Some things I’m thinking about regarding the housing market:

How affordable is housing for the majority of Americans? The 50/30/20 rule says that you should spend roughly 50% of your income on necessities (housing, transportation, healthcare, etc.), 30% of your income on wants (dining out, travel, entertainment, etc.) and 20% of your income on savings or paying off debt.

Within the 50% necessity bucket, a good rule of thumb says you should spend around 30% towards your monthly housing payment. There is obviously some nuance involved depending on where you live and so on.

Redfin has a new report that shows many households would struggle to stay within the bounds of this rule based on current housing prices and mortgage rates:

A household on the median income would need to spend 39% of their earnings on housing to buy the median priced home. But there’s some good news: That’s down from 40.5% last year, likely because incomes have risen while home prices have barely budged (the median U.S. home sale price is up just 1% year over year).

While only about one-third (34.6%) of home listings are affordable for the typical U.S. household, that’s up slightly from 33.2% a year ago.

This is not good news for prospective homebuyers, but what about all of the people who already own a home?

If you owned a property pre-2021 and locked in a 3% mortgage, your monthly housing cost is likely significantly lower than 30%.

Consider yourself lucky if you locked in extraordinarily low housing costs. Those days are long gone.

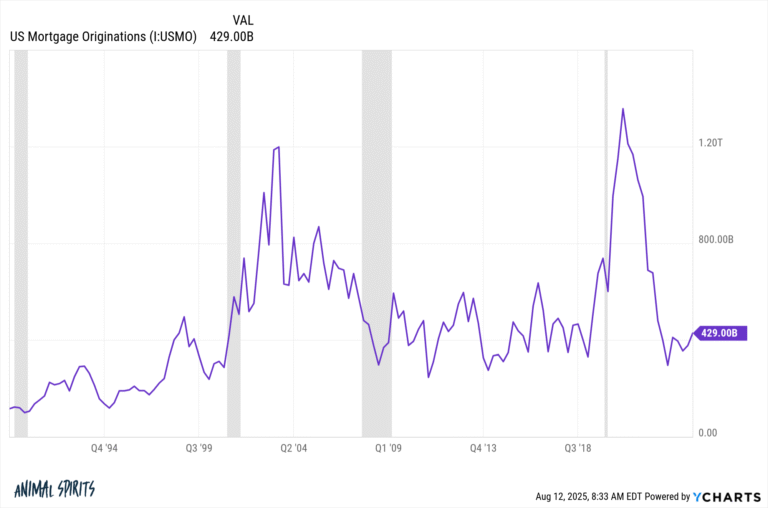

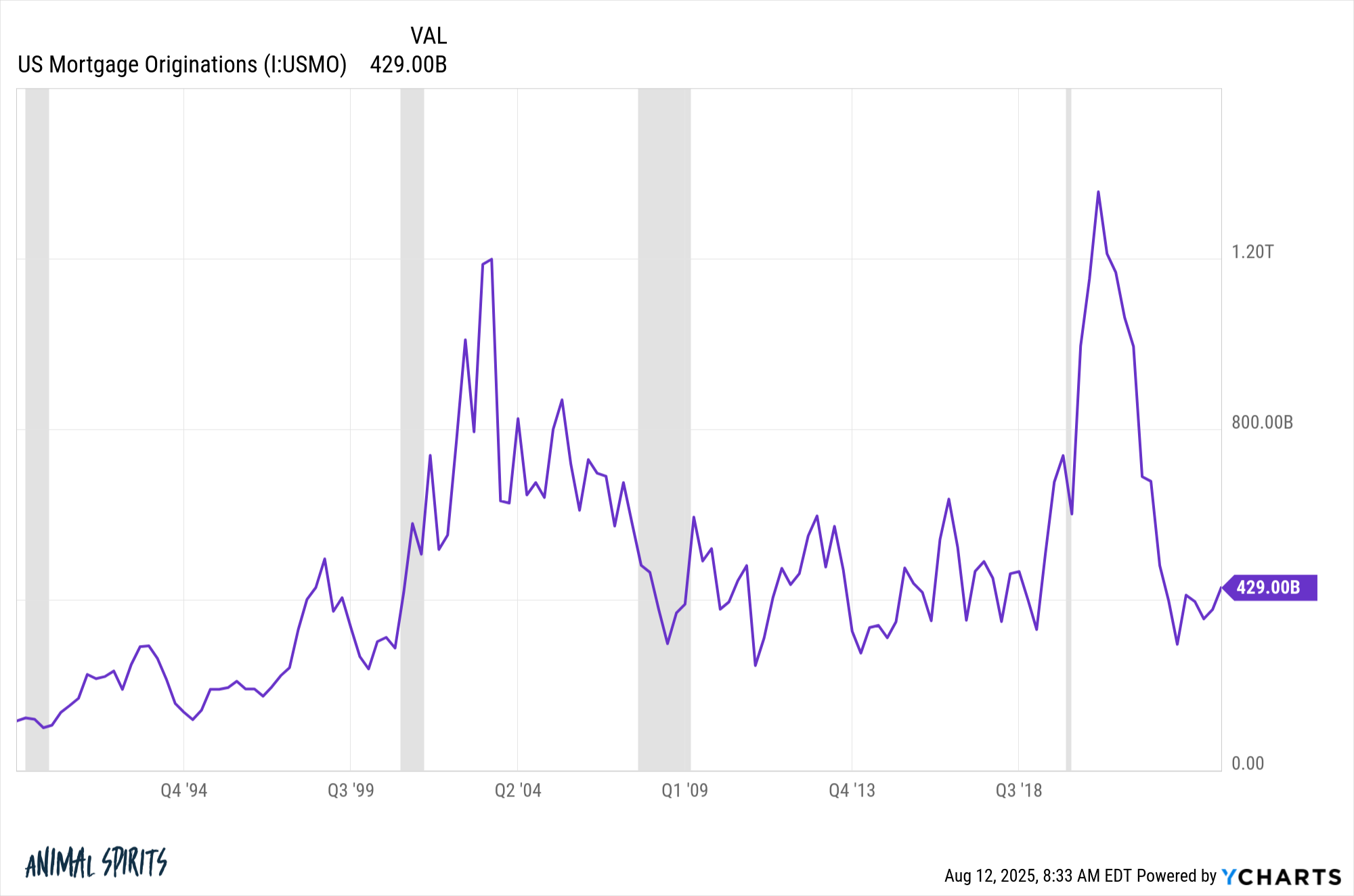

Will housing activity boom during the next recession? Housing activity remains weak by historical standards:

No one wants to refinance with rates so high and no one wants to buy a house with prices so high.1

We’ll get another recession someday. Maybe in a year. Maybe in 7 years. Who knows?

Whenever an economic contraction occurs, we’re likely to see lower rates. These things aren’t scientific but mortgage rates have fallen by an average of around 1-2% during past recessions.

If that happens this time around I think you’re going to see an explosion of housing activity from pent-up supply and demand that has been sitting on the sidelines. We could also see a big uptick in cash-out refis and HELOCs if rates are at more reasonable levels because so much equity is tied up in homes these days.

People would be very confused by this but the housing market already went through a recession so it wouldn’t surprise me to see it lead us out of the next one.

