Today’s Animal Spirits is brought to you by NEOS Investments and Exhibit A:

Explore NEOS Investments’ award-winning lineup at https://neosfunds.com.

Financial Advisors: To book a 20 minute demo of Exhibit A with Chart Kid Matt, click this link: https://calendly.com/matt-exhibitaforadvice/20min. Or, start a risk free 7-day free trial: https://exhibitaforadvice.com/register.

On today’s show, we discuss:

Listen here:

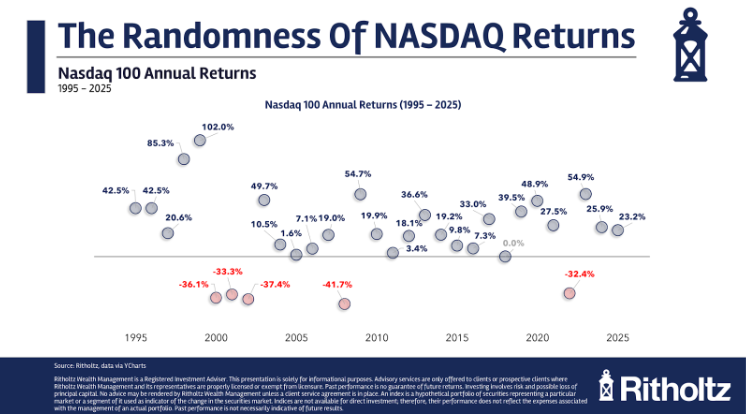

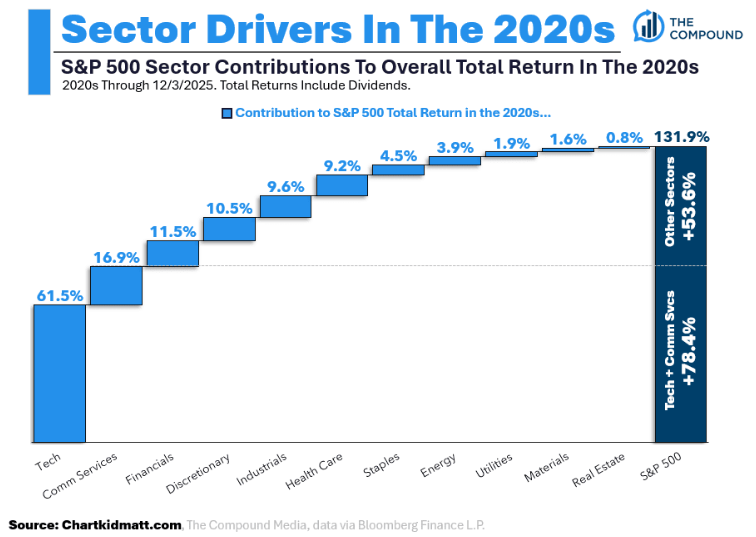

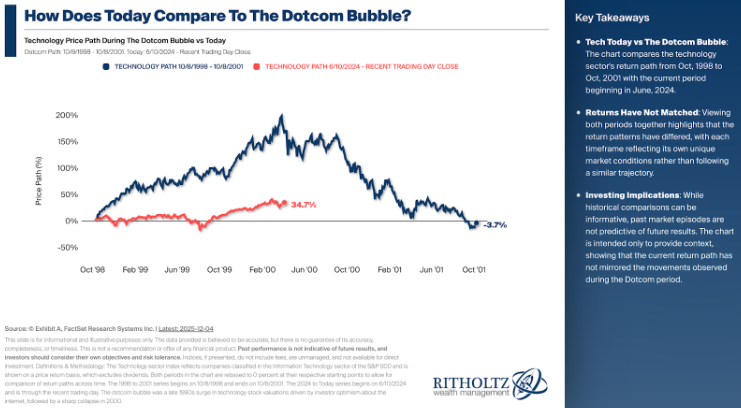

Charts:

Recommendations:

Tweets/Bluesky

Wild chart from Jim Reid at Deutsche Bank, showing how much OpenAI is expected to burn before turning a profit.

A couple things stand out also: How small the $AMZN burn really was for its first 8 years. How big the $UBER burn was before ultimately getting in the black pic.twitter.com/blSwalu11A

— Joe Weisenthal (@TheStalwart) December 4, 2025

Disposable income and employee compensation continue to grow faster than inflation.

This is one reason we never saw a recession in ’23 when many others did.

