Social Security is the most important retirement plan ever created in the United States.

Around 70 million Americans receive Social Security benefits. That number will surely rise in the years ahead as more baby boomers retire.

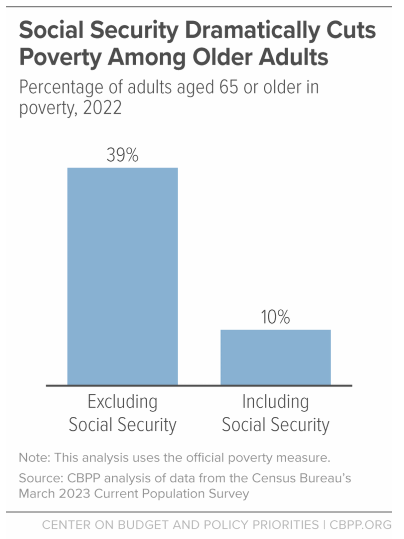

For people who are 65 or older, more than 40% of recipients receive 50% or more of their income from Social Security. Millions of retirees would be impoverished without Social Security benefits:

Here are some lingering questions about the program:

Is it going insolvent? According to the latest report from the Social Security Administration, the trust fund will be paying out more money than it’s bringing in starting in 2034.

Social Security is a pay-as-you-go program that is funded by current tax receipts. With more people retiring than ever before we’re looking at going from 2.7 workers per beneficiary to 2.3 by 2035.

That puts some strain on the funds, which are inflation-adjusted.

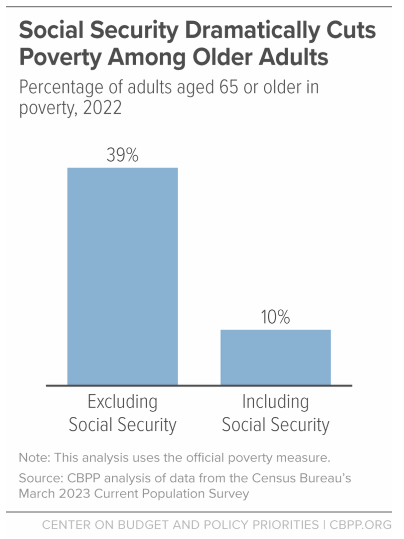

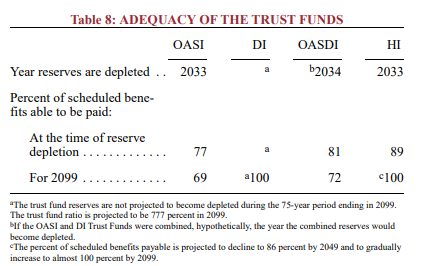

But this stuff is governed by math. The actuaries model out 75 years into the future every year. The trust fund will still cover around 80 cents on the dollar in the mid-2030s:

That’s not ideal but not the end of the world either.

Can young people still expect to receive benefits? If nothing is done, the SSA still expects the revenue Social Security taxes bring in will cover around 70 cents on the dollar by 2099 (when I’m 118 years old).

So yeah, young people can expect to receive some Social Security benefits.

Can we fill the gap? It depends on what the politicians decide to do.

They could simply fund the difference by diverting spending from elsewhere or taking on more debt. We’re good at borrowing more money.

You could also cut down on future strain by increasing the retirement age for say people currently under 40 or 50. You could increase the cap for earnings that are subject to Social Security taxes to bring in more revenue.

There are some simple fixes if anyone ever wants to tackle this.

What if they cut benefits? That’s another option. People could get 80 cents on the dollar in the 2030s if they don’t agree on a solution by then.

You never know what politicians will do tomorrow let alone eight years from now.

But I can’t imagine any politician would be dumb brave enough to cut benefits. It would be political suicide.

An AARP survey found 95% of Republicans, 98% of Democrats and 93% of independents support Social Security. We can’t get 90%+ people to agree on anything these days.

I don’t know what the future holds but Social Security is not a huge worry of mine.

What will be important is how and when retirees decide to claim benefits in the years ahead.

This week on Talking Wealth I spoke to Mike Piper from Oblivious Investor about the solvency of the program, when to claim your benefits, the average Social Security check size and much more:

Be sure to check out Mike’s free Social Security calculator at Open Social Security.

The podcast version is here:

Subscribe to our newsletter for more.

Further Reading:

The Most Important Retirement Plan Ever Created

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.