

That’s a welcome development.

Michael and I talked about investors buying the dip and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

One of the Best Investment Books I’ve Read in a While

Now here’s what I’ve been reading lately:

Books: