A reader asks:

I think the education of retail investors is better than it’s ever been — blogs, books, newsletters, podcasts, etc. The proper education about how crazy markets are and to not overreact and to think long-term is working. And that’s why retail is the smart money now. Could be a good topic: Is financial education working?

My short answer is, yes, financial education seems to be working.

Allow me to explain.

When I graduated college and started my first job I quickly realized I had a bunch of textbook knowledge but no understanding of how markets, people, incentives, behavior or investing works in the real world.

This was back in 2005.

There were no podcasts, blogs, newsletters, YouTube channels or social media personalities to learn from. So I read as many books about the markets and behavioral psychology as I could get my hands on.

I peppered people with questions. My boss was kind enough to give me a tutorial on a whiteboard every few weeks about how the markets work. He taught me about asset allocation, diversification, investment policy, and how to communicate with clients.

It certainly wasn’t easy and took a number of years until I was comfortable enough to feel like I knew anything of substance.

Investing itself was difficult too.

There were higher minimums, higher fees, no zero-trade commissions, less automation and a bunch of antiquated legacy financial firms that generally made it difficult to invest if you were just starting out.

Now we have much better resources. The barriers to entry have vanished. You can now set up an account on your iPhone and buy fractional shares of stocks five minutes later. Plus, investors have been beaten over the head for 15 years straight about the power of long-term thinking, market timing is hard, don’t panic, etc.

In the old days, the assumption was that retail investors would buy high and sell low. They got greedy when others were greedy and fearful when others were fearful.

That’s not the case anymore.

The dumb money isn’t so dumb anymore.

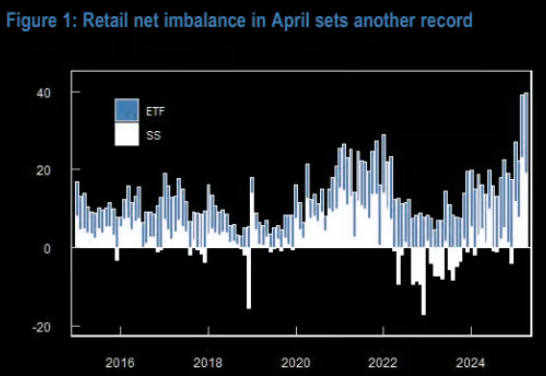

JP Morgan data shows there was a record monthly inflow by retail investors in April to the tune of $40 billion:

The stock market fell 20% and retail investors didn’t run for the exits. They bought low!

Markets were in a freefall and retail was the steady hand. How about Wall Street?

According to Barron’s, professional investors were more bearish on stocks than they have been in at least 30 years.

The smart money got scared. The dumb money rushed into the burning building. Maybe the smart money isn’t so smart anymore.

Of course, being a good long-term investor is not just about buying stocks when they’re down (although it helps).

There are now more set-it-and-forget-it investors than ever before.

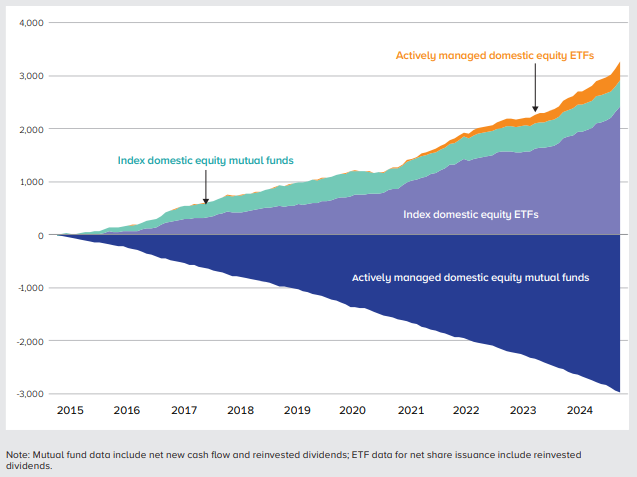

In 2024 just 5% of investors in a Vanguard 401k plan made changes to their portfolio. There is now more than $4 trillion in targetdate funds. More money is going into index funds and ETFs and out of actively managed funds:

Investors are making better decisions than ever before.

Does this mean retail investors are perfect?

Of course not!

There are still plenty of people who speculate, employ too much leverage, chase fads, trade short-dated options and invest in stuff they don’t understand.

But that’s always going to be the case. You can’t save everyone. If everyone were a disciplined long-term investor, long-term investing wouldn’t work as well as it does.

I’ve been using the terms smart and dumb money a lot here but I’m not a huge fan of that nomenclature. There are intelligent professional investors. There are intelligent retail investors. There are foolish professional and retail investors too.

I don’t know who the smart money is exactly. It seems to change from cycle to cycle.

But retail as a whole is certainly not the dumb money anymore.

Financial education is working and investor behavior is improving.

This is a wonderful development.

Steve Quirk from Robinhood joined me on Ask the Compound this week to cover this question in greater detail:

We also discussed why investors are buying the dip more often, the future of retail trading, how tax-deferred retirement accounts will evolve and how AI will change the wealth management landscape.

Further Reading:

Two of the Biggest Trends This Decade