Some random rules of thumb for living a good life:

Don’t brag about your children’s accomplishments. No one cares. Your friends may not want to hear about how smart or athletic your kid is because parents can be super competitive. You’ll just make them feel bad about their own kids.

The only people you can brag to about your children are their grandparents or your spouse. That’s it.

(Am I guilty of this one from time to time? Of course I am!)

Don’t complain about your flight delays or travel problems you had on vacation. No one cares about that either. It happens to everyone.

It’s like losing your phone, keys or wallet. That sucks. Glad it wasn’t me. Don’t want to hear the story.

Don’t leave your AirPods in when talking to someone. It’s a common courtesy.

Don’t hold the door for someone who is more than 15 feet away. No one wants to do that fake half jog while you wait. Just let it go. We can open the door ourselves.

Don’t flex in the mirror at the gym. As a middle-aged guy who still frequents the gym I feel like I’m part of the only sane generation left.

The old guys all walk around naked in the locker room. They just don’t care. And the young guys are constantly flexing in the mirrors and taking gym selfies.

Sneak one in while no one’s looking but don’t hold a pose. Have some self-respect.

Don’t be the person who takes a phone call right before you take off or right after you land. You can text until you get off the plane. No phone call is that important unless you need to get off the plane immediately.

Don’t be afraid to pick up the tab for everyone in your group. My Grandpa Kennedy used to hand the waiter or waitress his credit card before anyone even ordered at a big family meal out. He took this very seriously.

No one else could pick up the tab. Ever. One time it seemed like he wanted to get into a fistfight with my dad and uncles for even suggesting they would chip in.

You don’t have to be that extreme but it’s always a nice move when everyone goes to settle up for a round of drinks or dinner and you tell them it’s already taken care of.

Pure class.

Don’t sit in your hotel room all night if you’re in a new city for work travel. Go for a walk. Go for a run. Check out a new restaurant or bar. Explore your surroundings.

And finally, here’s a finance rule of thumb:

Don’t listen to personal finance people about spending money. Personal finance experts are great at offering ways to save, compound, pay off debt and behave better when it comes to your money.

They are NOT helpful when it comes to spending your money. Personal finance people want you to delay gratification for the rest of your life so you have a big portfolio but are miserable because you never enjoy any of it.1

You will make your own shampoo in your backyard and you will like it!

OK, maybe I’m being a tad harsh.

Someone asked me a question about this idea:

Are you a “die with nothing” guy? How much do you need to save? What if you live until 100? Yes, enjoy life, but you need to save.

I’ve been on a crusade against hoarding all of your money lately.

Here’s the thing — your relationship with money is directly impacted by your lived experiences. How could it not be?

I’m approaching this topic from the hundreds of conversations I’ve had over the years with people who have more than enough money but cannot force themselves to spend it on things they enjoy.

Plus, I had a stark reminder this year that life is short when my brother passed away in his 40s. This experience has completely changed the way I think about money, right or wrong.

I have spent more money in 2025 than any other year in my life. The personal finance spending scolds would blush at my outlays in 2025. We’re taking more vacations. We did a big renovation on our house. I’m looking at an upgrade to my boat.

Of course, part of the reason I’m comfortable spending more money now is because my wife and I have diligently saved for more than 20 years.

Spending is like risk to investors. Risk means different things to different investors at different stages of their investing lifecycle. Bear markets are a wonderful opportunity for young people but can be seriously painful for retirees.

The same applies to your spending lifecycle.

When you’re young you probably have to look for more ways to be frugal than someone who is older and more established. Someone who is in debt up to their eyeballs should have a different spending plan than someone with a 7-figure net worth.

I’m something of a born-again spender. I was a spendthrift when I was younger. My views on this topic have evolved over the years as they should.2

I now think certain material possessions can make you happy if you prioritize the right things.

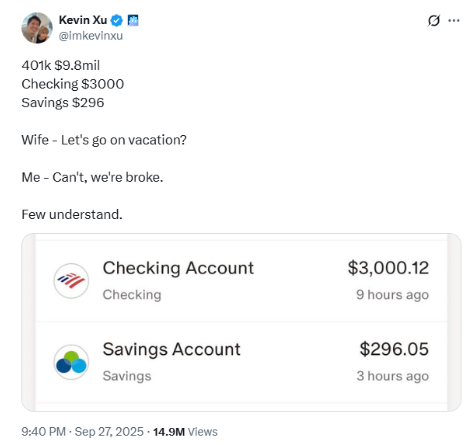

This is the kind of thing I’m talking about:

Take your wife on vacation! Your portfolio balance won’t give you cherished memories for years to come.

Life is short. If you have money you should enjoy some of it. That’s what it’s for!

I’m not a hardcore Die With Zero person but I relate to those ideas far more than the FIRE movement. I like the idea of seeing your net worth peak in your mid-50s so you can spend more money while you’re healthy. I also like the idea of taking a remote semi-early retirement while still working.

Life is all about seeking harmony among your priorities.

I diet and exercise so I can feel OK drinking beer and eating pizza on occasion.

I work hard but also don’t want to miss any of my kids’ sporting or school events.

I save and invest so I can spend the rest and not feel guilty about buying stuff or taking a trip with my family.

No one has this stuff all figured out but balance is the key.

Michael and I talked travel etiquette, spending money, AI bubbles and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode:

Further Reading:

10 Things I’ve Learned About Wealth Management in the Last 10 Years

Now here’s what I’ve been reading lately:

Books:

1Ramit is one of the few personal finance experts who openly tells people to spend money on the things that are important to them.

2When I buy a new sweater or jacket I get the dopamine hit when I buy it but again and again every time I wear it. Material possessions can be just like experiences if you use them the right way.