OpenAI released ChatGPT in November 2022.

That was just a month after the stock market bottomed from the bear market and a few months after the inflation rate topped out at 9%.

At that point almost everyone assumed a recession was a foregone conclusion.

It didn’t happen.

Would we have seen an economic contraction if our tech overlords didn’t go on an insane AI spending spree from there?

Could there have been an even worse downturn from the trade war earlier this year without the massive AI spend?

We don’t live in a world with counterfactuals.

But this feels like the week when everyone decided to put data behind the idea that AI has more or less been carrying the economy and markets.

There were three charts I saw that essentially all say the same thing — the tech giants are spending a boatload of money on the AI arms race.

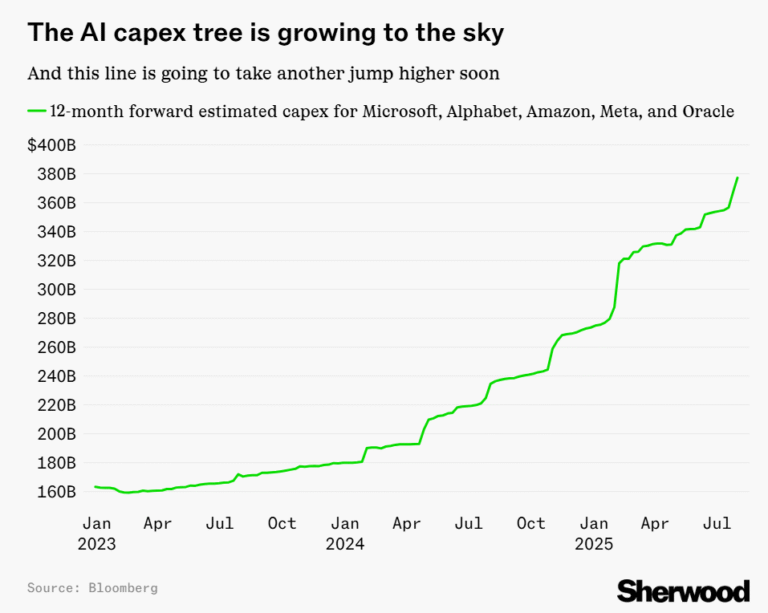

Here’s one from Sherwood News on the forward capex estimates for five of the biggest spenders:

Every step is just a little steeper.

