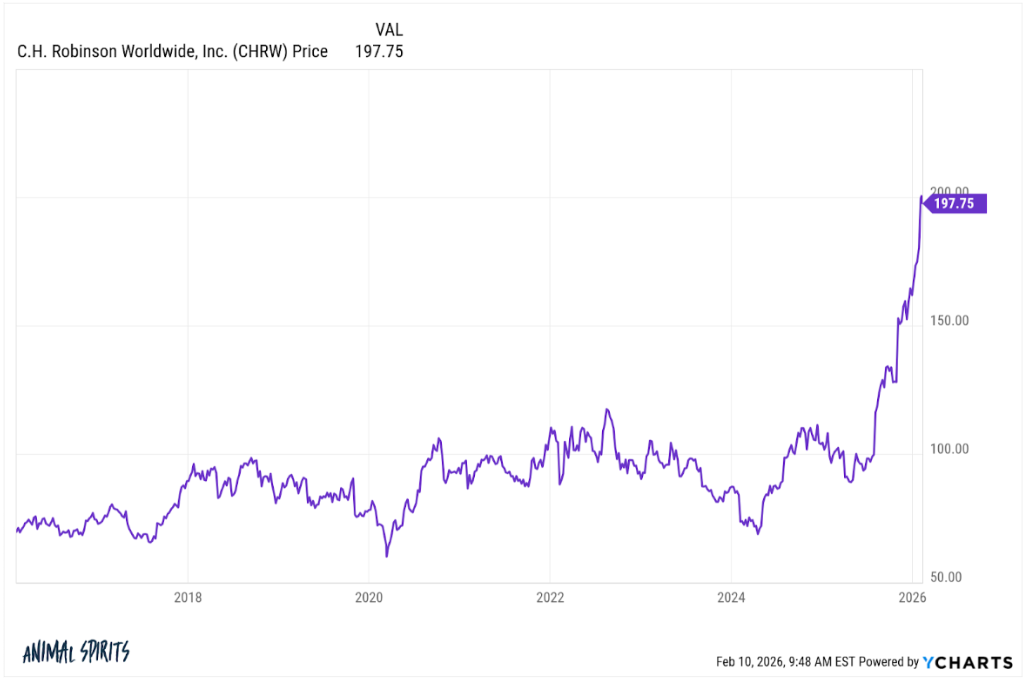

Today’s Animal Spirits is brought to you by Pacer and Ycharts:

This episode is sponsored by YCharts. Download Top 10 Visuals here And start your free YCharts trial through Animal Spirits (new customers only).

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky

Amazon P/E: 29x

Walmart P/E: 46x

Costco P/E: 54x— Ed Elson (@edels0n) February 9, 2026

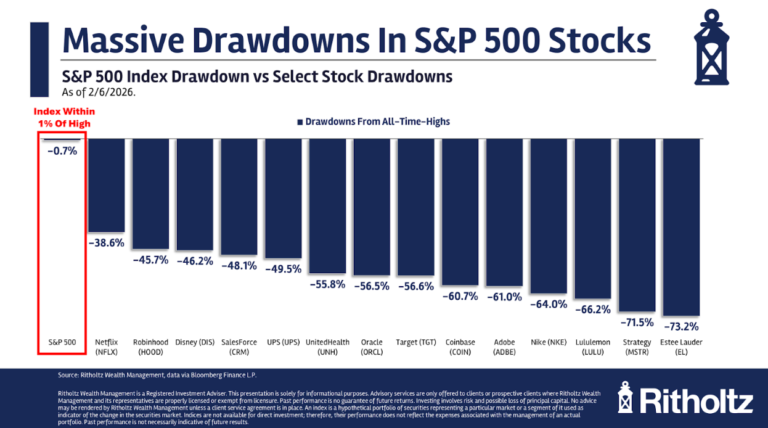

YTD, 60% of S&P 500 stocks are outpacing the index, compared to less than 35% in each of the previous three years. @truist @soberlook https://t.co/EGLX7QmA3x pic.twitter.com/SzZxXgrzdj

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 5, 2026

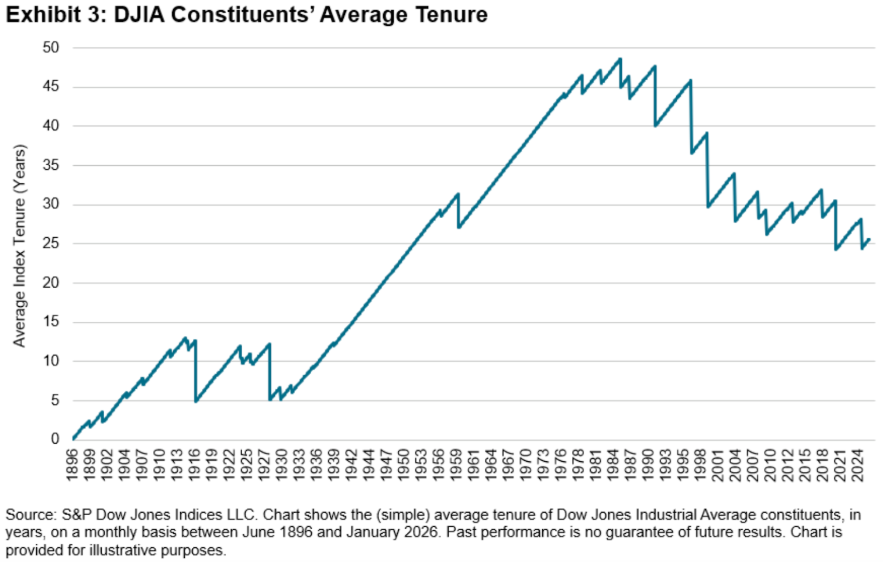

$DIA leading all flows on Friday as the Dow Jones hits ATH and is running laps around SPX this year. This index is equiv of a rotary phone, price-weighted, invented when Grover Cleveland was POTUS, but it could be perfectly situated for 2026’s equity rotations. Good note on this… pic.twitter.com/Yt87iSTeqe

— Eric Balchunas (@EricBalchunas) February 9, 2026

h/t @MichaelKantro for this: iShares Expanded Tech-Software Sector ETF (IGV) and Bitcoin look like twins pic.twitter.com/dgD3wuutkm

— Alexandra Semenova (@alexandraandnyc) February 5, 2026

GS basket of most shorted stocks jumped by 8.8% on Friday … best day since April 2025 and one of the best days in the post-pandemic era pic.twitter.com/RjeZcxwYTG

— Kevin Gordon (@KevRGordon) February 9, 2026

BofA: Hyperscalers’ capex as % of operating cash was 65% in 2025, expected to be nearly 90% In 2026

It was 40% from 2017-2023 pic.twitter.com/KfldLRfZu2

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 8, 2026

$314B of incremental CapEx spend in 2026 guidance from the Big 5.

That’s +1% point of GDP growth from and >2% of total US GDP from 5 companies. pic.twitter.com/vOjrUX0uDy

— Matt Vinson (@mattmvinson) February 5, 2026

Wild inflows to sectors outside of technology this year

“Sector funds excluding Tech have seen a record $62bn in inflows in the first five weeks of the year. To put that in context, that’s more than they saw in all of 2025 (just over $50bn)” –DB

— Gunjan Banerji (@GunjanJS) February 6, 2026

h/t @MichaelKantro for this: iShares Expanded Tech-Software Sector ETF (IGV) and Bitcoin look like twins pic.twitter.com/dgD3wuutkm

