A reader asks:

I’ve been a long time listener, and while I have many questions in the realm of finance, the one I keep coming back to is bonds. When you say the 2020s are the worst ever decade for bonds, and then I see a Business Insider article saying the 60/40 is in its worst stretch in 150 years, I just can’t understand what is going on. I am a simple investor, mostly investing in my work 403b and 457 with target date funds (I’m in healthcare), but I do own and continue to buy investments like: BNDX, AGG, VBTLX, etc.

What I am trying to understand is, if bonds are in a “bear” market, am I buying them “on sale” like a person would do in a bear market with equities? I feel like everytime I check my bond holdings are in the “red”. Does that mean I am getting them for a lower price, and I can hope they will go up? Or are buying bond index funds more like a static experience: what you buy that day is what you get, and they don’t move like equities?

I wrote a post a couple of months ago making the case this is the worst decade ever for bonds.

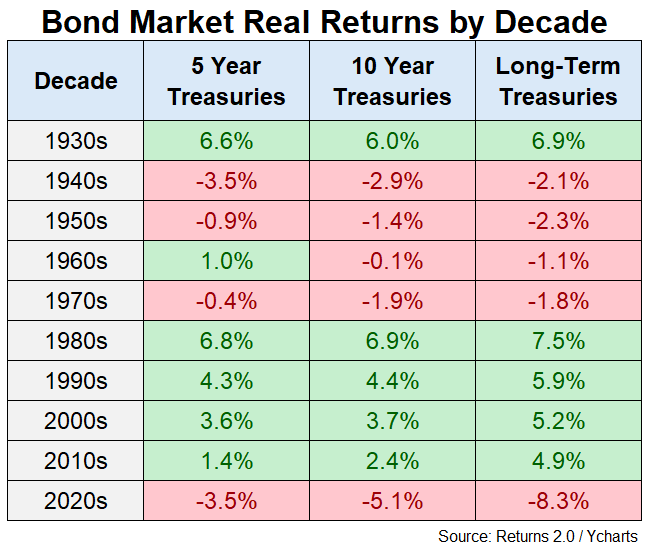

Look at the annual returns by decade for various U.S. government bond maturities:

Now look at the inflation-adjusted numbers:

A little more than halfway through the decade, the 2020s have been downright dreadful. The decade’s not over but we’ve never seen returns this bad before for an extended period of time.