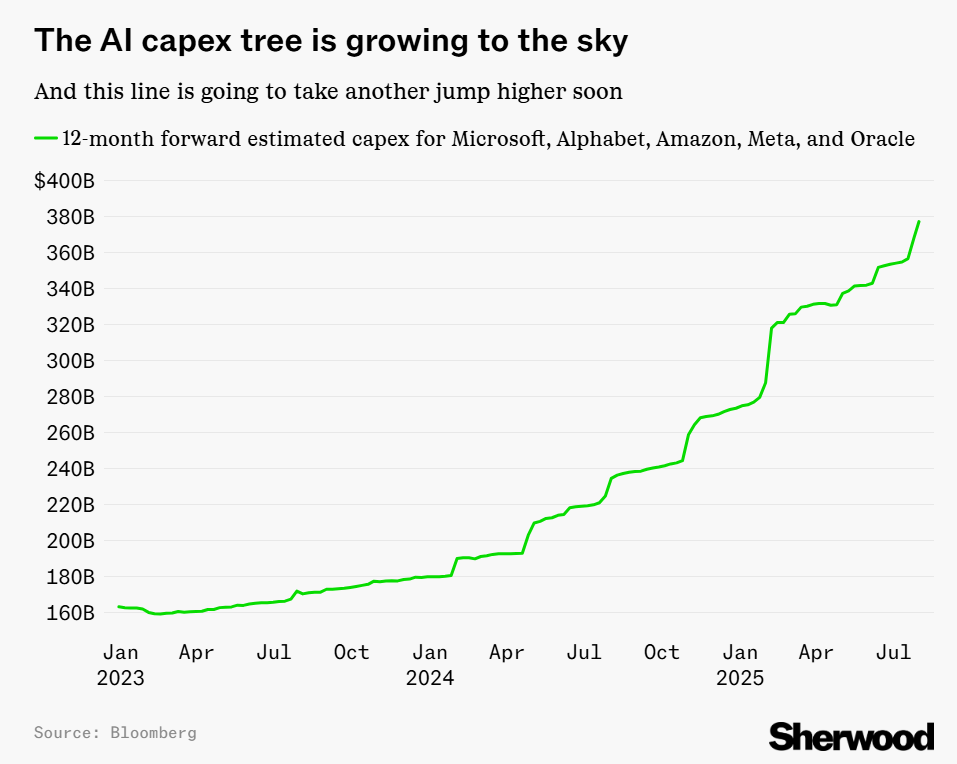

Here’s a similar chart from The Wall Street Journal on four of the Mag 7:

Up and to the right.

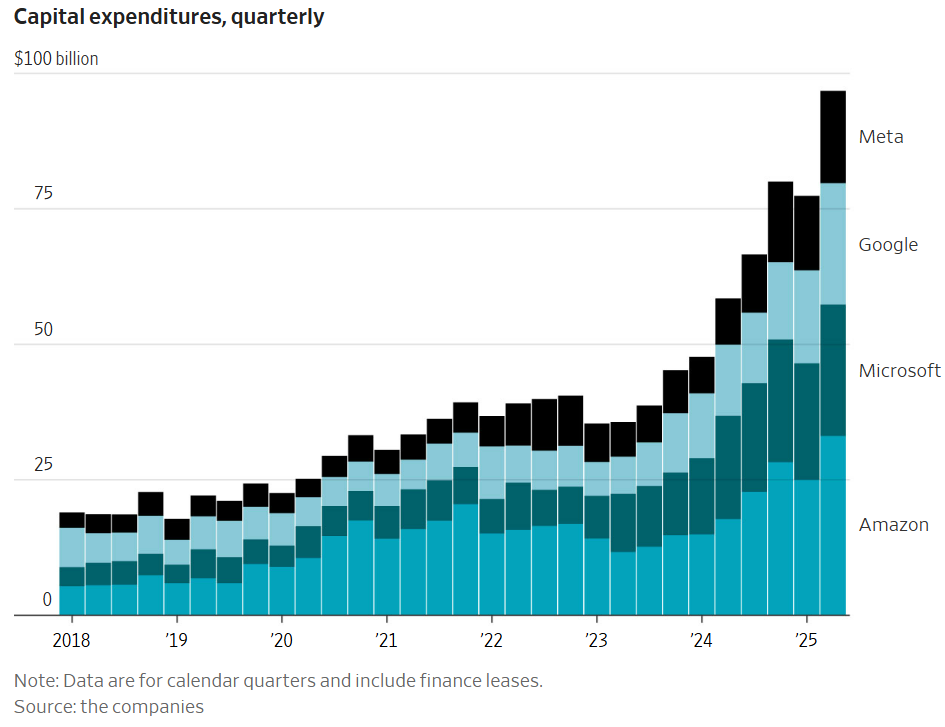

And finally The Financial Times shows the capex spend over the last three years:

Microsoft, Google, Amazon, and Facebook spent a combined $151 billion in 2023, $246 billion in 2024, and are forecasted to exceed $320 billion this year in competition for AI supremacy.

Spending by the Mag 7 was up 40% in 2024 while the other 493 stocks in the S&P 500 saw capex increase by less than 4%.

The sheer amount of spending boggles the mind but makes sense when you consider the opportunity in AI.

