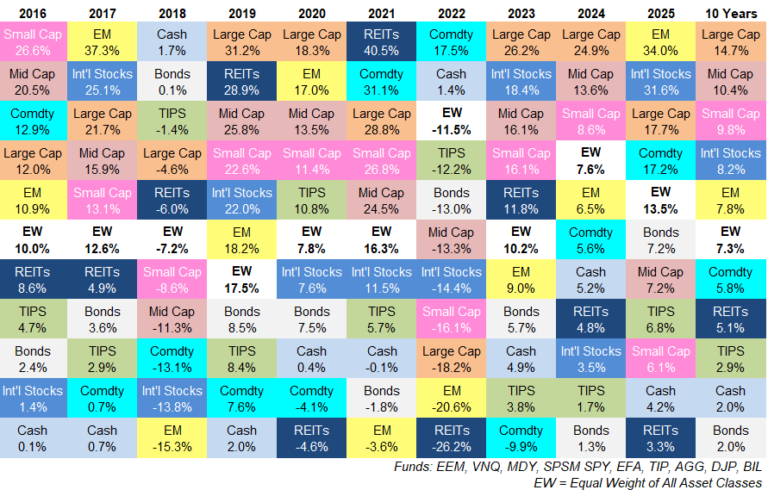

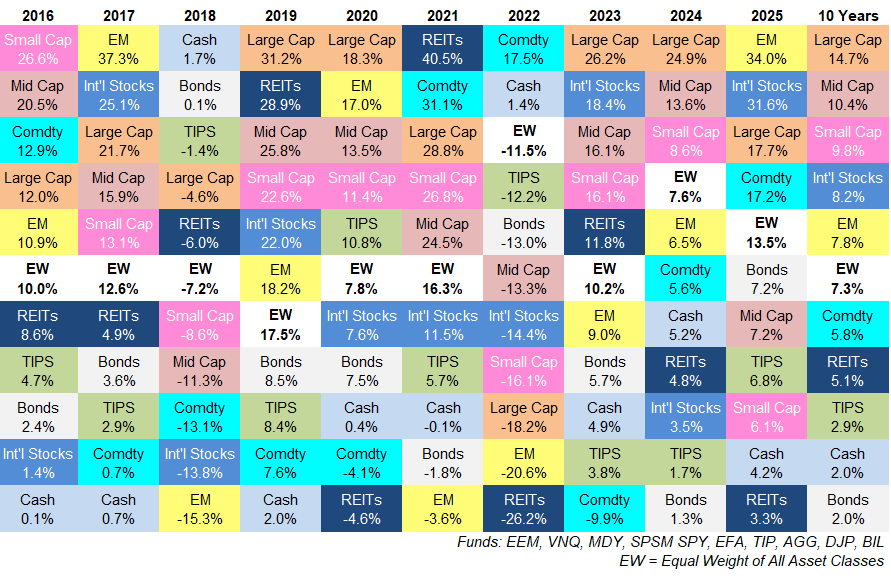

I’ve been updating my asset allocation quilt for over a decade now.

Here’s the latest iteration through 2025:

Some thoughts:

Foreign stocks are perking up. Developed and emerging market stocks have had a tough go at it this cycle (relative to the S&P 500).

2025 was the first year since 2017 in which both asset classes outperformed the S&P 500. The 10 year returns are still lagging far behind U.S. stocks but 2025 was a great year for international stocks. And the longer-term returns are respectable once again.

Commodities are doing better. Commodities1 had a negative 10 year return through year end 2017, 2018, 2019, 2020, 2021, 2022 and 2023. So the fact that commodities have now delivered a decent near-6% annual return over the past 10 years is a big change from the previous cycle.

Commodities are having a good 2020s, up 65% this decade.

High-quality bonds were the worst-performing asset class over the past 10 years. If you kept your money in T-bills for the past 10 years you would have marginally outperformed the Aggregate Bond Index.2

And that is despite the fact that cash was yielding next-to-nothing for a decent chunk of the past decade. It’s been a rough stretch for bonds.

Luckily, yields are higher now so returns should be much better from here.

