A reader asks:

What purchases and decisions do you wish your clients would run by you first? Which ones do you prefer they just go live their life without asking? I’m in Ben’s shoes with a looming home project that will likely spiral. Ran it by our planner but always wondered… what makes a client annoying?

I can already tell this person is a good client for the simple fact that they’re self-aware enough to even ask it.

The people who are actually annoying — in any business relationship or life in general — lack self-awareness.

My general rule of thumb here is the more information the better. Good financial advisors want as much information about your circumstances as possible so they can help you make more strategic decisions.

Concealing financial information makes it much harder on your advisor. If you’re willing to share about your finances, spending habits, goals, etc. and your advisor is annoyed that’s on them, not you.

So what types of purchases and decisions should you run by your advisor? This is not an exhuastive list but here’s a good start:

- Big ticket items: House, boat, home renovation, college education, vacation property, etc.

- Major life changes: Career moves, early retirement, marriage, divorce, children, a death in the family, etc.

- Business ventures: Stock options, starting a new business, selling a business, making new private investments, etc.

- Reserves: Outside cash reserves or investments the advisor doesn’t know about.

- The boring stuff: Insurance, estate planning, trusts, wills, etc.

- Goals: Changes, updates and overhauls to your desires and aspirations with your finances and life.

- Spending patterns: Advisors need to know if your budget changes meaningfully.

- Savings rates: How much you save and contribute to your investments and where the money goes.

I’m sure I missed a few things but good financial advisors want to hear from you on this stuff. The more they know about your finances and spending habits the better.

I have attributes in mind of what makes a good client but let’s pull a Charlie Munger and invert by showing what it looks like to be a bad client first:

The performance chaser. Why am I not beating that benchmark? Why is the S&P 500 beating my portfolio? Why is my portfolio down this year? Why am I only up 23% when my golf buddy is up 27%?!

Everything is recency. Why don’t I own that thing that just did really well? You should’ve put my portfolio into that instead of that junky asset class that just underperformed. Small cap stocks are down this year. Get me out!

The hindsight client. Why didn’t we go all in on Nvidia?! Why didn’t you buy Bitcoin for me? We should’ve had all of my money in tech stocks.

[in a bull market] Bonds are pointless. We should be all in equities and dial up the risk.

[in a bear market] I think we took too much risk in stocks. We should dial it down.

The macro worrier. The government debt is too high. The system is going under. Oh no, rates are rising! On no, rates are falling! This politician is going to crash the market! Did you hear about the Straight of Hormuz this week?

The waffler. I can’t make a decision. What if this happens? But what if that happens? If I take too much risk I could lose money. If I don’t take enough risk I’ll never make any money.

Irrational confidence. Just pick the best stocks for me. I want 12% guaranteed every single year, and I don’t like volatility. Just rotate into the best performing asset classes each year and avoid the duds.

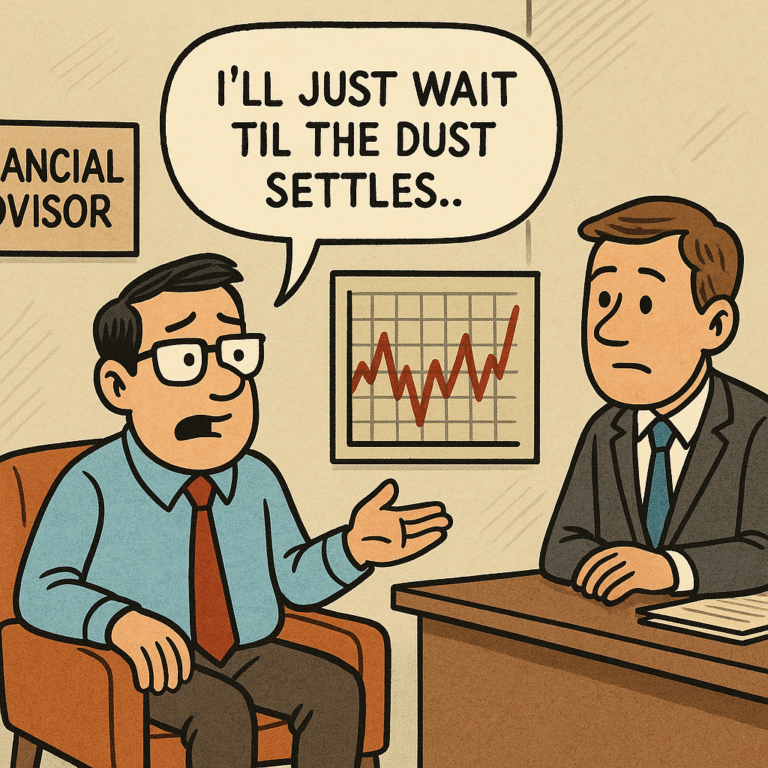

The market timer. I just want to get out for a little while until the dust settles. I swear I’ll get back in. Just until after the election…

I think now is the time to double down and go all-in.

Now here’s how to be a good client:

Tell your advisor what you want. Be clear about your priorities and values. Tell your advisor exactly what you’re looking for in terms of portfolio management, expected returns, communication cadence, and reporting needs. It’s they’re job to do it for you. If they can’t do it? They should tell you that.

Financial advisors can’t work magic but the clearer you are about what you want, the better they can tailor a plan to suit your needs.

Ask questions. We don’t live in a financial world of “trust us, we got this” anymore. A good financial advisor will be transparent and up-front about their entire service model.

You should feel comfortable asking questions about your advisor’s business model, services, fees, philosophy and financial planning process.

You have to trust their process for the relationship to work, but you need to verify first that it’s the right fit for you (just like they should be figuring out if you’re the right fit for them).

What do I own and why do I own it? Why is this my allocation? Why are we doing it this way? How much am I paying in fees all-in?

You can outsource your planning but not your understanding of the plan.

Be realistic. Your advisor should be setting expectations. You should go into that relationship with reasonable expectations too.

Proactive communication. It’s always best to check in with your advisor before a big decision. Maybe you don’t need their help but it’s possible there are financial or tax consequences you’re not even considering and a good financial advisor should be able to provide some checks and balances.

It’s much better to overplan than try to fix mistakes after the fact.

Emotional intelligence. Financial advisors are just as susceptible to emotions as anyone else. Those emotions just might be different than what the client is facing because no one cares more about your money than you.

It’s good to inform your advisor about past mistakes or the money emotions — fear, greed, envy, guilt, regret, etc. — that impact you the most.

If a financial advisor understands your concerns and limitations they can build those into your plan.

Bill Sweet and I discussed this question on an all new episode of Ask the Compound:

We also answered questions about all of the crazy market volatility we’ve experienced this decade, all of the new tax alpha strategies, 401k rollovers with $30 million and whether or not you should own a home in Colorado.

Further Reading:

The Future of Investment Management is the Paradox of Choice