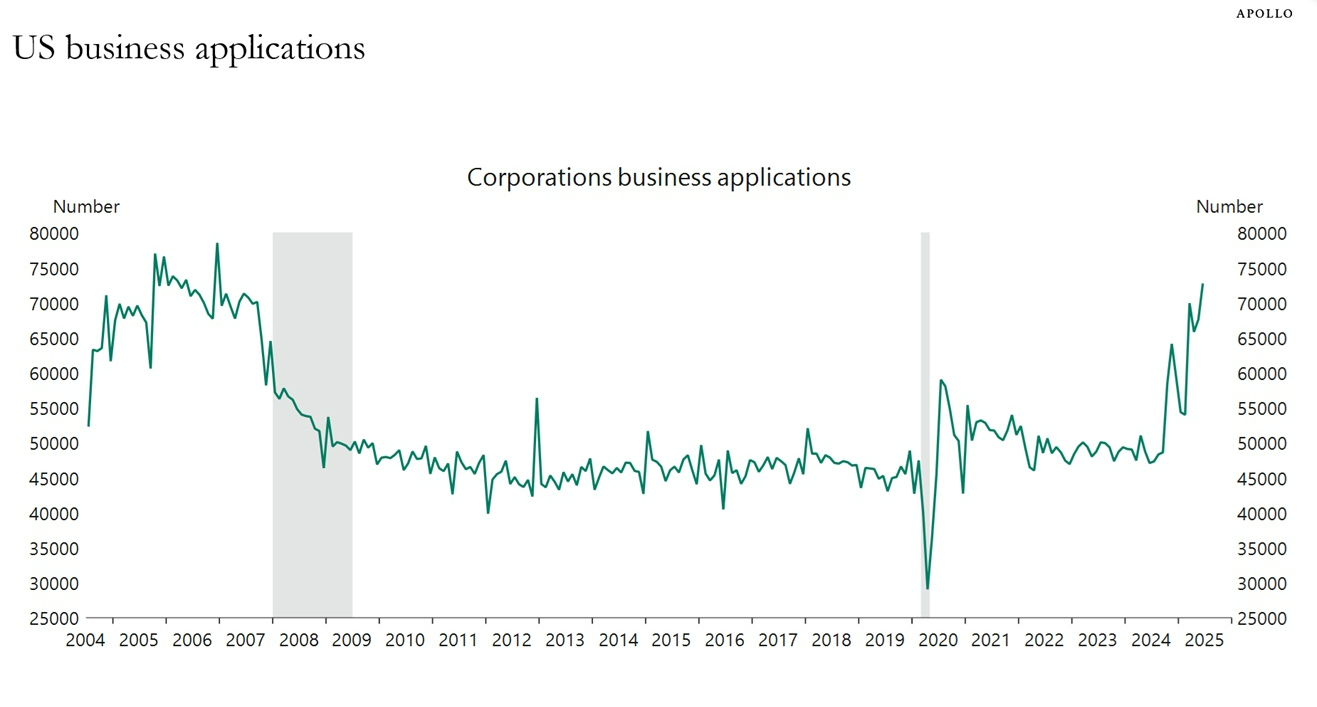

Why do we make it so easy to start a business and hard to build more housing? I guess this is more of a rhetorical question.

Look at the number of business applications in America:

The fact that we went through a pandemic and it led to a boom in new business applications is one of the things that makes this country great. Starting a business is relatively easy.

Building more housing is a process that’s full of red tape.

It makes no sense.

Will we ever see actual policy changes that spur more building? There are many reasons housing has become unaffordable for so many people.

The simplest explanation is that we don’t build enough housing.

For some reason this hasn’t become much of a political issue just yet. Politicians haven’t done much to alleviate the pain of higher housing costs. That might be changing.

The ROAD to Housing Act is the first bipartisan housing legislation to be approved by a Senate committee in over a decade.

The general idea behind this act is that we need to reduce regulation in housing development and get rid of all the red tape that makes it such a pain to build more. It’s one of the most comprehensive bills in years to confront the housing crisis through regulation reform, construction innovation, and affordability initiatives.

There are a lot of details that still need to be ironed out and the Senate still needs to vote on this but it’s the first piece of good news on the housing supply front I’ve heard of in years.2

We’re getting a lot of deregulation in other areas of the financial system right now but housing is where we need it the most.

I hope this actually happens and we build more housing.

Further Reading:

Housing Market Nobility

1There is still some activity going on obviously. Over the past 12 months there were around 3.9 million existing home sales. That’s just well below the 5.2 million average number this century.

2Cardiff Garcia has a great podcast on The ROAD to Housing Act with Alex Armlovich that’s worth a listen: