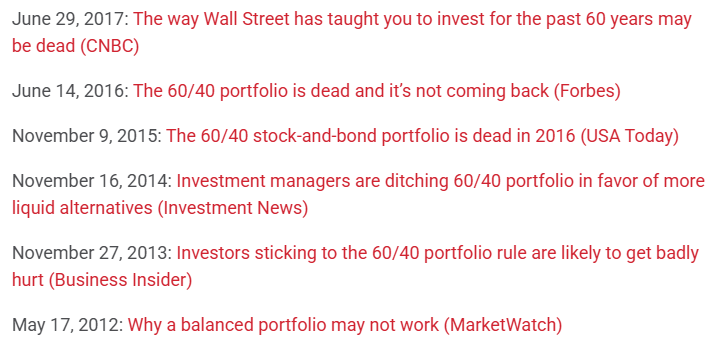

Back in 2019 I penned a eulogy for the 60/40 portfolio:

The 60/40 portfolio passed away on October 16, 2019, from complications of low interest rates and a bad case of Fed manipulation. This is the 27th time 60/40 has died in the past decade but enemies market timing, day traders, and alternative investments are hopeful it will stick this time around.

I couldn’t help it. The financial media kept pronouncing it dead year after year.

Low bond yields made it exceedingly difficult for investors seeking balanced portfolios.

When I wrote my eulogy the 10-year Treasury yielded around 1.5%. It would go even lower during the early days of the pandemic bottoming out below 0.5%.

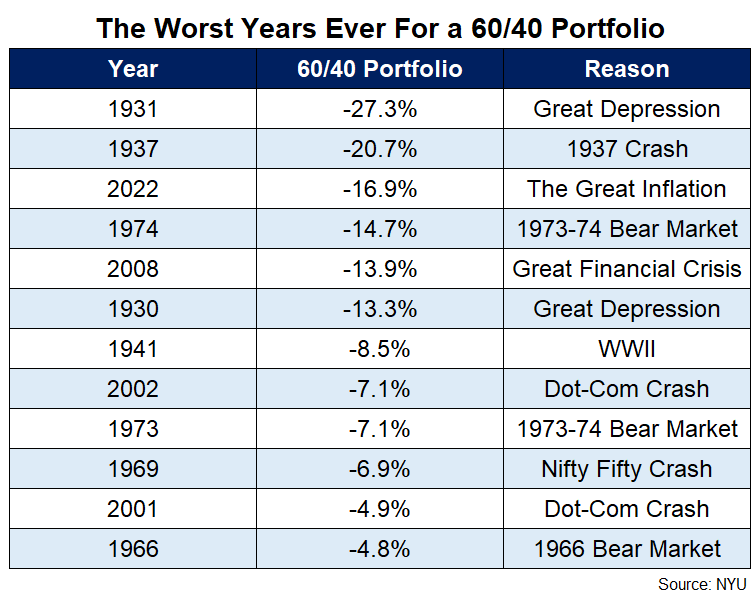

Then interest rates went screaming higher from the floor to 5% or so. In 2022, it actually did feel like the 60/40 portfolio was dead. It got hit by a truck in one of the worst years ever for the combination of stocks and bonds.

The good news is short-term Treasuries and cash stepped in to help on the fixed income side of things but I understand why so many investors became hesitant to own bonds after that bloodbath.

If you invested in a total bond market fund you experienced the worst fixed income returns on high quality bonds in history.

In the 2010s when bond yields were so low investors were being pushed out on the risk curve but also pushed out on the complexity curve. There is a notion among certain wealth managers that you need alternatives, leverage, private investments, etc. to succeed.

I’m not completely opposed to those kinds of investments. They are not right for a lot of investors but for those who understand how they work and invest in a reasonable way these types of investments can work.

But introducing more complexity into your portfolio can make it much harder to manage. The fees are higher, they’re more illiquid, it’s harder to rebalance, and there isn’t nearly as much transparency. You have to know what you’re doing when you venture outside of simple portfolios and even then you might not be satisfied with the results.

Having said that, the bond market massacre of 2022 left fixed income investors with principal losses but also much higher yields. Bonds are not knocking it out of the park because bonds are boring investments. But since 2022 the higher yields have led to slow and steady gains.

