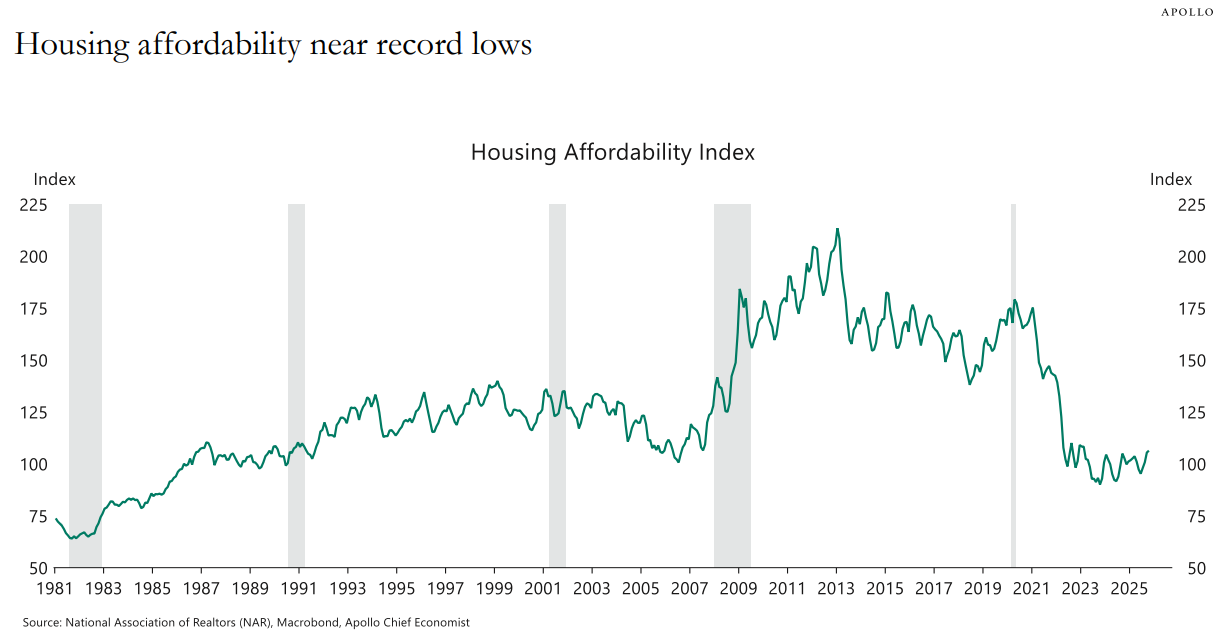

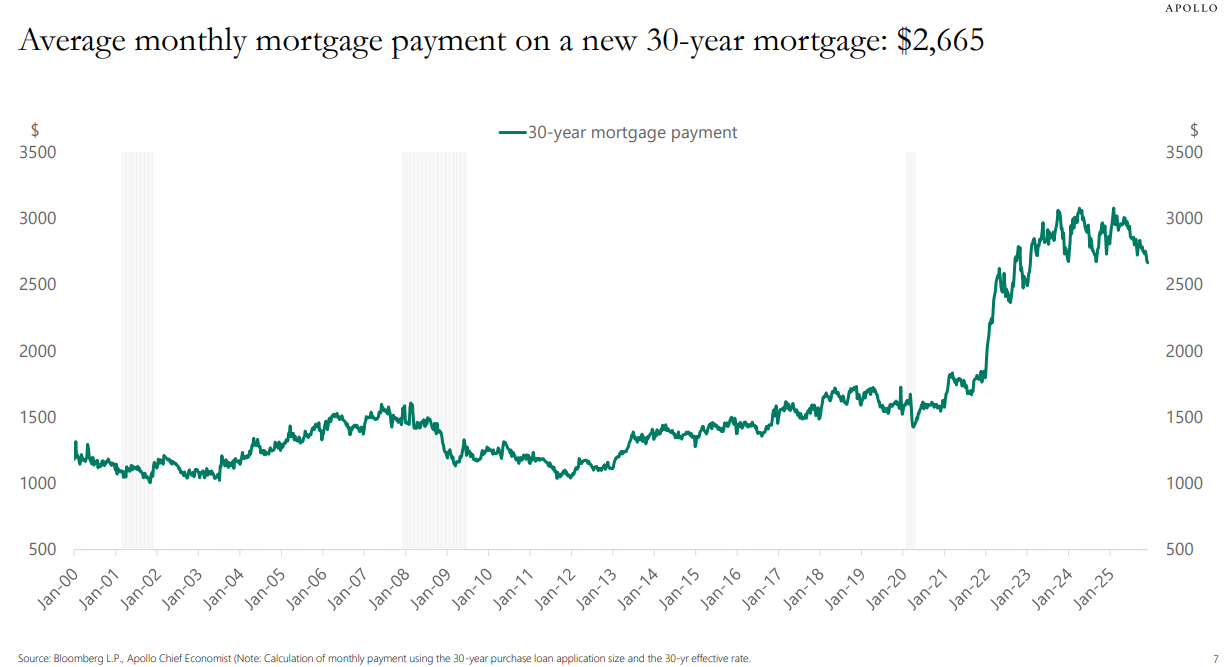

No one needs a chart to show housing is unaffordable right now but here are a couple from Apollo anyway:

The Trump administration has offered some ideas in recent weeks to help with affordability.

The first idea is to ban institutional ownership of homes:

The idea here is if you take away demand from professional investors, that should free up supply for households.

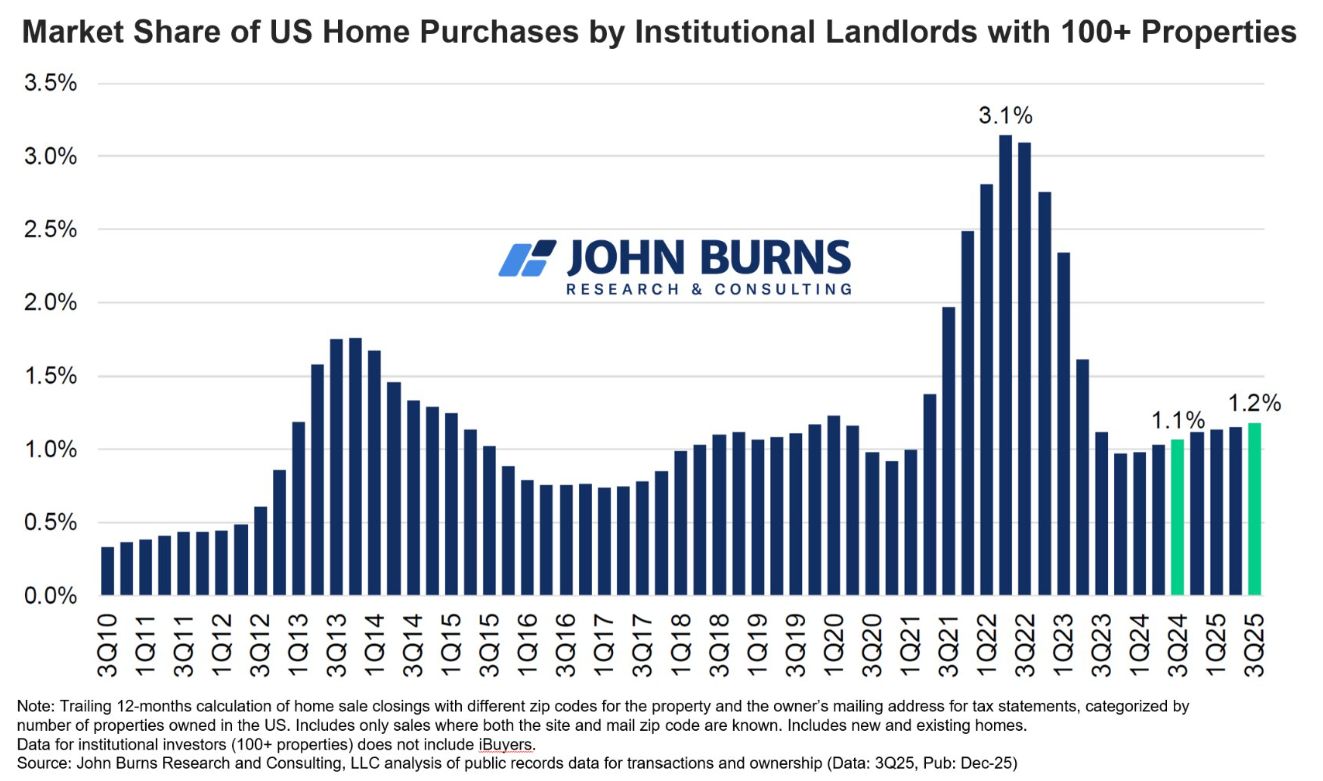

In theory, this makes sense, but this feels like pushing on a string. Institutional investors simply aren’t a huge part of the housing market.

John Burns shows they make up around 1% of all home purchases right now:

Most real estate investors are still of the mom and pop variety. Plus, it’s possible by removing this cohort it could actually decrease supply because it would mean fewer homes being built.

The other idea is to buy mortgage bonds to decrease mortgage rates:

This one makes more sense to me.

When the Fed lowers short-term interest rates, that doesn’t guarantee mortgage rates will fall. In fact, when they cut rates for the first time this cycle, mortgage rates actually rose.

Buying mortgage-backed securities can help narrow the spread between mortgage rates and the 10 year Treasury yield. These spreads blew out after mortgage rates went from sub-3% to 8% in a hurry.

If we really want to get creative I have some other ideas.

Why don’t we offer all first-time homebuyers a one-time 3% mortgage rate? You missed out on generationally low borrowing rates in the early-2020s? Now you get another shot.

Or how about this — let’s make mortgages portable. All of those people who are holding onto a 3% mortgage for dear life have slowed housing activity. What if you had the ability to keep your same low borrowing rate on a new loan for a new house?

That would surely unlock some housing supply.

But here’s the problem with all of these ideas — they don’t address the actual problem. These fixes would spur demand, sure, but they would also likely increase prices.

The real problem is housing supply.

We need to build more homes!

I can’t believe we don’t have more politicians making this a policy priority.

To be fair, this is a much harder solution to implement. Every municipality has its own rules and regulations for building codes and such. Cutting through all of the red tape to allow more building might not be easy but we know it works.

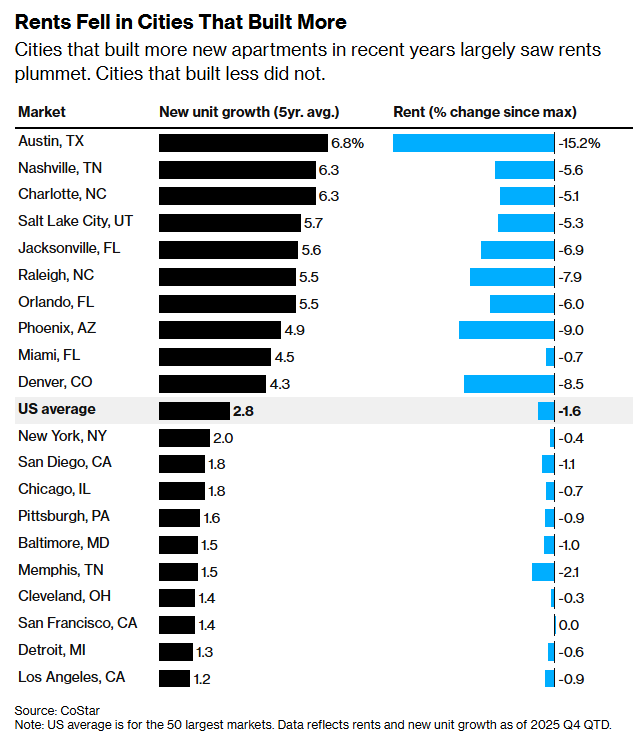

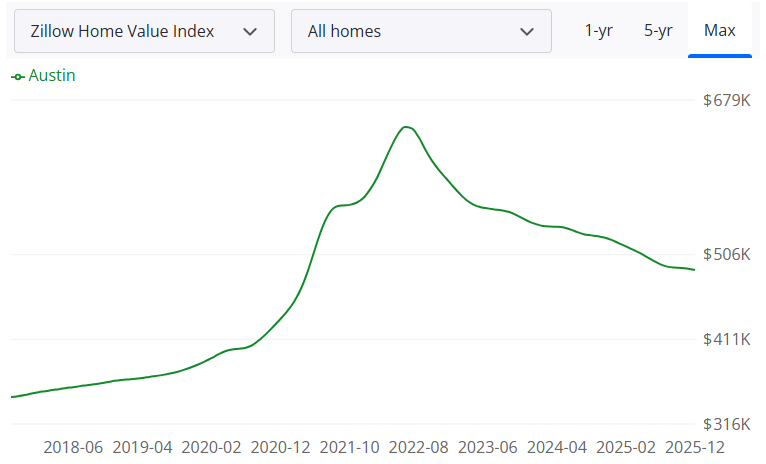

In Austin, they built more multi-family units and rents plummeted:

Guess what else happened when they built more apartments? Home prices fell too!

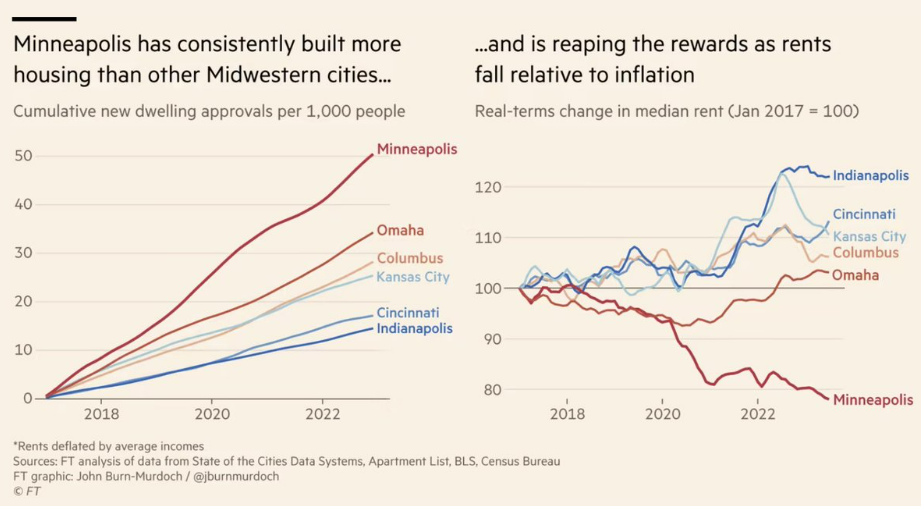

The same thing happened in Minneapolis:

To make a big enough difference across the country you would likely have to incentivize homebuilders in some fashion to build more.

Some people don’t like the government getting involved in markets like this. They would prefer to let the market sort things out. Maybe that will work, but in other countries things have just become more unaffordable since they did nothing to address the problems.

It’s worth noting that the government played a major role in building the middle class after World War II. They backed all the loans so homebuilders would go nuts and build enough houses in the suburbs for all of the soldiers who came back from the war.

There was plenty of housing and it was affordable.

If you want more affordable housing, the government needs to incentivize more supply.

Michael and I talked about the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why Don’t We Build More Housing?

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.