A reader asks:

What’s something that’s relatively simple that most investors don’t do?

Now this is my kind of question.

Simplicity is my thing.

Here are six simple ways you can improve your investment plan:

1. Automate and then get out of the way. This is one of the simplest and best things you can do to grow your wealth.

Automate your contributions, what you invest in, your asset allocation, how often you rebalance, your savings rate increases, dividend reinvestment, etc.

Make some good decisions ahead of time, stop tinkering with your portfolio and get on with your life.

The less you do the better off you’ll be.

2. Think big picture. Far too many investors focus too much on the individual investments in their portfolios.

Yes, individual securities, funds and asset classes matter in regards to your investment plan. But you have to think about how those individual components work together and complement one another.

When adding any investment you should think about how it fits within the context of your whole portfolio, not just its individual merits.

Each piece of your portfolio should have a job but those individual parts sum up to the whole. It’s all one big pile of money.

Your overall portfolio performance matters more than the performance of the individual holdings.

3. Consolidate. One of the best ways to view the portfolio as a whole is to consolidate your accounts. It’s much harder to track your asset allocation and true performance when you have accounts all over the place.

Things can get out of control when you have a 401k, a traditional IRA, a Roth IRA, a brokerage account, a 529 plan, an HSA and a handful of old retirement accounts from previous employers all over the map at different financial firms.

This is something I have personally been working on to simplify my investments.

We had a 403b from my wife’s previous employer sitting there in its own account so I finally rolled it over. We have all of our retirement accounts at Schwab and Fidelity so I moved my crypto and brokerage accounts to those platforms as well.

It’s just much easier to understand the entire picture of your investment plan when everything is under the one roof.

4. Track your performance. I have a love-hate relationship with investment performance.

Some investors obsess over short-term performance metrics and benchmarks to their detriment. Long-term returns are the only ones that matter so who cares if you have a bad month, quarter or year?

However, other investors are clueless about performance. This is especially important if you’re actively managing some or all of your portfolio. You should absolutely track the performance of your stock picks to see if it’s worth the time, effort and potential anguish.

Once a year, I do a back-of-the-envelope that takes into account our starting portfolio value, annual contributions/distributions, and ending portfolio value.

It’s a worthwhile exercise even though one year results aren’t all that important.

5. Define your time horizon before investing. The three most important variables in any investment decision are:

1. Your goals.

2. Your risk profile.

3. Your time horizon.

The last one can get you into trouble if you don’t define your time horizon ahead of time or confuse it with someone else’s.

Are you making a trade? A buy-and-hold investment? Something with a defined upside or downside?

Matching your investments with a well-definded time horizon can save you from unecessary mistakes but also help guide your decisions when it comes to buying, selling or holding an asset.

6. Save a little more money every year. The best alpha in your portfolio typically comes from saving more money, not the investments you make.

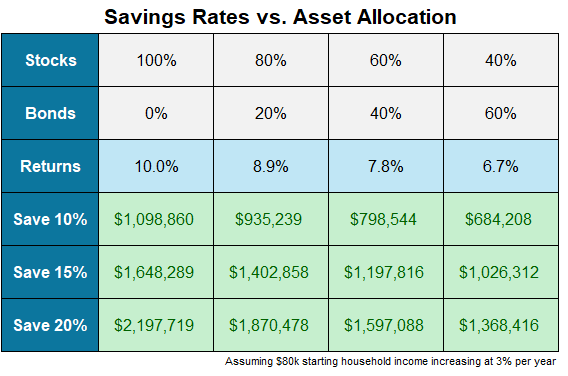

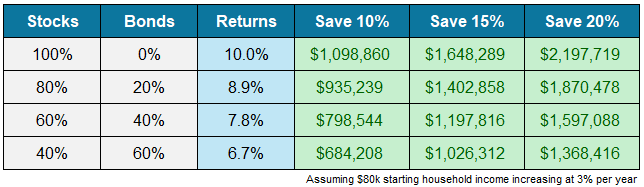

I created a chart using some simple assumptions — median household income, historical rates of return and inflation — and compared different asset allocations and savings rates over a 25 year period:

Saving 15% of your income resulted in a higher ending value for the 80/20 and 60/40 portfolios as the 100% stock portfolio only saving 10% of income. Saving 20% of your income resulted in a better outcome for a 40/60 portfolio than 100% in stocks saving just 10%.

Saving isn’t sexy but it’s one of the simplest ways to improve portfolio outcomes.

I answered this question on an all-new Ask the Compound:

We also covered questions from our viewers about 10 things you need to know about investing in stocks, the difference between cyclical and secular markets, how bonds impact your retirement plan and 15 year vs. 30 year mortgages.