The problem with most retirement calculators and spending rules is that they assume life is linear and static.

In reality, life and spending tend to be lumpy.

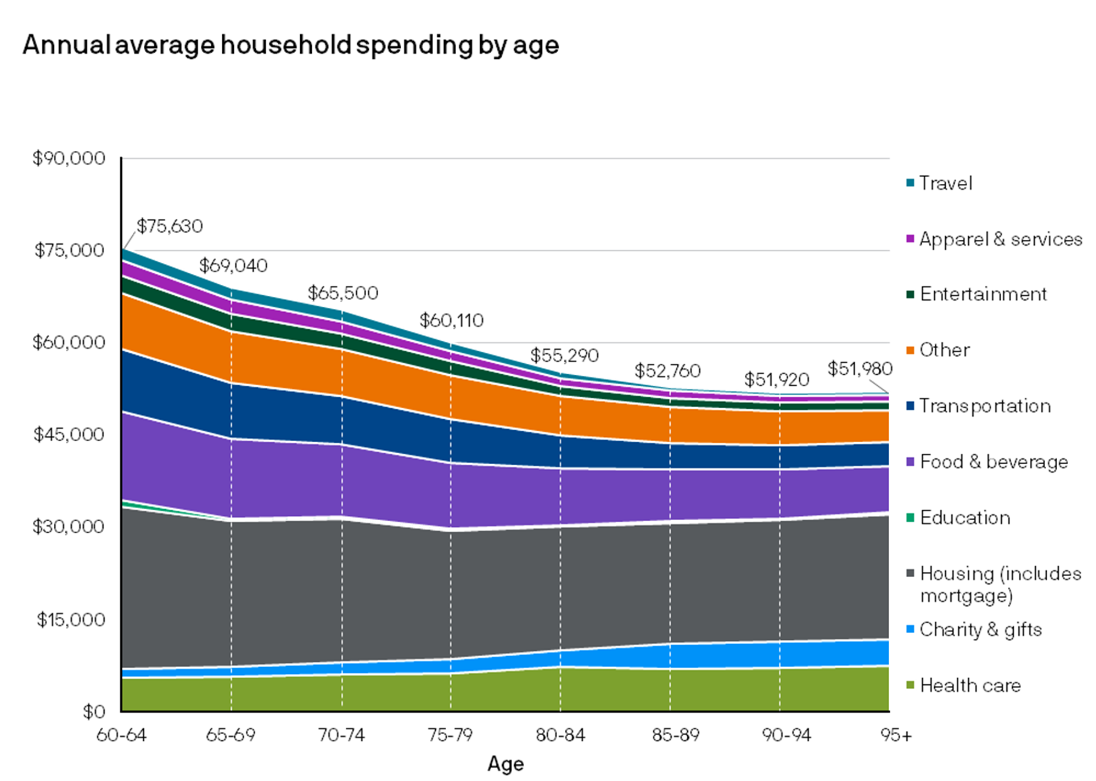

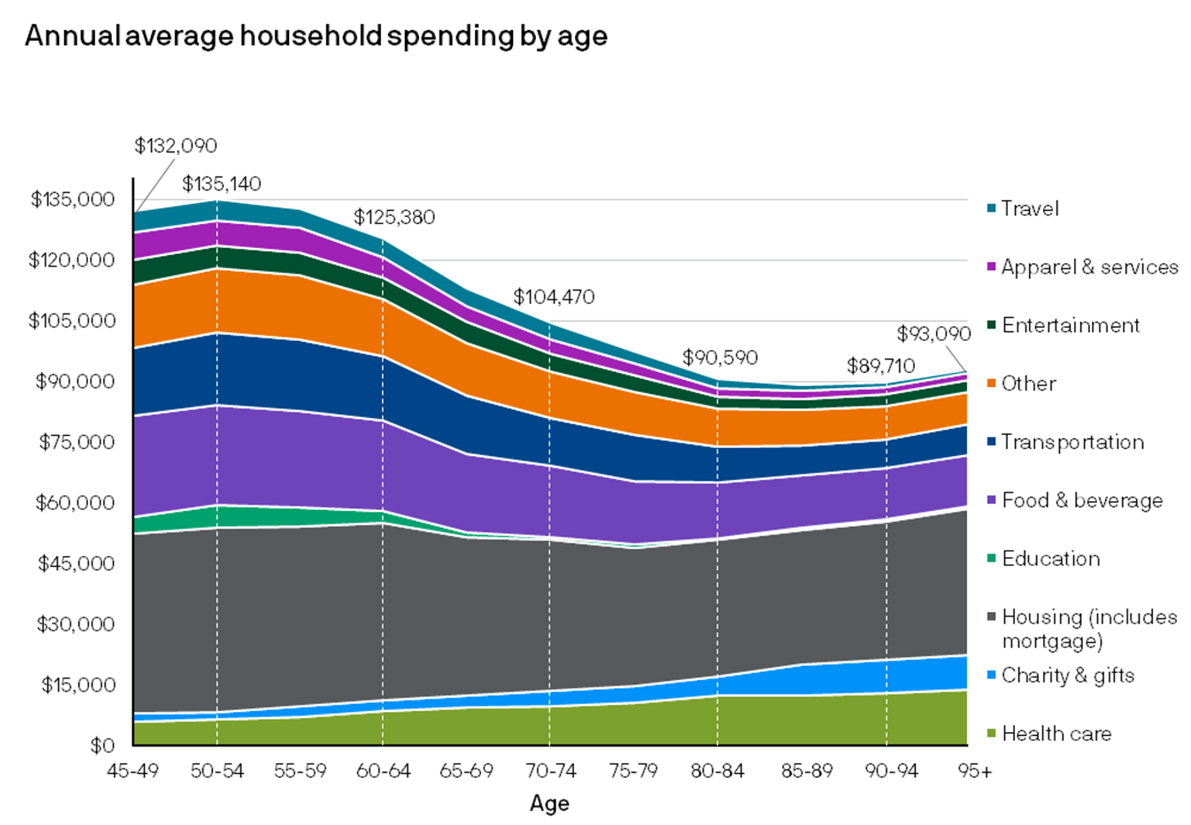

JP Morgan’s Guide to Retirement has a neat breakdown of how spending tends to change for retirees as they age.

These are the average spending levels for retired households with $250k-$750k of investible assets:

These are the average spending levels for retired households with $1-$3 million of investible assets:

The amounts don’t matter as much as the trend. You can see spending peaks close to retirement age and then declines as you get older.

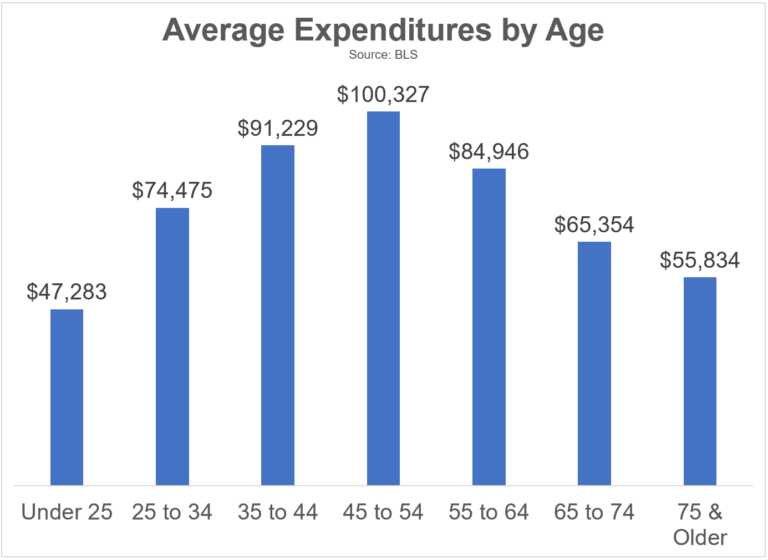

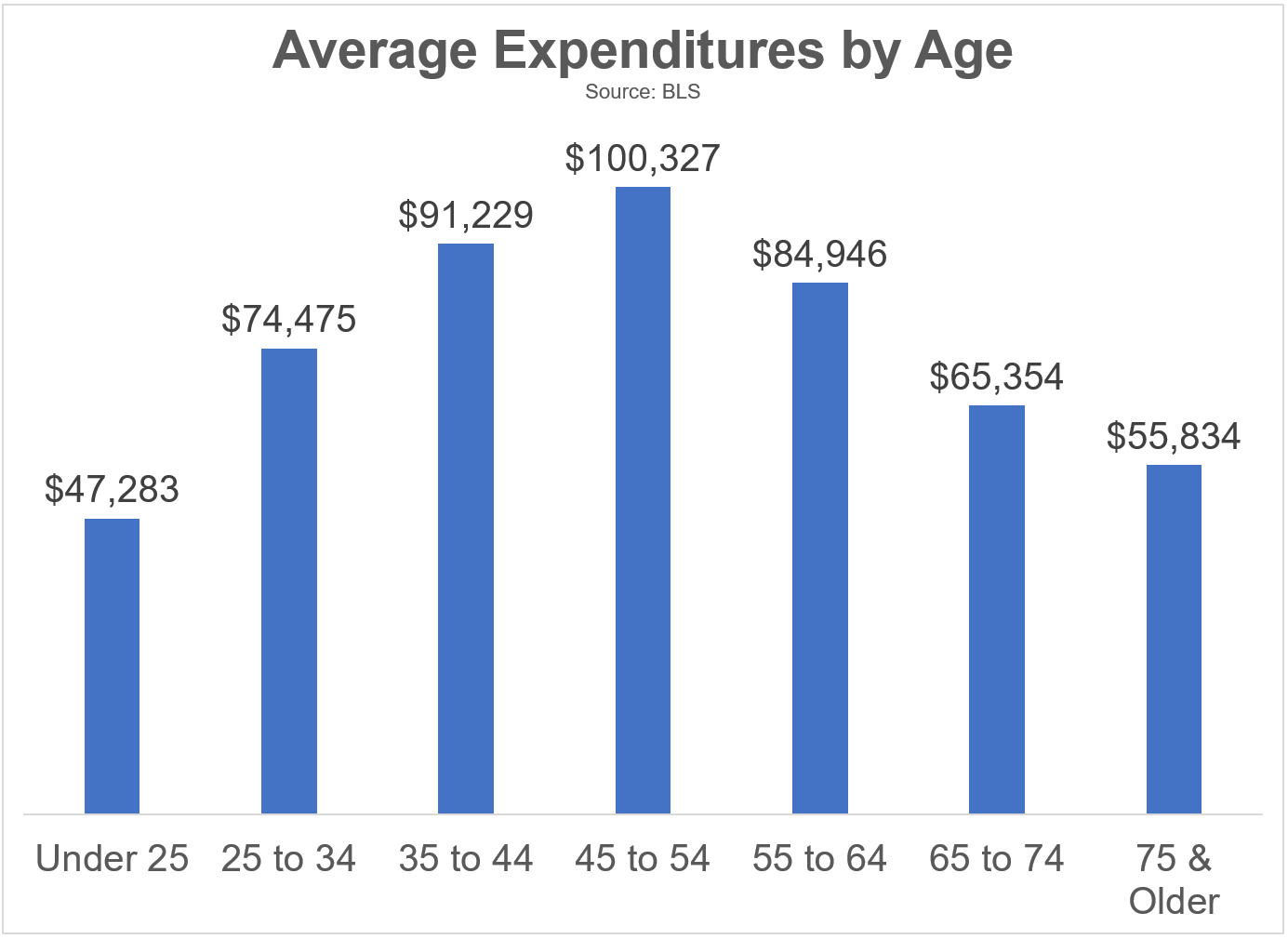

This trend is backed up by BLS data too:

This one starts earlier and shows spending ramps up as you age, peaks in your 50s and then slowly falls from there.1

The reasons for this are pretty obvious.

You generally have more responsibilities in your 40s and 50s. Maybe your kids are still on the payroll. Maybe you’re paying some college tuition. You might have aging parents who need help.

You’re in your peak earnings years so there is a lifestyle factor too.

Your spending is higher in the early years of retirement because your health is better as well. It’s much harder to travel and be out and about in your 70s and 80s than it is in your 50s and 60s.

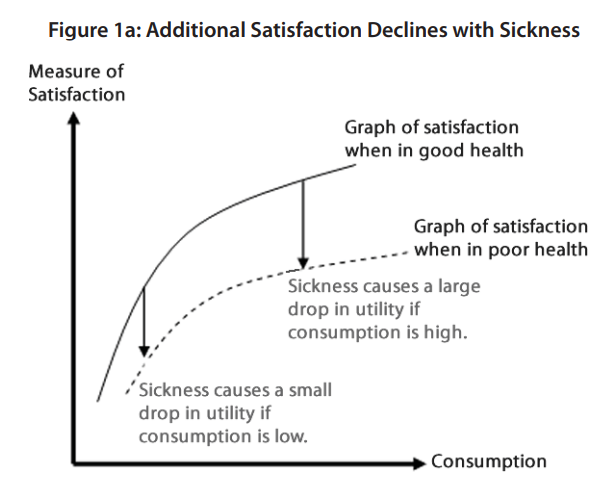

Harvard researchers looked at the relationship between health, life satisfaction and consumption in a piece called What Good is Wealth Without Health?

It’s not surprising that your satisfaction with life declines when you’re not healthy. But look at how the gap grows if you want to spend more money when you’re sick:

Here are my main takeaways from all of these charts and data:

Spend it when you can enjoy it. Many retirees are reluctant to spend money for fear of outliving it. But if your wealth peaks when your health begins to fail the money doesn’t bring as much satisfaction.

You should spend more money when you have the ability to enjoy it.

A bigger pile later in life can’t buy back your healthy years.

You should have multiple retirement spending plans. When my colleague Tony Isola creates retirement plans for clients he prioritizes a first decade spending plan to account for the fact that most people run out of health before wealth.

Retirement planning should take into account how your lifestyle will change as you age.

Maybe your net worth should peak sooner. Spending peaks in your 50s for the average household but I’m guessing the net worth high-water mark comes sometime in the 60s to 70s age range.

I’ve been thinking lately that it might make sense for your net worth to peak in your mid-50s when your spending does.

Spend down some of your money while you have your health. Spending is likely to slow down in your 70s and 80s, when it’s less comfortable to travel and be active.

When your health goes, all you have are your memories of more active experiences.

Create them while you can.

Further Reading:

How to Beat the 4% Rule

1Interestingly enough, research shows your happiness tends to bottom out in middle age too when you’re spending the most money.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.