There were 22 trading days in March of 2020.

Just one day out of those 22 saw a move of less than plus or minus 1%.

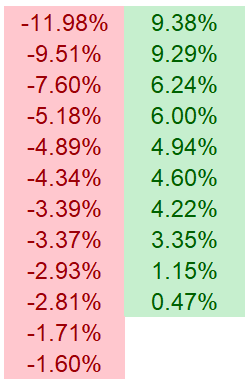

Every other day saw a large move including 8 days of down 3% or worse and 8 days of up 3% or better. These were the daily returns during that fateful month:

It felt like a year’s worth of volatility in a single month.1 It was one of the most volatile months in stock market history, right up there with the murderer’s row in the 1930s.2

The S&P 500 finished the month down more than 12%. At the worst of the downturn, stocks were down 34% from the February highs just weeks before.

One of the craziest things about this whole ordeal is that the market finished the year up 18%. I don’t have to recount the reasons why. It wasn’t that long ago.

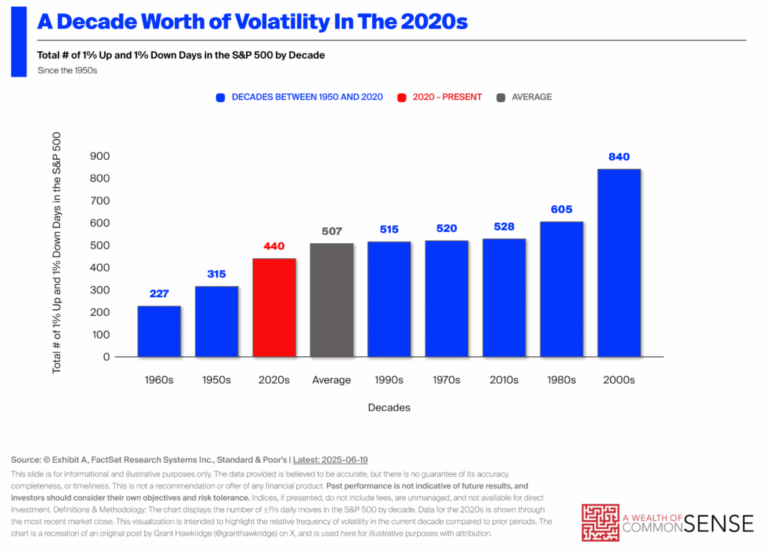

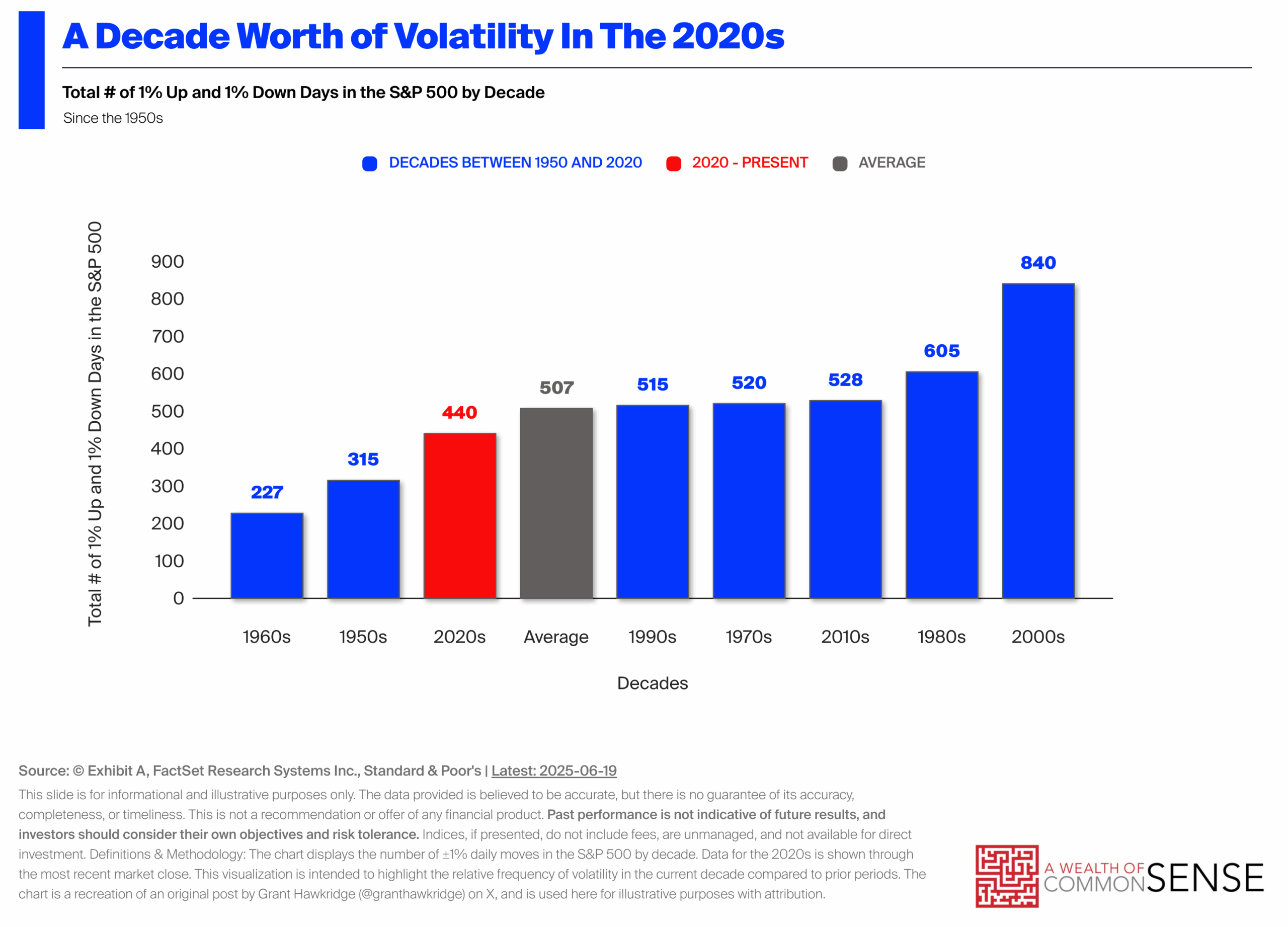

Insane volatility with wonderful returns is the story of the 2020s. This decade is on pace for the most +/-1% days in a decade over the past 8 decades:

It wouldn’t shock me if we break the 2000s record.

But remember, the annualized return in the first decade of the 21st century was a loss of -1%. The volatility in the 2000s made sense in the context of poor returns, which is typically what happens.

Bad things tend to happen during bad markets.

Although this decade has seen a lot of bad things happen, the S&P 500 is still up nearly 14% on an annualized basis for the 2020s.

It feels like we go through some crazy situation, then investors freak out a little, the market nose dives but then everyone forgets about it and moves on like a case of financial amnesia.

Think about all the stuff we’ve gone through this decade — the pandemic, the meme stock craze, 9% inflation, the Fed jacking up rates from 0% to 5% in a hurry, the Silicon Valley mini banking panic, the Yen carry trade blow out, Liberation Day and a bunch of other stuff I’m forgetting.3

The booms and busts are happening faster than ever yet the market continues to charge higher.

Now we have a situation where the United States just bombed Iran.

Will this lead to another bout of volatility where investors completely forget about it a month later?

Possibly. We’ll see.

I just find it interesting how the market is behaving this cycle.

Markets are extremely volatile yet they just keep going up. Investors care about what’s going on in the moment but then move on immediately, like some sort of high school relationship you weren’t really into. In the information age it seems like the market only has the bandwidth to care about one event at a time.

This won’t last forever.

Returns will be below average for a period of time or we’ll have another financial crisis or recession or something to change the psyche of investors.

For now, volatility, booms, and amnesia reign.

One of the keys to successful long-term investing is the ability to follow your investment plan despite scary headlines.

This decade it’s working.

Further Reading:

Pandemic Babies & a Bull Market in Risk

1And this was bookended by 3 down days of 3% at the tailend of February along with a +2%, +7% and +3% in the first week of April. And then we were off to the races.

2The 1930s are in a class of their own.

3See I have financial amnesia too.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.