The Wall Street Journal says the middle class is getting pessimistic about the economy:

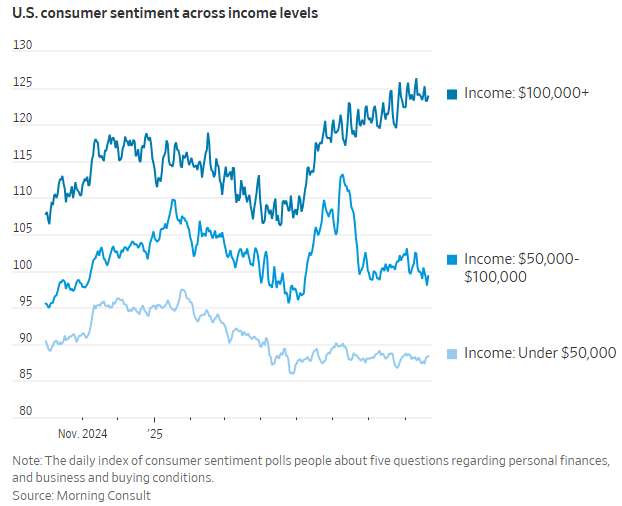

The middle class–generally considered to include households making roughly $53,000 to $161,000 a year–is playing an outsize role in that waning optimism. After months of tracking high-income earners’ increasing confidence about the economy, households making between $50,000 and $100,000 made an abrupt about-face in June. They now more closely resemble low-income earners’ gloomier views, according to surveys done by Morning Consult, a data-intelligence firm.

Here’s a chart that breaks down sentiment by income levels:

You can quibble with their definition of middle class but the thing that stands out to me is how volatile these numbers are. Sentiment crashes then shoots higher then crashes again.

I’m not sure we can trust these surveys anymore.

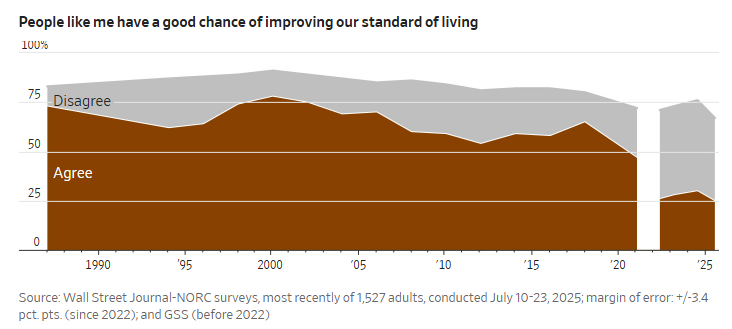

Here’s another one from the WSJ that asks people if they have a good chance of improving their standard of living:

The article says people are losing faith in the idea that they can get ahead through hard work.

Maybe things are harder today than they were in the past. In some ways, they probably are. In other ways, things are far easier.

But look at the trend in this survey over time. It was already going downhill…and then Covid hit and it crashed. I contend some combination of social media and our collective experience during the pandemic has broken the vibes for good. We can’t trust these sentiment indicators anymore. They’re far too noisy.

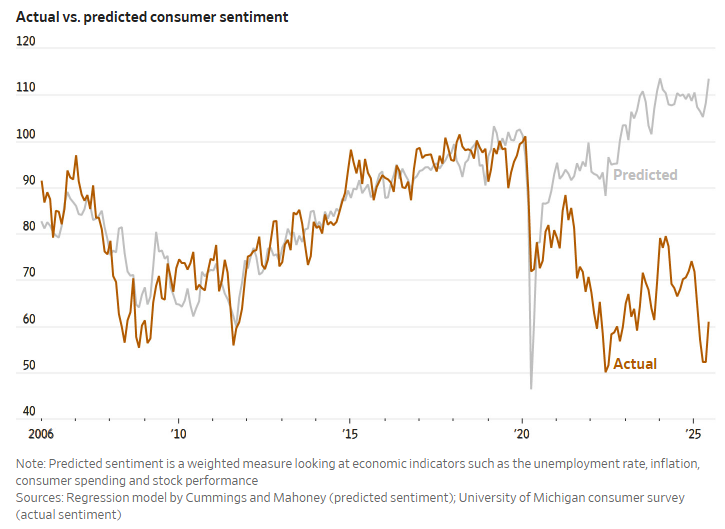

Two Stanford researchers have a model that looks at how the economy is performing versus the perception of the economy through sentiment readings. The two used to track closely. Not anymore:

This is from the story:

“The gap is staggering,” Mahoney said of the separation of sentiment from the solid economic metrics. One factor fueling the gap recently, he said, has been the stock market boom–“which has historically translated into stronger sentiment. But not on this occasion.”

You have to watch what people do not what they say. People say a lot of stuff on the internet that doesn’t match reality.

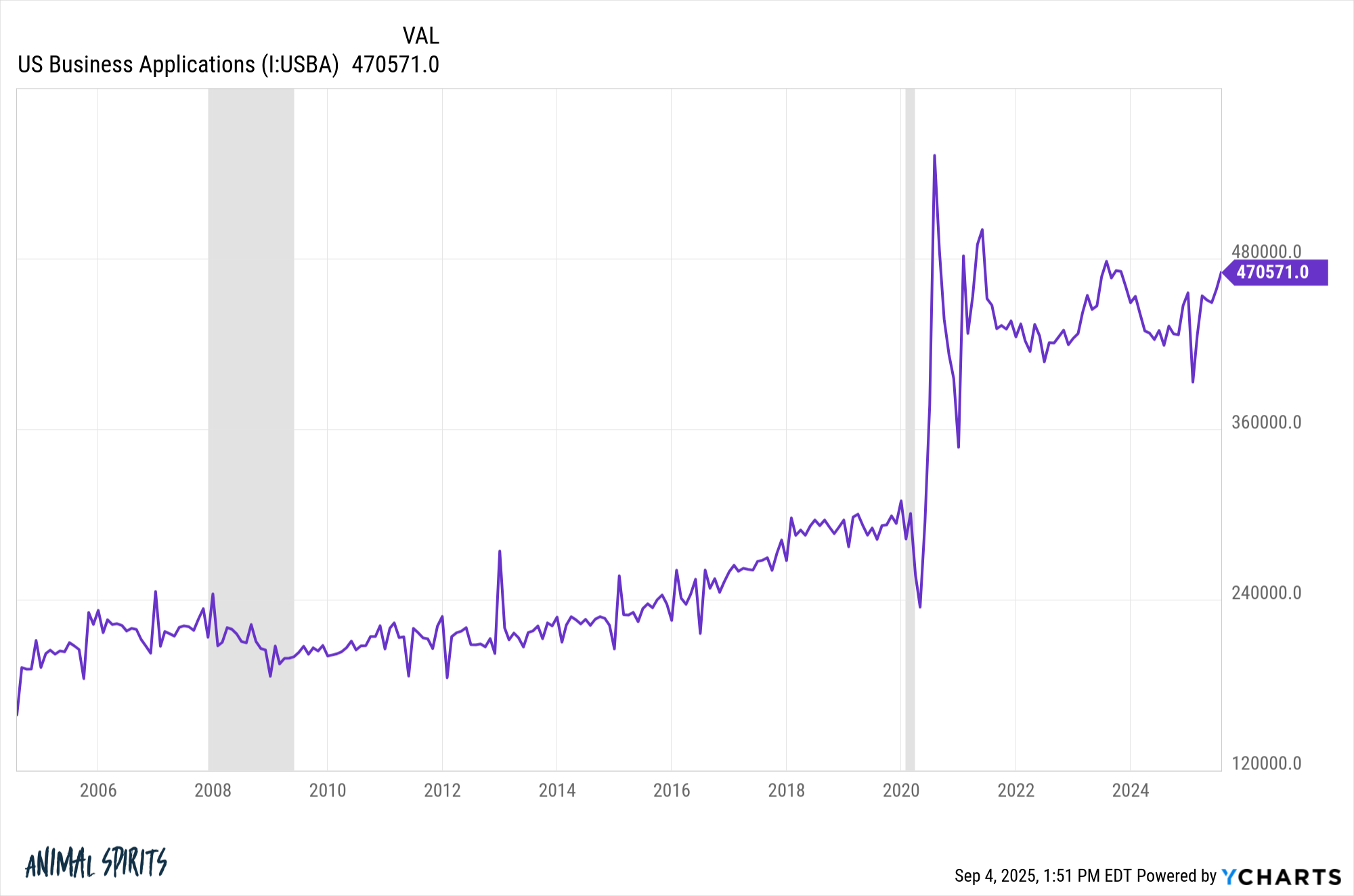

Roger Lowenstein wrote an op-ed in the Journal about American exceptionalism. He says last year one out of every 24 household registered a new business application. You don’t start a new buisness if you’re worried about the future or hard work.

Look at this chart:

New business applications have exploded since the pandemic while sentiment has dropped to the floor.

Which one should we trust more — people’s feelings or their actions?

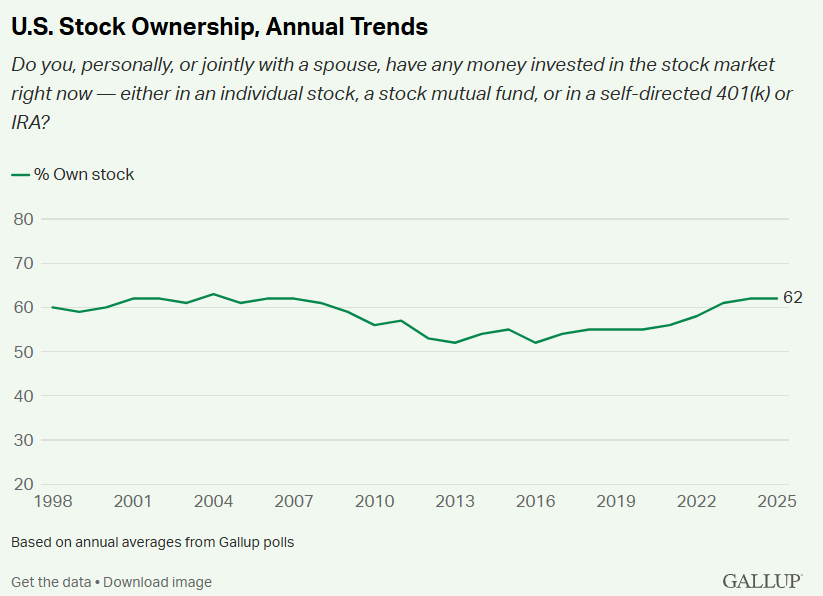

Gallup shows the number of households who own stocks continues to rise:

The increase in the 2020s has been substantial, going from 55% in 2019 to 62% now. Would more people be investing in the stock market if they thought things were going downhill from here?

People say they are pessimistic about the future. Their actions don’t match their words.

Don’t trust the vibes. They’re broken.

Maybe for good.

Michael and I talked about seniment readings, American exceptionalism and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further reading:

The News is Making You Miserable

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.