Today’s Animal Spirits is brought to you by Innovator:

This episode is sponsored by Innovator. Learn more at https://www.innovatoretfs.com/pdf/ddq_product_brief.pdf

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky

First @BillAckman said capping credit card interest rates was a “mistake” (in a since deleted post).

Now he says it’s a “worthy” goal. https://t.co/2MTvgcYXOh pic.twitter.com/WjtMxstt4a

— Annmarie Hordern (@annmarie) January 10, 2026

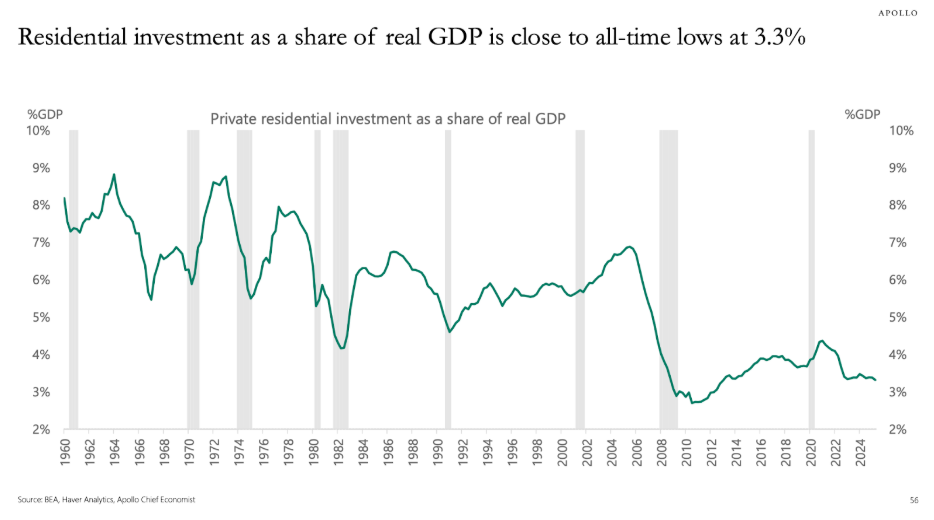

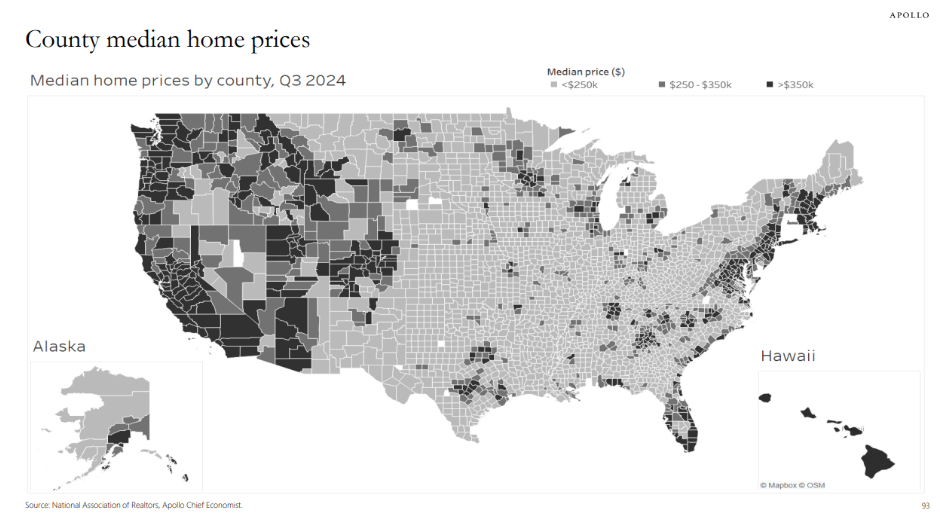

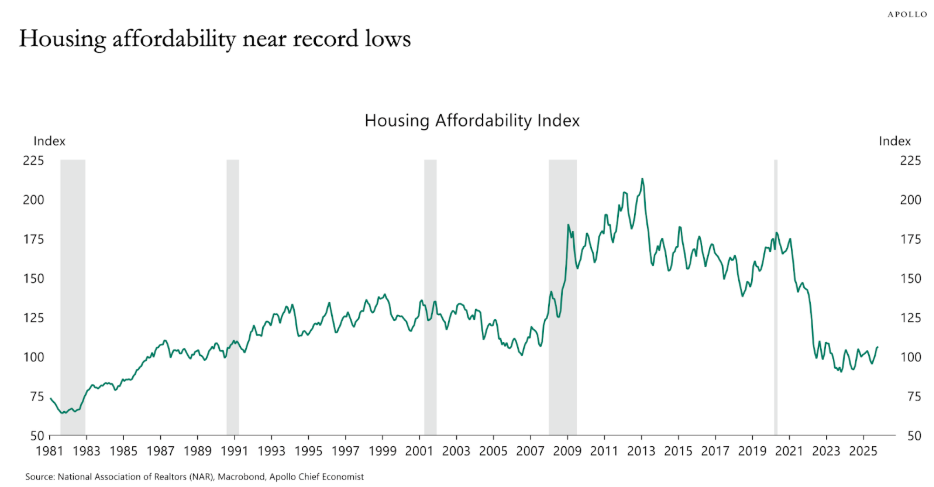

RFK Jr: “Your kids are never going to buy a home.”

“There’s three big companies: BlackRock, State Street, Vanguard. They basically just own everything.”

“And now what they’ve decided is they want to own every single family home in our country.” pic.twitter.com/yTyiCZGBBj

— conspiracybot (@conspiracyb0t) January 12, 2026

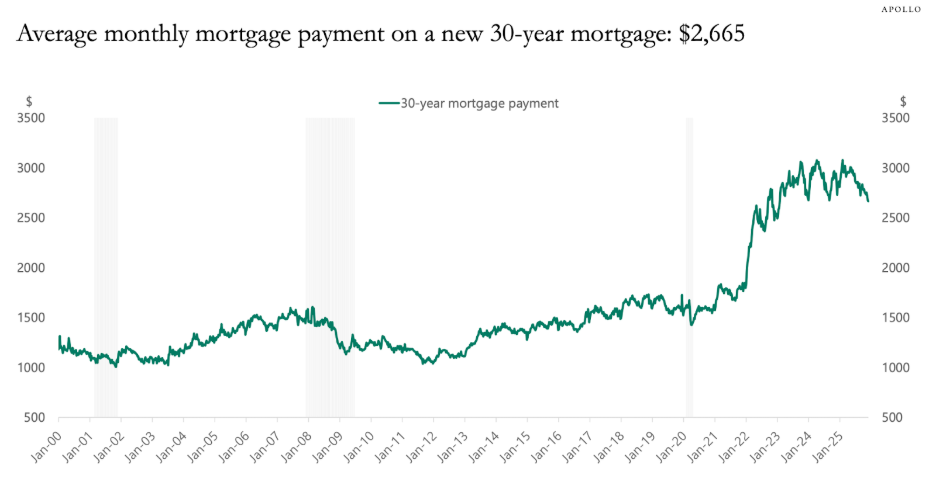

NEW: Trump says he’s instructing unnamed representatives to buy $200 billion in MBS in a bid to narrow mortgage spreads and bring down rates. pic.twitter.com/gTX89jVCfi

— Nick Timiraos (@NickTimiraos) January 8, 2026

Mortgage spreads reached up to 3.10% in 2023. We started the year at 2%, and recent historical normal levels are between 1.60% and 1.80%. We were close to normal before the news broke out pic.twitter.com/WVB5mPnHkc

— Logan Mohtashami (@LoganMohtashami) January 9, 2026

Institutional investors = 1% of US home purchases. pic.twitter.com/lkpiZbYupW

— Rick Palacios Jr. (@RickPalaciosJr) January 7, 2026

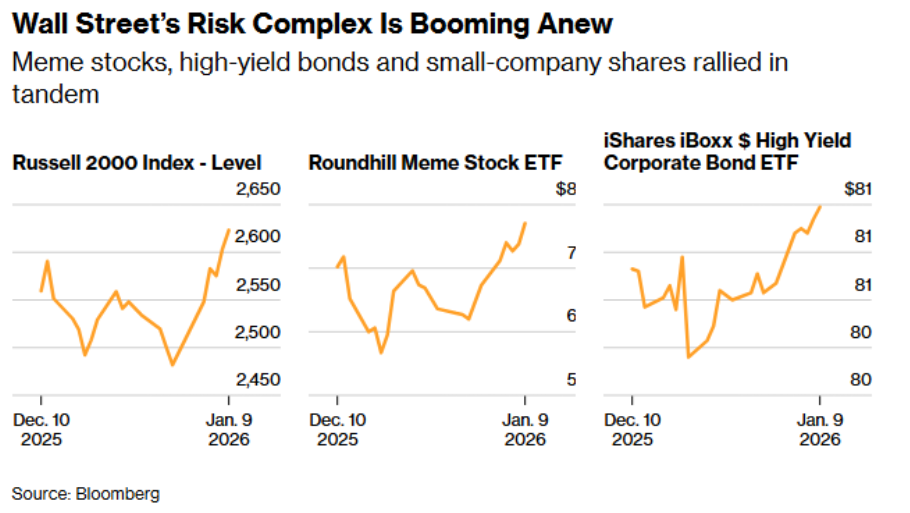

The second fastest growing sector in America in terms of GDP growth from 2019-2024 was gambling. https://t.co/oryjNAruuz

— Matt Stoller (@matthewstoller) January 9, 2026

Eric Adams, former NYC major, has just removed liquidity of his new memecoin, $NYC, scamming investors for over $2,536,301

He launched a $NYC memecoin just 30 minutes ago, and has removed its liquidity after promoting it on his personal social media, claiming to be the NYC token https://t.co/4s20jOTKEN pic.twitter.com/pFAG7l0XMq

— Rune (@RuneCrypto_) January 12, 2026

200bps excess spread vs. syndicated loans

Here’s what that 200bps is paying you for:

> Can’t sell it

> Can’t price it

> Borrower can stop paying cash and switch to PIK

> You mark it yourself pic.twitter.com/SbwWbUtYvh— junkbondinvestor (@junkbondinvest) December 30, 2025

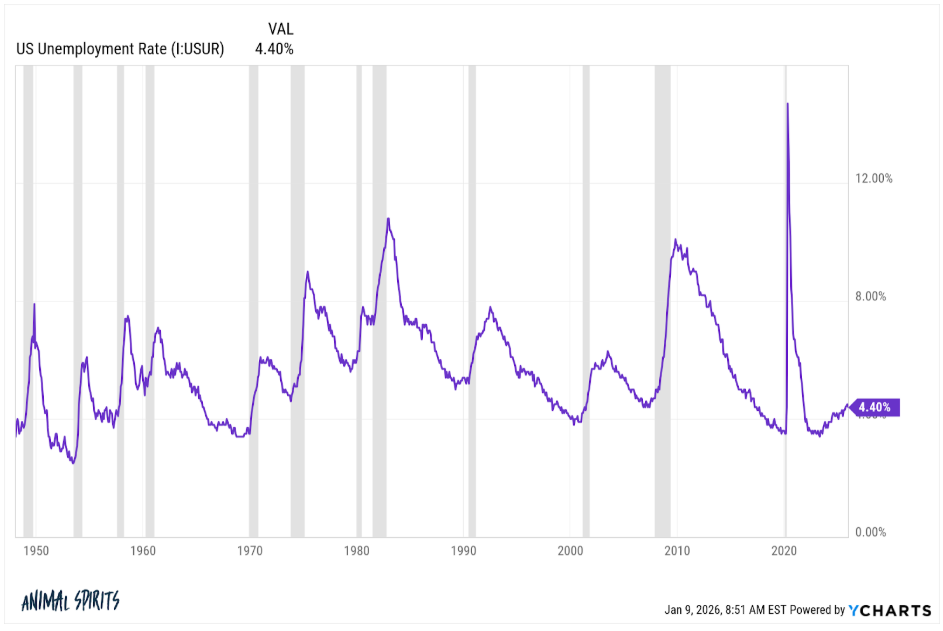

$JPM CEO Jamie Dimon: “The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy. These conditions could persist for some time…” pic.twitter.com/Cxr8d06y6b

— The Transcript (@TheTranscript_) January 13, 2026

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.