A reader asks:

I’m a Bogle-DIY investor with a broad allocation with most of my money in total US and foreign stock index funds. But I also sprinkle some smaller allocations to small cap value, emerging markets and bonds. Everything outside of US stocks has been sucking wind for the past decade…until the past 15 months. Ben, is it finally time for diversification to pay off? Please say yes.

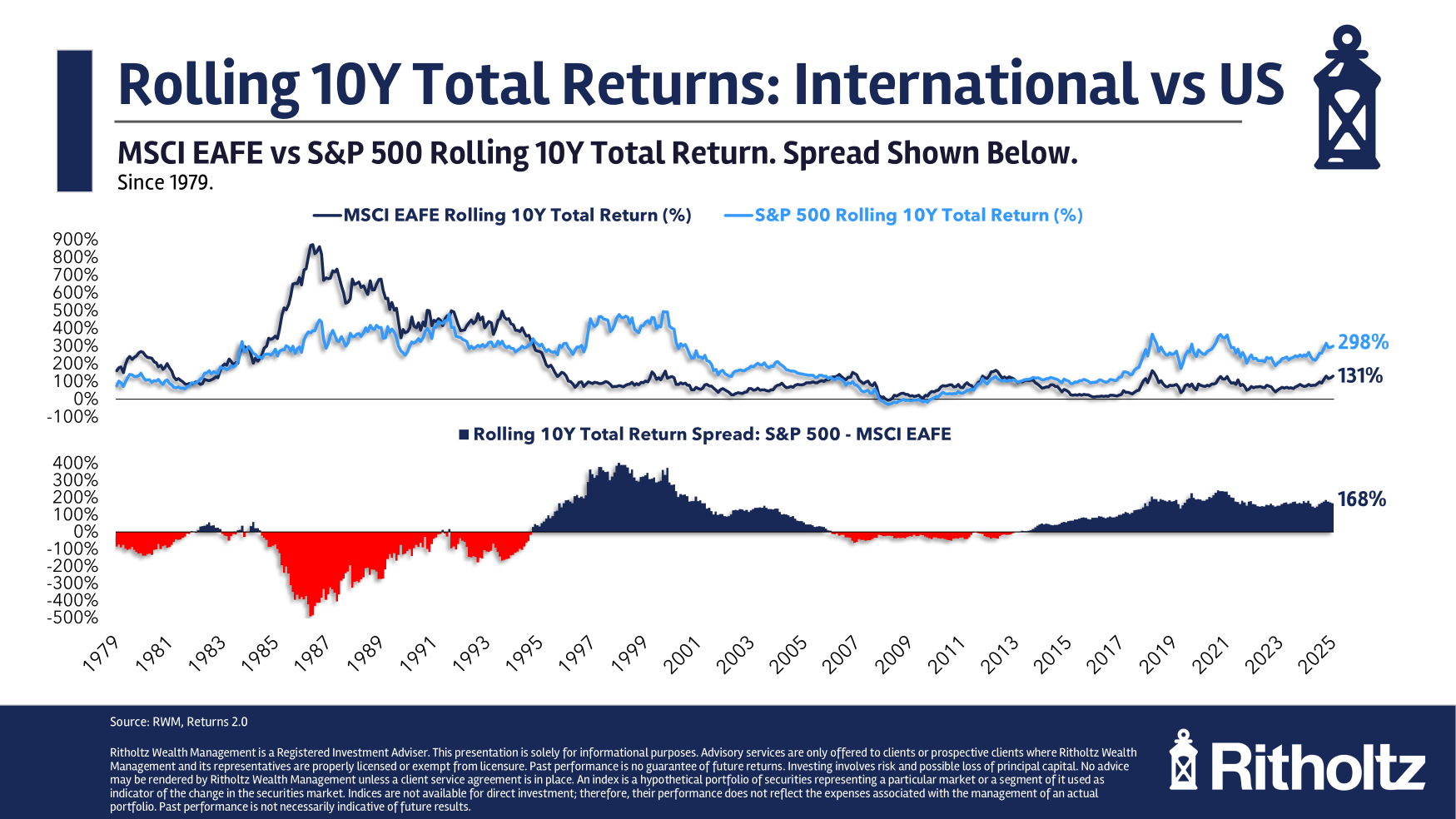

If you zoom out, international stocks have experienced a long run of underperformance relative to U.S. stocks:

Historically, this relationship has been cyclical, but the current cycle dates back to the end of the Great Financial Crisis.

Now let’s zoom in.

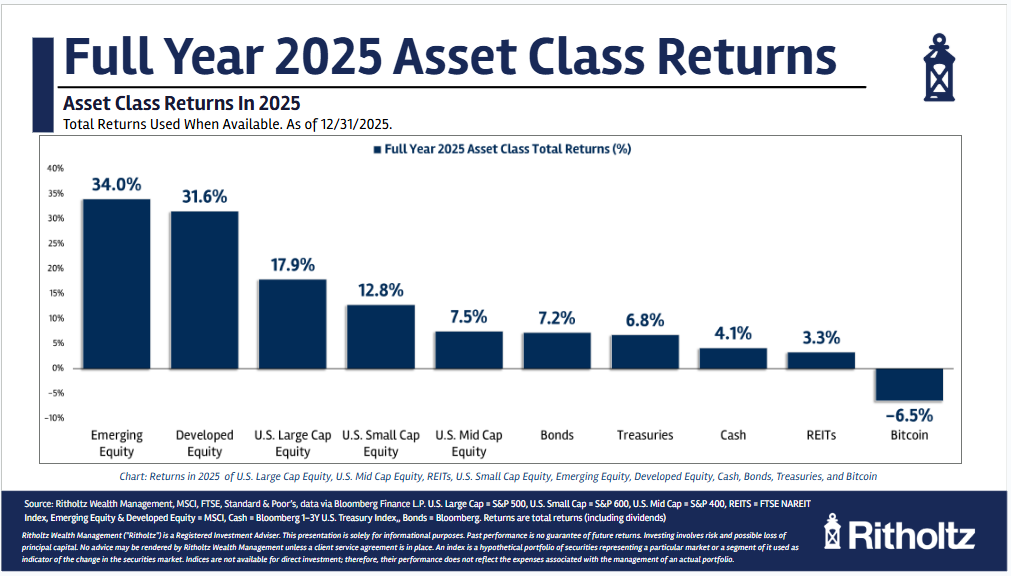

Here’s what happened to various asset classes in 2025:

International stocks flipped the script for the first time in years. In fact, it was the largest relative outperformance for foreign developed markets since 1993.