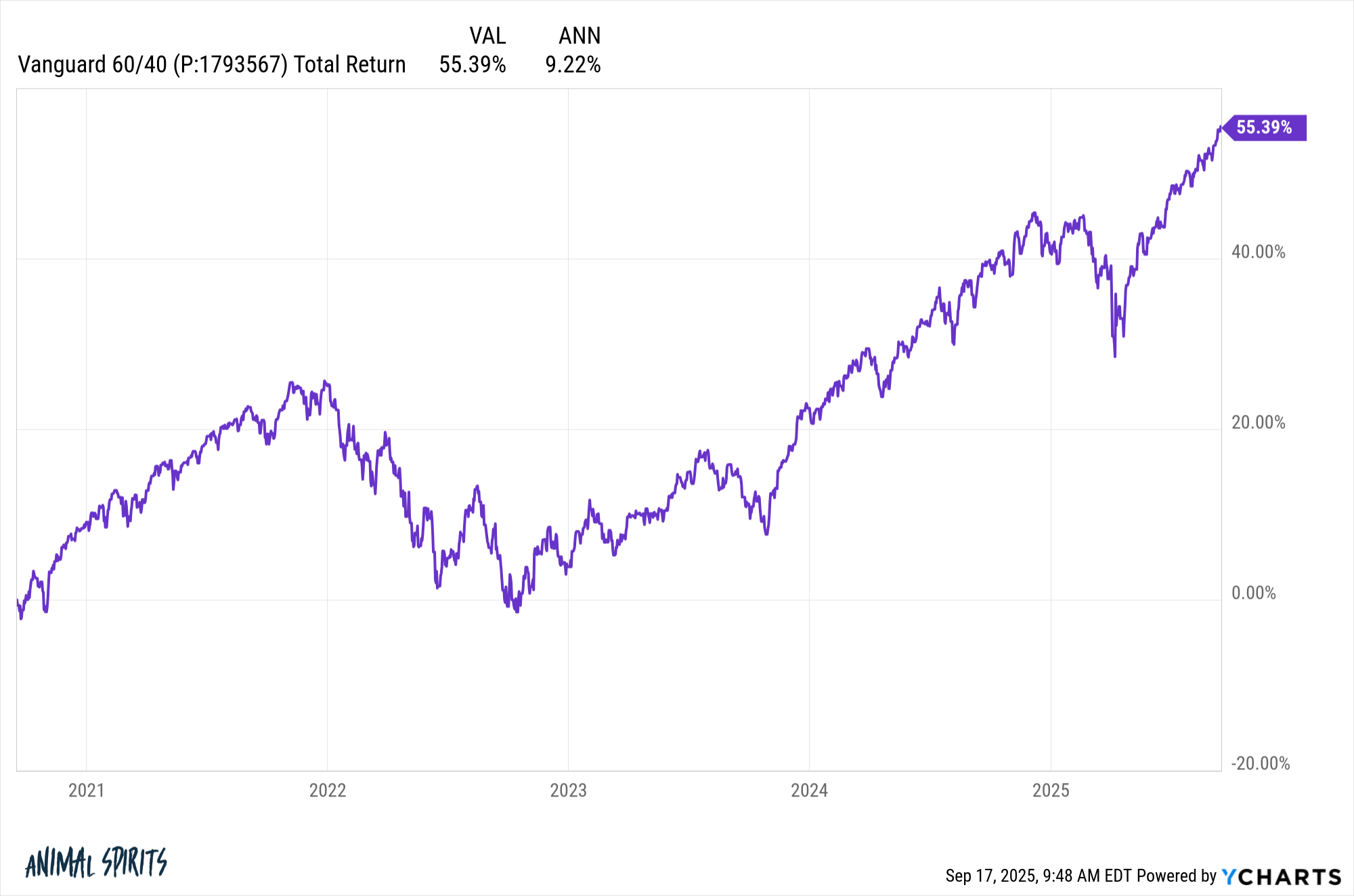

However, while bonds have had a brutal decade, the stock market has more than made up for it. This is a simple 60/40 portfolio1 over the past 5 years:

Despite the fact that bonds have lagged badly over the past 5 years, a 60/40 portfolio is up more than 9% per year.

This is the beauty of diversification. Bonds have stunk but stocks have picked up the slack.

I’d say there are two things you really need to know when it comes to investing in bonds:

1. Rates and prices have an inverse relationship. When bond yields fall, bond prices rise. When bond yields rise, bond prices fall. If this wasn’t abundantly clear before the 2020s, investors understand it now.

2. Starting yield matters a lot. In the short run, changes in interest rates, inflation and economic growth can make certain types of bonds volatile. For longer run returns, starting yield is far and away the biggest predictor of expected returns.

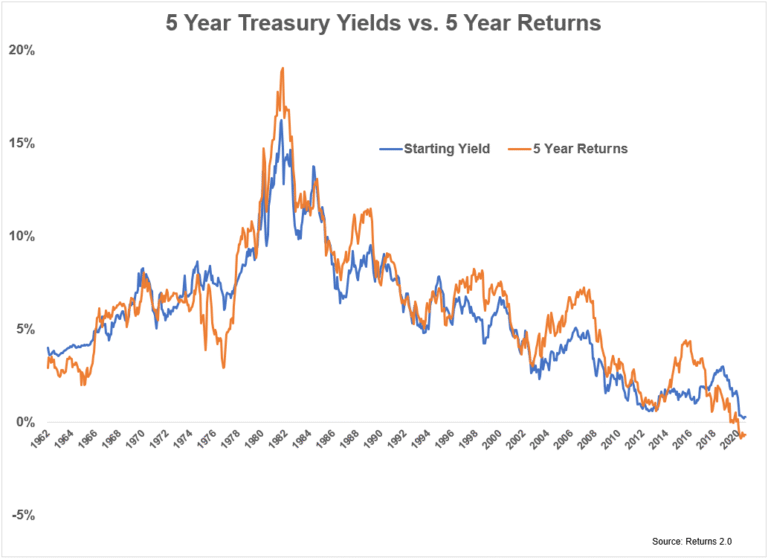

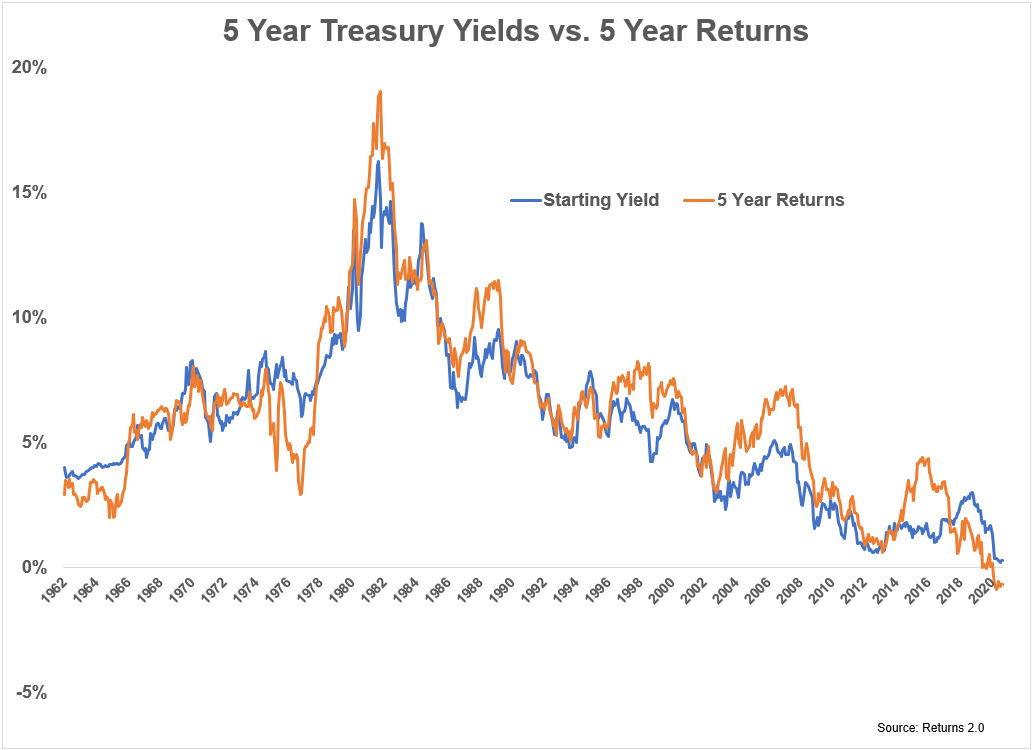

This is my favorite bond market relationship:

This shows the starting yield for 5 year Treasury bonds along with the ensuing 5 year annual return. The correlation between the starting yield and the subsequent 5 year return is 0.93. If you need to brush up on your statistics, that’s a strong to quite strong relationship.

This is for government bonds. For other bonds like high yield, corporate bonds, etc., you need to take the starting yield and subtract any defaults, which are typically very low but still happen from time to time.