— Alexandra Semenova (@alexandraandnyc) February 5, 2026

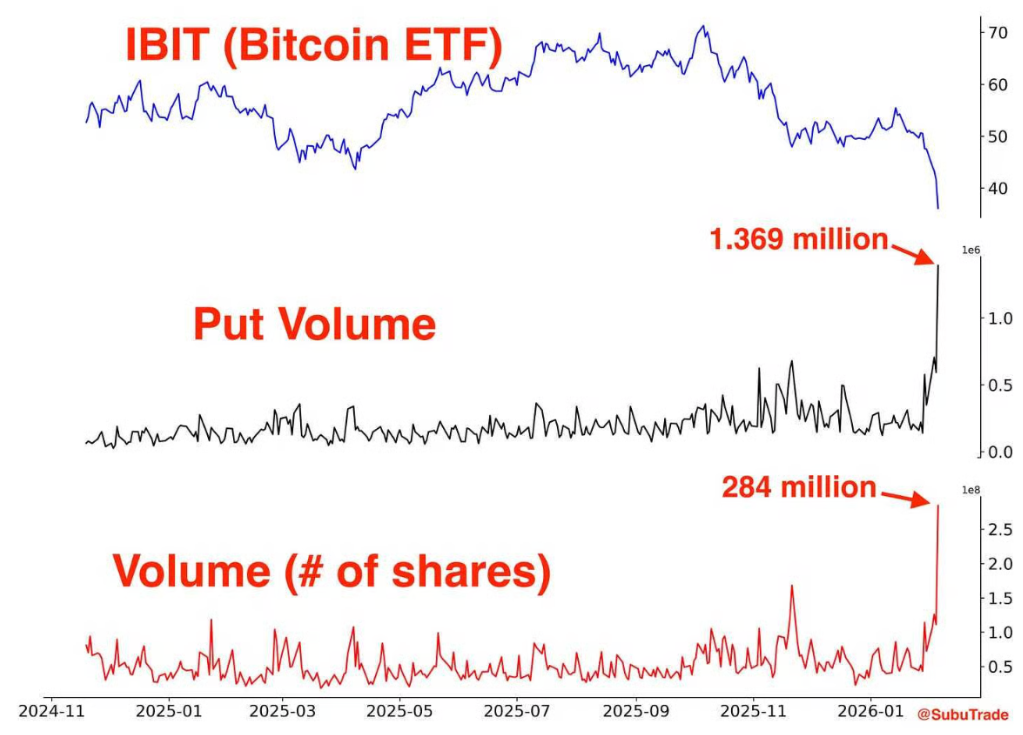

I’ve now seen multiple big crypto accounts saying this is the worst sentiment they’ve ever seen.

And we aren’t even in a recession. Can’t imagine what would be happening if stocks were crashing too https://t.co/YDWWQF17Nd

— Nick Maggiulli (@dollarsanddata) February 5, 2026

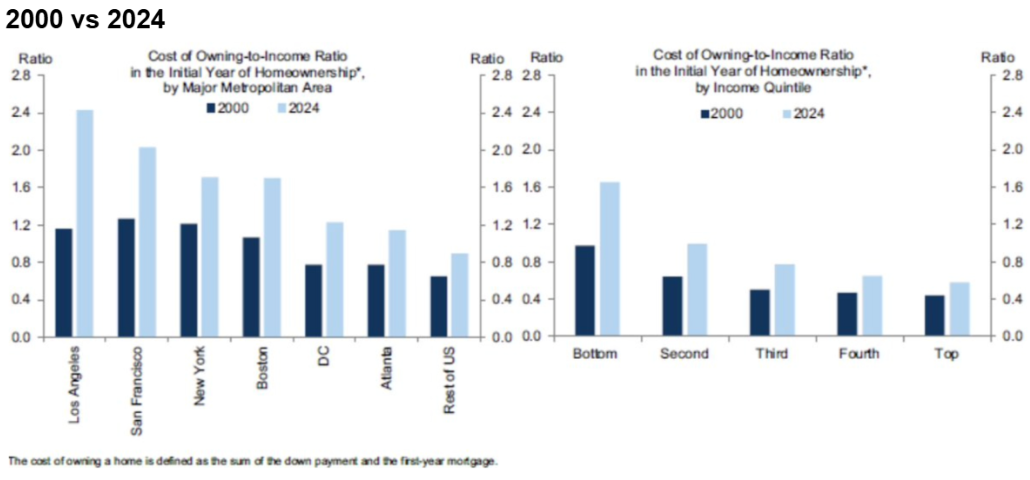

Why is a $3M home a status symbol but a $3M portfolio isn’t?

How can someone value “looking wealthy” over having more financial freedom?

Makes zero sense.

— Nick Maggiulli (@dollarsanddata) February 5, 2026

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.