Some questions to consider as we approach a new year for the stock market:

What will the worst drawdown look like? Going back to 1928, the average peak-to-trough drawdown in a given calendar year is -16%.

That’s higher than it seems, right?

Drawdowns were worse than average in 2025 (-18.9%), 2022 (-25.4%) and 2020 (-33.9%). Peak-to-trough drawdowns were better than average in 2024 (-8.5%), 2023 (-10.3%) and 2021 (-5.2%).

Will 2026 look better or worse than that historical drawdown profile?

My guess is most investors assume 2026 will see losses of more than 16% at some point because of all the AI stuff.

We shall see.

How average will the returns be? Returns in a given year are rarely close to the long-term averages.

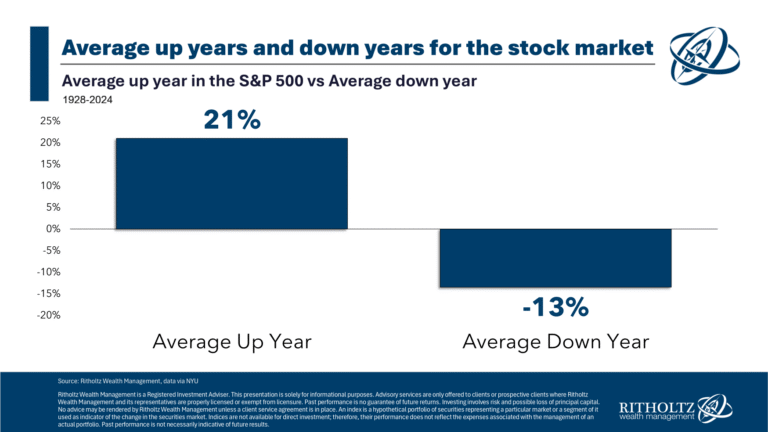

The typical year isn’t a return of 8-10% but rather a wide range of big gains or big losses:

The average up year tends to see stocks rise by 20% or so.

In fact, the S&P 500 has finished the year up 20% or more in roughly 4 out of every 10 years.

The average down year tends to see stocks fall by double-digits.

The 2020s are a perfect example of this wide range of returns. Here they are in order: +18%, +29%, -18%, +26%, +25% and +17% (so far).

What’s more likely — the long-term average (+10%) or the short-term average (+21% or -13%)?

And which short-term average — up or down?

Will the stock market finish the year down? Since 2020, the S&P 500 is up 5 out of 6 years.1

Since 2009, it’s up 15 out of the past 17 years.

Since 2000, the ratio of gains to losses is 20 to 6.

That’s pretty close to the long-term average over the past 100 years which is gains roughly 3 out of every 4 years.

Most of the time the stock market goes up. Yay!

Sometimes it goes down. Boo!

I guess these outcomes depend on your investment stance and human capital.

It’s important to recognize that historical relationships are not set in stone. There’s no guarantee past return profiles will remain in the future. That’s what gives the stock market a risk premium.

No one knows!

I believe this uncertainty is one of the reasons the stock market has a risk premium in the first place.

The stock market could experience huge gains again in 2026, or it could see enormous losses.

It’s also possible the market will go through a big drawdown on the way to big gains by the end of the year.

That’s normal too!

My financial ethos is based on the idea that you should build an investment plan that can withstand both the good times and the bad, the good years and the bad, the uptrends and the downtrends.

I don’t know what’s going to happen in 2026.

My best guess is that there will be some volatility, whether the market finishes up or down.

Michael and I talked about stock market probabilities, possibilities, Disney and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

My Year-End Stock Market Forecast

Now here’s what I’ve been reading lately:

Books:

1Assuming something drastic doesn’t happen in December. Always a possibility!

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.