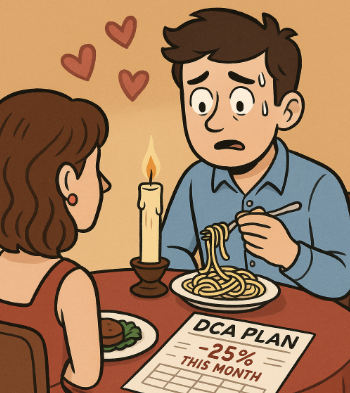

Last week on Ask the Compound, we answered a question from a young person who wanted to know how to balance saving money with dating:

How should one balance dating/socializing when it could impact your monthly DCA by 25%?

I had a lot of fun with this one. I can help with the financial aspects of a question like this but I’m a little out of practice when it comes to the dating side of things.

I’m just glad I got married before the onset of online dating apps. It’s a whole new ballgame. One would think the ability to match with people across various dating apps would make things easier to find a mate. For some people it does but for others the choice overload just makes things more stressful.

One study of online daters in Canada tested the idea that using the apps would make dating more efficient. Instead, researchers discovered people spent far more time on the apps looking for potential mates. With hundreds of different options to filter through — age, height, interests, etc. — there was a paralysis by analysis that overwhelmed users and caused them to second guess the choices they did make.

And the people who did find lots of matches were less likely to make a lot of selections because they were less satisfied from outsized expectations. With so many profiles to choose from, people tend to focus on the most superficial traits, meaning they were less committed to the people they were matched up with.

That’s why so many of the relationships formed on the dating apps are short-term in nature.

This paradox of choice exists in the investment management industry as well and it’s only going to get worse.

There has never been a better time to be an individual investor than right now. We’re hitting new all-time highs every single day — lower fees, more investment options, better user interfaces, more data availability, tech that allows you to automate good decisions, etc.

It’s only going to get better from here.

New ETFs are coming to market on a regular basis for strategies that employ option-based income, defined outcome structured products, long-short equity, leverage, inverse, thematic, crypto and more. This trend will continue.

Customization is another big trend this decade with the rise of direct indexing platforms that allow for more tax loss harvesting and concentrated position management. The ability to customize will only grow in the years ahead and advisors and investment platforms offer more tools for tax efficiency, portfolio allocations, margin loans and more.

You also have private equity coming to 401k plans, private credit funds popping up like new Zach Bryan albums, the tokenization of private companies by Robinhood and these single stock ETFs that allow you to use leverage or sell options on a company of your choosing. Plus you have online sports gambling, the ability to make bets on current events and trade stocks 24/7.

Artificial intelligence is going to supercharge these trends.

You’re going to be able to type almost any strategy into an AI prompt in the not-too-distant future, it will spit out a backtest and offer to make the trades on your behalf.

Investor: I’d like to own the S&P 500 ex-Mag 7 stocks with a 14% allocation to Bitcoin on Thursday evenings and sell Tesla every time Elon tweets something political.

AI: Done — would you like me to execute for you?

For certain investors, these strategies and tools are going to be amazing. It’s going to make life easier for advisors and DIY investors alike.

But it’s a double-edged sword.

Much like dating apps, the paradox of choice is going to be paralyzing for certain investors. The temptation to make changes to your strategies when they’re not working is going to be off the charts.

Every day you’ll be able to find a new backtest from your favorite AI model that will feel like the optimal solution…until it stops working and you go looking for another solution.

The ability to customize, hedge, tax-loss harvest, employ leverage, invest in private markets and more are all new and exciting options for individual investors. But this new world is going to require more filters, guardrails and critical thinking when building out your portfolio allocations.

Perfect is going to be the enemy of good for a lot of investors in the years ahead.

It’s going to be more important than ever to define what you own, why you own it and, more importantly, what you won’t own.

Customization with limitations will be the way forward.

Last week, Michael and I talked to Leif Abraham, Co-Founder of Public, about where things are heading in the future of investment management:

Further Reading:

The Evolution of Financial Advice