Here’s a question we got in the Animal Spirits inbox this week:

They always say the stock market has returned 10% over the last 100 years mainly with the old school industrial companies. You guys have talked about how the new Mag 7 is way more profitable than those companies. Who knows what the future holds but why does everyone pencil in 4-5% returns because the markets is high? Seems like being optimistic with the new profit margins and the new companies are tech and less industrial. Why doesn’t anyone think annual returns over the next 25-50 years will probably be more like 13-15%.

This is a fair question in theory.

If corporations are becoming more efficient with higher profit margins shouldn’t we expect higher returns?

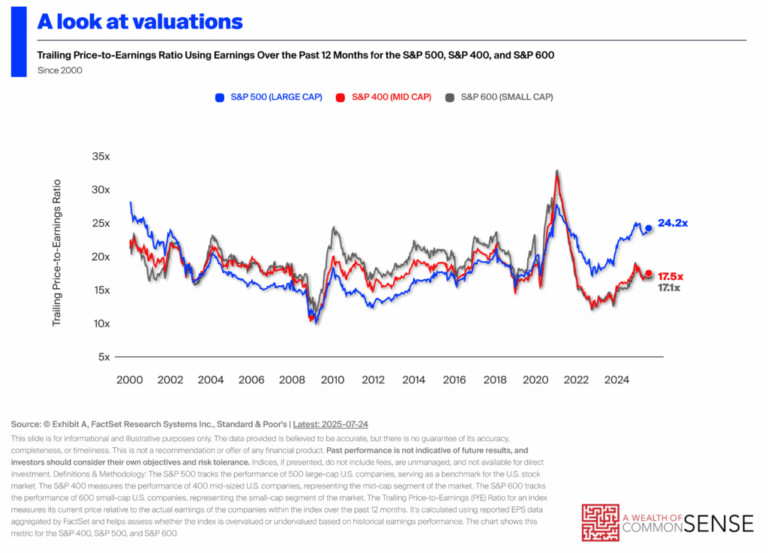

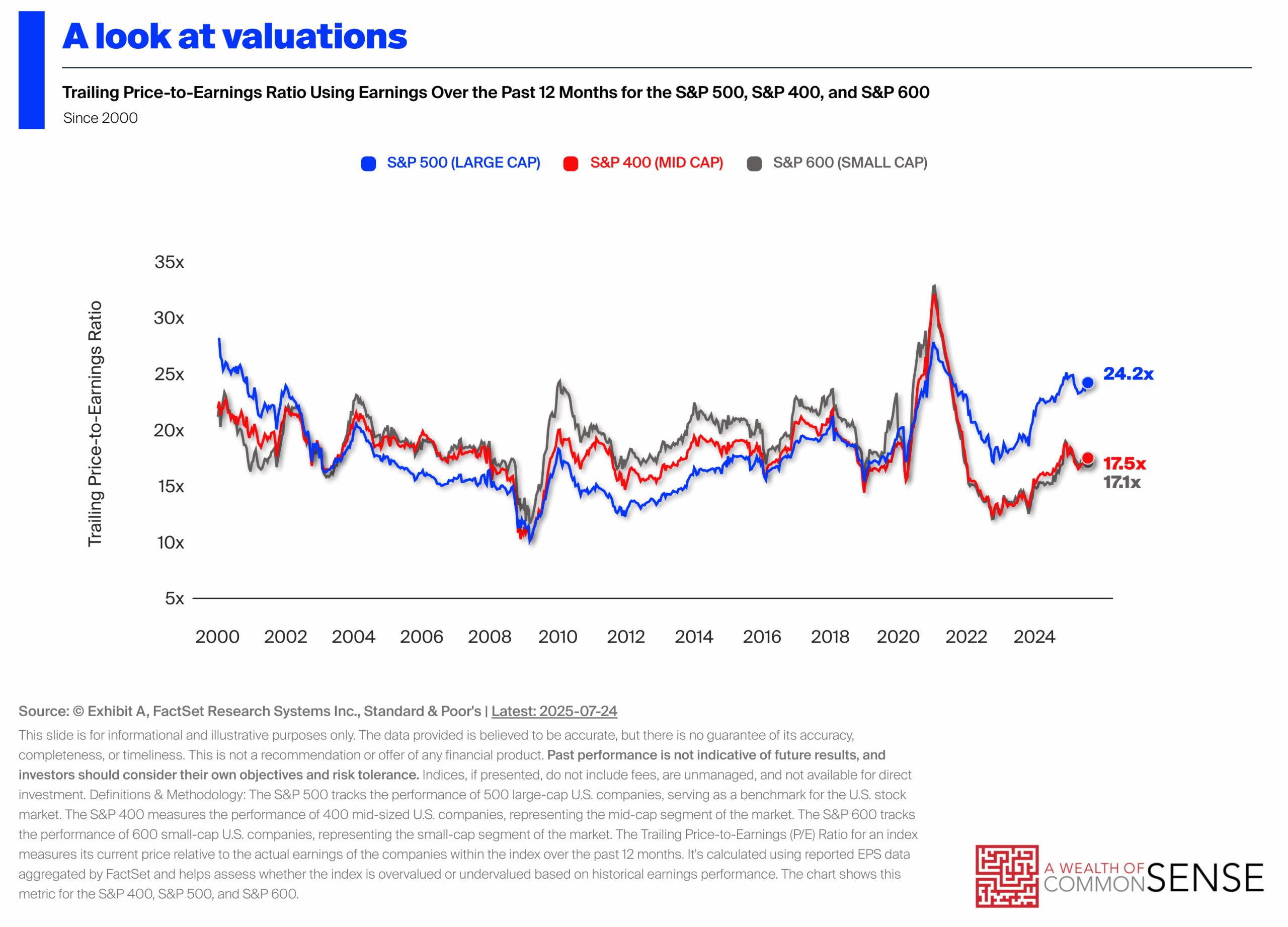

It’s possible we just experienced this exact situation. But now valuations reflect these facts:

Can valuations remain this high or move higher? Absolutely. It wouldn’t surprise me if that happened. Valuations should be higher because tech stocks now dominate the market.

But there are limits. Even with higher margins, corporate profits and sales are still tied to economic growth and consumer spending.

The economy is already enormous so it’s unlikely we experience the same growth levels we saw in the past.

Kleiber’s Law is the idea that larger animals are more energy efficient than smaller animals. Geoffrey West wrote about this idea in his book Scale:

If an animal is twice the size of another (whether 10 lbs. vs. 5 lbs. or 1,000 lbs. vs. 500 lbs.) we might naively expect metabolic rate to be twice as large, reflecting classic linear thinking. The scaling law, however, is nonlinear and says that metabolic rates don’t double but, in fact, increase by only about 75 percent, representing a whopping 25 percent savings with every doubling of size.

Economies of scale have limits. West further explains:

We just saw that a cat that is 100 times heavier than a mouse requires only about 32 times as much energy to sustain it even though it has approximately 100 times as many cells– a classic example of an economy of scale resulting from the essential nonlinear nature of Kleiber’s law.

