Every quarter Michael and I record a market and portfolio update video for our clients at Ritholtz Wealth.

We talk about what happened, why it happened, go over the impact on client portfolios and share a bunch of charts and data from our research team.

Our research team — Sean and Matt — did such an amazing job this quarter that I decided to share some of the charts.

Let’s take a look.

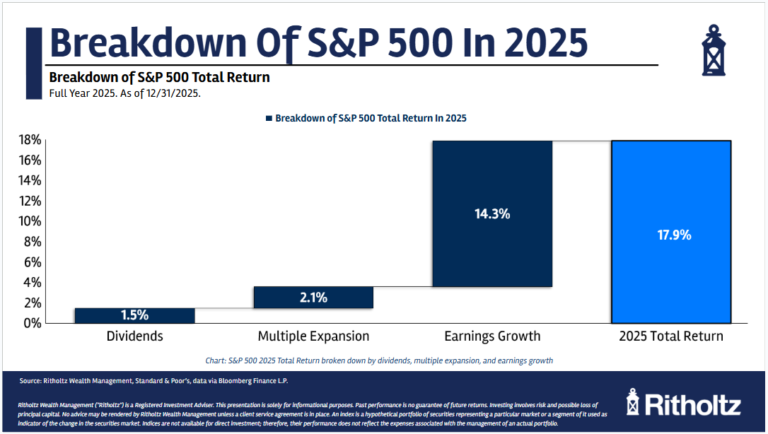

The bull market charged on yet another year but so did fundamentals:

The market keeps getting more concentrated. Corporations keep getting bigger. But so do earnings. It was another good year for earnings growth, which nearly matched the gain in the S&P 500.

This is good news.

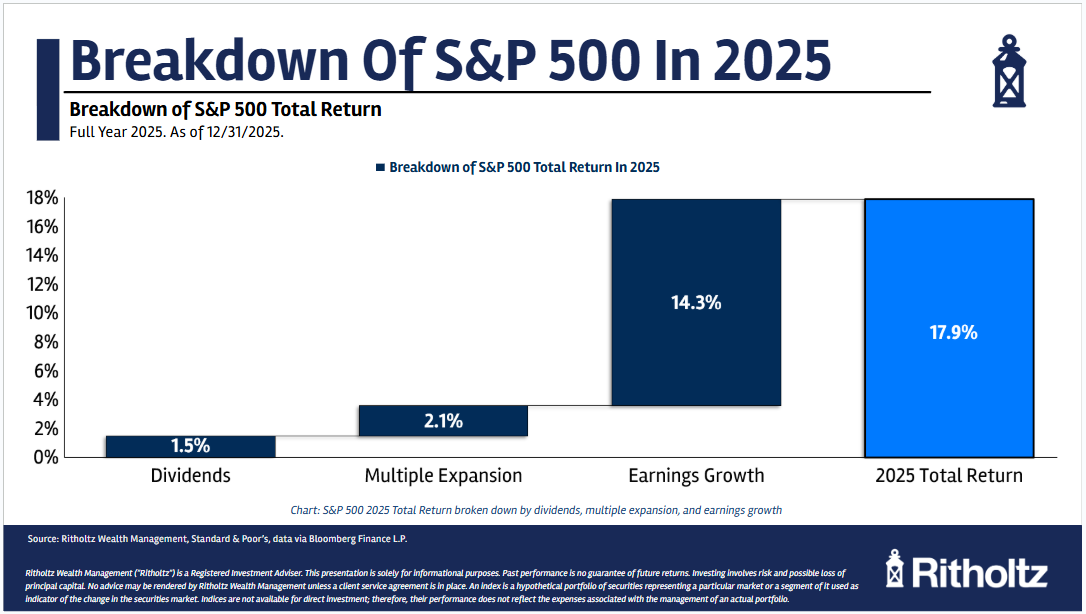

Speaking of fundamentals, check out the difference in forward PE ratios between the Mag 7 and the rest of the S&P 500:

Here’s the hard part about gauging the fundamentals of the stock market today: valuations are much higher for big tech stocks than the rest of the market.

But these are also the biggest, most profitable companies in history. They deserve to have higher valuations. So when does it become a concern?

It really depends on the embedded expectations and what happens with earnings from here. That seems like a cop out but it’s the truth.

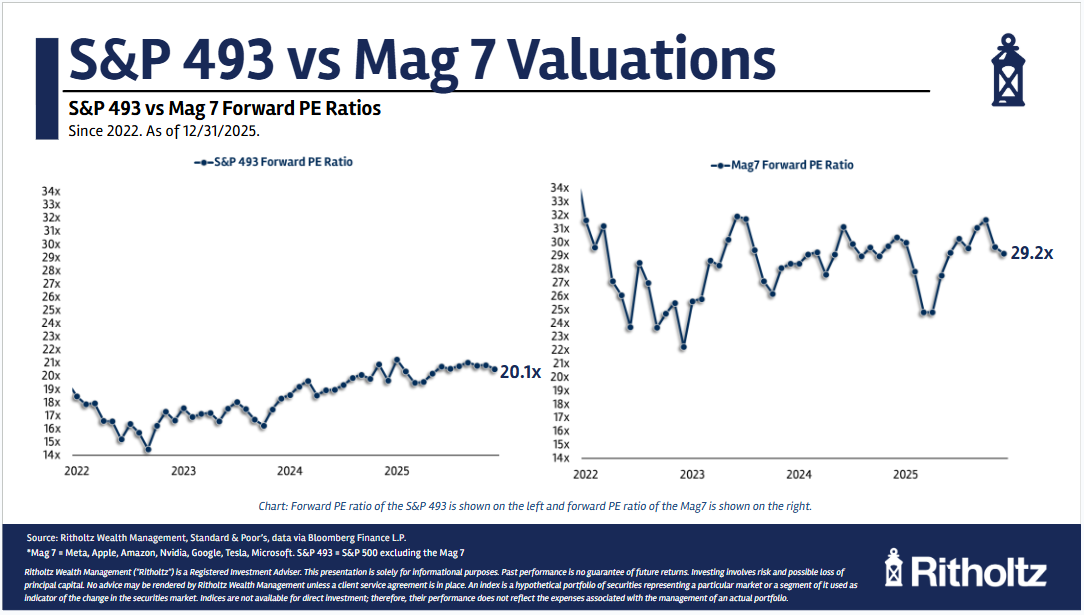

There’s a much lower margin of safety in mega cap tech than everything else:

The biggest bull case for smaller stocks is the fact that valuations and thus expectations are lower. It’s not going to take much good news for smaller companies to close this gap.

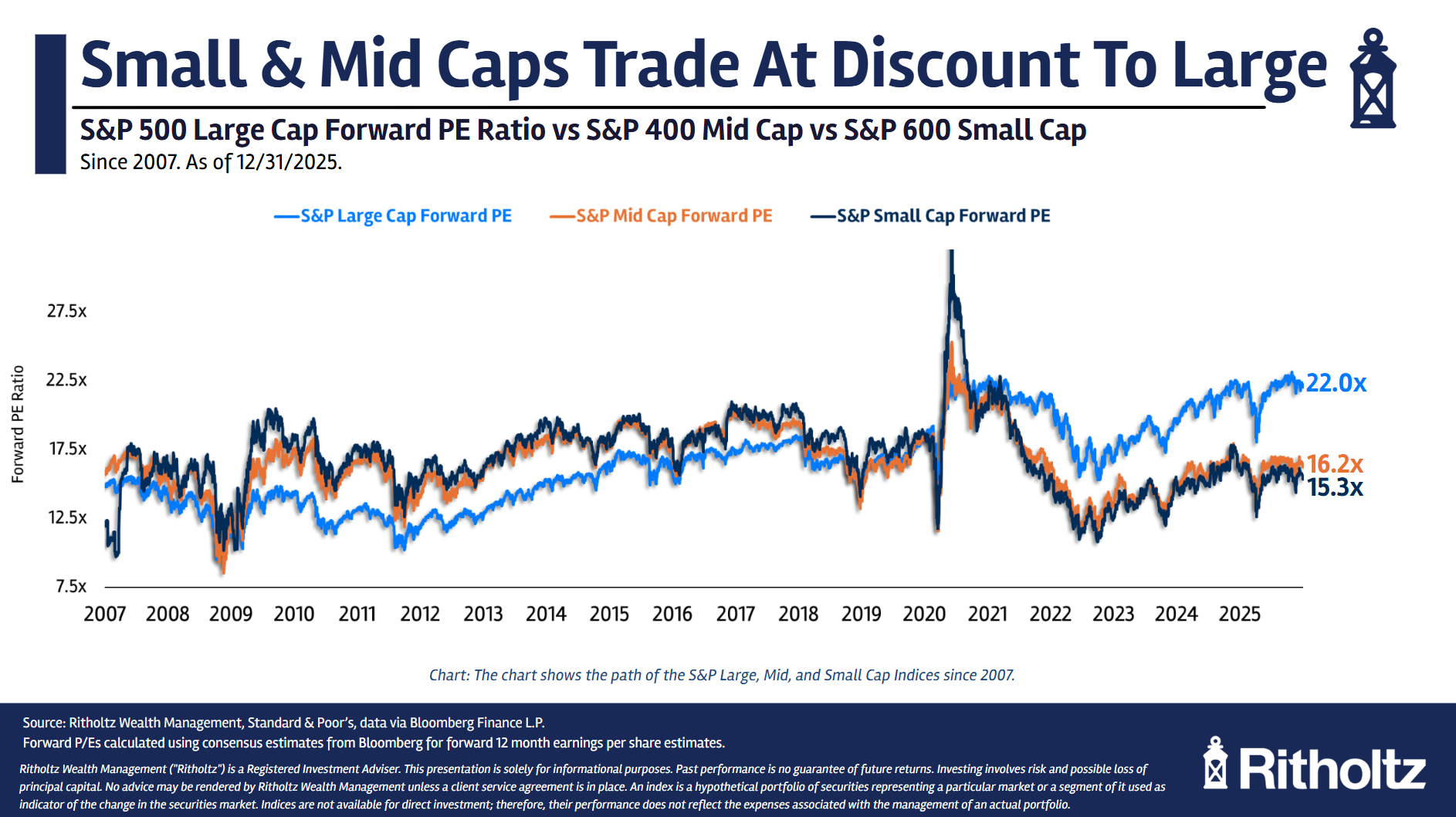

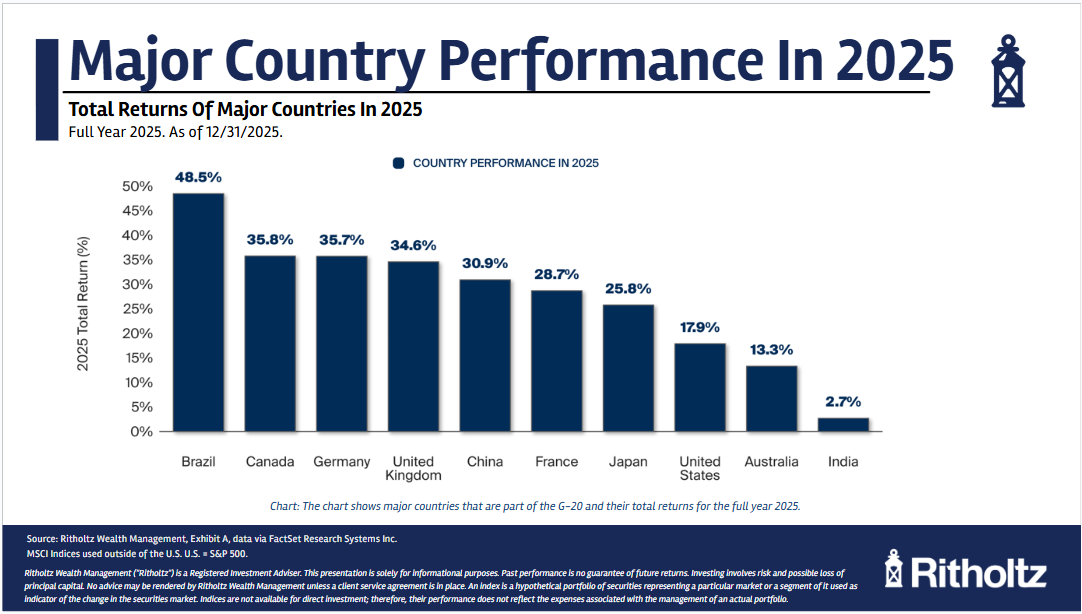

Maybe small caps will be the international of 2025. The country performance numbers last year were quite surprising:

The U.S. stock market was close to the bottom of the list. No one saw this coming heading into last year.

