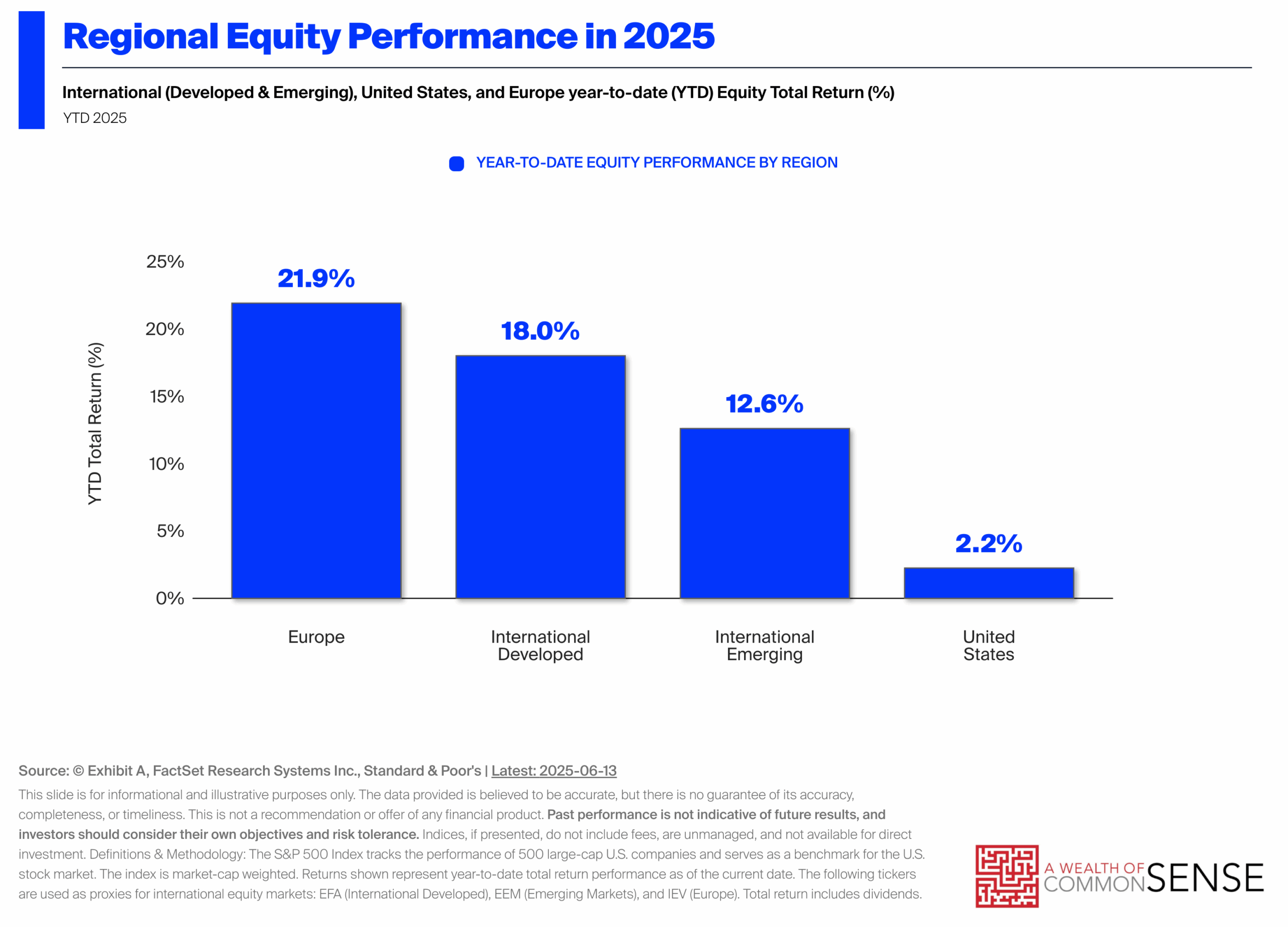

In my last post I looked at the impressive outperformance of international stocks this year:

