An old boss of mine used to say, “It’s OK to be surprised by what happens in the markets. Just don’t be surprised that you’re surprised.”

Here are some things that were surprising in 2025:

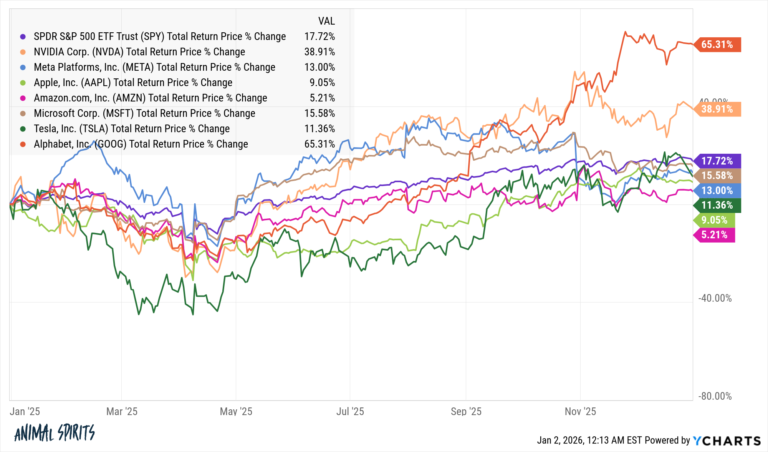

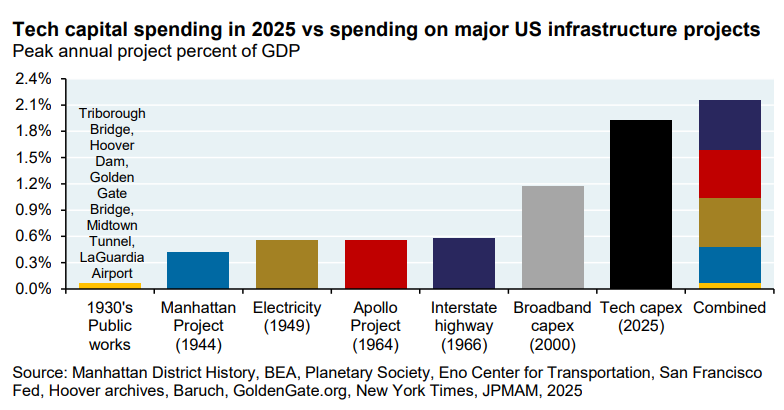

1. Just two of the Mag 7 stocks outperformed the S&P 500. Only Google and Nvidia beat the market in 2025:

Microsoft, Tesla, Amazon, Apple and Meta all underperformed.

That’s pretty surprising given all the AI/tech bubble talk we heard throughout the year.

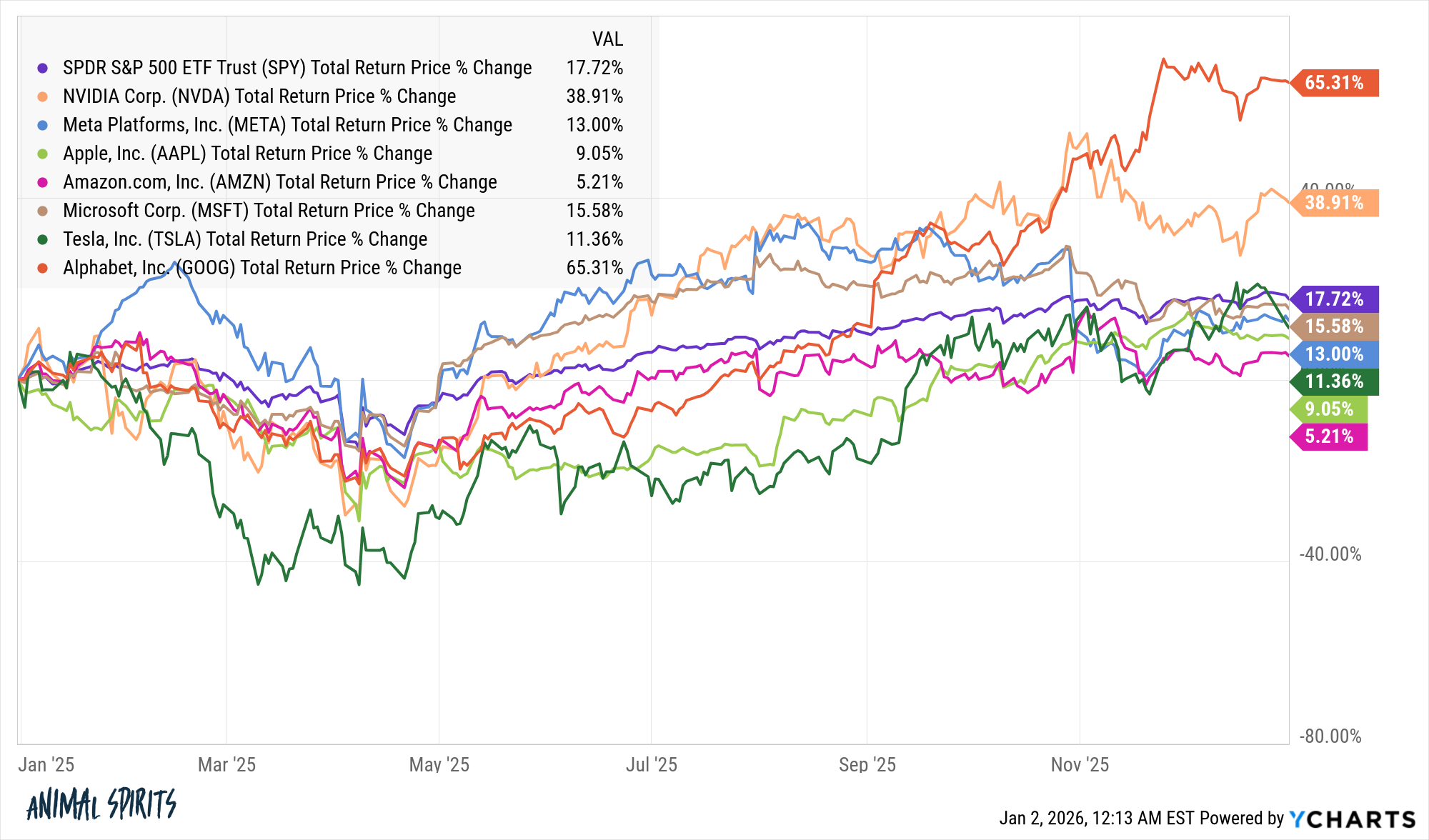

2. Big tech stock valuations didn’t go to the moon. Other than Tesla, valuations for the giant tech stocks were more or less unchanged:

For Broadcom, Nvidia, Amazon, Oracle and Apple, the P/E ratios actually went down.

Of course, there are other metrics you can look at. But on a valuation basis it’s not like tech stocks entered a blow-off bubble in 2025.

Maybe the bubble is still coming, but it doesn’t appear to have happened last year.

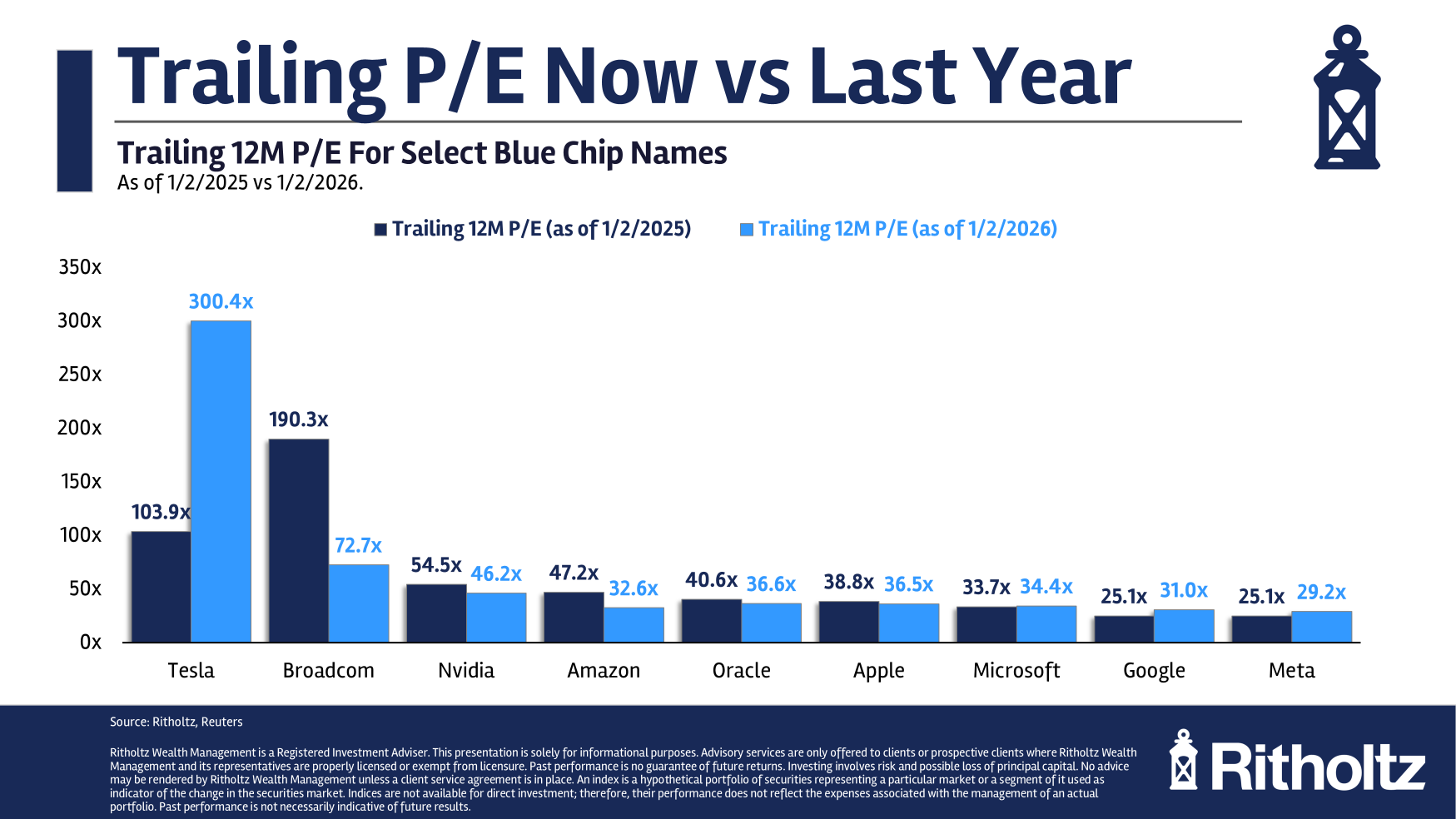

3. Still no recession. Maybe AI didn’t blow into a gigantic bubble but a lot of people believe all the capital outlays from tech companies more or less carried the economy.

This chart from Michael Cembalest puts it into perspective versus history’s other great spending sprees:

AI spend certainly seems to have dulled the impact of tariffs on the economy.

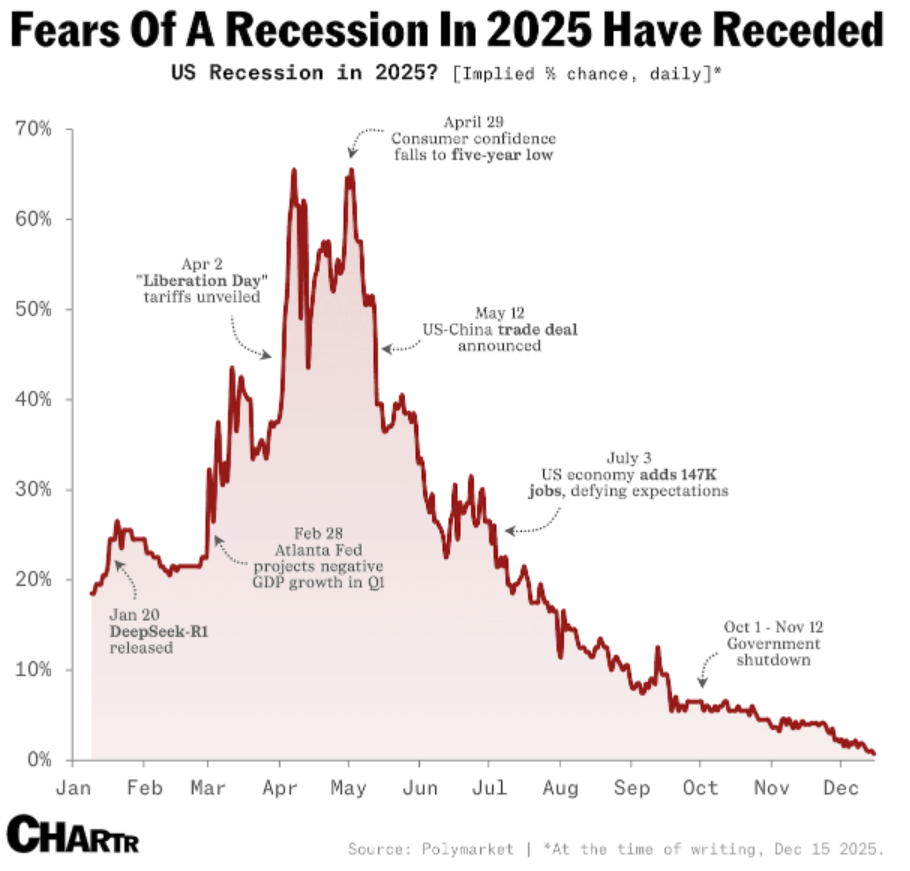

It sure felt like we were close to a downturn in April with the Tariff Tantrum. The betting markets were certainly worried:

Tariffs, 9% inflation, 8% mortgage rates, 5% Fed Funds Rate…none of it has derailed the economy.

Maybe the actual surprise will be when we do go into a recession.

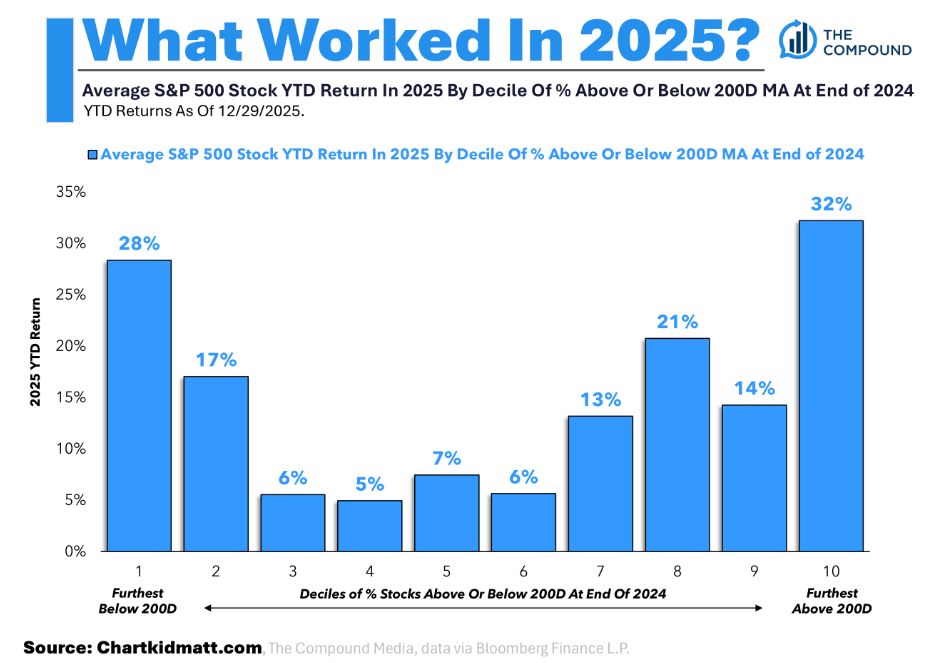

4. Stocks that worked in 2025. Chart Kid Matt broke down the S&P 500 into drawdown deciles heading into 2025:

This shows the stocks that were the most beaten down (all the way to the left) and the stocks that were already doing well (all the way to the right) were the two best-performing baskets.

Buying the momentum plays and the beaten-down value plays worked.

That’s odd in the same year.

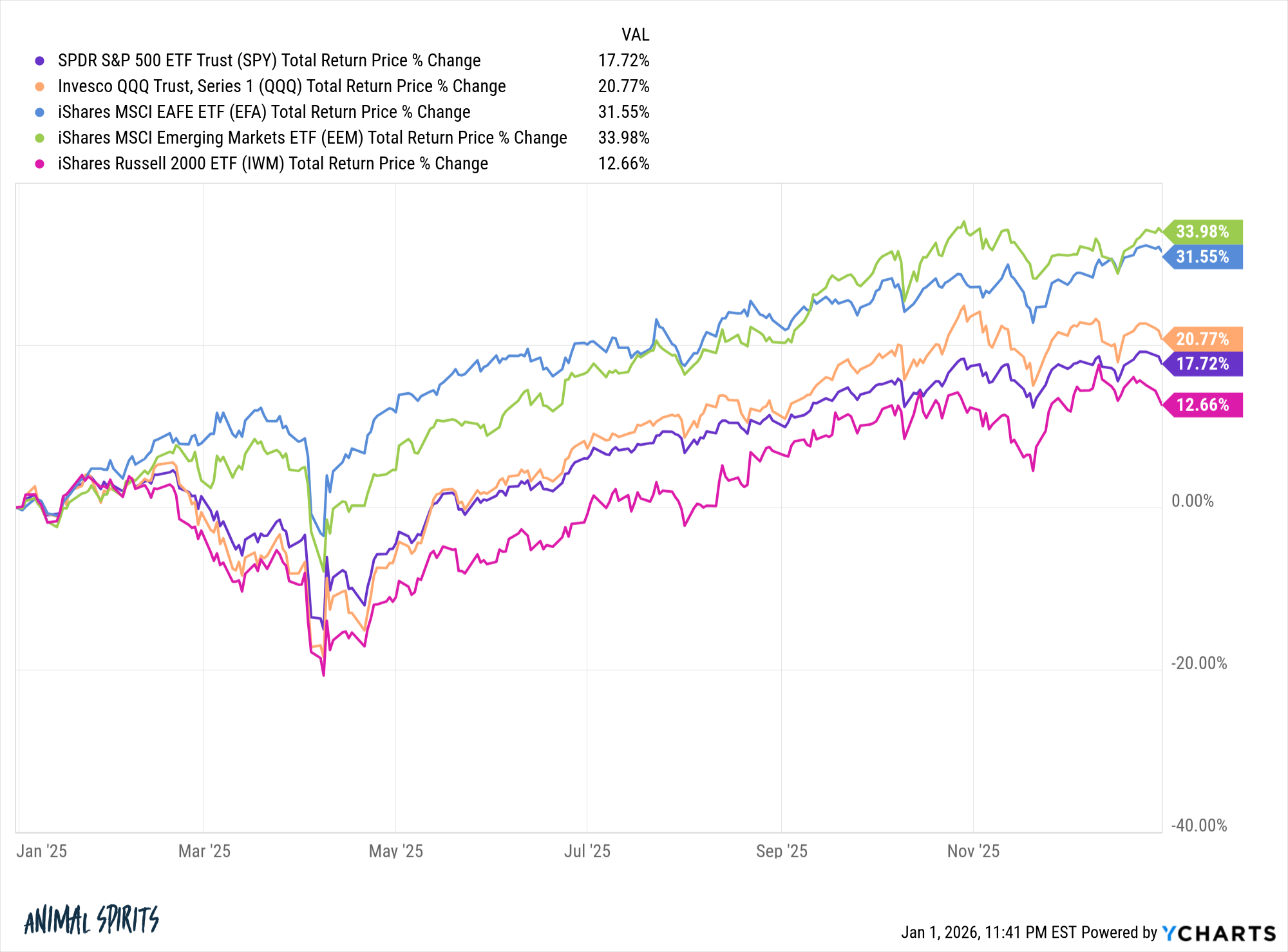

5. International stocks outperformed. Finally!

Take a look:

Foreign developed and emerging market stocks both outperformed the U.S. stock market by double digits.

By my calculations, the ~14% outperformance for the MSCI EAFE over the S&P 500 is the biggest gap since 1993.

Yet no one seems to care!

I think it will take another year or two before more investors take notice.

We shall see.

6. Self-driving cars are here. My family took a trip to Scottsdale this past week to get out of the Midwest cold. The first thing I noticed coming out of the airport was that Waymos were everywhere.

It is quite bizarre to see cars driving around all over the place with no one in the driver’s seat.

I made a point of taking one just to have the experience. I also wanted my kids to experience it.1 It was just as magical as everyone says it is. That first ride was surreal, like something you see only in movies.

Ten years ago it felt like this wasn’t going to happen. Now Waymo says they did 14 million rides in 2025.

I told my kids the next 10-20 years are going to be nuts — self-driving cars, AI, robotics, etc.

I know this period will present challenges. There will be setbacks. Certain jobs and groups of people will be displaced. The transitional phase will be bumpy. We’ll finally go into a recession at some point. Maybe the AI bubble will pop.

But I cannot imagine being bearish about the future when we can create a self-driving vehicle.

I remain bullish on the future.

Josh, Michael and I talked about all of these surprises and much more on The Compound and Friends this week:

Or check out the podcast version here:

Further Reading:

The Biggest Risks in 2026

1They were all making fun of me because I was so excited about it.