I’ve always been a glass-is-half-full kind of person.

I don’t worry too much about things outside of my control. I try not to get stuck in the gloom-and-doom vortex so many people have been sucked into since the 2008 financial crisis and the advent of social media.

That doesn’t mean I’m naive to the fact that things are bad for a lot of people these days.

Everything’s expensive. There has never been a worse time to be a first-time homebuyer. And the rich keep getting richer as wealth inequality threatens to tear society apart at the seams.

Everywhere you look these days the media reminds you we’re living in a K-shaped economy:

The idea here is that rich people are the only ones doing well in the economy today. They own all the assets. They spend all the money. They get to have all the fun and everyone else is struggling.

Here’s a story from The Wall Street Journal on this subject:

Here’s the explanation:

Investors’ rosy feelings about having a lot more money–at least on paper–are powering spending on restaurant meals, business-class airline tickets, home improvement and more, keeping the broader economy humming.

It’s a very different story for everyone else. Americans with large investment portfolios feel markedly better about the economy than those who don’t own stocks.

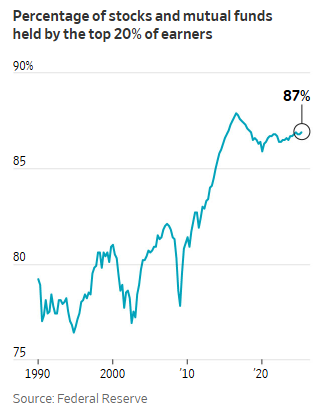

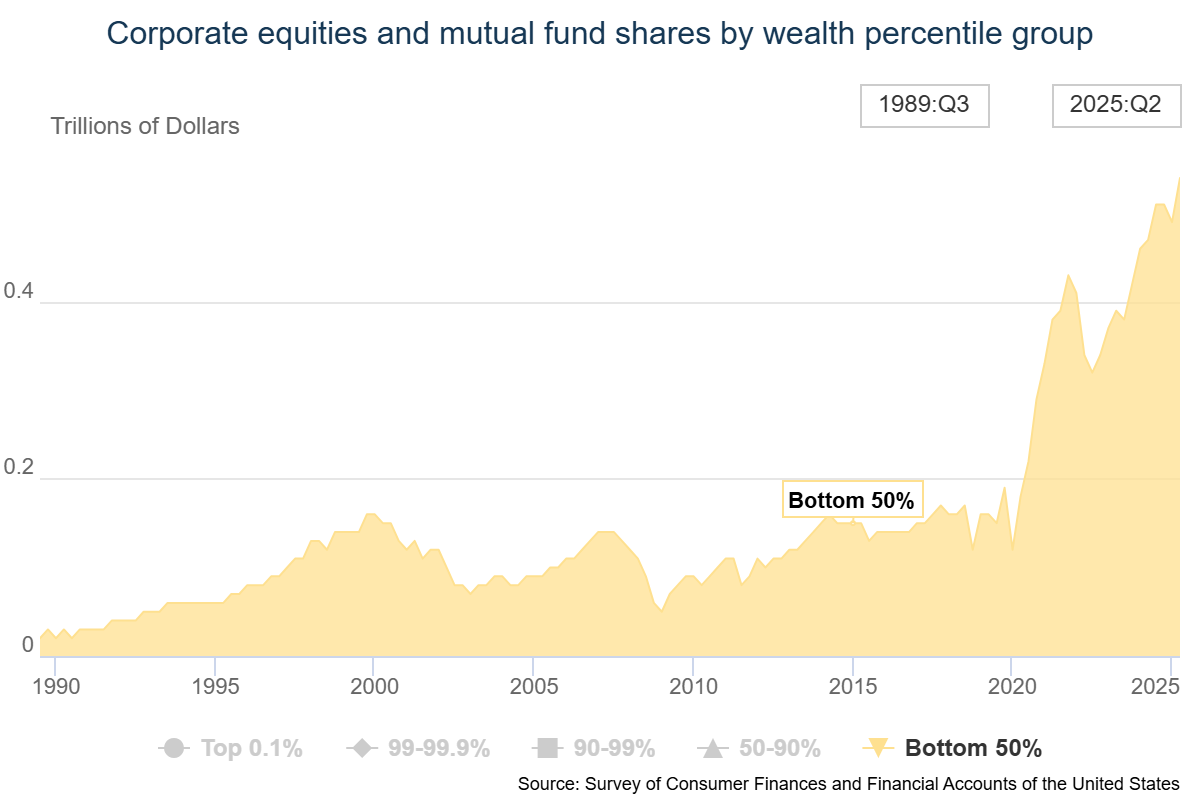

Just look at how concentrated stocks are in the hands of the wealthy:

Stocks are expensive. Houses are expensive. Borrowing rates are expensive. Food is expensive. Daycare is expensive. Healthcare is expensive.

I understand why many people are annoyed with the current environment. It doesn’t seem fair that rich people should be able to enjoy the economy while so many others are suffering.

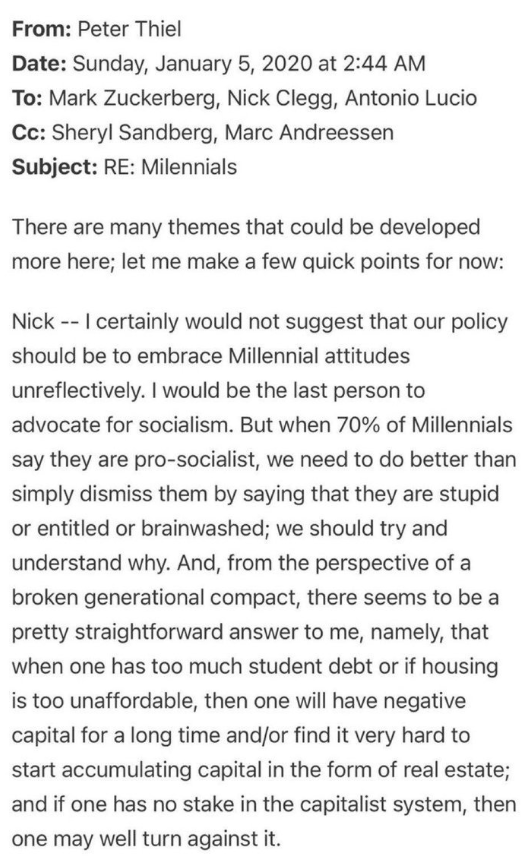

An old email from Peter Thiel surfaced this week that explains why so many young people are fed up with the current system:

This is a fair point. If you don’t get to participate in the upside of the system you’re going to fight against the system.

But it’s not completely accurate. It’s more based on vibes than facts. I’m not naive to the fact that the current environment is difficult for some people. However, what if things aren’t as bad as they appear?

Let’s take a look.

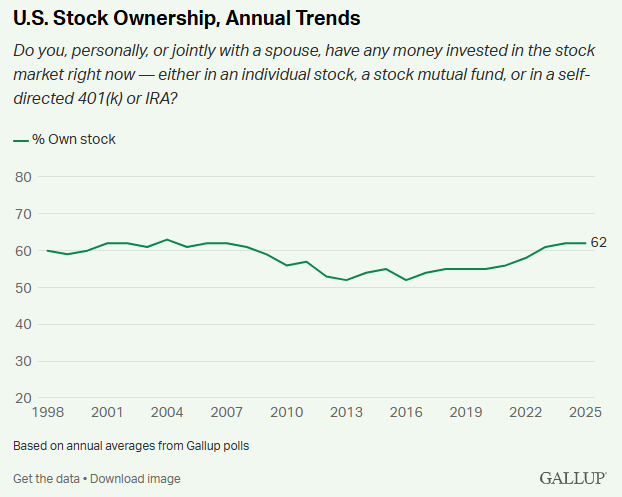

Yes rich people own the majority of the stock market. But nearly two-thirds of all households now own stocks in some fashion:

In the early-1980s less than 20% of Americans invested in the stock market. There are way more people benefiting from stocks going up now!

And it’s not just rich people. The bottom 50% have seen the value of their stock holdings increase by 350% since 2020:

Is it still a very low share of the total? Yes but this improvement is worth celebrating. More people are involved in the greatest wealth creation vehicle ever invented.

There are a lot of structural reasons households invested less in the stock market back in the day. But part of it was baby boomers went to school, got married bought a house and then bought some stocks later in life.

For many young people that has reversed. Housing is more expensive so they’re buying stocks now and (hopefully) a house later on.

Here are some stats I’ve written about before that are worth highlighting:

- 54% of Americans with incomes between $30k and $80k now have a taxable brokerage account and half of them have entered the stock market in the past 5 years.

- Robinhood has something like 25 million customers. For half of them, it’s the first brokerage account they’ve ever opened.

- Nearly 40% of 25-year-olds now have investment accounts up from just 6% in 2015.

- Households with incomes below the median now account for one-third of JP Morgan customers moving money into investment accounts up from 20% in the 2010s.

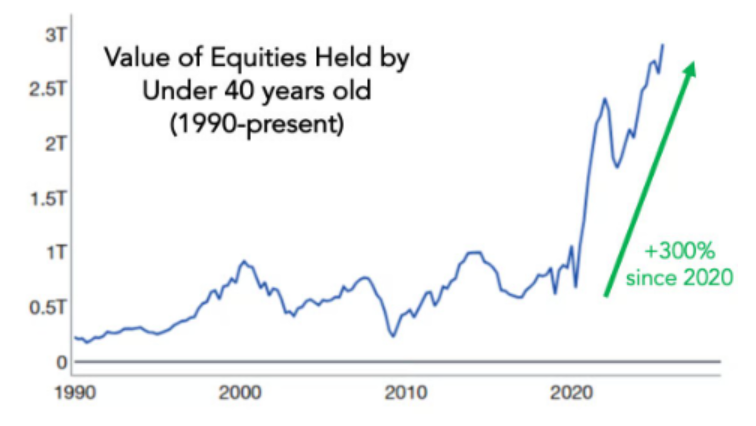

We’ve gone from housing being your biggest investment to the stock market. Just look at the increase in stock holdings for people under 40:

If they stick it out these young people are going to be much wealthier because of it from the compounding benefits of investing earlier. Plus investments in the stock market are more diversified, more liquid and offer greater flexibility than owning a home.

Of course, there are psychic benefits to owning your home. These things don’t always boil down to numbers.