There was a dip in incomes around the tariff drama, but it has perked up in Q3. This is a healthy sign for the consumer. pic.twitter.com/3FVg3Ce6vu

— Ryan Detrick, CMT (@RyanDetrick) December 8, 2025

Oof. Businesses with 20-49 employees shed 74k payrolls in November … that was 6th decline out of the past 7 months and the largest drop since October 2020 pic.twitter.com/8HqNDC2gVB

— Kevin Gordon (@KevRGordon) December 3, 2025

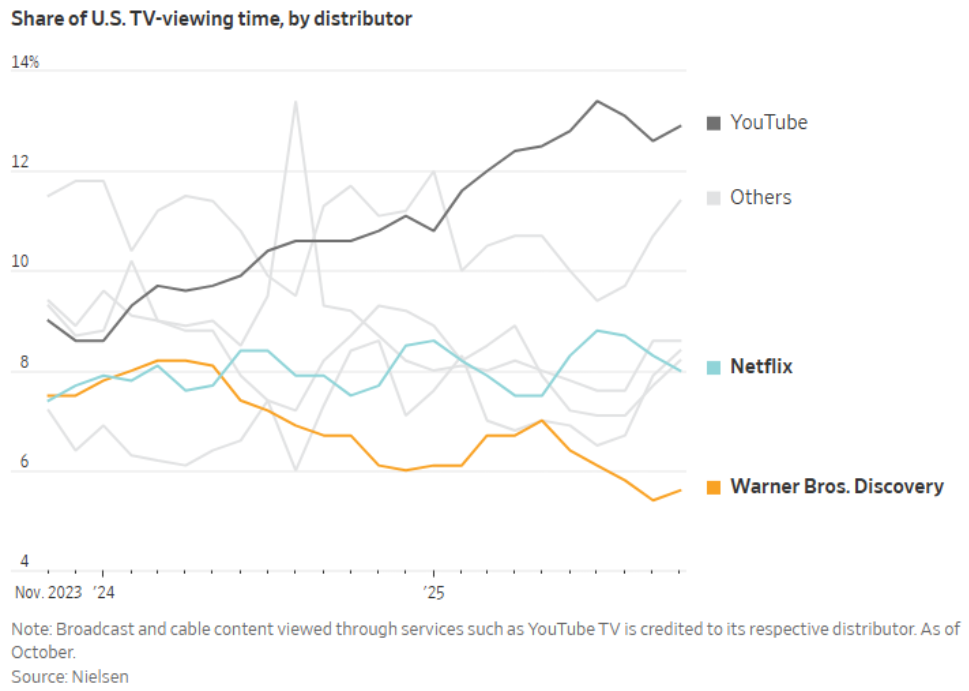

Saw a 65 inch tv at Target for $250

Feels like Netflix is just gonna give us all free tvs someday w/a membership

— Ben Carlson (@awealthofcs) December 4, 2025

$IBM CEO: “That’s $8 trillion of CapEx. It’s my view that there’s no way you’re going to get a return on that because $8 trillion of CapEx means you need roughly $800 billion of profit just to pay for the interest.”https://t.co/KM4BTqGl4W pic.twitter.com/q1OePgPGlu

— The Transcript (@TheTranscript_) December 7, 2025

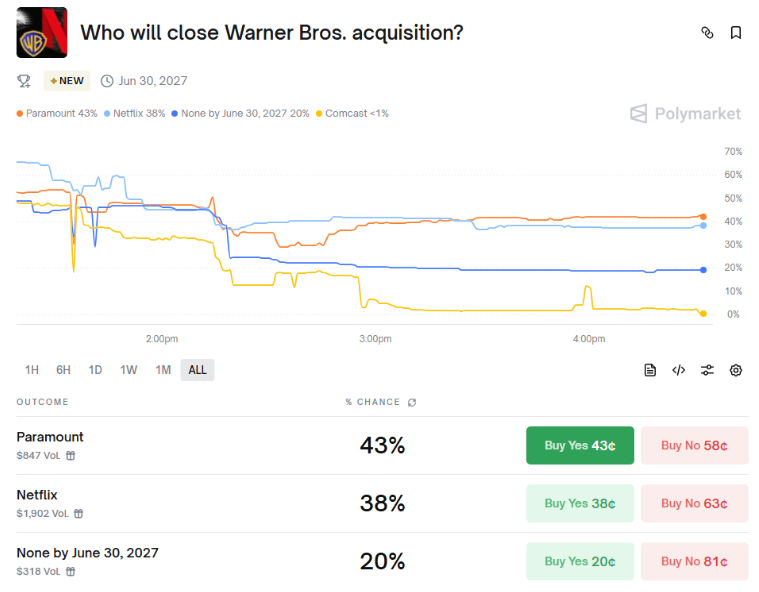

Netflix reiterates it will:

> Release WB movies in theaters

> Produce WB TV shows for third partiesIt sounds like it wants to sell HBO as an add-on to Netflix, but company didn’t say that outright.

— Lucas Shaw (@Lucas_Shaw) December 5, 2025

Apparently there is now a Gen Z TikTok trend where they are romanticizing being a millennial in 2012 pic.twitter.com/opmlVykPuA

— Circe (@vocalcry) December 7, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.