Why did international stocks have such a good year? Here’s the attribution broken out by fundamentals, currency moves and emotions:

The falling dollar was a tailwind for foreign stocks last year but earnings growth was good too. Everything went right for foreign stocks last year.

Will it last? I don’t know.

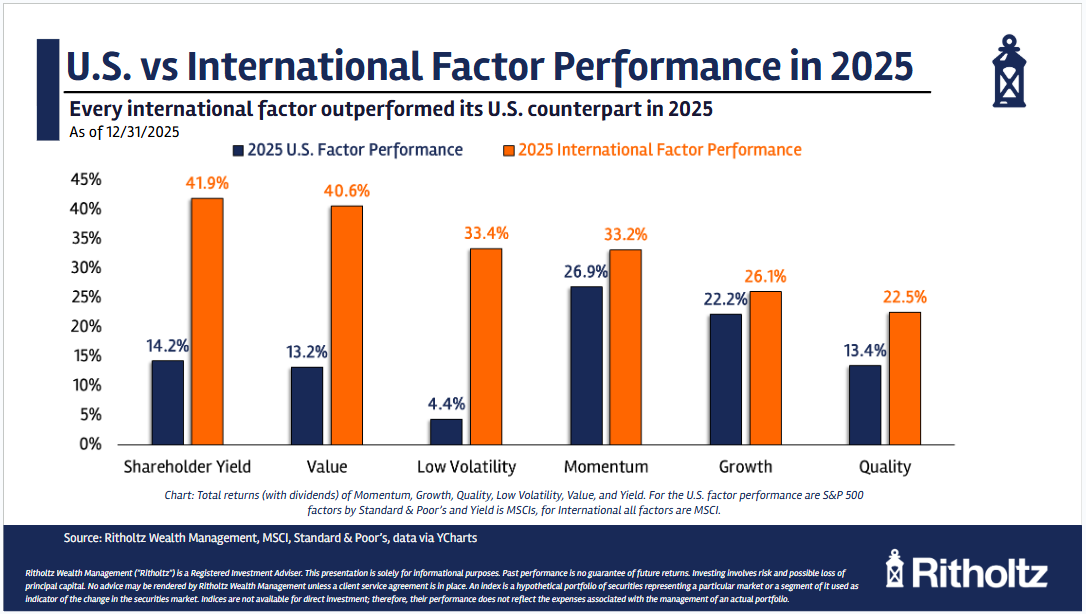

It’s also interesting to look at the divergence in factor performance between American and international markets:

Value stocks underperformed in U.S. markets last year. But look at value, shareholder yield and low vol stocks overseas — they crushed!

This is why diversification can be so maddening and eye-opening — you never know where the outperformance will come from.

Let’s finish with the boring but necessary stuff.