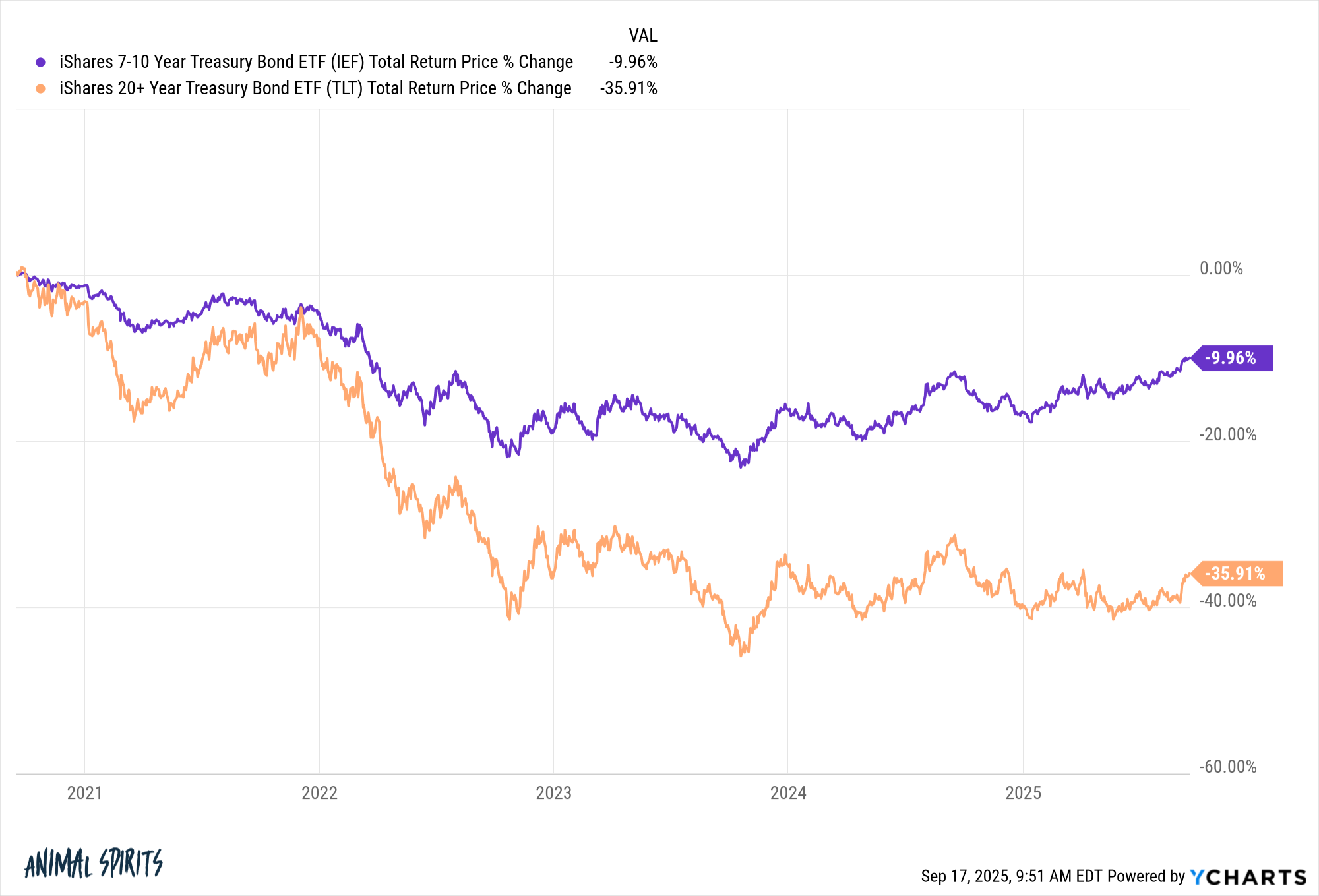

It is true that some bonds are still on sale:

U.S. government bonds with maturities of 7 years or greater have basically been underwater since 2021. Long-term bonds have gotten smoked in the 2020s from the impact of rising rates combined with high duration.

The good news about falling bond prices is you’re getting to invest at higher starting yields. That means expected returns have risen. Your short-run returns are down but your long-run returns are going up. It’s trading short-term pain for long-term gain.

You can’t say bonds are a screaming buy here because inflation could re-accelerate. Government spending shows no signs of slowing down. We have yet to experience the full impact of the new tariff policies. If that forces interest rates to rise, that would hurt bonds again in the short-term.

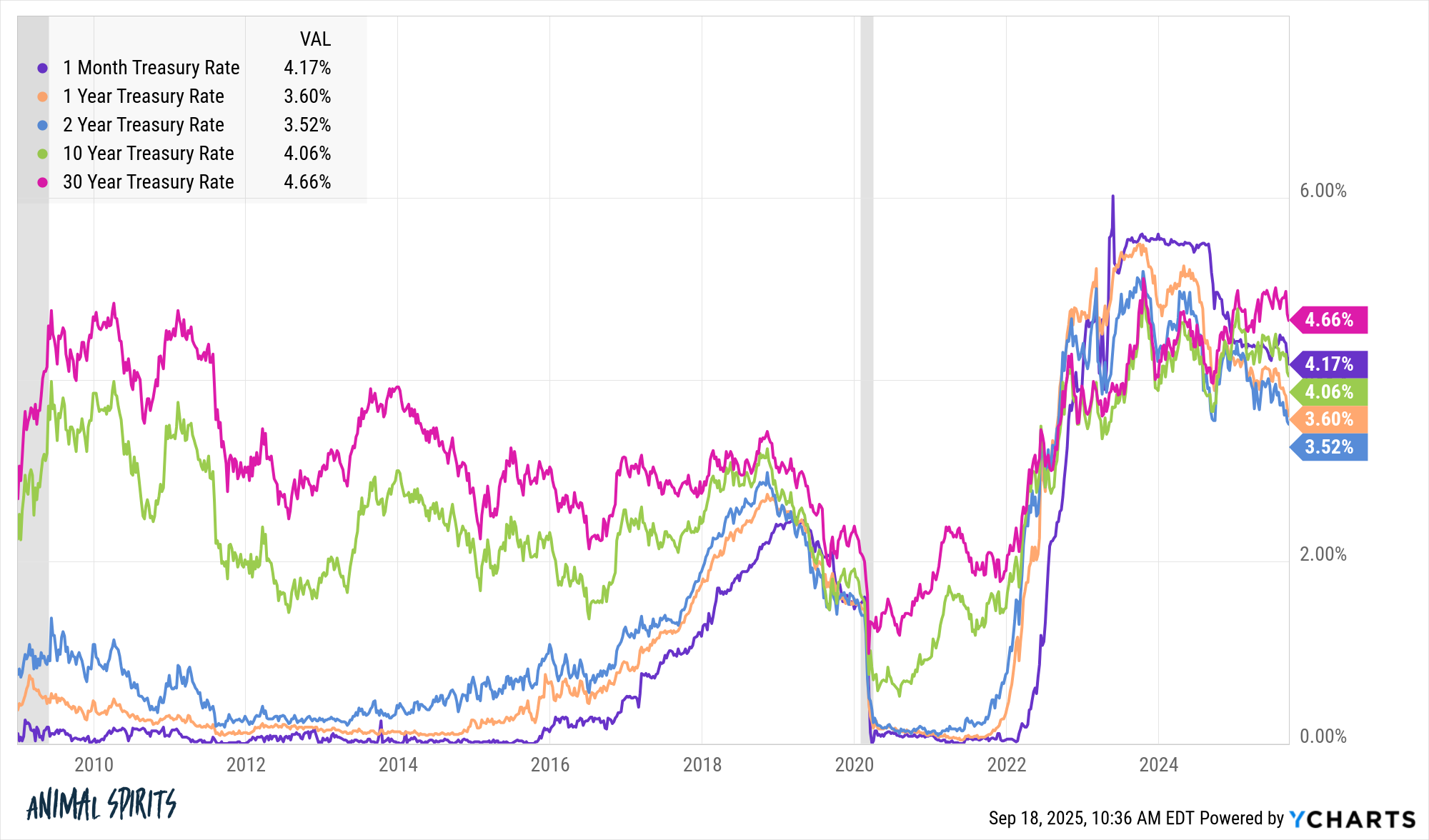

The case for investing in bonds is that yields are much higher than they were for the entirety of the 2010s:

There is a much bigger margin of safety built into fixed income now than there was when rates fell to the floor during the early days of the pandemic.

If the labor market continues to weaken, bonds are a great hedge against an economic slowdown. Plus, the Fed just cut rates yesterday and signalled there will be more cuts through year end. That’s just short-term rates and doesn’t guarantee longer-term bond yields will fall but it probably helps.

And if bond yields don’t fall too much or rise too much from here, you’re earning something in the range of 4-6% right now depending on your credit quality and duration. That’s pretty good considering inflation is sub-3%.

The one thing many investors have realized by living through their first fixed income bear market is you have to be more thoughtful about your bond allocation.

There are certain fixed income assets that are better for rising rate environments (cash, T-bills, short-term bonds, floating rate debt, short-dated TIPS, etc.).

There are certain fixed income assets that are better for falling rate environments (Treasuries, long-term bonds, mortgage-backed securities, etc.).

And there are certain fixed income assets that are better for higher yields (corporate bonds, high yield, emerging market debt, private credit, etc.).

It all depends on what you want to get out of your fixed income allocation.

For most investors there are three reasons to own fixed income:

- The income.

- Protection against volatility.

- Liquidity for spending purposes.

For some it’s a combination of the three.

As with any investment, there are always trade-offs involved. You just have to pick the allocation and strategy you’re comfortable sticking with that meets your willingness, need and ability to take risk.

I covered this question on an all new edition of Ask the Compound:

Bill Sweet joined me on the show this week to discuss questions about financial advice for service members, when to let up on your Roth contributions, 30 year fixed rate mortgages vs. ARMs, HSAs and tax planning for an early retirement.

Further Reading:

Is This the Worst Decade Ever For Bonds?

160% Vanguard Total U.S. Stock Market Index Fund and 40% Vanguard Total U.S. Bond Market Index Fund.