Today’s Animal Spirits is brought to you by Nuveen and Fabric:

See here for more information on Nuveen’s alternative strategies

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get Compound merch here

See here for info on the AI demo drop

Subscribe to The Unlock for a spicy take on what AI will do to the wealth industry

On today’s show, we discuss:

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

Quantum Beverage $QUBT is a $3B company that trades more daily dollar volume than Intel $INTC but with less revenue in forward projections than a single Chick-Fil-A location. https://t.co/7rMxf45mxN

— Consensus Media (@ConsensusGurus) June 11, 2025

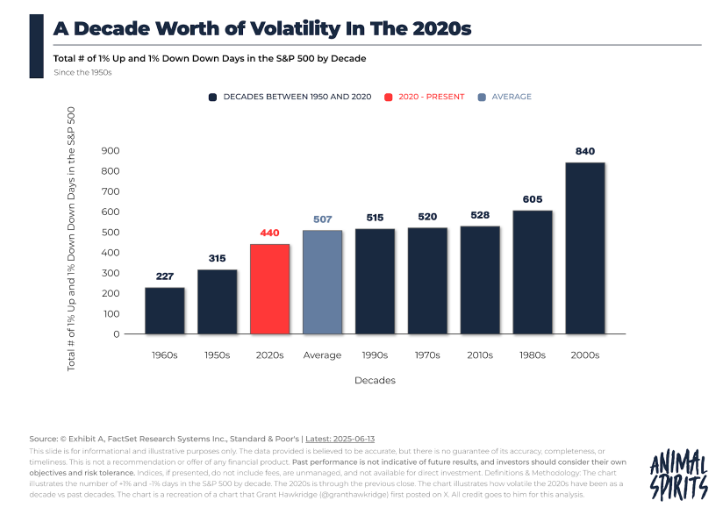

437 ±1% days and counting.

The 2020s are on track to be the most volatile decade in market history.

But here’s the twist… The S&P 500 is up over 80% since 2020.

Big moves. Big gains.

Not the combo we’re used to.

👉https://t.co/GefTCgARz0 pic.twitter.com/7zStYCqq5F

— Grant Hawkridge (@granthawkridge) June 13, 2025

The top 1% own 51% of stocks

The bottom 50% own 1% pic.twitter.com/jJVENsMMXA

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) June 14, 2025

Restaurant & bar retail sales down by -0.9% in May … worst since February 2023 pic.twitter.com/zjxgDInPbR

— Kevin Gordon (@KevRGordon) June 17, 2025

Errata: I didn’t have the most recent forecast from Goldman in the above table; they’re at a December start to cutting, not July. pic.twitter.com/OpR4lE2ajQ

— Nick Timiraos (@NickTimiraos) June 11, 2025

It’s surreal just how big Polymarket has gotten pic.twitter.com/iXT52YQkEY

— Shayne Coplan 🦅 (@shayne_coplan) June 13, 2025

bitcoin is currently $105,300

if you want to buy on coinbase, they charge $106,900. if you want to sell, it’s $103,950.

WTF?!?

— lynk (@lynk0x) June 14, 2025

Circle made about $200m after paying out incentives in 2024.

Trading ~162x those figures now.

Market can’t get enough stablecoin exposure. https://t.co/w9BeMSWzYY

— Zaheer (@SplitCapital) June 16, 2025

Ingvar Kamprad was the founder of IKEA

He was worth close to $60 billion at the time of his death

I really love some of his frugal habits

– He drove a 1993 Volvo for two decades

– Purchased clothes from flea markets

– Got his haircut in foreign countries

– He flew coach pic.twitter.com/1K016HdJ7o— Dividend Growth Investor (@DividendGrowth) June 10, 2025

‘SPACEBALLS 2’ may have already revealed its title nearly 40 years ago: https://t.co/bItgSrVUt3

— ScreenTime (@screentime) June 13, 2025

#MastersOfTheUniverse has wrapped production.

via Nicholas Galitzine pic.twitter.com/RXN0ZTESW8

— Rotten Tomatoes (@RottenTomatoes) June 16, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.