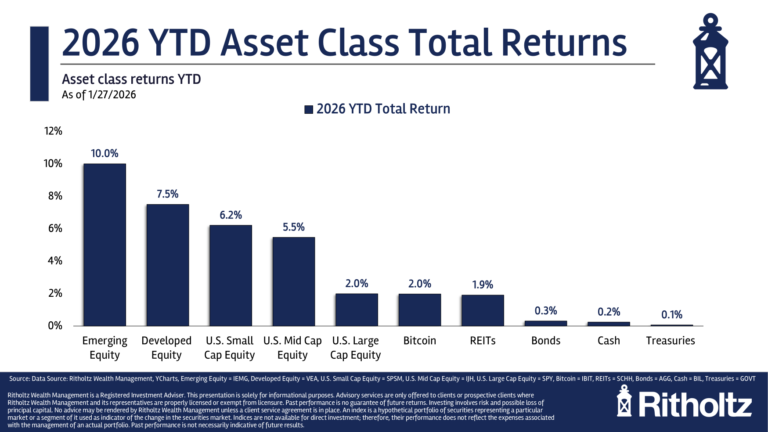

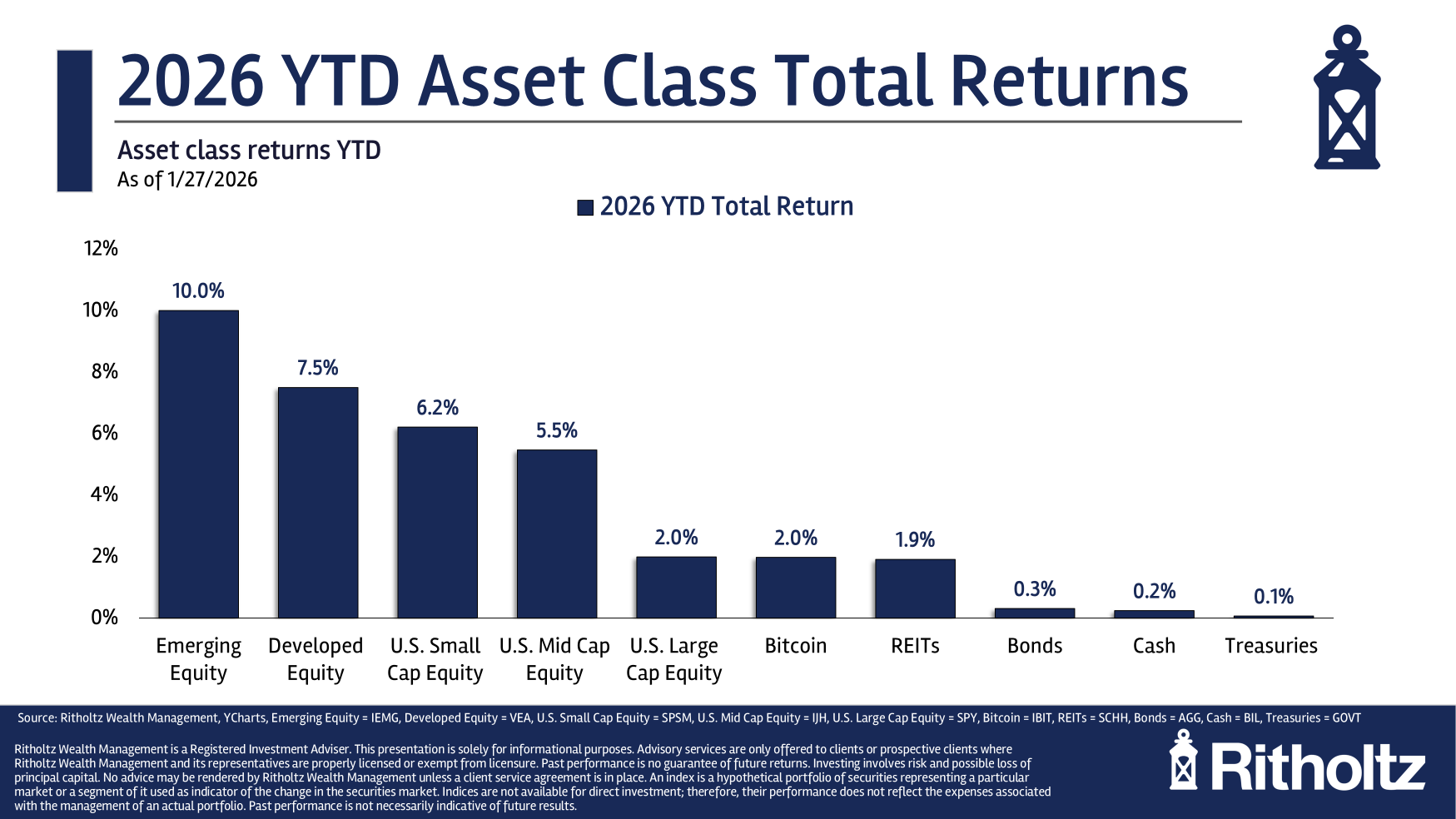

Now here’s what the admittedly very early year to date returns look like in 2026:

There is some follow-through here. Foreign stocks are outperforming yet again. Small and mid cap stocks have joined the party too.

Obviously, 13 months does not make a long-term trend, but this has to feel like a reprieve for those who have been geographically diversified.

Can it continue?

There are some trends in place that could help these other asset classes. Let’s make the case.

The dollar is going down. That’s good for international stocks, especially emerging markets. The dollar rolling over has also been a tailwind for gold and other hard assets.

If interest rates continue to fall, that could benefit small and mid cap companies who rely more heavily on debt markets than large cap corporations.

Large caps still have the AI thing going for them but AI could also level the playing field for smaller corporations by making them more efficient and improving margins.

On the other hand, you could easily make the case this will be a blip. The biggest, best companies are still at the top of the S&P 500. They produce more cash flow, more profit and have higher margins.

Another reader asks:

Not sure how hot or timely a topic this is but…would enjoy hearing you talk about emerging markets. But I have owned an EM ETF for 5 years and it basically hasn’t gone anywhere in all that time even going back to 2017 it is flat. How you one invest in emerging markets and actually make money?

This question came in back in 2024, before the current run-up in EM but it’s worth looking at the history of performance cycles in the developing world markets.

On a relative basis, the S&P 500 and MSCI Emerging Markets Index have a boom-bust relationship:

The returns go from big outperformance to big underperformance depending on the cycle.

The latest cycle has been of the bust variety for emerging markets. From 2010-2024 the EM index was up just 3.4% per year versus an annual gain of 13.9% for the S&P 500.

It’s been a brutal run.

Maybe it’s not so bad if you’ve been dollar cost averaging into EM but that depends on what happens from here. The past year and change has finally seen some life in these stocks.

Is this the turning point in the boom-bust cycle?

The three wisest words any investor can utter are:

1. I

2. Don’t

3. Know

If you knew what was going to happen you wouldn’t need to diversify in the first place. Diversification only “works” because you don’t have to determine the winners in advance.

If you own some U.S. stocks, some international stocks, some emerging market stocks, some small cap stocks, some bonds, maybe some gold or bitcoin or other asset of your choice one of them is going to outperform.

You’ll wish you had a much higher allocation to that asset.

One or more will also underperform. You’ll wish you had a much lower allocation to that asset.

It’s easy to know what outperformed in the past but nearly impossible to predict what will outperform in the futre.

That’s why you diversify.

You give up on home runs to avoid striking out.

I answered these questions on this week’s Ask the Compound:

We also discussed questions about rental investments, the benefits of taxable brokerage accounts and the 4% rule.

Further Reading:

6 Surprises From 2025