One of the biggest financial trends this century is the rising cost of living in many necessities. That trend has been supercharged in the 2020s.

The cost of vehicles.

The cost of auto insurance.

The cost of housing.

The cost of health insurance.

It’s all getting more and more expensive.

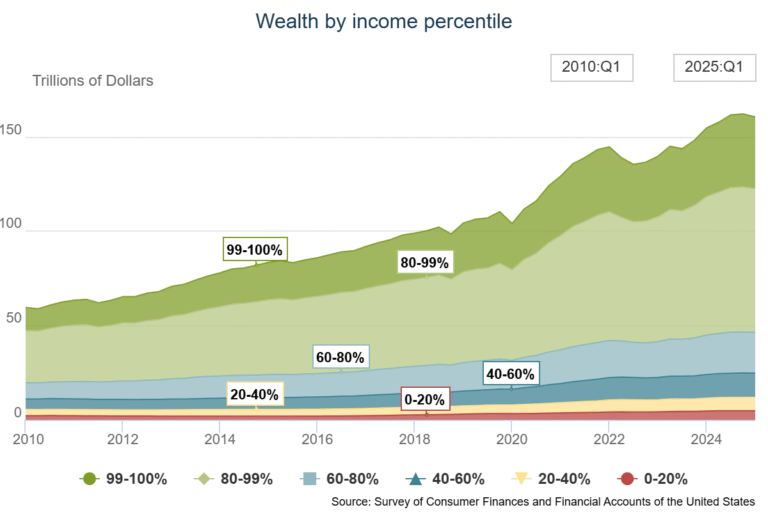

This chart from The New York Times shows the changes in the proportion of different spending categories over the past 96 years:

The good news is that spending on necessities such as food and clothing/shoes has dropped considerably over time as a percentage of household budgets. The bad news is that healthcare costs have completely eaten up all of those relative gains.

While incomes have risen in the 2020s along with a booming stock market, many Americans have a legitimate gripe about the rising cost of living in this country. Healthcare, housing and automobiles are all a lot more expensive now and it can create a strain on household budgets.

One group that doesn’t have as much of a gripe is those at the top of the income spectrum. The problem is that many of them don’t feel all that secure despite experiencing the biggest gains in recent decades.

The Wall Street Journal had a piece this week about people in the top 10% by income who don’t feel rich:

Here’s an example from the story:

Lauren Fichter and her husband earn about $350,000 a year. The couple own their Reading, Pa., home and a vacation property they rent out on Airbnb. Their three children play club sports, and the family often grabs takeout after games.

But when her son Dalton heads to college next year, he’ll have to tap student loans and hunt for scholarships. The couple haven’t been able to save enough to cover all of their children’s expected college expenses, which often cost around $75,000 a year per student for families at their income level.

“When I was younger, I wouldn’t even fathom making this much money,” said Fichter, 47. But today, “I feel like we’re just the normal, run-of-the-mill, middle-class family.”

It’s not necessarily that they feel poor — they just don’t feel rich.1 They’re not alone:

More than a quarter of people whose households earn between $200,000 and $300,000 a year report that they are either “not very satisfied” or “not at all satisfied” with their financial situation, he said.

This seems like madness but I completely understand how people making this type of income could feel this way.

As you make more money your lifestyle changes. You spend more money. Luxuries become necessities. You begin hanging out with people who make even more money than you do and try to keep up with them. Your expectations get inflated, the goalposts keep moving and all of the sudden $350k doesn’t go nearly as far as you thought it would.

It’s a tale as old as money.