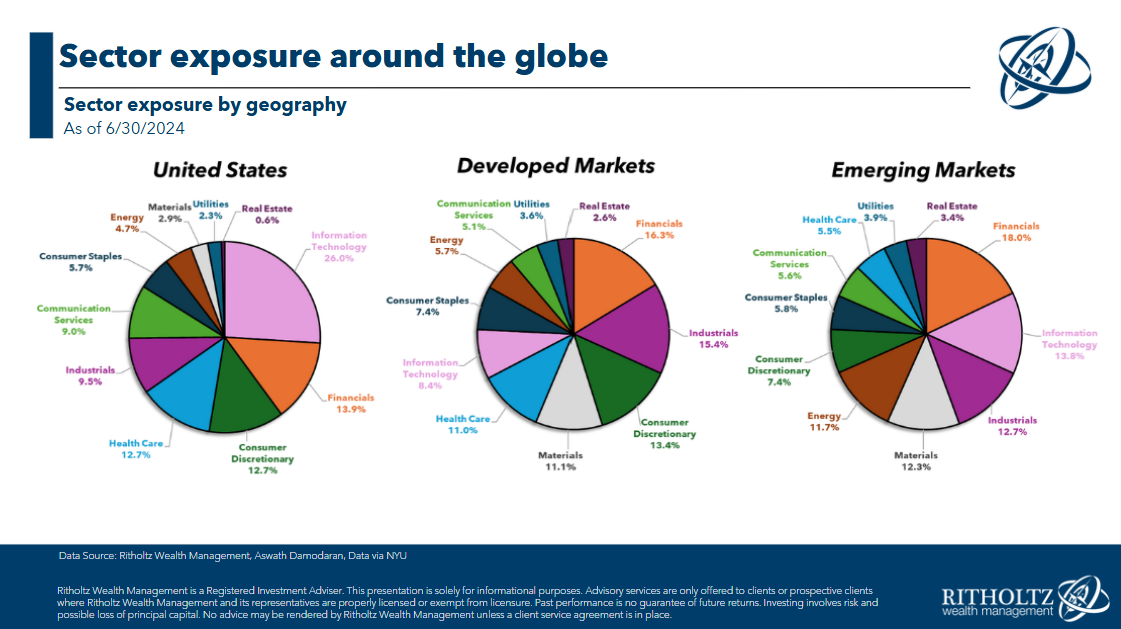

With all the AI excitement it’s hard to believe foreign stocks are beating the pants off American stocks in 2025 when you consider the sector exposure discepancies:

When you include communication services (which includes Google, Facebook and Netflix) and the tech stocks in consumer discretionary (which includes Amazon and Tesla), technology stocks make up something like 40% of the U.S. stock market.

That number is much lower in overseas markets.

So why are international stocks crushing U.S. stocks so badly this year?

Obviously, the trade war has had an impact. Foreign investors poured money into U.S. stocks hand over fist in recent years, but some of those flows have reversed this year.

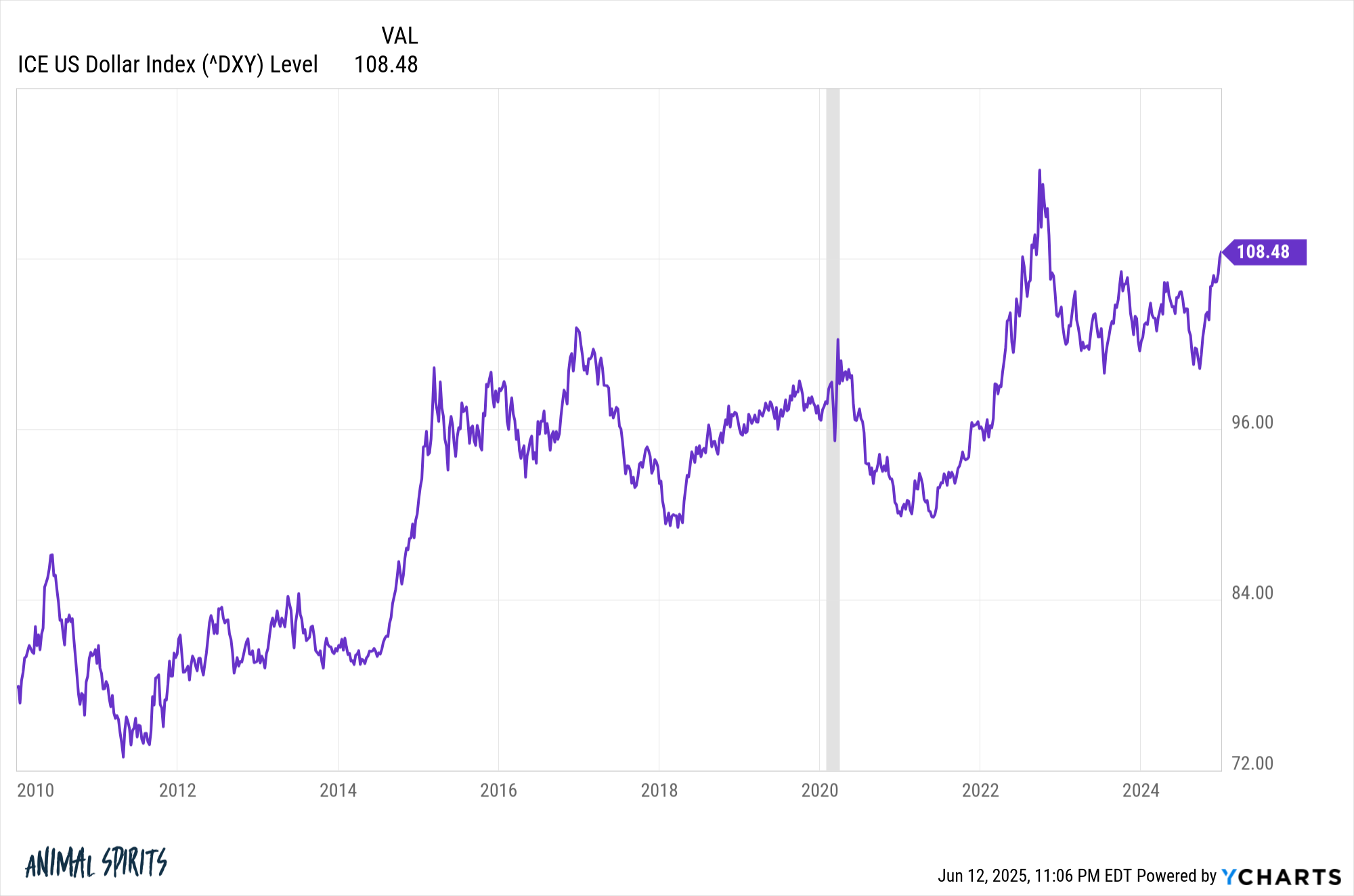

Those foreign investors have also received a tailwind in the form of a strong dollar.

This is what the dollar looks like versus a basket of foreign currencies since the end of the Great Recession through the tailend of 2024:

It’s been a steady move higher with the occasional countertrend reversal.

If you’re an overseas investor who has owned U.S. stocks you’ve received a double whammy of outperformance in terms of stock prices but also a strong dollar. A rising dollar (thus falling foreign currencies) has given foreign investors a currency boost to boot.

It’s been a win-win.

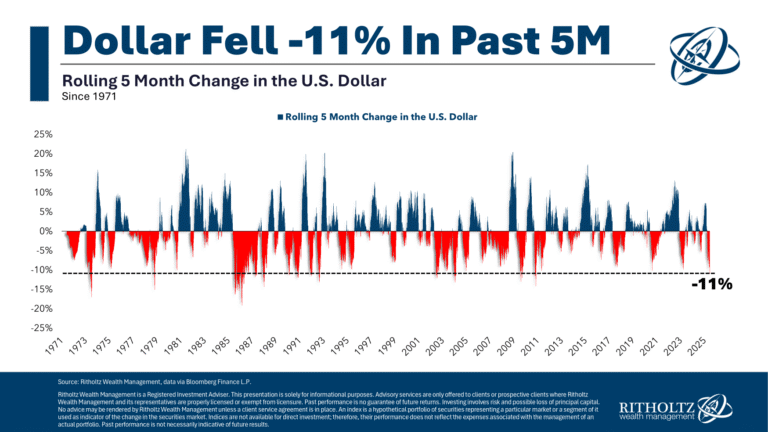

This year is a much different story. Look at the dollar over the past five months:

It’s dropped like a rock in the first half of this year.

That’s bad for foreign investors in U.S. stocks but a wonderful development for U.S. based investors who own international stocks. A weak dollar means stronger foreign currencies which aids in the returns of your foreign stock holdings.

Now, it’s our turn to benefit from the double whammy. From the perspective of U.S. investors, a weak dollar is supercharging the performance of foreign stocks.

This is one of the unsung benefits of international diversification. You also get currency diversification. Sometimes it helps. Sometimes it hurts. It’s more or less a wash over the long-term but it can provide diversification benefits at times in both positive and negative directions.

Plenty of people are worried about the dollar’s status as THE global reserve currency. I don’t necessarily share those concerns. What’s the alternative? Who is going to step up to dethrone the dollar? I don’t see it just yet.

But what if I’m wrong? Or it just weakens for a considerable period of time?

Sure, you could own gold or Bitcoin. I would imagine those assets would potentially do well in that scenario.

But so would international stocks and companies based outside our borders. International stocks are a wonderful hedge against the U.S. dollar weakening.

Again, I don’t necessarily agree with the idea that the dollar is in trouble. But I can’t be 100% positive in that stance. I could be wrong!

It’s also possible the dollar has been so strong for the past cycle that it was due for a reversal.

Sometimes currency diversification goes against you.

This year it’s helping a lot.

Further Reading:

The U.S. Dollar vs. Your Portfolio

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.