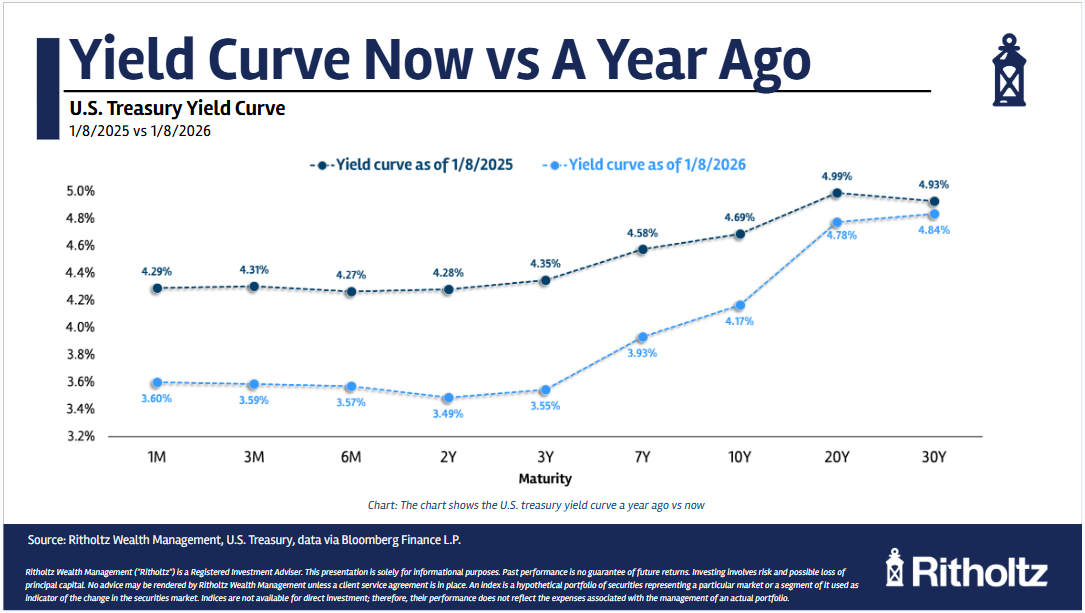

The bond market is healing:

For the last few years short-term yields have been higher or on par with longer-term yields. That’s not the normal state of the risk-reward relationship.

The yield curve is starting to look normal again.

It’s been a terrible decade for bonds but yields are in a good place right now for fixed income investors.

What does this mean?

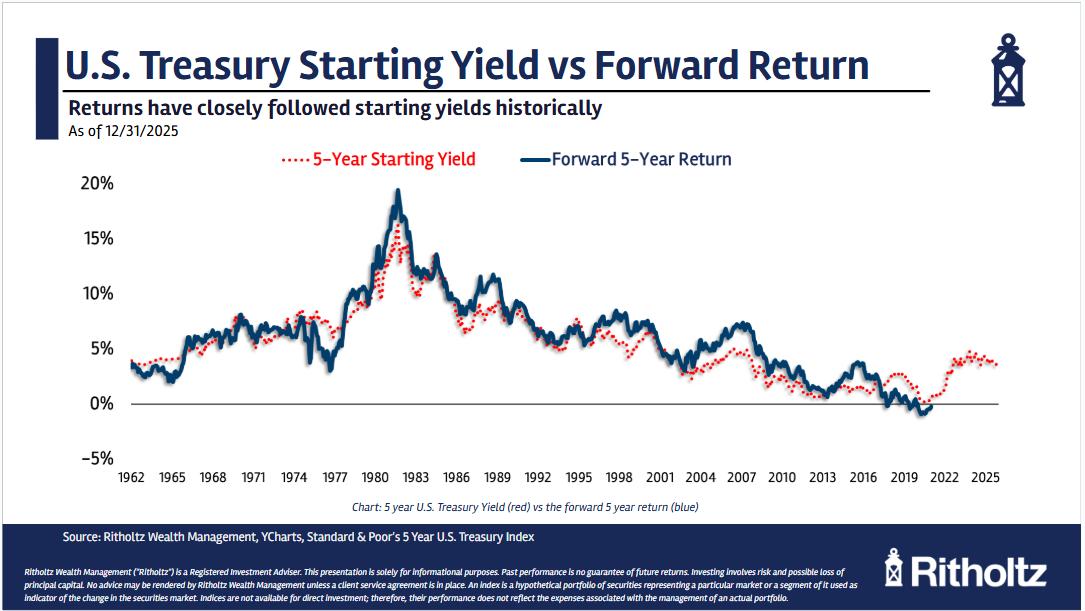

Returns going forward for bond investors should be decent since the best predictor of future returns are starting yields:

Bond yields are still pretty decent today.

Returns in the future should be too.

If you want to learn more about what it’s like to be a client of Ritholtz, reach out here.

Further Reading:

Historical Returns For Stocks, Bonds, Cash, Housing and Gold

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.