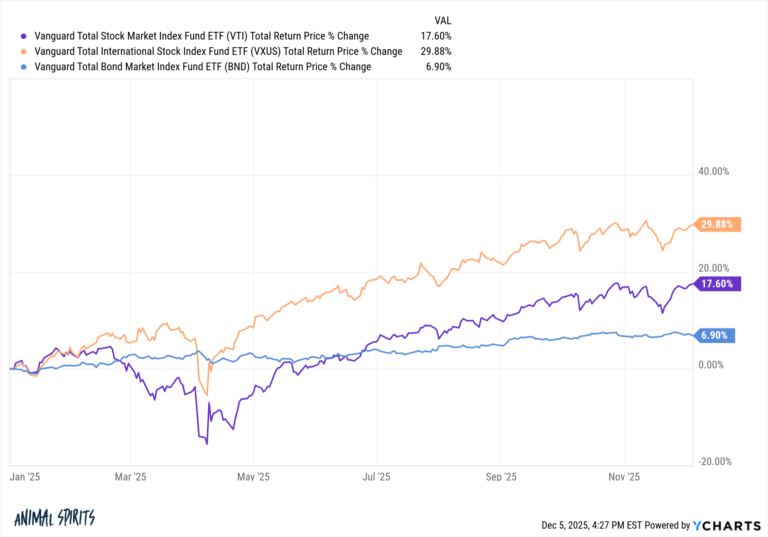

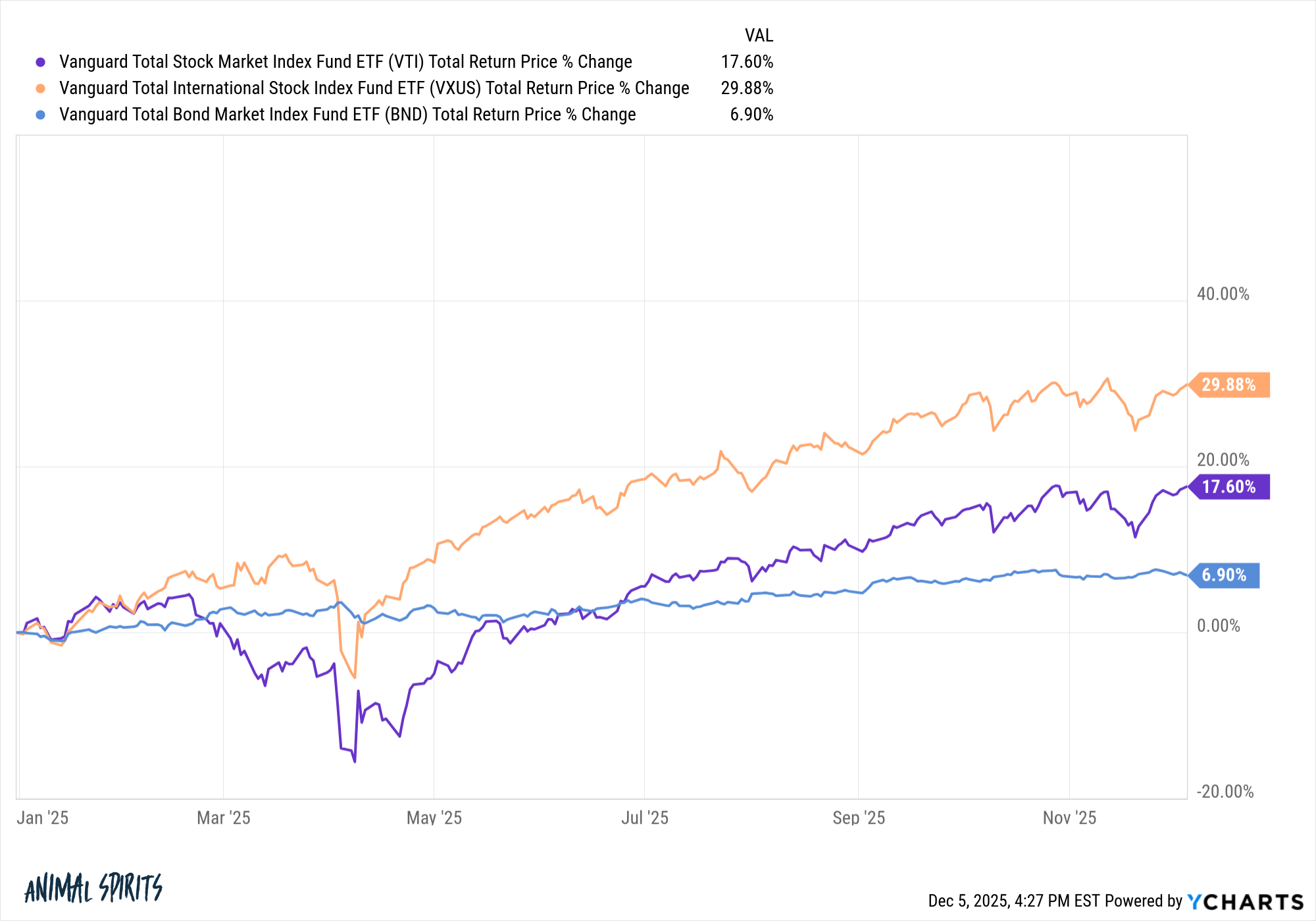

And if you look at something like a simple 3-fund Vanguard portfolio boring is having a pretty darn good year in 2025 and that includes bonds:

International stocks are up 30%. U.S. stocks are up almost 20%. But look at bonds — up almost 7%! That’s a great year for fixed income.

Put it altogether and a 60/40 three fund portfolio1 is up nearly 16% in 2025. That’s pretty good.

This portfolio is up 7.8% per year in the 2020s. That number includes the worst bond market crash in history.2

The 60/40 portfolio was not dead, just dormant for a year or two.

Boring is still beautiful when it comes to investing.

Michael and I talked about plain vanilla portfolios and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

A Eulogy for the 60/40 Portfolio

Now here’s what I’ve been reading lately:

Books:

140% U.S. stocks, 20% international stocks and 40% bonds.

2This portfolio was down 16% in 2022.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.