Spencer Jakab at The Wall Street Journal makes the case that we could use a long bear market:

He explains:

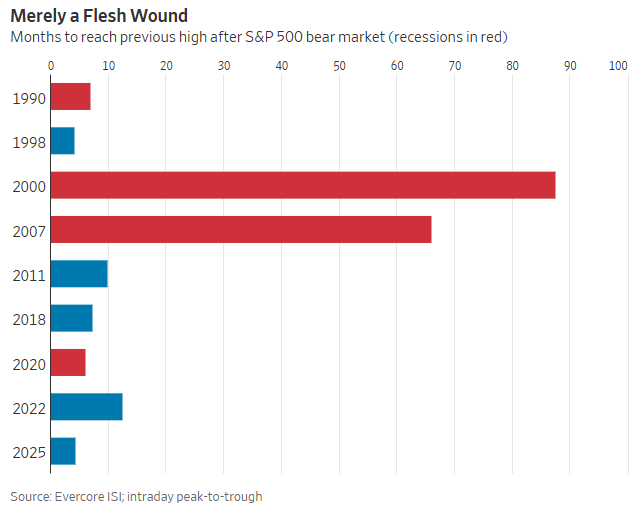

The average time to reach the previous high when a bear market was accompanied by a recession was 81 months. It took just 21 without a recession. Over the past 16 years, downturns have lasted less than eight months before the old high was reached.

Hardly anyone younger than 40 now even had a 401(k) during the 2007-09 wipeout. Most Wall Street pros hadn’t graduated from college yet.

Bear markets are educational, but the tuition is a doozy.

This chart shows how quickly markets have recovered from recent downturns:

So while investors have lived through plenty of volatility and downturns, the magnitude of those downturns has been tame. For those investors who haven’t experienced a long bear market, they could be in for a rude awakening.

William Bernstein and Edward McQuarrie recently wrote a piece that echoes these sentiments:

More than a generation ago, financial historian Peter Bernstein (sadly, no relation to Bill) wrote about investors’ “memory banks,” the market experience that accumulates in their hippocampi over their investing lives and molds their investment strategy. As he put it, looking back on the 1990s: “Most of the new participants in the market had no memory of what a bear market was like.”

Most investors should have had their memory banks erased based on the current bull market run.

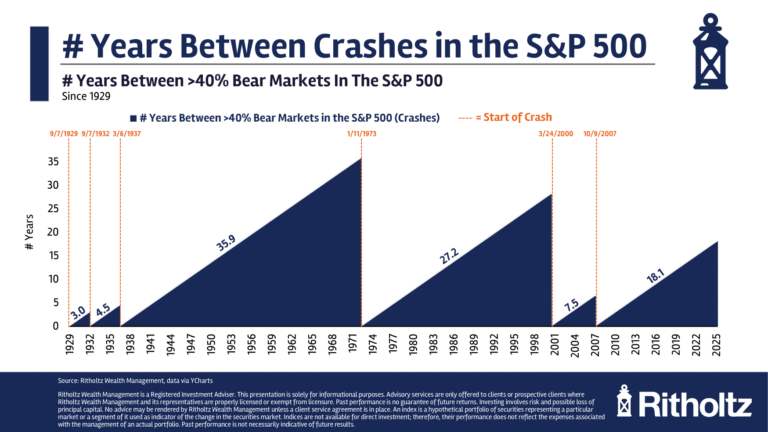

I’m going to assume a drawdown of 40% or worse is the definition of a market crash. By that definition, it’s been some time since the last crash. This is perfectly normal based on historical data:

There have been multiple-decade-long stretches without a crash. There were no long bear markets between the Great Depression and the Great Inflation of the 1970s. There was another long period of relative calm from the 1970s through the dot-com bubble with no market crashes.

That was followed by a real jolt to the system with two crashes in less than a decade.

We’ve had a handful of bear markets but no crashes with an extended duration since the 2008 crisis.

There are now more young people invested in the stock market than ever before. Surely, a long bear market would be difficult for these new investors to handle. But it’s not just new investors I would be concerned about in this scenario.

I vividly remember the Great Financial Crisis.

I started a new job the day after my honeymoon ended in the summer of 2007. The banking crisis was already underway by that point. Managing money through that crisis was instructional for me but also nerve-racking.

But from a personal perspective investing was relatively easy.

I didn’t have much money. My stock market investments were down 50-60% by the bottom but it was a relatively small amount of money. I just had to keep shoveling my contributions into the market at fire-sale prices. Human capital trumped the crash.

The people I saw freaking out and making mistakes weren’t young people but those with more seasoned portfolios. Why? They had more money to lose!

I know a lot of retirees who are worried about a stock market crash. This would be a new thing for middle-aged people like myself too.

I have a lot more money in my portfolio now than in 2008. Even if the percentage decline was lower than it was in 2008, the dollar losses would be far more painful from a 40% crash.

Losing 40% of your money when you have $100k is $40k. Losing 40% of your money when you have $1 million is $400k. This is an obvious statement but seeing that much money evaporate can be incredibly painful.

There are now a lot of wealthy investors who have never had this much money at stake before.

Listen, I would rather not live through a nasty recession and long bear market. But I know those risks exist. The market will crash at some point. Maybe it comes back relatively quickly but that’s not guaranteed.

That’s why I diversify. I don’t use leverage in my portfolio. I don’t have concentrated positions.

The name of the game in a long bear market is surviving, both mentally and financially, to live another day in the markets.

Predicting a market crash is more or less impossible but you have to prepare for one because it will happen eventually.

Michael and I talked about long bear markets and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Going All-In on MSTR

Now here’s what I’ve been reading lately:

Books: