I’m going through my annual tradition of updating historical return data now that we’ve turned the calendar on another year.

Some people have resolutions. I have spreadsheets.

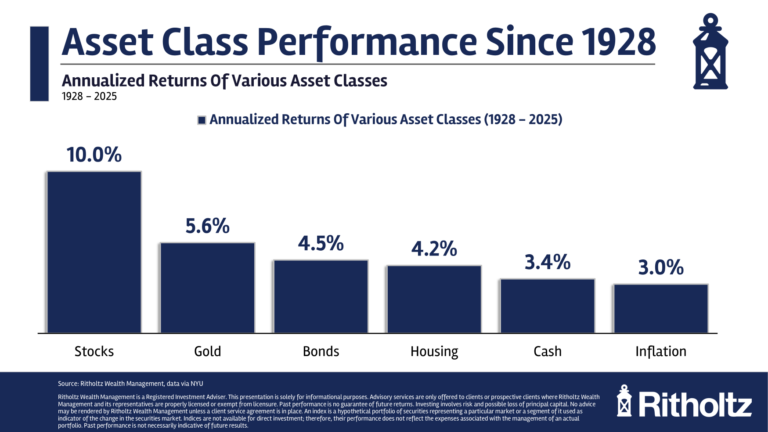

Aswath Damodaran updates annual returns for stocks, bonds, cash, gold and housing at NYU each year going back to 1928.

I love slicing and dicing this dataset.

Here are the updated returns through year-end 2025 (along with the inflation rate for good measure):

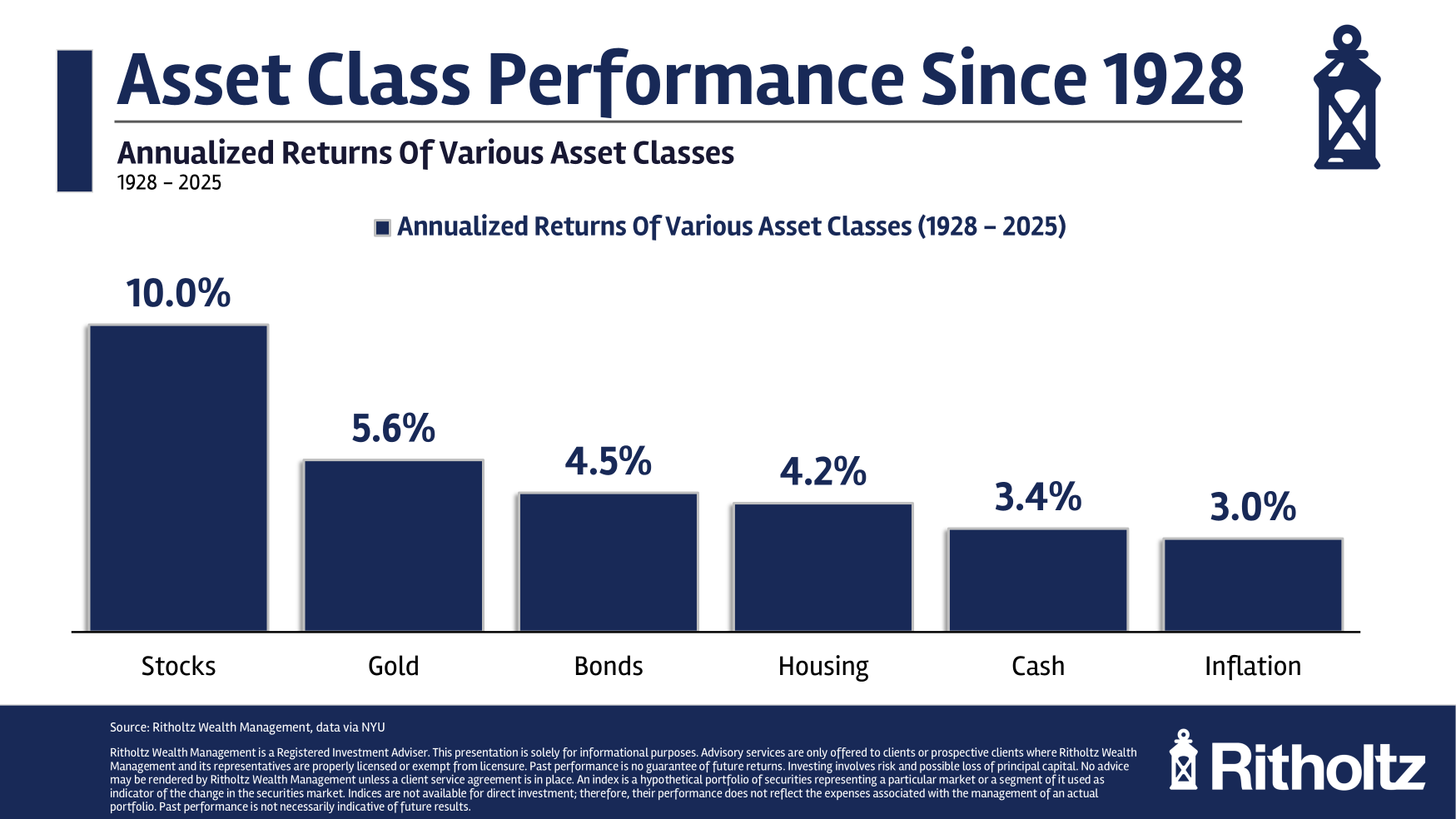

Now here are the returns by decade going back to the 1930s:

Gold and stocks are both having a wonderful decade thus far. Bonds…not so much.

It’s also interesting to note that as painful as higher inflation has felt in the 2020s, it was higher in the 1940s, 1970s and 1980s. We’re not really that far off from the historical average of 3%.1

I’ve noted this before but I like regular reminders — in 4 out of the past 5 decades, the stock market has provided above average double-digit annual returns. As painful as the lost decade from 2000-2009 was, the past 5 decades have seen phenomenal gains for investors in risk assets.

If you go back one more decade, gold has experienced double-digit annual returns in 3 of the past 6 decades. The yellow metal has been feast or famine when you look at decade-long return numbers.

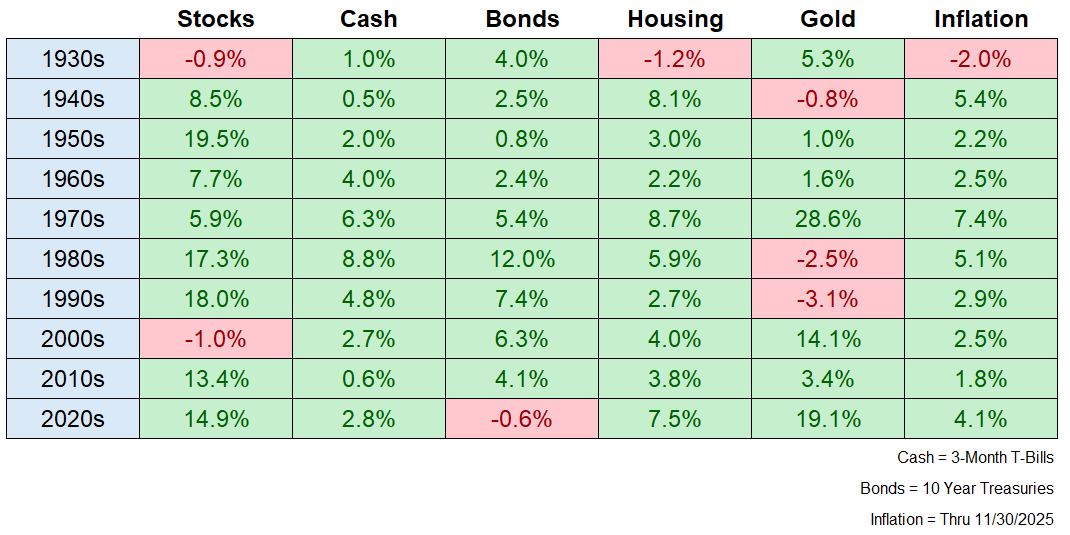

Now, for another annual tradition — here is a scatterplot of S&P 500 returns from 1928-2025:

The stock market in any given year is unpredictable.

Asset class returns in any given decade are often unpredictable as well.

When we check back in on these numbers next year the annual returns for 2026 are anyone’s guess.

But the long-term returns won’t change all that much.

There’s in lesson in that dichotomy.

Further Reading:

Is This the Worst Decade Ever For Bonds?

1Send your inflation hate mail to dontshootthemessenger@nope.com

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.