The larger the organism the less energy has to be produced per cell per second to sustain a gram of tissue. Your cells work less hard than your dog’s, but your horse’s work even less hard. Elephants are roughly 10,000 times heavier than rats but their metabolic rates are only 1,000 times larger, despite having roughly 10,000 times as many cells to support.

Elephants are more efficient than mice but they don’t grow to the size of a cruise ship.

Exponential returns for a ~$50 trillion stock market would eventually consume the entire economy so there are limits to the growth rates.

This is also a bull market question. No one asks this kind of question during a nasty bear market. That’s how sentiment works.

This got me thinking about the things people say or think during bull and bear markets:

Bull markets: It’s too early to sell and too late to buy.

Bear markets: It’s too early to buy and too late to sell.

Bull markets: Am I a genius?

Bear markets: Am I an idiot?

Bull markets: Why do I hold any bonds or cash?

Bear markets: Why don’t I own more bonds and cash?

Bull markets: I’ll rebalance later. Just a little higher I swear.

Bear markets: I’ll just wait until the dust settles.

Bull markets: Investing is easy!

Bear markets: Why do I do this to myself?

Bull markets: Long live buy and hold!

Bear markets: Buy and hold is dead!

Bull markets: Diversification is for losers.

Bear markets: I should’ve hedged more.

Bull markets: Why don’t I own that?!

Bear markets: Thank God I don’t own that.

Bull markets: Cautiously optimistic.

Bear markets: Recklessly pessimistic.

Bull markets: That guy who’s been calling for a crash forever is always wrong.

Bear markets: That guy who’s always calling for a crash is brilliant. He saw it coming.

Bull markets: Quoting Warren Buffett.

Bear markets: Quoting Mike Tyson.

Bull markets: Someone is getting richer than me.

Bear markets: No one is getting rich.

Bull markets: Staring at charts all day in hopes they keep going up.

Bear markets: Starign at charts all day in hopes they stop going down.

Bull markets: This is going to last forever.

Bear markets: This will never end.

Michael and I discussed bull market behavior and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Pandemic Babies & a Bull Market in Risk

Now here’s what I’ve been reading lately:

Books: