A couple of weeks ago, it was announced that OpenAI is going to invest up to $300 billion in Oracle’s cloud computing.

This week, Nvidia committed $100 billion of investments into OpenAI.

Oracle is spending billions of dollars on Nvidia’s GPUs.

Nvidia invests in OpenAI who then invests in Oracle who then invests in Nvidia and Finkle is Einhorn and Einhorn is Finkle.

We’ve reached the mutually assured destruction phase of the AI bubble where the tech giants have decided they’re all in this together. If one is going to take the risk on massive capital expenditures then they’re all going to take the risk.

And yeah, I’m ready to call this a bubble based purely on the history of excess investments in innovation.

During the dot-com bubble of the 1990s, the telecom companies laid down more than 80 million miles of fiber-optic cables. Five years after the bubble burst, 85% of these fiber-optic cables still remained unused.

The Nasdaq crashed more than 80%.

The Railway Bubble of the 1800s also comes to mind. Here are some facts and figures I found while researching Don’t Fall For It:

- There were 500 new railway companies by 1845

- That same year, the Board of Trade was considering some 8,000 miles of new track in Great Britain alone, almost 20x the length of England.

- The cost of the buildout was more than the national income of the entire country.

- There were 14 bi-weekly newsletters about the railroad industry in circulation.

- Charles Darwin got caught up in the bubble, losing 60% of his investment.

The good news is both of those bubbles were great for innovation.

By 1855, there were over 8,000 miles of railroad track in operation, giving Britain the highest density of railroad tracks in the world, measuring seven times the length of France or Germany. The telecomm bubble helped power YouTube, social media, streaming movies, video calls, and everything else people dreamed about in the 1990s and more.

There are some similarities to the current AI buildout but many differences too.

The dot-com bubble was fueled by investor speculation in immature companies that didn’t generate any profits. Today’s tech firms are printing cash flow with insanely high margins.

Nearly all the money for the railways came from individuals. Retail investors were fueling the bubble.

The AI boom is coming from inside the house. It’s being led by the tech CEOs who are making these capital allocation decisions.

In the 1990s, Bill Gates said:

Gold rushes tend to encourage impetuous investments. A few will pay off, but when the frenzy is behind us, we will look back incredulously at the wreckage of failed ventures and wonder, ‘Who funded those companies? What was going on in their minds? Was that just a mania at work?’

Here’s what Mark Zuckerberg said in an interview recently:

If we end up misspending a couple of hundred billion dollars, I think that that is going to be very unfortunate obviously. But what I’d say is I actually think the risk is higher on the other side. If you if you build too slowly and then super intelligence is possible in three years, but you built it out assuming it would be there in five years, then you’re just out of position on what I think is going to be the most important technology that enables the most new products and innovation and value creation and history.

In other words — we’re not going to undershoot on this. If it turns into a mania, so be it.

These tech leaders aren’t stupid. They know the history of over-investment. But they’re saying the risk comes from not spending enough.

So case closed? This is a bubble that’s sure to pop?

If this truly is a bubble of epic proportions it’s one of the weirdest ones we’ve ever seen.

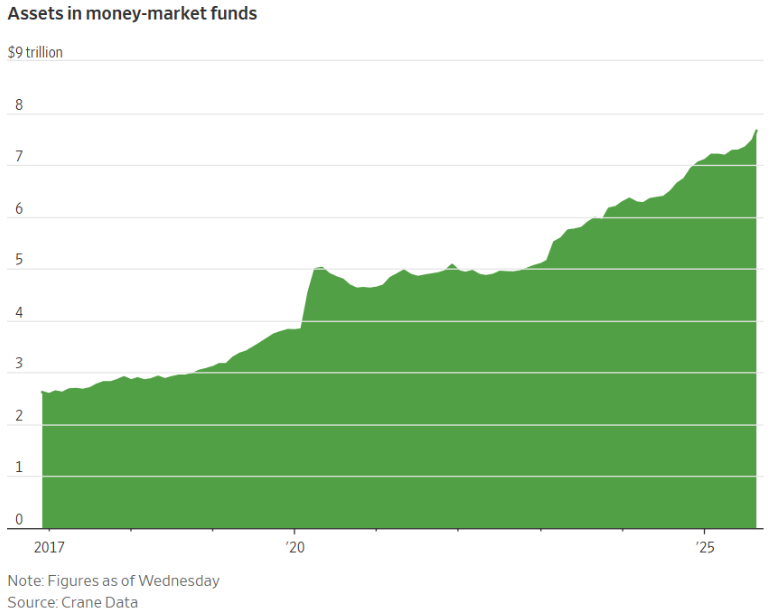

According to The Wall Street Journal, there is now $7.7 trillion sitting in money market funds:

It’s a bull market in cash holdings.

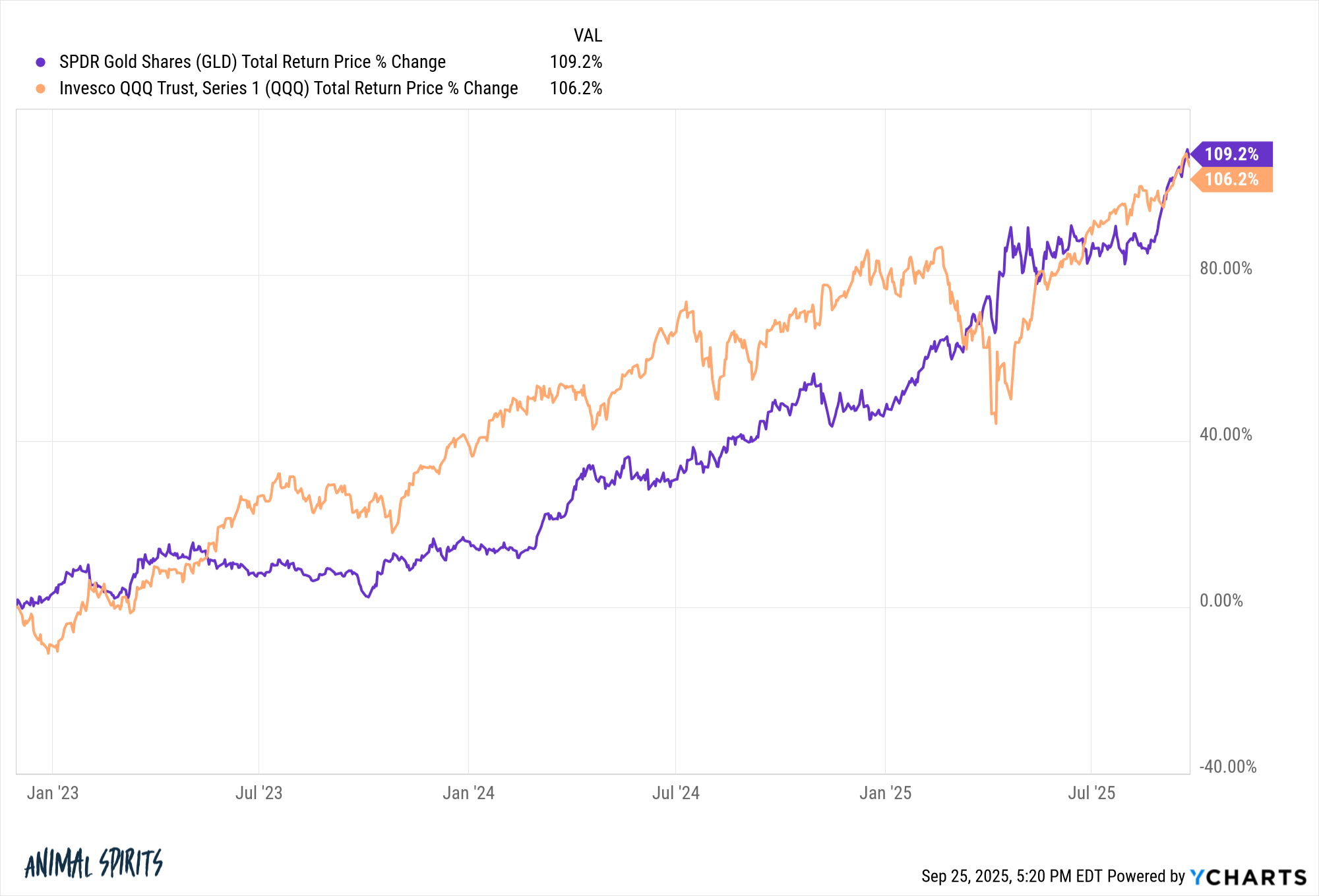

Gold is up more than 40% this year alone and hitting new all-time highs at a healthy clip. Since ChatGPT was released in November 2022, gold is actually outperforming the Nasdaq 100:

How could a relic that’s been used for thousands of years outperform the biggest, baddest technology companies we’ve ever seen during an orgy of AI spending?

The other part that makes the current situation tricky to understand is the companies leading the charge in the AI bubble have the fundamentals to back it up. JP Morgan’s Michael Cembalest shared the following in a new research piece this week:

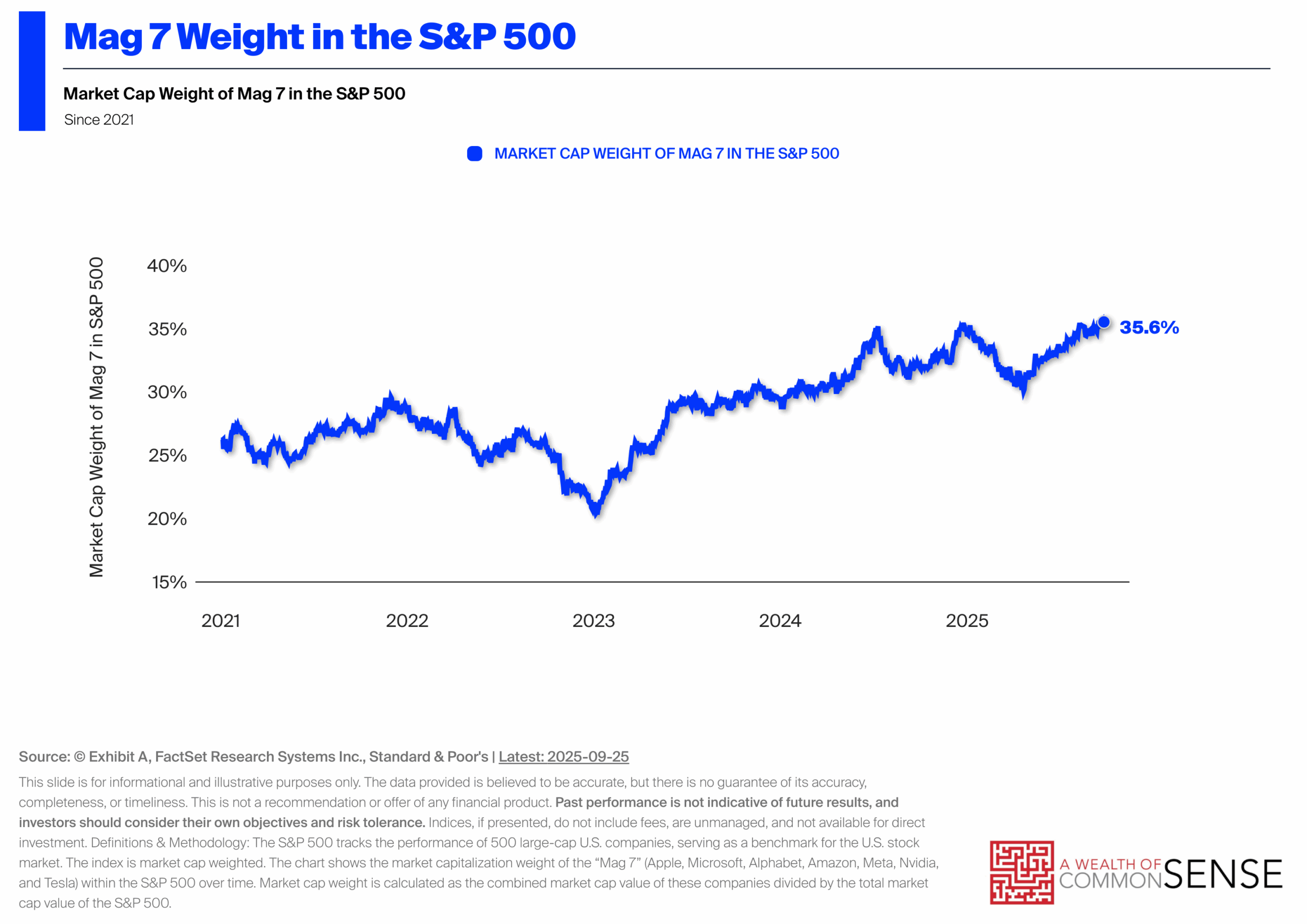

AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.

These companies are spending like drunken sailors but they can all afford the booze!

I understand why many investors are worried about the prospects of a bubble. When they burst it tends to be painful. If you’re invested in the market, you have plenty of exposure to the gigantic tech stocks:

Just because this feels like some of history’s biggest bubbles doesn’t make it any easier to handicap.

The thing that worries me the most right now is everyone who has ever studied market history is now calling this a bubble. It seems so obvious. Markets are rarely that easy.

So what if you’re convinced we’re in a bubble? What actions should you take?

I’ll share some thoughts on this topic next week.

In the meantime, Michael and I talked dissected the AI bubble from all angles and much more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is This 1996 or 1999?

Now here’s what I’ve been reading lately:

Books: