A reader asks:

Let’s say I have a brother. Let’s say he was on a lucky hot streak this year YOLO’ing into the most speculative plays in the market (quantum, crypto, meme stocks, etc) and was up 100% YTD. Pressing his luck, he thought it was a good idea to put nearly all of his portfolio into MSTR (using margin for more leverage) when it was trading in the 300’s and he is now down 50%. I told him to never touch MSTR with a 10-foot pole and if he was bullish Bitcoin, just buy Bitcoin. I also told him many times to never use margin, especially on high risk stocks. He is at risk of a significant % of his net worth (>50%) going away forever with a home purchase on the horizon as well that’s in jeopardy. Now he suddenly wants my advice on how to get out of this mess. I told him I don’t know and I honestly don’t. It’s a darned if you do, darned if you don’t lesser of two evils situation. How do you deal with clients that consistently ignore your advice and now want your help getting out of a mess?

I have a lot of thoughts here but first a story.

I more or less gave up watching baseball a decade or so ago. It was too boring, the games were too long and I had other stuff going on in my life.

But I got into the playoffs this year for the first time in a while. The Tigers gave the Mariners everything they could handle. Then the Mariners-Blue Jays series went down to the wire too. Otani is a modern day Babe Ruth. And the Dodgers-Blue Jays played one of the best World Series and games 7s of my lifetime.

The lead analyst for MLB playoff games on Fox is John Smoltz.

Listening to Smoltz talk for so many games reminded me that he almost became a client of a firm I used to work for.

The consulting firm I worked for right out of college managed money for institutional investors but we had a handful of individual clients. Smoltz is from Detroit and was actually drafted by the Tigers before they stupidly traded him to the Braves.

Somehow that Michigan connection led him to be recommended to our firm. My boss gave his people a hard no.

The aftermath of that decision looked something like this:

Me: Wait what?! Why would we not take this meeting?!

My boss: I worked with a professional athlete in the past, and I’m never doing it again. It was a bad experience.

Me: But it’s John Smoltz!

My boss: It doesn’t matter who it is. I only want to work with certain kinds of clients. We can’t save everyone.

I was young and didn’t understand the reasoning but I do now. My old boss knew nothing about John Smoltz but he had hard and fast client fit rules to save himself time and energy, even if it meant sometimes passing on potentially good clients.

He didn’t want to spend his time trying to save clients from potentially harmful financial decisions.

Which brings us to the brother who put half of his life savings into Strategy (MSTR) shares…using margin…for money that needs to be used to buy a house!

I cringed more with each word I read in this question. It’s like a Russian doll of investment mistakes.

This is the problem with the bull market brain you get from making big gains in the markets. It’s difficult to know if you’ve morphed into a degenerate gambler when you’re making money. Investors who have taken on excessive levels of risk the past few years have been compensated for it.

Once you get a couple of big wins under your belt it’s easy to let things get out of control.

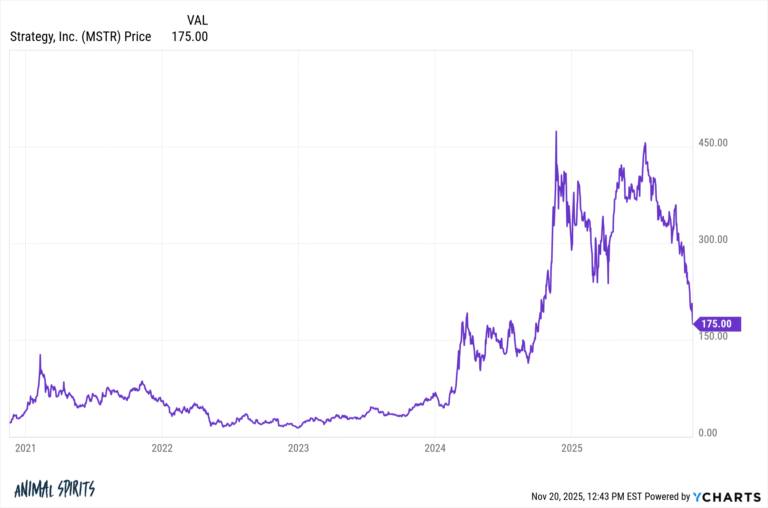

Strategy (formerly Microstrategy) was in the $300s when the brother got into the stock. Now it’s well below $200 and falling fast:

The stock is now down more than 63% from the highs:

This is a 2008-level crash in a matter of months.

Here’s the thing — I don’t know if Michael Saylor’s bitcoin experiment will work or not. It’s already worked better than anyone could have exptected. Despite recent losses the stock is still up more than 900% over the past 10 years.

The problem is this guy’s brother wasn’t around for those gains. He’s only taken part in the losses.

Those gains came with a lot of risk too. Just look at the drawdown profile over the past 10 years:

You’re looking at a 20% drawdown. A 50% drawdown. A 90% drawdown! A 46% drawdown. And now a 60% drawdown.

Michael Saylor’s experiment may still work out. If Bitcoin resumes its uptrend, it’s possible Strategy will too. Even if it does, I can’t condone putting 50% of your net worth in the stock.

Strategy is a levered play on Bitcoin because Saylor is borrowing money to buy crypto. But then your brother borrowed money as well? And he needs the house for a home purchase?

This is a Dumb & Dumber situation:

Here’s the thing — you could try to offer sensible advice. Sell now before it gets worse and you get a huge margin call. Invest in something far more reasonable and diversified.

I’m not sure it will matter.

When I first started my blog I had this dream that I could somehow save people from making illogical financial decisions. After creating financial content for more than a decade now I’ve come to realize this but some people cannot be saved.

They are doomed to make money mistake after money mistake and there’s nothing you can do about it.

Then there are others who need to make a huge mistake before having an ah-ha moment of realization that they need to change their behavior. Some people do change their stripes but it’s not easy.

Can your brother be saved?

Maybe.

He likely needs someone else to take the steering wheel like a family member or advisor.

It’s one thing if you’re YOLO trading as a young person without a lot of responsibilities. I don’t condone degenerate behavior, but young people have plenty of time and human capital to make up for early mistakes.

But if you’re YOLOing money that’s meant for a new house?!

You have a problem.

You either put your portfolio on autopilot or hand the keys to a professional in that case.

I’m afraid this guy won’t learn his lesson until he gets margin-called.

We covered this question on the latest edition of Ask the Compound:

Bill Sweet was on the show again this week to help me answer questions about selling in a tax-efficient manner with big capital gains, Roth 401ks, paying for a home remodeling project, Roth conversions and HSAs.

Further Reading:

Ben Graham & Bull Market Brain