Cash returns have been good for a few years. T-bills were up 4-5% in 2023, 2024 and 2025. That’s a decent run considering cash yields were stuck on the floor for much of the 2010s and the early-2020s.

Will it continue?

The Fed is already cutting rates so I would say don’t get used to it. Enjoy it while it lasts.

Small caps and mid caps have done fine. A lot of investors have been freaking out about small and mid cap stocks because they’ve underperformed in recent years.

But look at the 10-year returns — right around 10% per year for both.3

Yes, large cap stocks have outperformed on a relative basis but on an absolute basis smaller and mid-sized companies have been doing just fine. Everything can’t perform well at the same time.

Markets don’t work like that.

Higher rates hurt REITs. My 11-year-old daughter would look at returns for REITs and tell me they’re mid.3

Slow activity in the real estate market is certainly having an impact but higher interest rates have obviously led to lower returns for this rate-sensitive asset class.

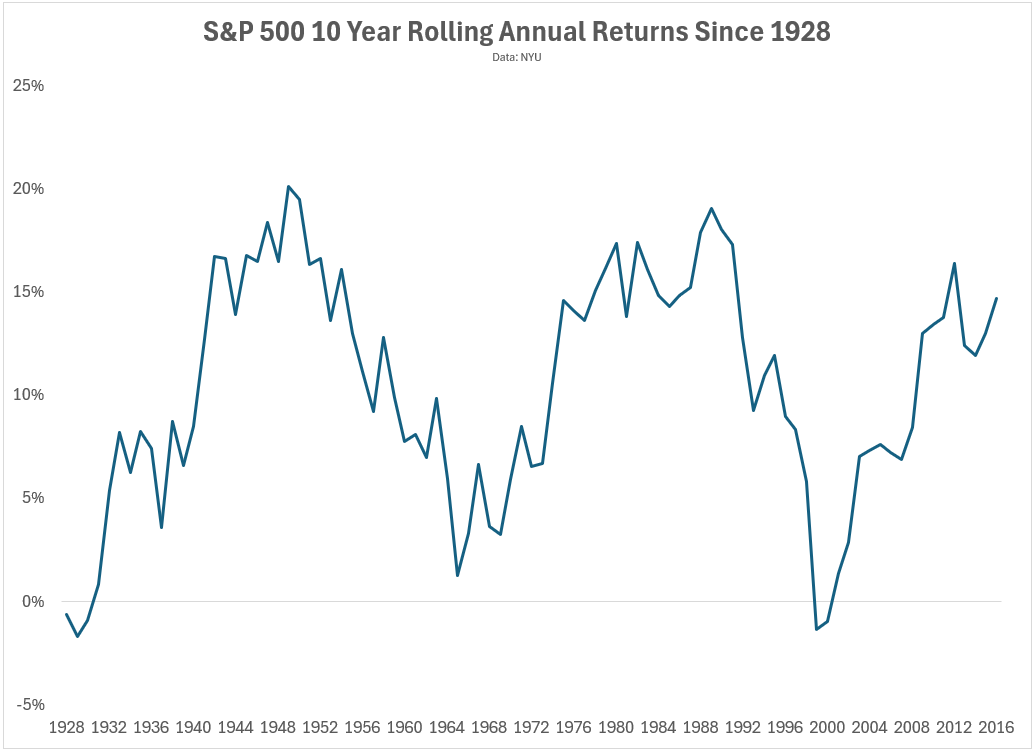

Large cap stocks have been dominant. The S&P 500 is up almost 15% per year in the 10 years ending 2025. How does that stack up historically?

I looked at the rolling 10 year returns going back to 1928:

We’re not quite at the peaks of the late-1940s or late-1980s but it’s certainly close.

There’s a pretty clear pattern of above-average performance followed by below-average performance.

Logic would say this pattern should continue but who knows what the range of above- and below-average performance should look like going forward.

And the timing is alwaya the tricky part of the equation.

Further Reading:

Updating My Favorite Performance Chart For 2024

1I use DJP as a proxy for a diversified basket of commodities.

2The two-decimal place returns were 2.04% vs. 1.95%.

3I know I shouldn’t make fun of the way kids talk these days because we said some cringe stuff in my day but I can’t help it.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.