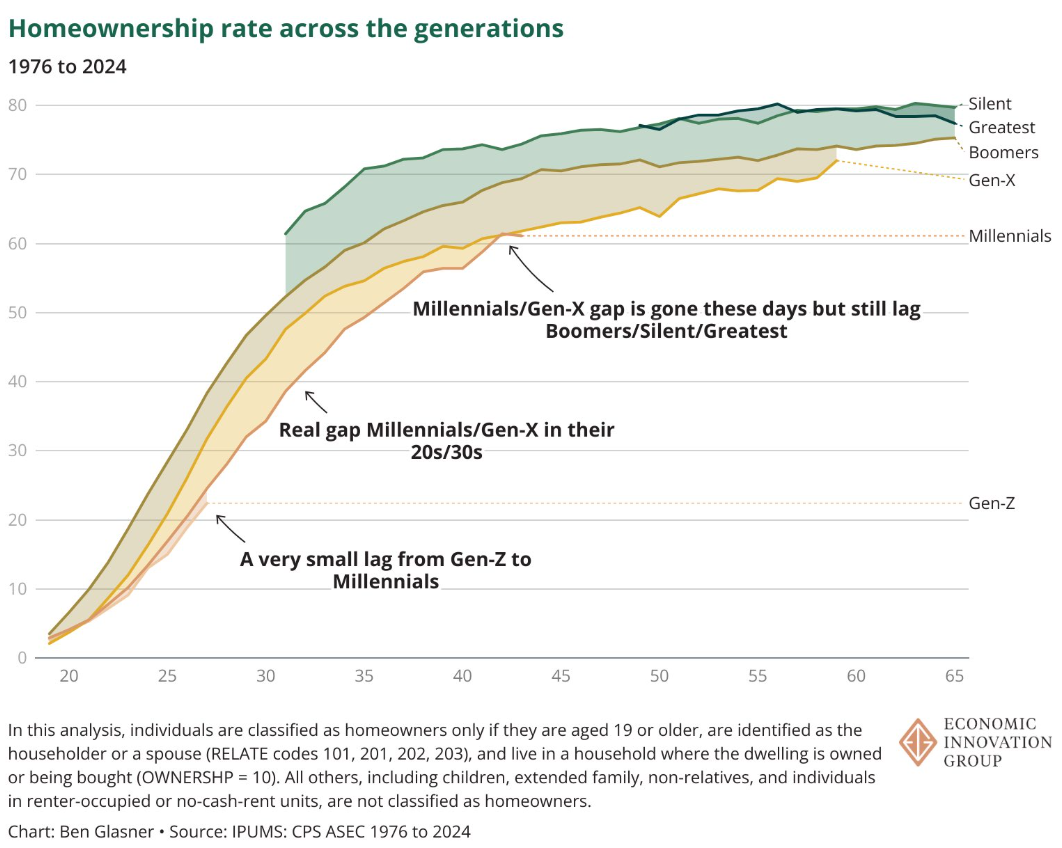

But while today is a wretched environment to be a first-time homebuyer, young people are still becoming homeowners. It’s just a little slower than previous generations:

It’s still going up and to the right just at a slower pace.

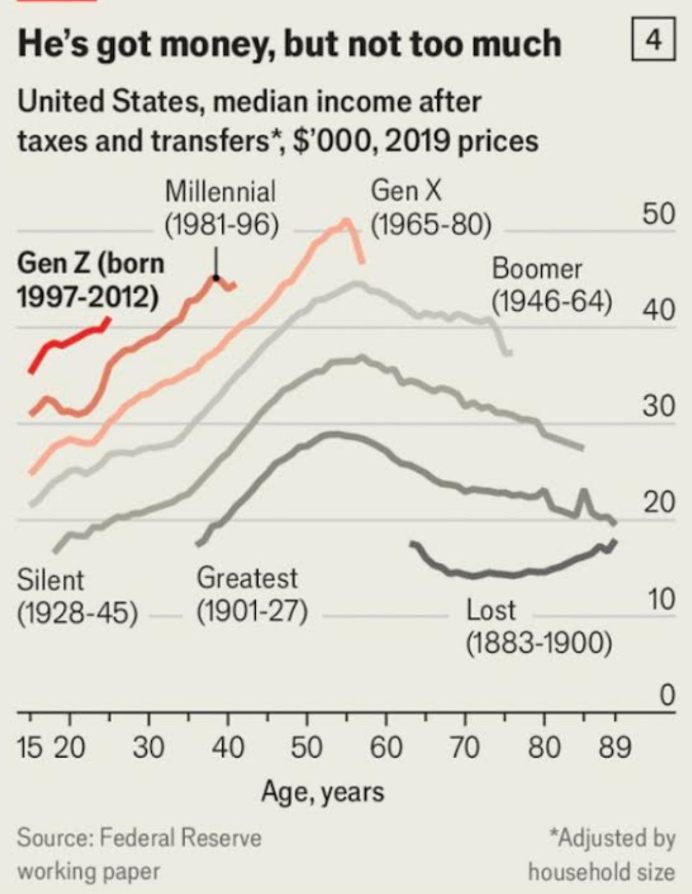

And I’m confident many young people are going to be able to afford a home at some point. Why? They make more money than previous generations did even after accounting for inflation:

Does this mean everything is easy for young people today?

Of course not.

Life is more expensive. Luxuries have become necessities.

It’s hard to get ahead when you’re paying off student loans. Kids are expensive and daycare costs are outrageous. New vehicles now cost $50k. The median home sells for nearly half a million dollars.

Life is still hard for many people and it always will be. I’m not blind to this fact. No one likes to hear things are better in aggregate than their personal experience.

But maybe things are better than you read in the news and on social media.

People hate the economy right now and it’s doing pretty well. How are people going to feel when we go into an actual recession?

Michael and I went on Plain English with Derek Thompson this week to talk about the plight of young people, the housing market, AI and more:

And we hit on the K-shaped economy on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Are Young People Screwed?

Now here’s what I’ve been reading lately:

Books: