A reader asks:

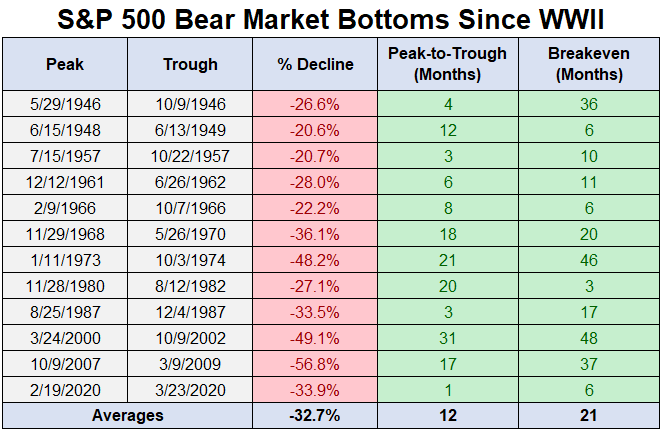

I saved one of your articles that had some figures from all the bear markets since 1950 thru 2020 (was couple years ago). It had a table with the % drop at the trough, the number of days to the bottom, the date and number of days back up to breakeven, as well as that time expressed in years. I have attached it here.

Wondering if you have similar statistics for a Balanced/60-40 portfolio, which would be more typical of the average client and their experience? I am trying to get a handle on what is the appropriate amount if ’emergency cash’ that an investor could hold in a portfolio, with high confidence that this would see them through most major corrections and back to even before they had to start chewing into their market-based investments. For a 100% equity portfolio, it would seem that 24 months would see someone thru all but the most severe bear markets. I have to think 60/40 would be even shorter time to recovery on average.

There have already been a handful of bear markets this decade so there has been plenty of opportunity to write about this stuff.

I did a lot of work on bear markets during the 2020 Covid crash but updated that data during the 2022 bear market:

You can see the average drawdown is 33% or so while the average time it takes to go from peak-to-trough is 12 months. The average breakeven — going from peak to trough and back again — is 21 months.

As with all market averages there is a wide range around the average itself but these kinds of numbers can help give you a range of potential outcomes, even though the future might not look like the past.

This analysis is a little trickier for a 60/40 portfolio.

I have good daily stock market data going back 100 years. That doesn’t really exist for bonds so we have to do this using monthly returns.1

