A reader asks:

My partner and I are both 30 y/o and operate a small business. We made the max SEP IRA contribution in December 2025 of $70k; then another max contribution for FY 2026 of $72k in January 2026. The SEP IRA has $365k total market value and now about $145k in cash. My question is; psychologically how do I invest this money? I know I can follow all of Ben’s rules: lump sum over DCA, diversify, manage risk tolerance etc. But now I’m starting to feel the pressure given that the account is at such a large amount. What should we do?

The SEP IRA is one most people are likely unfamiliar with.

The 2026 contribution limit is $72,000. For a traditional or Roth IRA this year it’s just $7,500. Why the huge difference?

SEP IRAs are intended for small business owners, freelancers and self-employed individuals who don’t have access to a retirement plan like a 401k. And if you have employees you can also make contributions on their behalf.1

It’s a pretty good deal for sole proprietors who want to stash a decent amount of money into tax-deferred retirement accounts. I have a SEP IRA, and it almost doesn’t seem fair that my limit is that high.2

If I were America’s retirement czar, I would do away with all of the different accounts — 401k, IRA, Roth, HSA, 529, Solo 401k, SEP IRA, etc. — and just make one big contribution limit for everyone in a single account. But I digress…

Onto the real question here — you’re sitting on a big lump sum of cash in the six figures that makes up 40% of your IRA. That’s a lot of money. It’s understandable why you feel the pressure on this one. There’s more at stake here.

I’ve gone over the math of lump sum investing versus dollar cost averaging on the blog many times over the years.

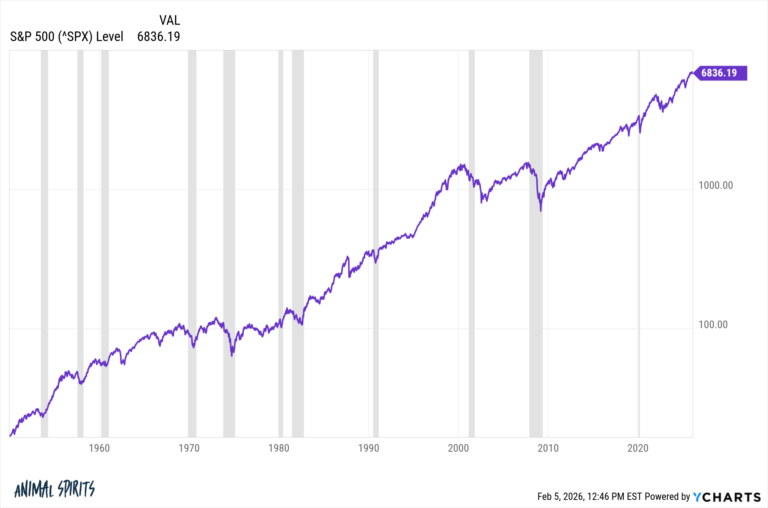

A lump sum into the market makes more sense from a probability perspective because most of the time the stock market goes up.

Since 1928, the US stock market has been up in 73% of all years. Since 1950, the stock market has been positive in 80% of rolling 12 month periods.

That’s an amazing win rate.

However, Murphy’s Law of Investing applies here.

Almost every investor with a lump sum of cash to invest assumes anything that can go wrong will go wrong when they put the money to work. These feelings are even more amplified when the stock market has been doing well.

We have a lot of these conversations with our clients who come to us with cash from the sale of a business, concentrated stock position, RSUs, etc.

Some people are swayed by the math. You show them the numbers, the light bulb goes off and they make the spreadsheet choice by putting the lump sum to work immediately.

Others see the numbers, understand the numbers, but prefer to make a more psychologically driven decision to average in over time.

Neither of these decisions is necessarily right or wrong. It really depends on which choice you’ll regret more — missing out on potential gains or missing out on potential losses.

Here are some ways in which you can go about implementing a strategy to get your cash invested:

Rip off the bandaid. If you’re going to put that entire lump sum to work just do it and don’t look back. The market goes up and down. That’s how stocks work. If you rip off the bandaid, there’s no second guessing.

Split the difference. You could also put a lump sum to work immediately and average into the market with the rest. Maybe you put that 2025 contribution to work right away and then come up with a DCA schedule for the 2026 cash.

That way all of your bases are covered.

You could create some thresholds. The biggest reason you worry about doing a lump sum is because the market might fall out of bed right after you pull the trigger. Some people like the idea of waiting for a correction to put money to work.

I am not one of them.

The longer you wait, the harder it is to invest. Cash becomes an addiction. If the market takes off there is no entry point low enough to get you back in when it finally drops.

But you could create a DCA schedule with some off-ramps. If the market falls 10%, 15%, maybe 20% then you give yourself the ability to speed up the process. This makes sense to me as long as you’re already periodically investing.

Whatever plan you come up with, just write it down.

If you’re averaging into the market, write down the cadence you choose (weekly, monthly, quarterly, etc.) and then stick with it.

If you’re putting the entire lump sum in today write down why you’re doing it.

If you’re going to split the difference or wait for a correction or some other variation, write down your plan and the reasons for your plan.

Pick a plan, stick with the plan.

Sometimes you’ll like the outcome, sometimes you won’t but we’re all dealing with imperfect information about the future.

You make an informed decision based on your emotional make-up and information available to you at the time, write it down to remind yourself, and then move on with your life.

The hard part is out of the way.

You already saved a lot of money.

I discussed this question on the latest episode of Ask the Compound:

Bill Sweet joined me on the show again this week to answer questions about healthcare options in early retirement, in-plan Roth conversions, the secret sauce of retirement planning and how the new Trump savings accounts work.

Further Reading:

The Psychology of Sitting in Cash

1If you contribute 10% of your salary as the employer you would have to also do a 10% contribution for your employee based on their salary.

2I have an LLC for A Wealth of Common Sense for ad revenue, book sales, speaking gigs and such. Technically, I’m not a businessman; I’m a business, man.