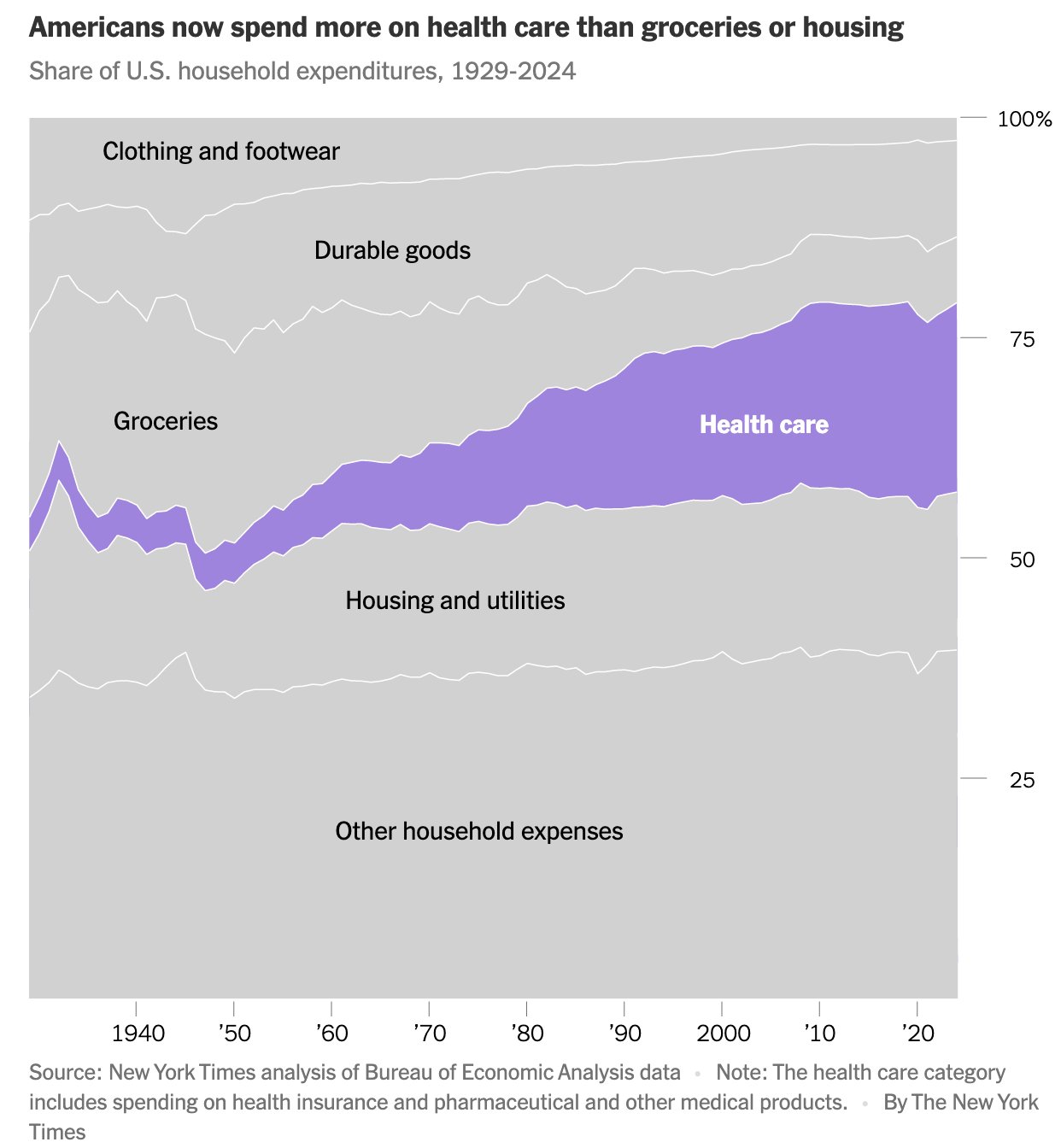

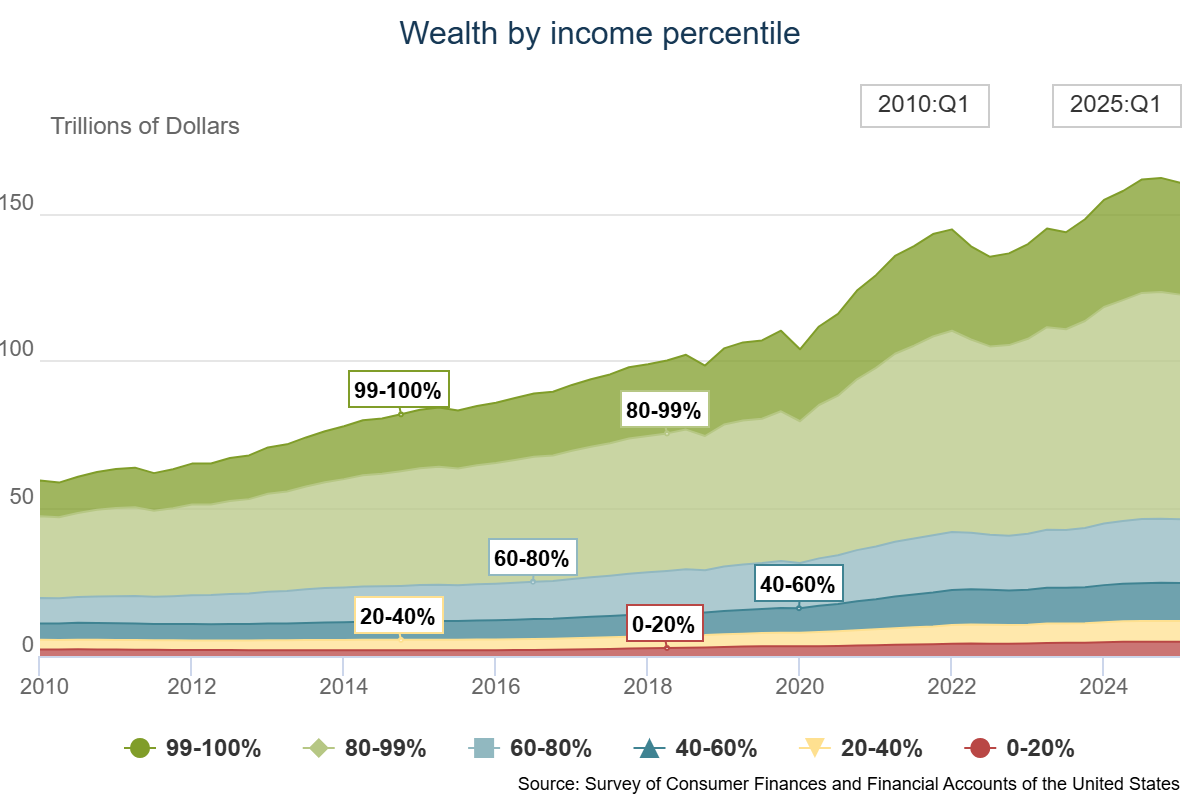

This group has also experienced inflation in asset prices:

The top 20% by income holds 71% of the wealth in this country.2 That’s up from 60% in 1989. The Journal notes that the inflation-adjusted incomes of the top 5% rose more than 100% from 1983 to 2019. People at the high end don’t feel inflation as much as the rest of the income population.

Obviously, people move in and out of different income brackets over time. There’s more movement in these brackets than you think. I wrote this in Don’t Fall For It:

Research shows over 50% of Americans will find themselves in the top 10% of earners for at least one year of their lives. More than 11% will find themselves in the top 1% of income-earners at some point. And close to 99% of those who make it into the top 1% of earners will find themselves on the outside looking in within a decade.

There are also many different definitions of rich. Just because you make a lot doesn’t mean you keep a lot. A six-figure income goes further in some locations than others. Wealth isn’t the same thing as income or spending. Wealth is what you don’t spend.

Wherever you fall on the income or wealth spectrum, this is one financial problem that will never go away. It can’t — it’s human nature.

In the social media information age, this is only going to get worse.

Michael and I discussed healthcare inflation, the top 10%, rich people who don’t feel rich and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Top 10%

Now here’s what I’ve been reading lately:

Books:

1Ben’s rich rule of thumb: If you own more than one house, you’re probably rich.

2The top 1% by income is close to 24% of the total, up from around 16% in 1989.