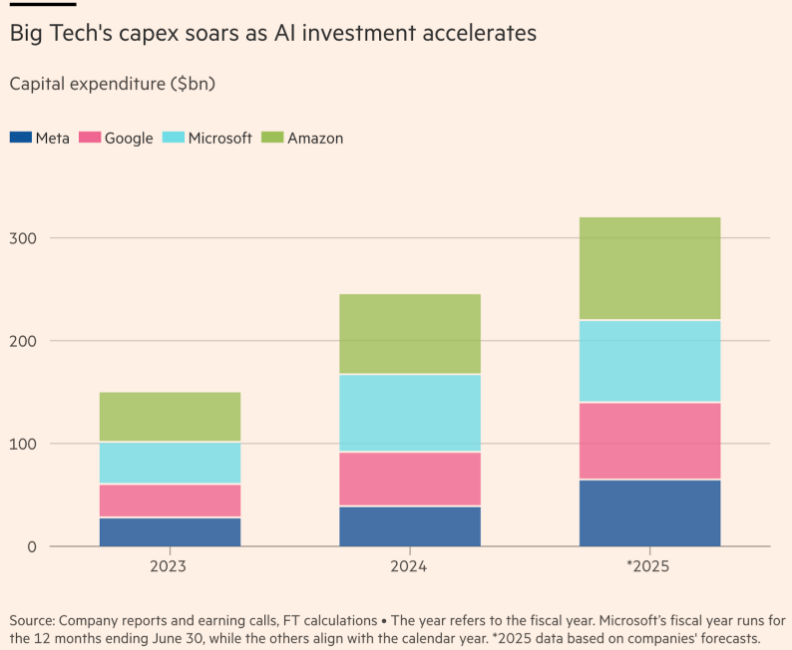

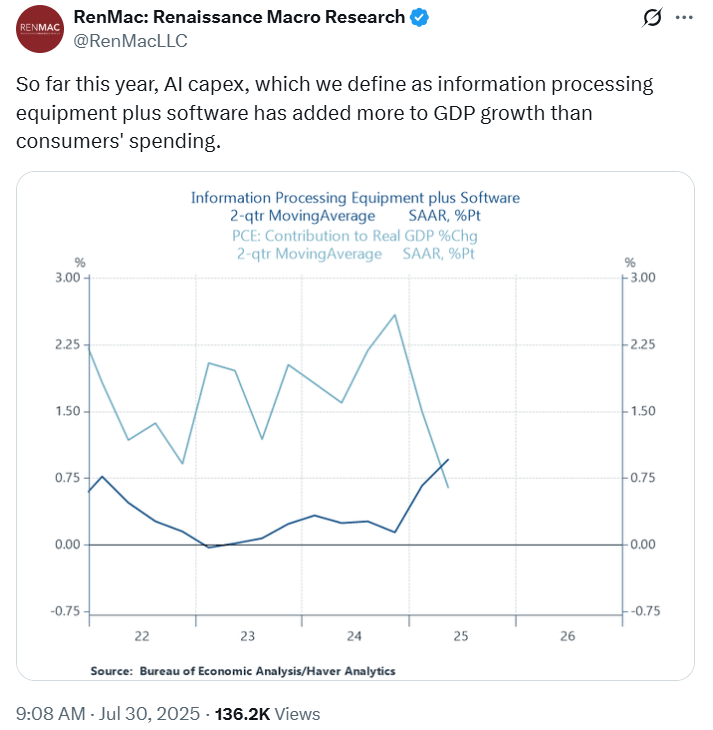

It’s not only powering the stock market but it’s now having a real impact on the economy. Ren Mac shared what may be the chart of the year so far:

This is nuts. Consumer spending makes up ~70% of the U.S. economy. AI spending is currently adding more to GDP than consumer spending!

Now what?

How this all shakes out, no one knows.

My best guess is there are two outcomes, both of which will look obvious with the benefit of hindsight if things play out either way:

(1) Of course these companies crashed and burned. They spent way too much. The ROI was less than expected. Expectations were far too high. It was obvious!

(2) Of course these companies continued to dominate. They threw a kajillion dollars at a game-changing technology. AI changed the world and to the victor go the spoils. It was obvious!

I just don’t know which one it will be.

Maybe option (1) will go first followed by option (2). Or we get something in the middle.

This is a fascinating time in the macro landscape.

The labor market might be softening. Housing and construction activity remain muted due to high mortgage rates. Tariffs could slow consumer spending.

Yet the biggest, most important companies in the stock market are pot-committed and continue to spend like your drunk friend in Vegas who just went to the ATM for the third time before midnight.

AI capex might save the economy yet again if all of this spending translates into immediate returns for the Mag 7.

If it doesn’t…watch out below?

We have to experience an economic contraction eventually…right?

Maybe AI excesses will do the trick.

Or maybe we’ll go the rest of this decade without another recession because of a transformative technological innovation.

I would love to give you the definitive answer but I’m not sure anyone knows how this all plays out.

Further Reading:

Mega Cap World Domination

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.