In my last post I wrote about the history of melt-ups in the stock market.

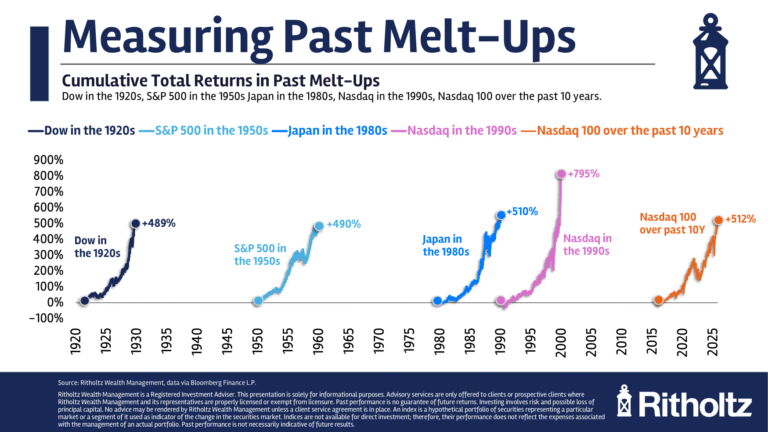

This chart tells the story.

Each of these melt-ups led to a meltdown.

You’ll notice there’s a rather large gap between the 1930s and 1980s.

Were there no face-rippers in this time frame?

I thought about adding the Nifty Fifty stocks in the early-1970s but there wasn’t an index or fund for these one-decision stocks back then so the overall performance is difficult to lock down. That was more of a valuation bubble than a crazy melt-up.

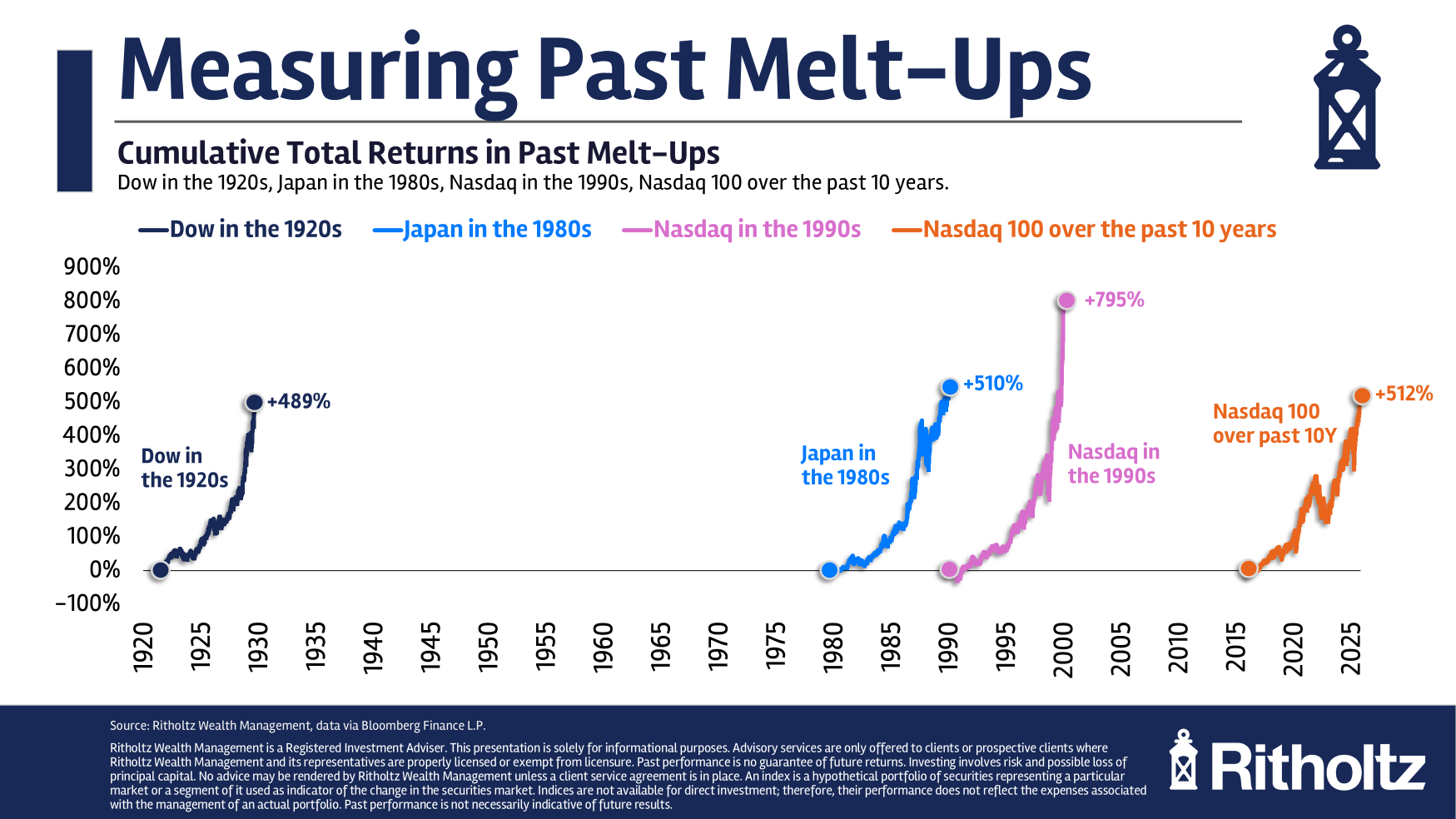

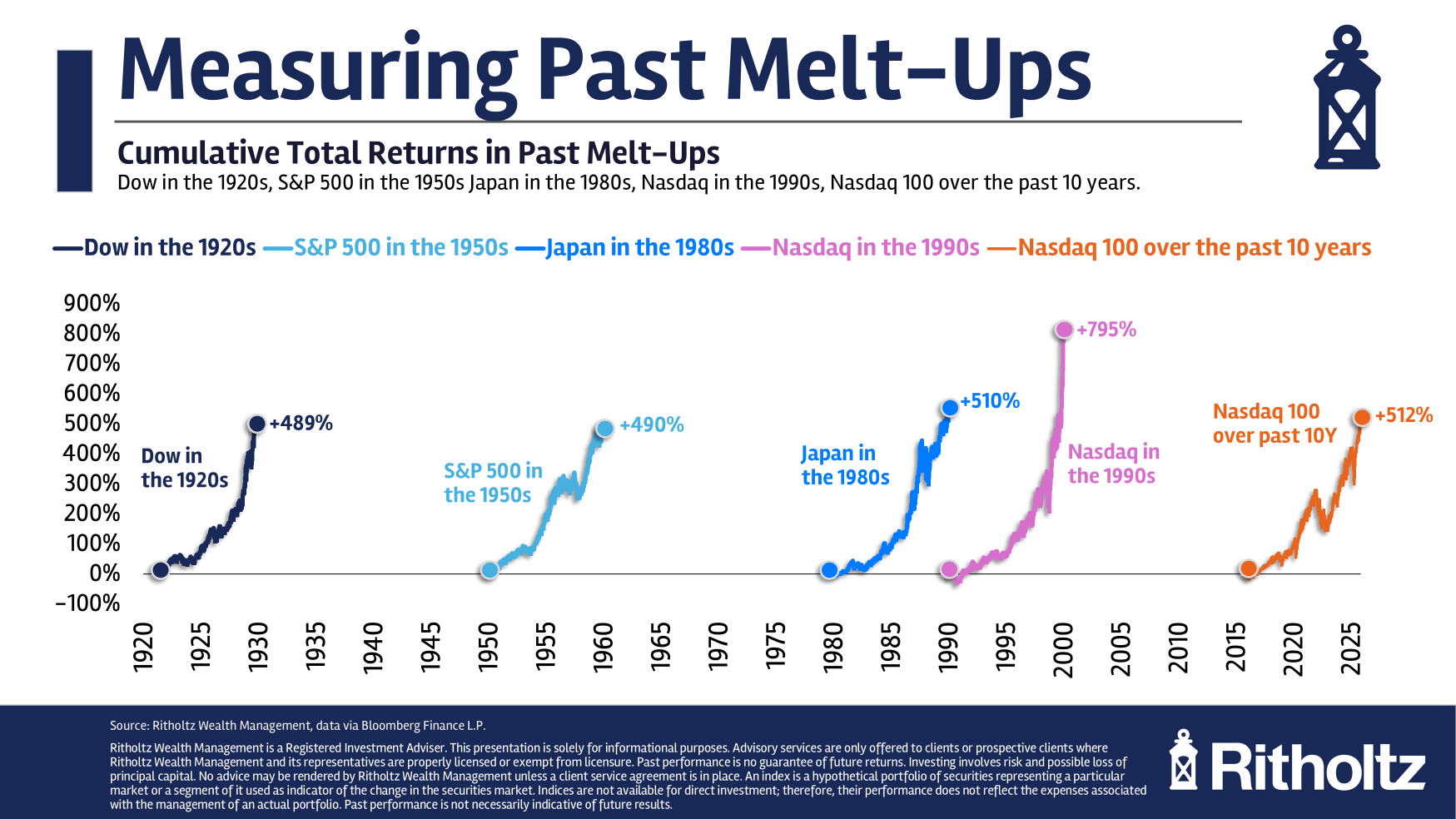

The only other option is the 1950s bull market. Here it is on the chart:

Right in line with the other gains. Impressive, right?

No one ever talks about the 1950s bull market but it was glorious. Look at the returns that decade by year:

- 1950 +30.8%

- 1951 +23.7%

- 1952 +18.2%

- 1953 -1.2%

- 1954 +52.6%

- 1955 +32.6%

- 1956 +7.4%

- 1957 -10.5%

- 1958 +43.7%

- 1959 +12.1%

The annual returns in 1954 and 1958 are two of the best years ever in U.S. stock market history. Seven out of 10 years were up double-digits. Half of the annual returns in the 1950s were 20% or better while 40% of them were 30% or higher.

The worst down year was a loss of roughly 11%.

No one was prepared for this bull market because everyone was still so gun-shy from the Great Depression. Martin Fridson details the poor investor sentiment in the early-195os for his book It Was a Very Good Year:

Wall Street had a blue Christmas in 1953, despite the autumn/winter rally. Many brokerage firms lost money that year and were forced to shut down or merge. “Amidst the greatest prosperity in U.S. history,” wrote Robert M. Bleiberg in Barron’s, “Wall Street has become a depressed industry.

The problem was that although stock prices were on the rise, trading volume was stagnant. Americans had never shed the aversion to owning equities that arose from the 1929 crash. To the detriment of commission-dependent brokers, the financial institutions to which people entrusted their savings were not active transactors. Fewer shares were traded on the New York Stock Exchange in 1953 than in 1925, notwithstanding a sixfold expansion in the number of shares listed. As a result in the drastic decline in turnover, seats on the Exchange sold for little more than they had in 1899.

The scars from the 1930s ran deep.

There was one minor bear market in the 1950s, when the S&P 500 fell just a shade over 20%.1 That sell-off was at least partially caused by the Soviet Union’s launch of Sputnik I in the fall of 1957. Many worried we had lost our technological edge to the Soviets.

Those fears quickly subsided after the snapback rally in 1958. By the end of the decade, many observers began to become concerned things were getting out of hand.

A Business Week story noted, “To some Wall Street veterans, the cult of equities has some ugly parallels to the New Era of the late 1920s.”

Another reporter quipped, “The current situation resembles that of 1929.”

I don’t blame them. Living through an 85% crash would change the way you view risk in the stock market. Those risks never came to pass.

The U.S. stock market finished the 1950s with the best annual return of any decade (+19.5%) beating even the insane runs in the 1980s (+17.3%) and the 1990s (+18.0%). We all know how that two-decade bull market ended — the dot-com bubble popped and was followed by a lost decade.

The same is true of the 1930s that came after the Roaring 20s. Japan had multiple lost decades after the 1980s boom.

That didn’t happen after the 1950s bull market. It ended with a whimper, not a bang.

The 1960s weren’t great, but they weren’t bad either. The S&P 500 was up 7.7% per year on the decade.

And there wasn’t a bone-crushing crash that ended the bull market. There were corrections and some bear markets but no crash that left investors reeling.

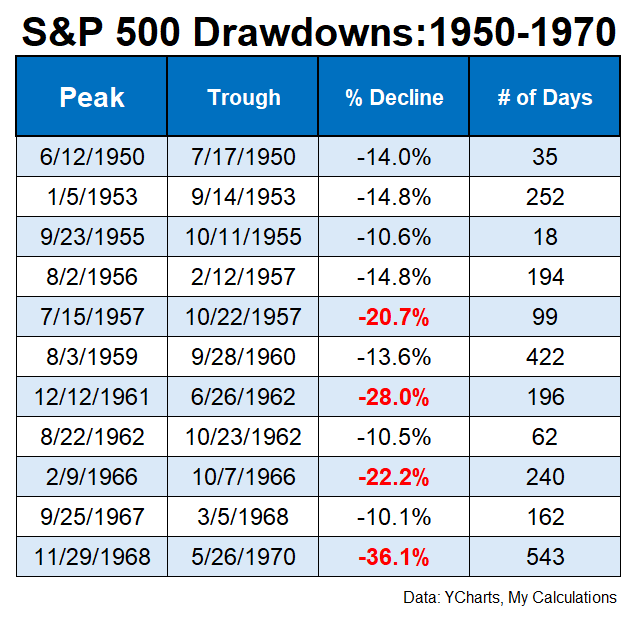

This is the drawdown profile of the S&P 500 throughout the 1950s and 1960s:

Some corrections and run-of-the-mill bear markets but no Earth-shattering crash. The worst of it came in 1968 at the end of the Go-Go Years. But that was an entirelty different cycle at that point.

Obviously, the 1950s bull market was different than the current cycle.

The post-WWII years were an explosion of consumer spending, economic growth and a buildout of the middle class unlike anything ever seen before or since.

But it’s important to recognize that every bull market doesn’t necessarily have to end in a crippling crash.

You may have seen this movie before but that doesn’t mean you know how it’s going to end.

Further Reading:

The Melt-Up

1It was -20.7% to be exact.