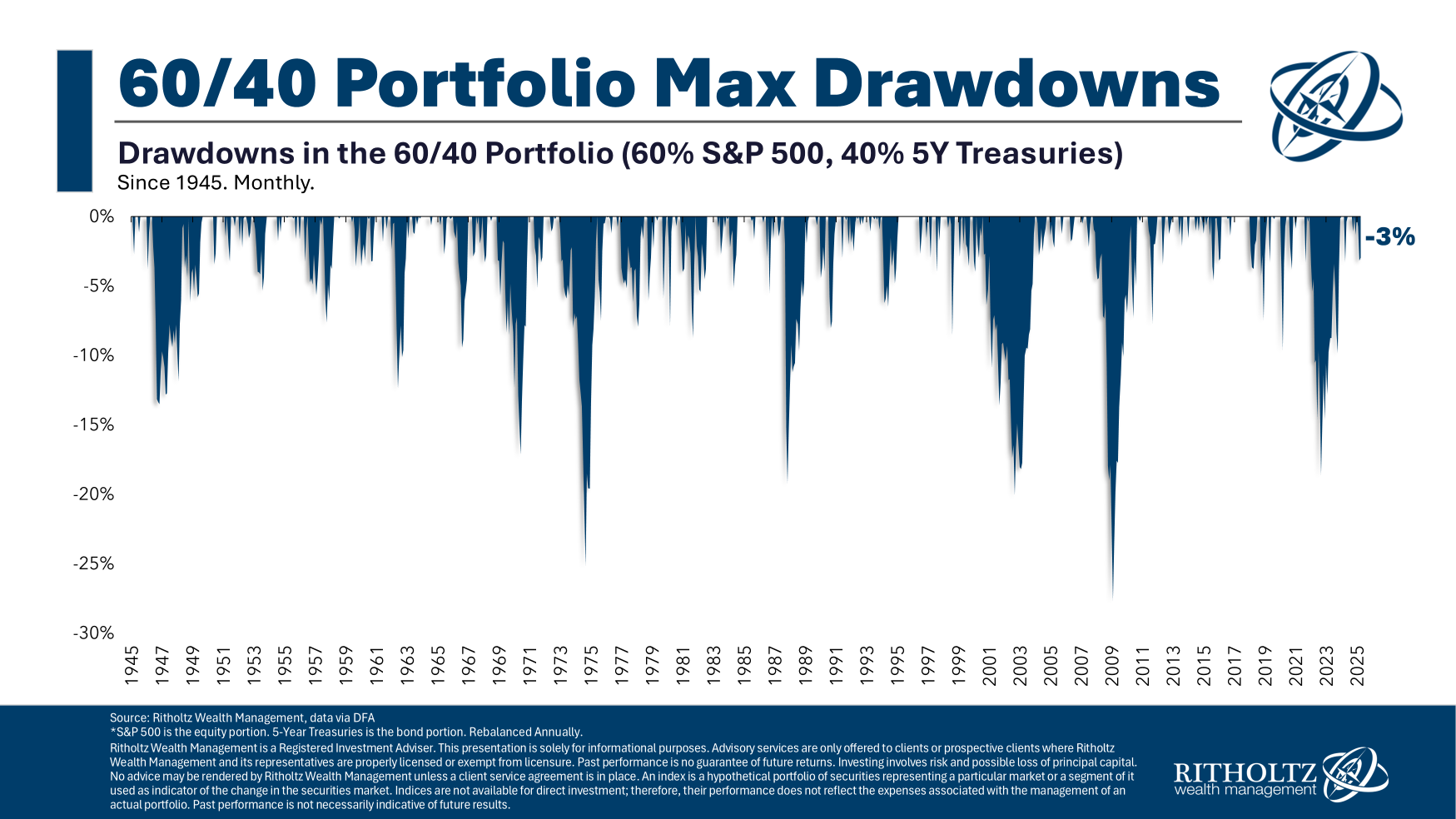

Now that the caveats are out of the way, here is the drawdown profile for a 60/40 portfolio consisting of the S&P 500 and 5 year Treasury bonds going back to the end of World War II:

You can see there haven’t been that many down downturns of 20% or worse so I’m going to include all double-digit corrections here to cast a wider net.

By my calculations there have been eight double-digit drawdowns for a 60/40 portfolio since 1945. That compares with 44 double-digits drawdowns for the stock market in that same time frame.

So the good news is a 60/40 portfolio does a really nice job of dampening volatility and reducing drawdowns. That’s one of the selling points of a balanced portfolio!

Now let’s look at the magnitude and length of those drawdowns:

A few things stand out from the data here:

The drawdowns for a 60/40 portfolio are shallower, last just as long from peak-to-trough and take longer to recover from than the average stock bear market.

These attributes all make sense because of the nature of investing in bonds.

Fixed income acts as the shock absorber during most stock market sell-offs2 so it makes sense that the losses are more muted.

For example, the S&P 500 has had 17 down years since 1945, with an average loss of -13%. The average return for 5 year Treasuries in those same down years was +5.3%.

It’s also interesting to note that the recovery periods take much longer for a 60/40 portfolio than the stock market. The average breakeven was 29 months.

This also makes sense because fixed income returns are typically much lower than stock market returns. And this is especially true coming out of a bear market when the stock market tends to take off like a rocket ship.

A balanced portfolio mixes the tortoise with the hare.

The great thing about a balanced portfolio is you can take distributions from the fixed income side of the ledger if you need to spend down some of your investments. That way you’re not selling stocks while they’re down. Or you can lean into the pain and rebalance into stocks when they’re on sale.

Investing is always and forever about trade-offs and regret minimization.

Balanced portfolios are not a perfect solution because perfect solutions do not exist in the markets.

But a 60/40 portfolio is still a pretty good option for those investors who desire lower volatility, lower drawdowns and more stability than investing solely in the stock market.

I did a deep dive into this question on Ask the Compound this week:

Bill Sweet joined me on the show again to discuss questions from our audience about harvesting gains in your stock portfolio to diversify, remote work for less money versus going back to the office for more, mis-timing the market and picking the right benchmark for your investments.

Further Reading:

How Long Does it Take For Stocks to Bottom in a Bear Market?

1This means the drawdowns would likely look a little worse but this is horseshoes and hand grendades — close enough is good enough.

2Most, not all. The 2022 bear market saw both stocks and bonds fall.